Copper Market News: What’s Next

Updated March 2023

Hence the argument that the markets will likely experience a more substantial correction in 2022 continues to gain traction. The markets have not experienced a robust discipline for a while. They could shed 18% on the low end and 24 to 27 per cent on the high end. The odds are that the trend will remain intact, and this strong correction will lead to the birth of an even spunkier bull. Or it could simply reinvigorate the current bull. The bull born after the COVID crash is a hybrid bull that will put up a mighty fight before it surrenders. Market update Nov 2021

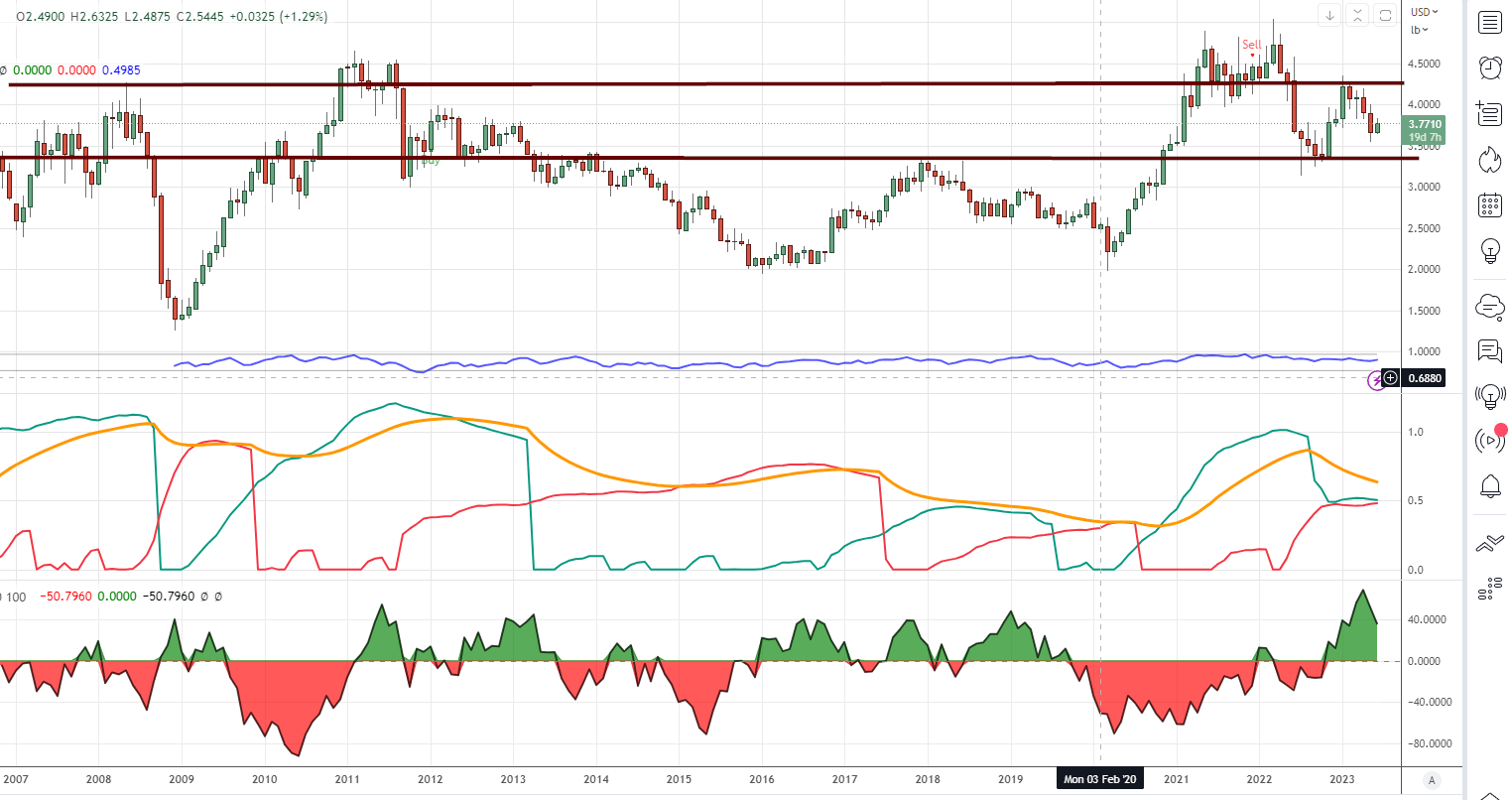

The Copper Market tends to precede the Stock Market in reaching its highs and lows. Therefore, carefully analysing the copper market can yield valuable insights into the overall market’s direction. If, for instance, the copper market reaches its peak following a robust rally, it serves as an early indicator that the stock market is likely to undergo a substantial correction. Let us examine the current situation. In March of 2022, copper peaked, effectively foreshadowing the subsequent course of the markets, which experienced a downturn.

Presently, copper is striving to establish a sequence of progressively higher lows. As long as the monthly closing price remains above 3.13, this pattern will persist, and it is reasonable to anticipate that copper will ultimately surpass the 4.80 mark. Moreover, the current pattern also indicates that copper formed a secondary peak in January of 2023, which could be interpreted as a warning that the markets are poised to undergo a period of correction, as copper typically reaches its peak several weeks to months before the needs. Nevertheless, the pattern suggests that we should embrace the next pullback.

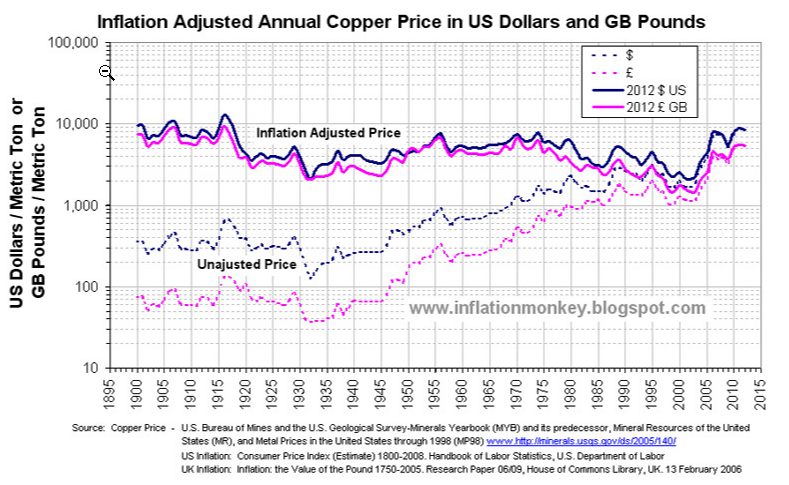

The price of copper on an inflation-adjusted basis was higher in the 1915-1916 timelines than today, so much for the Hyperinflation garbage theory. Copper is a leading indicator that tends to bottom and top before the markets. Looking at the current action of copper, it appears that copper has enough mojo left for one more sprint. This sprint could take it to the 5.10 to 5.50 ranges, likely coinciding with a multi-month top.

Interesting read: The Stock Market Forecast For Next 3 months: Buckle Up

Copper News: Unveiling the Dynamics of Manflation

To navigate the dynamic and volatile financial markets, it is crucial to remain steadfastly focused on the prevailing trends while disregarding extraneous noise. These trends serve as our allies, while all other factors can be considered potential adversaries. The recent surge in copper prices may be seen as a positive indication that the economic recovery is gathering momentum, and we must continue to monitor this trend closely.

Copper Market News: Analyzing Trends Amid Economic Turbulence

Let us not allow ourselves to be sidetracked by extraneous distractions and instead concentrate on analyzing the underlying trends. The rise in copper prices may signify that the current economic turbulence is due to “inflation” rather than genuine inflationary pressures. However, as the US dollar is anticipated to reach a peak over the next several months in 2023, the North American continent will undoubtedly experience the true ramifications of inflation.

Inflationary environments are typically beneficial for stocks, but market activity can be turbulent and unpredictable. The initial stages of the upcoming breakout are expected to be volatile and range-bound, testing the patience of even the most seasoned investors. Nevertheless, this range-bound activity may well provide the foundation for the most auspicious buying opportunities in recent memory.

Inflation 2023: Unveiling Economic Trends and Predictions

Macroeconomic forces, such as rising inflation, energy costs, and interest rates, exerted significant pressure on copper in 2022, leading to fluctuations in price. Copper prices reached record highs in 2022, surpassing the US$10,000 per metric ton threshold for the first time in history, but were unable to maintain these gains and remained volatile throughout most of the year.

However, the world is currently grappling with a shortage of copper, fueled by increasingly challenging supply streams in South America and escalating demand pressures. The deficit is expected to inundate global markets throughout 2023, with some analysts predicting that the shortfall could continue for the remainder of the decade.

Copper is a leading indicator of economic vitality due to its incorporation in various essential applications, such as electrical equipment and industrial machinery. A copper squeeze may be interpreted as an ominous harbinger of escalating inflationary pressures and may compel central banks to adopt a more hawkish stance for longer. The correlation between copper and the S&P 500 index is robust because copper is a bellwether of economic health. In 2022, copper prices collapsed alongside significant stock indices as international monetary policy became more stringent.

Unlocking Opportunities: Maximising Returns in the Era of Manflation

Copper is presently in a consolidation phase, indicating that it is gathering momentum for its next upward movement. The bullish outlook will remain intact as long as the monthly closing price stays above 3.70. A closing price at or above 4.35 would likely trigger a series of new highs. Additionally, according to the weekly charts, copper is trading in the highly oversold range, suggesting that it eagerly awaits a breakout catalyst.

Individual investors can participate in the copper market by considering investments in FCX, JJC, COPX, and other stocks within this sector.

Other Articles of Interest

Sentiment Trader: March to Your Own Beat

Becoming a Better Investor: Key Strategic Moves

History of Stock Market Crashes: Embrace Fear, Ignore the Noise

Investing in a Bear Market: Ignore the Naysayers

Buy the Dip: Dive into Wealth with this Thrilling Strategy

Resource Wars: Navigating a Shifting Global Landscape

Stock Market Sell-Off: Embrace Fear & Seize Opportunities

The Prudent Investor: Prioritizing Trends Over Speculation

Optimal Strategies for The Best Stocks To Invest Long Term

Market Correction Definition: Myths and Realities

Seizing Dominance: The Relentless Rise of Mental Warfare

Stock Market Predictions Today: Americans Fear The Market

Investor Sentiment Survey Defies Stock Market Crash Outlook

What is Inflation? Unveiling Effects and Strategies for Mastery