Copper Market News: Decoding Long-Term Patterns

Jan 30, 2025

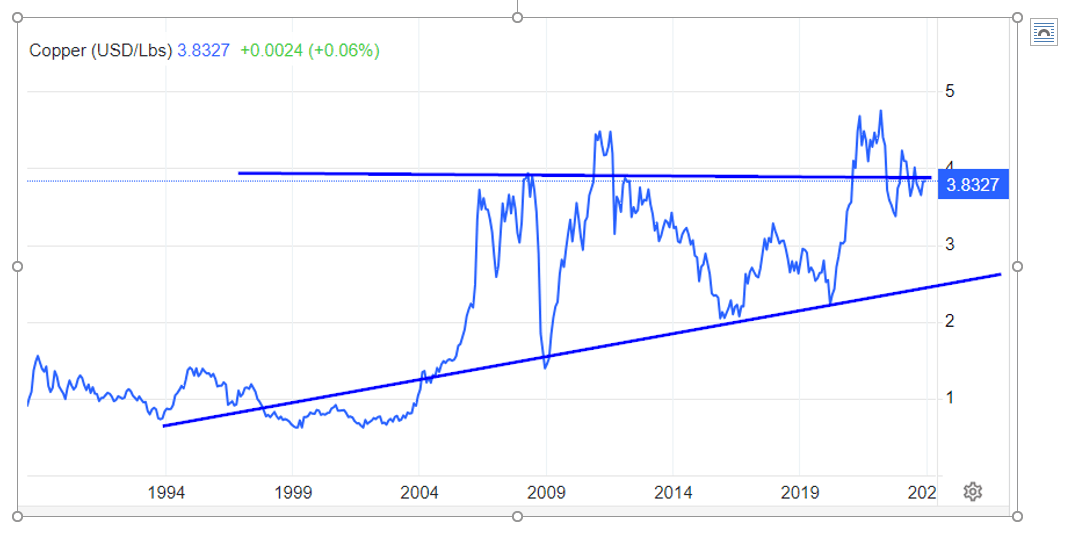

This chart reinforces and validates our primary perspective: that, from a long-term standpoint, market crashes present buying opportunities. Similar to the Dow utilities, and possibly even more prominently, copper is a leading indicator for both upward and downward movements. The long-term trend depicted in this chart highlights copper’s consistent upward trajectory, suggesting that unless it falls below 1.90, it remains within its long-term trend line. Until such a deviation occurs, the approach remains to “buy the crash and disregard the alarms of thrash.”

Shifting focus to more crucial aspects, a new bull market typically commences when surpassing old highs and concludes when the price doubles from the breakout point. In the case of copper since 2009, breakouts occurred in 2011, 2021, and 2022, yet the price failed to double after each breakout—the breakout point hovers around the 3.80 to 3.90 range. To complete the next bullish cycle, copper must trade at approximately 7.60. A weekly close at or above 3.90 should signal higher prices, and if we see a monthly close at 4.20, it will ignite a significant upward momentum, setting the stage for a test of the 6.50 plus range.

Anticipating the Supply-Demand Gap in Copper: A Long-Term Opportunity

The projected deficit in copper supply is not a temporary phenomenon but a long-term trend driven by the exponential growth of critical industries. This dynamic presents both challenges and opportunities for investors and policymakers alike.

Demand Drivers

The primary drivers of the copper demand surge are:

1. Electric Vehicle (EV) Production: According to recent projections, EV production is expected to increase significantly, contributing to a substantial growth in copper demand.

2. Renewable Energy Infrastructure: The shift towards sustainable energy systems, including solar and wind power, further amplifies copper demand.

3. Green Growth Initiatives: The intersection of environmental sustainability and economic growth creates new opportunities for cleaner technologies, which rely heavily on copper.

Supply Challenges

The supply side faces several obstacles:

1. Time-Consuming Mine Development: Opening new mines is lengthy, often taking years to become operational.

2. Production Constraints: Existing mines face limitations in increasing their output to meet growing demand.

3. Resource Depletion: Under all considered scenarios, the projected increase in copper demand could result in the exhaustion of identified copper resources unless high end-of-life recovery rates are achieved.

Market Dynamics and Projections

Recent studies have provided updated projections on the copper supply-demand gap:

1. Demand Growth: Some studies expect copper demand to double by 2050, with more aggressive estimates suggesting a five- to eightfold increase if CO2 neutrality is to be achieved.

2. Supply Deficit: The supply of copper peaked around 2012 and has fallen sharply since. The supply deficit in 2019 was projected to be much larger than in 2018, with the gap between supply and demand expected to grow until at least 2035.

3. Price Implications: These market dynamics are likely to keep copper prices elevated, potentially impacting the pace of the energy transition if not addressed promptly.

Behavioral Psychology Component

The copper market, like other commodity markets, is influenced by human behaviour and psychology:

1. Complex Dynamic Systems: Mineral commodity markets are complex dynamic systems driven by the evolution of economic, financial, political, and psychological variables.

2. Human Preferences and Expectations: Market prices of commodities are influenced by supply and demand levels, which depend on human preferences, desires, and expectations resulting from evolving cognitive capacities.

3. Investor Behavior: During periods of substantial market premiums, investor demand for the futures market can significantly affect both spot and futures prices, with a greater influence than during weaker market conditions.

Investment Opportunity and Strategy

Given these market dynamics and behavioural factors, investors may consider the following:

1. Long-Term Positioning: Establishing a base position in copper-related investments could be a prudent strategy, aligning with the long-term outlook of a consistent upward trajectory in copper demand and prices.

2. Diversification: Consider investments across the copper value chain, including mining companies, processors, and end-use industries benefiting from increased copper utilization.

3. Circular Economy Opportunities: With the growing importance of high end-of-life recovery rates, companies focusing on copper recycling and circular economy solutions may present attractive investment prospects.

Leveraging Mass Psychology and Technical Analysis for Timing Copper Market Entries

Mass psychology and technical analysis are potent tools for timing entries into the copper market. Understanding the sentiment and emotions driving the market can help identify oversold conditions and potential buying opportunities. Mass psychology, a concept rooted in the study of crowd behaviour, influences how investors react to market events and news. By recognizing prevailing emotions, investors can make more informed decisions.

For example, during a market correction or period of negative news, investors may exhibit fear and anxiety, leading to a rush to sell. This herd behaviour can result in an oversold market, presenting a buying opportunity for those who recognize the emotional drivers. Technical analysis provides tools to identify these moments.

Moving averages, such as the simple moving average (SMA) or exponential moving average (EMA), help smooth out price data and identify potential support or resistance levels. When prices correct and approach these moving averages, it indicates a possible buying opportunity. For instance, during the 2020 market crash driven by pandemic fears, the copper price corrected towards its 200-day SMA, presenting a strategic entry point for long-term investors.

Additionally, oscillators like the Relative Strength Index (RSI) and Stochastic RSI can identify oversold conditions. During the same 2020 crash, the RSI for copper dipped below 30, indicating an oversold market. This signal and the SMA support would have provided a compelling case for a timely entry.

Another valuable tool is the Moving Average Convergence Divergence (MACD) indicator, which identifies trends and potential buy or sell signals. During market corrections, a MACD crossover below zero, followed by a crossover above zero, often signifies a shift from bearish to bullish momentum, presenting another strategic entry point.

By combining mass psychology and technical analysis, investors can effectively time their entries, taking advantage of market sentiment to make profitable investments. This approach aligns with the contrarian approach of “buying the crash” and capitalizing on opportunities presented by pessimistic sentiment.

Conclusion: Unlocking the Potential in Commodities

In conclusion, while Bitcoin and AI stocks capture the limelight, a quiet revolution is unfolding in the commodities market, with copper, coal, and uranium presenting compelling investment opportunities. The narrative of supply-demand dynamics, coupled with the lengthy timelines required for mine development, underscores the potential for a significant mega-trend in these unsung heroes of the investment world.

The impending surge in demand for copper, driven by the rapid growth of electric vehicles and renewable energy solutions, cannot be overstated. With a projected thirtyfold increase in EV production by 2030, copper’s role as a critical component in these industries ensures its prominence in future years. The time-intensive process of opening new mines further accentuates the supply-demand gap, creating a perfect storm for price elevation and potential supply constraints.

Similarly, coal and uranium remain integral to the energy mix despite the global push for cleaner energy sources. The International Energy Agency forecasts a rise in global coal consumption, while countries like China and India’s increasing adoption of nuclear power underscores uranium’s relevance. Often overlooked by the masses, these commodities present opportunities for savvy investors who recognize their enduring value.

As Warren Buffett wisely advised, “Be fearful when others are greedy and greedy when others are fearful.” The crowd’s stupidity has led to a fascination with cryptocurrencies and AI, but prudent investors may find their edge in overlooked sectors. The time is ripe to explore and capitalize on these commodities, with copper leading in this unfolding mega-trend.