Copper ETF: Smart Play in a Bull Market

Updated April 15, 2024

Copper ETF: A Bullish Bet in the Commodities Market

The global commodities market is a playing field for astute investors, where keen market insights often yield rewarding results. Copper, in particular, has been creating ripples in this space for good reason. As we look towards 2024 and beyond, there’s a mounting case for why investing in copper and, notably, copper ETFs could be a strategic move. Here’s why.

The Case for Copper

Copper is essential to various industries, including construction, power generation, electric vehicle production, and renewable energy infrastructure. Its unique properties, such as high electrical and thermal conductivity, durability, and recyclability, make it indispensable.

According to the International Copper Study Group (ICSG), the predicted deficit of copper has increased. In 2023, there was a deficit of 435,000 tons, which is expected to widen further in the coming years, with a projected deficit of 550,000 tons in 2024 and a massive 650,000 tons in 2025. The increasing global demand for renewable energy and electric vehicles is critical to this projected shortage.

The extraction and production of copper are complex and time-consuming processes. It can take over a decade to discover a copper deposit and bring it to the operational phase of mining. This means that even if new deposits are found today, they won’t contribute to the global supply chain anytime soon.

Additionally, copper production faces various challenges. Environmental concerns, regulatory hurdles, labour issues, and technical difficulties can all disrupt supply. The copper industry is walking a tightrope, and any issues with major copper mines could significantly impact the predicted shortages.

The case for investing in copper ETFs is strong. Copper’s role in the transition to renewable energy and its importance in critical industries make it a strategic choice. The potential for supply disruptions and the projected deficits further strengthen the argument for securing exposure to this vital commodity.

Why Copper ETFs?

Considering these factors, investing in copper seems like a wise move. However, investing in copper stocks can be risky due to the volatility of individual companies. This is where Copper Exchange-Traded Funds (ETFs) come into play.

Copper ETFs offer exposure to the copper industry without investing in individual stocks. They track the performance of either copper futures or companies involved in the exploration and mining of copper. This offers a level of diversification that can help to mitigate risk.

Moreover, investing in copper ETFs allows investors to capitalize on the bullish copper market without understanding the complexities of futures contracts or the specific risks associated with individual mining companies.

Several copper ETFs are available for investors to consider. The Global X Copper Miners ETF (COPX) is the most popular. It provides exposure to a wide range of companies involved in copper mining around the globe. The United States Copper Index Fund (CPER) is another option. It tracks the performance of copper futures contracts, offering a different way to invest in the copper market.

Navigating Market Trends: The Copper Perspective

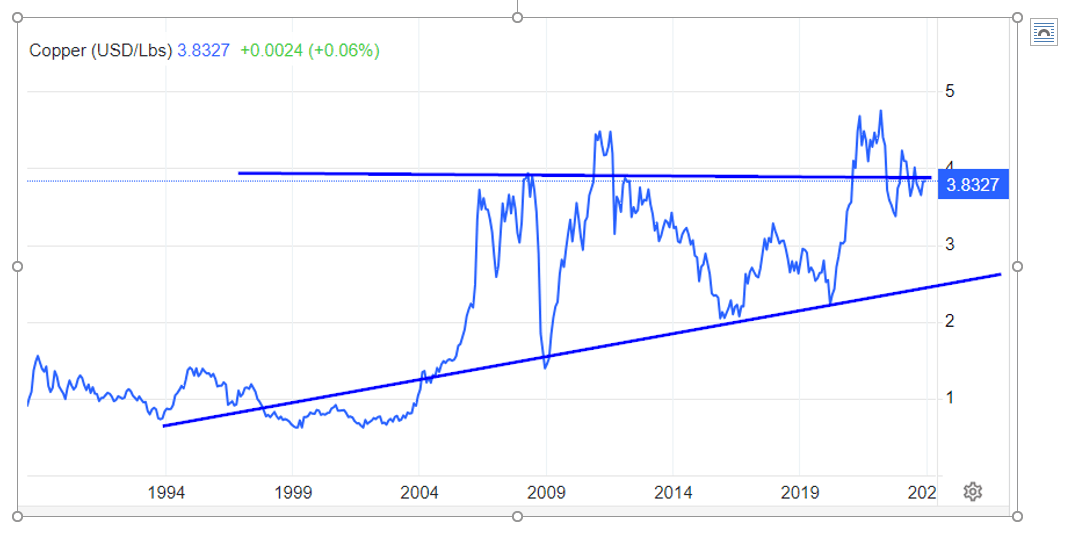

In the financial landscape, deciphering market trends is akin to a strategic chess game. Our analysis reaffirms a fundamental principle: market crashes, viewed through a long-term lens, are opportunities for astute investors. Drawing parallels with the Dow utilities, copper emerges as a potent leading indicator, showcasing distinctive signals for market fluctuations. Examining a long-term trend, the chart illustrates copper’s upward trajectory, suggesting stability unless it dips below 1.90. The guiding principle remains steadfast: “Buy the crash and dismiss the clamour of uncertainty.”

Copper’s Symphony: Harmonizing Investment Strategies

In the intricate symphony of investments, Copper, often overshadowed by the allure of cryptocurrencies and AI stocks, emerges as an unsung hero. Unveiling a compelling long-term investment narrative, Copper stands resilient amid the clamour for futuristic assets. A critical juncture approaches as demand for Copper, coal, and uranium intensifies, laying the groundwork for a potential mega-trend.

The narrative unfolds with profound simplicity: rising demand for Copper is poised to outstrip the available supply. The International Copper Study Group (ICSG) projects a significant deficit of 510,000 metric tonnes in the global copper market for 2024, starkly contrasting with the 2021 surplus of 600,000 tonnes. This shift is propelled by the swift expansion of industries reliant on Copper, notably in electric vehicle manufacturing and renewable energy solutions. The World Bank anticipates a more than thirtyfold increase in electric vehicle production by 2030, driving a 1.9% annual rise in Copper demand until that pivotal year.

Copper ETF: Simple Way To Bet On Copper

In 2022, copper prices hit record highs, indicating that the global economy was not in a dire state but rather a result of poor political decisions by world leaders. Despite a brief setback, copper remained steady and surged beyond the 4.50 mark, revealing that inflation and supply were merely symptoms of bad policies, with the United States policies being a prime example.

As a result, copper is gaining momentum and is set to trade past 4.50; this also means that the market will be range-bound for years, posing a challenge for long-term investors who focus on indices. However, this presents an excellent opportunity for traders who can use market psychology and technical analysis to their advantage.

Moreover, with the world moving towards renewable energy sources, copper will be in high demand for the production of solar panels, wind turbines, and electric vehicles. The need for copper is expected to increase with the global economic recovery, particularly in China, the world’s largest consumer of copper.

Copper Shortage: A Prolonged Challenge with Solutions in Supply Boost

The copper market will be affected for a long time by shortages unless immediate action is taken to address the supply shortfalls. The key lies in increasing exploration and mining activities. However, establishing new mining operations is a slow and intricate process. Consequently, copper demand is expected to exceed supply for an extended period.

According to Robin Griffin of Wood Mackenzie, unrest in Peru and rising demand from the energy transition sector are projected to cause significant deficits in copper supply until 2030. Peru’s protests have led to the closure of mines, affecting its 10% global copper supply contribution. Chile, the leading copper producer at 27%, has also witnessed a 7% year-over-year decrease in output. Despite these disruptions, experts like Timna Tanners anticipate the emergence of new mines in 2023. The reopening of China and the growing demand from the energy transition are straining copper resources, and the supply deficit might persist until 2024-2025, potentially doubling copper prices. Electrification, particularly in electric vehicles (EVs) and charging infrastructure, drives up copper demand due to their high usage of copper. The growth of the energy transition poses a significant long-term challenge to copper supply.

McKinsey predicts global electrification will increase copper demand to 36.6 million tonnes by 2031, while the estimated supply stands at 30.1 million tonnes, resulting in a 6.5 million tonne deficit. The utilization of copper in green technologies is expected to rise from 4% in 2020 to 17% by 2030. Achieving “net-zero emissions” would require an additional 54% of copper. S&P Global envisions demand approaching 50 million tonnes by 2035, but even with mining output growing at 2.69% annually, it would only reach 31 million tonnes. Experts emphasize the current and future supply gaps driven by the surging demand from EVs, renewables, and electricity grids. The copper market is grappling with tightening supply constraints and a substantial gap over the next decade.

Conclusion

In conclusion, investing in a copper ETF can be a wise decision, as copper is an essential commodity in various industries. With the global economy recovering, its demand is likely to increase. Copper prices are expected to rise while the US dollar is projected to stay at a multi-year high, triggering inflationary forces. Moreover, the current copper market presents an excellent opportunity for traders who can use market psychology and technical analysis to their advantage.

An excellent approach to capitalizing on the copper situation, especially if you prefer not to invest in copper stocks, is to consider one of the following ETFs. The global miners’ ETF is somewhat more volatile but provides the best opportunity to achieve the highest gains in the ETF sector.

Here is the list of copper ETFs:

1. iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC)

2. United States Copper Index Fund (CPER)

3. Global X Copper Miners ETF (COPX)

Please be aware that the availability of these ETFs may vary.

Now for the historical outlook

In the good old days, before QE changed everything, any signs of strength from copper could be construed as a positive development for the markets and vice versa. However, based on the price action of copper, the US markets should have crashed long ago, but they diverged strongly. Propped by hot money, the markets continued to soar higher. One wonders what will unfold when copper does finally put in a bottom. Market Update Oct 2nd, 2015.

The Fed’s success in manipulating the market and recreating reality has been awe-inspiring. The masses have been hypnotized and have swallowed their narrative whole, making it all the more likely that copper and the markets will rally together. This will only reinforce the illusion that everything is hunky-dory and that the economy cannot function without the Fed’s omnipotent intervention.

But make no mistake, dear reader. There are two distinct forces at play here. On one hand, the elite players are cunningly culling the herd, taking out the intermediate players and making way for their grand designs. On the other hand, some refuse to be deceived and struggle to survive in this cutthroat environment. It’s a battle for survival, and only the strongest and most adaptable will come out on top.

Copper ETF Stock: Good Hedge Against Hot Money

In reality, those in power are manipulating the masses for their gain and doing it with a nothing short of masterful finesse. The so-called “big players” are being taken out left and right, but it’s all part of a larger plan that is carefully hidden from public view. Meanwhile, a new psychological test is underway to see how much the masses will accept before they push back. The results so far are both fascinating and terrifying.

The powers that be have no interest in allowing natural economic forces to work out the excess in the system. Instead, they create money out of thin air, perpetuating the illusion of economic growth and lining their pockets. The rich get richer while the average person struggles to make ends meet.

But why bother with anything else when the masses remain complacent? The people are distracted by many issues, from immigration to economic woes, and the truth is often hidden in plain sight. The governments of Europe, for example, created an environment in which Muslim immigrants could invade, and now they’re using that as a smokescreen to hide their true intentions.

The situation in the US is no different. The powers that be are pulling the strings, and they’re doing it with a finesse that is both impressive and terrifying. Things will not end well if the people don’t wake up soon. The illusions will crumble, and the truth will come out. But will it be too late to do anything about it?

Other Stories of Interest

The Mob Psychology: Why You Have to Be In It to Win It

What Is Collective Behavior: Unveiling the Investment Enigma

What is the Rebound Effect? Unlock Hidden Profits Now

Dividend Collar Strategy: Double Digit Gains, Minimal Risk, Maximum Reward

Dividend Capture Strategy: A Devilishly Delightful Way to Boost Returns

BMY Stock Dividend Delight: Reaping a Rich Yield from a Blue-Chip Gem

Define Indoctrination: The Art of Subtle Brainwashing and Conditioning

What Is the Velocity of Money Formula?

What is Gambler’s Fallacy in Investing? Stupidity Meets Greed

Poor Man’s Covered Call: With King’s Ransom Potential

How to Start Saving for Retirement at 35: Don’t Snooze, Start Now

The Great Cholesterol Scam: Profiting at the Expense of Lives

USD to Japanese Yen: Buy Now or Face the Consequences?

How is Inflation Bad for the Economy: Let’s Start This Torrid Tale

Copper Stocks: Buy, Flee, or Wait?

The Lavish Tale of the Dot-Com Bubble: When the Internet Took the World by Storm