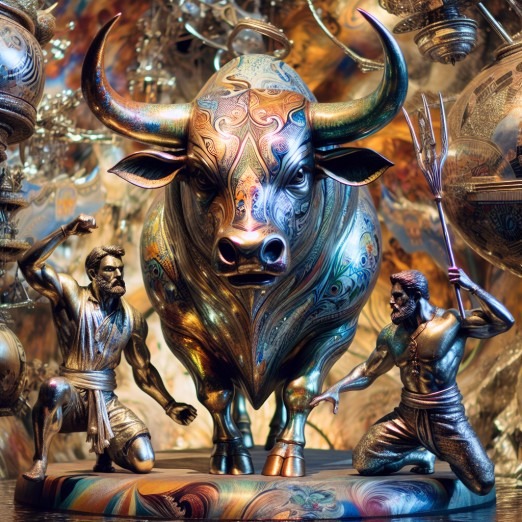

The Silver and Gold Bull: Fear’s Return to Power

Oct 29, 2025

Introduction: The Silent Coup Begins

For the first time in nearly three decades, global central banks now hold more gold than U.S. Treasuries. That single fact, stripped of the usual noise, marks a psychological rupture in the international monetary order. Roughly 36,000 metric tons of gold—worth about $4.5 trillion—now outweigh the $3.5 trillion in Treasuries held as reserves. Analysts frame it as diversification, fiscal prudence, or inflation hedging. Yet beneath these narratives lies one primal driver: fear.

Experts cite three formal forces behind the pivot—rising U.S. debt and ballooning deficits, inflation colliding with geopolitical tension, and the hum of de-dollarisation. But those are surface waves. The true tide began when Western governments froze Russia’s reserves in 2022. Overnight, money ceased being neutral. The implicit guarantee that sovereign reserves were safe under the U.S.-led system vanished. Every finance minister watching learned a permanent lesson: your reserves are yours only until Washington disagrees. That single act seeded a quiet panic, inaudible in speeches but thundering through boardrooms.

Gold’s Return to the Throne

Gold’s resurgence is not about yield or inflation-adjusted returns—it is about custody, sovereignty, and control. Gold cannot be frozen by sanctions or erased through policy. It exists beyond jurisdiction. Measured this way, gold’s rise is not a commodity trade; it is geopolitical insurance. The West calls it diversification. The rest call it survival.

Central bankers dress this shift in technocratic language: “reserve composition,” “prudential diversification.” But behind closed doors, they are hoarding what cannot be deactivated with a keystroke. Gold’s share of global reserves has climbed to roughly 27 per cent, overtaking Treasuries’ 23 per cent. The line crossed quietly but symbolically—it marked the moment the metal that predates fiat reclaimed primacy over the bond that once defined it.

Fear’s Geometry

This is not the “death of the dollar.” That phrase sells newsletters, not truth. The dollar will remain the medium of trade for decades, its inertia sustained by infrastructure and liquidity. But its purchasing power—the domestic core of its strength—faces erosion. Structural deficits, political paralysis, and debt monetisation guarantee a slow, steady decline. Inflation may fluctuate, but debasement endures.

Governments, like individuals, respond to loss by seeking tangible anchors. As commodities rise and currencies wobble, gold becomes confession. Each ton bought whispers, “We no longer trust promises.” And as rulers move, so will the ruled. Retail investors, sovereign funds, and family offices all chase the same gleam—not from macro insight, but from a shared intuition: trust has left the room.

Trust Leaves the Empire

The confiscation of Russian reserves did not merely isolate Moscow; it reminded the world that money held in Western custody is conditional property. Since Bretton Woods, the unspoken rule was simple: dollars were safe. That illusion cracked. What follows is not chaos, but re-anchoring. Gold, inert and ancient, has become the gravitational centre once more.

Irony laces the moment. The West, by punishing one nation, taught the rest to prepare for punishment. Fear birthed resilience. The same central banks that mocked gold as a relic now buy it by the ton. Financial media debate “multi-polarity,” but the more profound truth is psychological: trust has shifted from paper to metal.

The Silver and Gold Bull Emerges

The “de-dollarisation” narrative misses the nuance. Nations are not abandoning the dollar for trade; they are abandoning the West for storage. Trade in dollars, yes. Settle in dollars, often. But store reserves elsewhere—offshore, off-grid, off-ledger. The dollar remains the bloodstream of commerce but no longer the vault of safety.

From a market perspective, this realignment is seismic. Gold is transitioning from “defensive hedge” to “strategic core asset.” Treasuries, once sacrosanct, are losing their aura. Yield curves, collateral frameworks, and risk models will all bend to this reality. The U.S. can still print money, but it can no longer print trust.

The Logic of Empire and Erosion

Every empire’s currency does not die through rejection, but overextension. Rome clipped its coins. Britain debased sterling. America monetises deficits. Confidence fades, credibility follows, purchasing power collapses. The dollar’s decay will not be declared; it will unfold quietly, through inflation and migration of reserves. It will still be used everywhere, just worth less everywhere. The corpse will keep walking.

For traders and investors, the signal is unmistakable. Fear governs allocation now—not interest rates, not GDP prints—fear of confiscation, fear of dilution, fear of dependence on systems controlled by others. Sovereigns buy gold; retail follows. Nations hedge; investors imitate. Monetary psychology compounds faster than policy can contain it.

The Age of Tangible Faith

Faith has left the ledger and returned to the hand. The shift from paper to metal is not a trade—it’s a confession. After half a century of digital abstraction and fiat illusion, the world is relearning the weight of value. Silver and gold are no longer artefacts of nostalgia; they are the new instruments of self-defence in an age when trust itself has become a counterparty risk.

Silver, once dismissed as gold’s impatient cousin, is now the accelerant. When the system shakes, silver moves first, faster, wilder—a proxy for emotional conviction. It thrives where volatility becomes its own currency. In every bull market born of fear, silver’s violence signals belief turning physical. It is the rebellion of the retail class against invisible custody. The same instinct that drives nations to hoard gold drives individuals to hoard silver: a quiet insurrection against the custodians of decay.

What’s unfolding is not a commodity cycle—it’s a spiritual correction. The West’s financial architecture, built on promises of liquidity and control, is cracking under the weight of disbelief. The precious metals bull is not about price targets; it’s about psychological repricing. When systems lose moral authority, people retreat to what cannot lie. Gold is the ark; silver is the fire that lights the way to it.

This is the age of tangible faith, where trust is measured in ounces, not algorithms. The crowd may not articulate it, but they feel it: that the empire of credit is faltering, that the software of money is corrupted. And so they do what all creatures of instinct do when cornered—they seek something real.

When the last illusion burns, metal remains.

The Bull in Full Charge

The precious metals bull is an offshoot of the broader resource remobilisation wars. Gold leads the charge toward much higher prices. A monthly close near 4,500 will be the first significant signal. A sustained close above 5,100 will confirm the trajectory toward the 9,000 range as the initial target. At that stage, silver will likely trade well past 120. Sharp pullbacks are not threats but bullish resets within a structural uptrend.

The twin bulls of gold and silver are no longer mere hedges—they are declarations of defiance. Fear dethroned the dollar, and fear now fuels the rally. What we are witnessing is not speculative mania but psychological repricing. Paper is losing credibility; metal is reclaiming truth. The empire of trust has fallen, and the age of tangible value has begun.

Deeper Dive into Compelling Narratives