Millennials should prepare for Dow Dow 50000

In finance, Expert Synonym should be brain or moron, for most experts are only good and issuing pie in the high targets or stampeding the masses.

It would seem, on the market’s race to Dow (^DJI) 20,000, that we’ve hit a little speed bump. It’s not so much “if” we will hit that psychological and magical level, it’s more “when.” But what does it really mean? For traders here on the floor, it’s a significant benchmark in the Dow—one that will be celebrated with loud yells, confetti-like paper flying around, and high fives! After this three-minute celebration, it will be back to trading, and 20,000 will be in the history books.

Talk will start to focus on Dow 25,000, then 30,000. Yesterday, I heard someone talking about Dow 50,000 by the end of Trump’s eight-year presidency (eight years?!). What traders are truly preoccupied with is the market trend. There is a saying down here on the floor, “The trend is your friend,” and right now the trend is very friendly. The latest bullish sentiment out of the AAII (American Association of Individual Investors) shows bullish sentiment at 44.7% vs. bearish sentiment at 32.3%. However, bearish sentiment is starting to move, up +5.8% since the last read. Government data out this morning showed the final read on third-quarter GDP at 3.5%, up from the initial read of 3.2%. Initial jobless claims came in at 275,000 versus 256,000. That is still below 300,000 for the 94th straight week (Any number below 300,000 indicates a healthy economy.). Full Story

Dow 50000 Is possible but not as Fast as these Nuts are proclaiming

As we stated in the Interim update, such proclamations start to make us nervous. While this article covers a confluence of opinions, nevertheless the writer is feeling confident enough to come out with an entirely bombastic title. This is what took place in 2011 in Gold. We also witnessed some nonsense in 2015. One well-known trader stated that Gold would trade to 25K; another had the nerve to come out with a target of 50K. We penned a follow-up article where we asked these traders if they were under the influence of strong medicine when they issued these objectives for Gold.

How can one come up with such targets when Gold had not even made it to the 2K mark? You have to be insane or smoking crack to have the nerve to issue such insane targets. Years ago, we published extreme targets of 5K and at that the time we even felt slightly uncomfortable with these targets. Thus, we repeatedly stated that they were extreme targets. In other words, a feeding frenzy could create an irrational phase where the markets are pushed a lot higher than they would normally trade. Our primary targets fell in the 2500-3000 ranges. Despite the massive amounts of new money created, we see no reason to raise these targets.

For now, until Dow 30K is taken out decisively and by this, we mean that the Dow should end the month above 30K, it is a waste of time to focus on higher targets.

Stock market Update

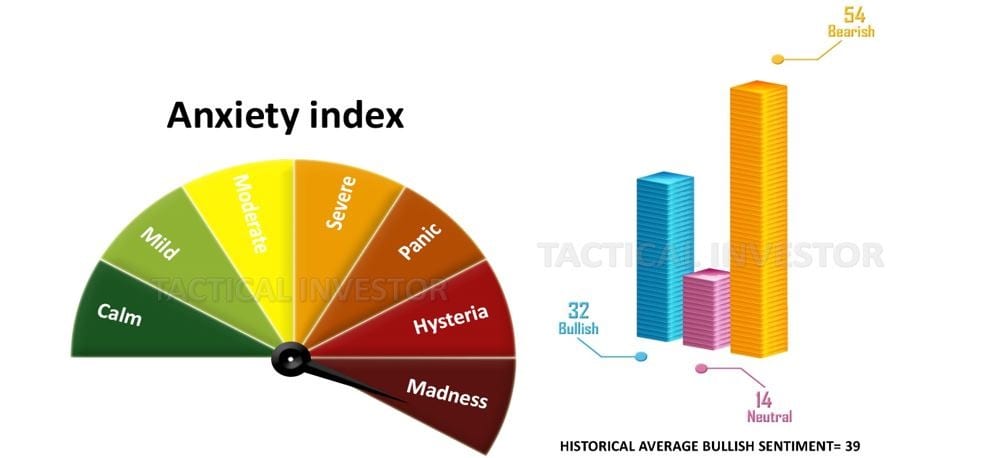

We are dangerously close to hitting the upper limit of the madness zone. Bear in mind that before this pandemic, the gauge never even hit the extreme end of the hysteria zone. So, this is an unprecedented development. Given this massive move in the anxiety gauge, neutral readings would now need only to dip down to 10% to trigger the “father of all buy signals” provided our technical indicators move to the extremely oversold ranges, and the Trend indicator remains positive (bullish).

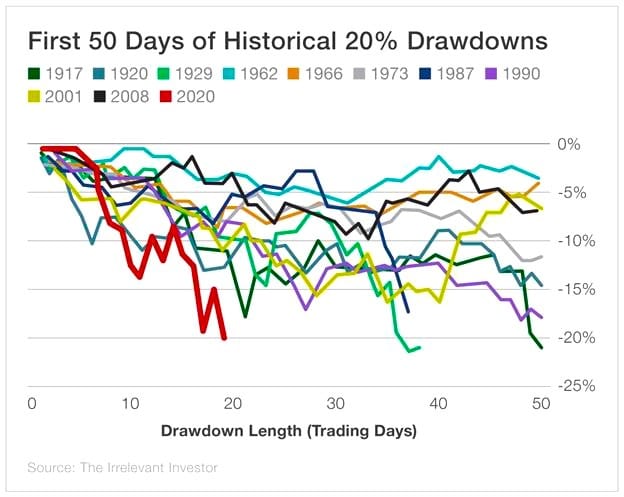

The above chart illustrates that whenever the markets experience extreme corrections, that from a long term perspective they make for incredible long term opportunities. The astute investor will buy when the masses are panicking, while the novice will flee for the hills

Successful investors focus on the long term outlook

Successful investing is based on taking the long term view and the best time to invest in stocks, if one adopts this view is when the markets are in turmoil. If one looks at our portfolios, one will see that from a historical basis, the most significant number of buys were triggered during moments of chaos. It’s when the masses are panicking that one has the opportunity to get into quality stocks at a considerable discount.

Even if one is stopped out, the overall gains from taking such an approach are huge, and this is easily verified by pulling up any long term chart of the market. Long term does not imply ten years. It generally falls in the 6 to 24-month category. Take the 2008 correction/crash; even if you were stopped out several times from the same play, you would have still walked away with huge gains, as long as you were not dumping money into some speculative or poorly run company.

We have seen this panic selling at play many times in the past, and the theme is always the same; create whatever crisis you want to create, but once the panic subsides the masses (always) regret their decision, vowing that it will be different the next time. When the next time approaches, they act precisely in the same manner as they did the last time, proving the mass mindset is programmed to panic at precisely the wrong time. One could almost go as far as to say that the mass mind-set has a secret desire to lose, for it does the same thing over and over again, virtually guaranteeing a negative outcome. Doing the same thing over and over again and hoping for a new result is the definition of insanity.

Other Stories of Interest

BIIB stock Price: Is it time to buy

Stock Market Forecast for Next 3 months

Next Stock Market Crash Prediction

Dow theory no longer relevant-Better Alternative exists

Inflation the Silent Killer Tax that’s destroying Middle-Class America