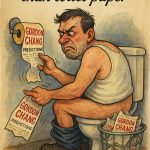

When There’s Blood in the Streets, Buy

Feb 20, 2025

The phrase “Buy when there’s blood in the streets,” often credited to Baron Rothschild, isn’t just a witty aphorism—it’s a brutal, battle-tested strategy. It speaks to the raw core of contrarian investing: when panic rules, logic often gets priced out.

“Blood” is symbolic, of course—but the emotion behind it isn’t. It means despair, capitulation, forced liquidations. It’s when portfolios are dumped, headlines scream collapse, and analysts are busy revising targets down instead of asking if the selling’s gone too far. That’s when real opportunity begins.

But let’s be clear—this isn’t about buying blindly during chaos. It’s about recognizing when the market has overshot on fear. Price collapses in a panic and often has little to do with fundamentals and everything to do with crowd psychology. That disconnect is where the upside lives—if you have the stomach for it.

Why It Works

Fear is a catalyst for mispricing. When market participants are driven by emotion rather than analysis, asset prices can fall well below intrinsic value. This creates a setup where even average investments can produce outsized returns simply because they were bought at distressed levels.

The Contrarian’s Edge

Investors who thrive in this environment don’t just survive—they accumulate. They assess risk rationally when others can’t. They understand that recovery rarely waits for full clarity. By the time the news turns positive, the best entry points are long gone.

To do this well, you need two things:

- Conviction in fundamentals — not narratives.

- A read on sentiment — understanding where we are in the emotional cycle.

That means tracking fear indexes, liquidity flows, credit spreads, volatility spikes—clues that suggest the market is in full-blown risk-off mode. Then, while others are begging for safety, you step into the fire.

Historical Echoes

- 2008 Financial Crisis: Panic dominated. But those who stepped in during the March 2009 bottom rode one of the strongest bull markets in history.

- March 2020 (COVID crash): Global shutdowns, economic paralysis, oil below zero. But buying during that moment of maximum fear? Tremendous upside.

- Late 2022: Recession warnings were everywhere, yet markets bottomed and 2023 turned out to be a powerhouse year.

The Psychology Behind Blood in the Streets Investing

The psychology behind “blood in the streets” investing is essential to understanding the contrarian approach. Contrarian investors recognize that market movements are not solely driven by rational analysis and objective factors. Emotions and psychological biases can significantly shape market sentiment and drive investor behaviour.

During market turmoil and panic, fear and uncertainty tend to dominate investor psychology. This fear can lead to a herd mentality, where one investor’s actions influence others’ actions, creating a self-reinforcing selling cycle. As prices plummet, many investors may succumb to panic and sell their positions, exacerbating the downward pressure on asset prices.

Contrarian investors, however, take advantage of this fear-driven behaviour. They understand that market sentiment often swings to extremes and that these extremes can present opportunities. By studying market psychology and recognizing the impact of emotional decision-making, contrarians position themselves to capitalize on the actions of others.

Contrarian investors also understand common psychological biases that can influence market behaviour, such as herd mentality, loss aversion, and recency bias. They aim to detach themselves from these biases and make rational, independent decisions based on their analysis and conviction.

By being contrarian, investors position themselves to buy when others are selling, potentially acquiring lower-priced assets. They are willing to go against the prevailing sentiment and have the patience and conviction to hold their investments until the market sentiment shifts and prices recover.

Contrarian Investing in the Digital Age: Going Off-Grid When the Herd Swarms

The core of contrarian investing hasn’t changed—but the battlefield has.

In the digital age, the herd is louder, faster, and more emotional. Algorithms feed panic. Sentiment shifts hourly. But amid this chaos, the edge remains: act when others retreat, think when others react. And above all—question the consensus, even when it’s screaming in all caps across your screen.

This isn’t about simply betting against the crowd. It’s about knowing why the crowd is wrong—and when the price dislocation is actionable. That’s where most contrarians fail: they nail the thesis but miss the vector. Timing becomes everything, and binary thinking (“now or never”) becomes the Achilles’ heel.

Modern Tools, Same Discipline

Sure, investors now have real-time sentiment dashboards, data analytics, and algo-assisted trade execution. But access to data isn’t an edge anymore—interpretation is. The contrarian advantage still lies in emotional discipline and structural thinking, not information overload.

Contrarians thrive in moments of chaos—when sentiment breaks away from fundamentals. And markets are prone to that more than ever. But to extract alpha, you must combine macro pattern recognition, non-linear thinking, and behavioral triggers.

Think of price not as truth but as narrative in motion. If everyone’s running for the door, it’s usually already too late for them—and exactly the right time for you.

Case Studies: When the Narrative Broke—and Opportunity Opened

Warren Buffett – 2008 Financial Crisis

The herd was dumping banks. Buffett wrote checks. Goldman Sachs and Bank of America looked toxic. He stepped in. The vector? Fear was peaking. Fundamentals were broken—but not irreparably. Ten years later, those trades made billions. Lesson: Timing the inflection is everything.

John Templeton – World War II

While the world was burning, Templeton bought 104 companies trading under $1. Not because he was an optimist—but because he knew panic pricing disconnects from reality. The market had overshot to the downside. Years later, those positions exploded upward. This wasn’t blind faith—it was contrarian vector logic: depressed sentiment + surviving fundamentals = asymmetrical payoff.

David Dreman – Dot-Com Meltdown

Everyone wanted dot-com darlings. Dreman bought old-school value stocks. While tech imploded in 2000, his boring, hated portfolio held firm. He understood that when attention becomes obsession, valuation stops mattering—until it matters again. His edge? Seeing the bubble not just as overvalued but unsustainable.

Sir John Templeton – Panic of 1959

Market panic, driven by global instability, crushed prices. Templeton bought beaten-down names others wouldn’t touch. He wasn’t “early”—he was precise. The rebound didn’t just recover losses—it created a multiplier. It was all about timing fear’s apex.

When Contrarian Goes Wrong: Timing and Vector Misalignment

Going against the crowd doesn’t mean you’re right by default. If you’re early, you’re wrong. If you’re fighting a secular shift, not a temporary panic, you’re not a contrarian—you’re a casualty.

Example: Investors who bought oil stocks in 2014 during the first crash assumed it was just a sentiment dip. It wasn’t. It was the beginning of a structural energy transition. They bet on blood—they got bludgeoned. The crowd wasn’t irrational—it was ahead of the curve.

This is where non-binary thinking separates signal from noise. You need to ask: Is this blood in the street—or a tectonic shift under the pavement?

Vector-Based Contrarianism: Reading the Terrain

Think in vectors, not snapshots.

A traditional contrarian sees red and buys. A modern contrarian reads the trajectory—how fast sentiment is falling, what caused the rupture, and whether it’s emotional overreaction or structural decline.

This is where mass psychology becomes a compass. When fear is driven by herd emotion and media hysteria (e.g. March 2020), you’ve got a setup. But you better know the difference when the crowd is fleeing for legitimate reasons (e.g., Lehman collapsing in 2008).

Visual Aid: Indicators of Fear

(See the infographic above or a breakdown of key fear indicators: VIX spikes, put/call ratios, volatility clusters, credit spreads, sentiment polls, etc.)

Cognitive Bias: The Invisible Saboteur

Even contrarians aren’t immune to their own biases. Anchoring to past rebounds, overconfidence in their thesis, or confirmation bias through selective data—these kill returns. Armstrong, Dent, and even Burry have all been guilty of this at times.

The solution? Build disconfirmation loops into your strategy. Challenge your thesis weekly. Use sentiment tools not to confirm your view—but to gauge just how wrong the market might be, or if you’re just early (and how early is too early).

Risk Management and Patience: The Steel Core of Contrarian Investing

Contrarian investing isn’t for the faint of heart. It’s not about being brave—it’s about being prepared. When you’re stepping into a market soaked in fear, these three pillars matter more than your thesis: patience, discipline, and risk control.

Patience isn’t passive—it’s strategic.

Markets don’t reward you on your timeline. A beaten-down asset won’t snap back because your thesis is right. It might grind lower for months, even years. Without patience, even the smartest contrarian play gets abandoned before it matures. You wait—not because you’re hopeful, but because your analysis demands it.

Discipline is what keeps you in the game.

It’s easy to say “buy the blood.” It’s hard to do it when headlines scream collapse and everyone you know is selling. Discipline means sticking to your framework—not your feelings. If your investment case is sound, short-term noise doesn’t shake you. Weak hands chase comfort. Strong hands hold conviction.

Risk management separates bold from reckless.

Being contrarian doesn’t mean going all-in. You’re not trying to be a hero—you’re trying to survive long enough to be right. That means sizing positions carefully, using stop-losses where necessary, and diversifying across uncorrelated ideas. You plan for being early, because early often feels wrong before it pays off.

Don’t just buy cheap—buy quality on sale.

Don’t just “buy the dip.” Read the dip. Know the vector. Know the sentiment pulse. Ask why everyone’s fleeing, and then ask: Are they wrong—or am I late?. Smart contrarians hunt for assets that are mispriced and structurally sound. That means digging into fundamentals, identifying catalysts, and stress-testing scenarios. It’s not about finding what’s down—it’s about finding what’s down but will get back up.

Conclusion: When There’s Blood in the Streets—Act, Don’t Flinch

The best time to buy often feels like the worst. That’s the paradox. When fear peaks and markets spiral, most investors freeze or flee. But the contrarian—prepared, liquid, and unemotional—moves in.

“Buy when there’s blood in the streets” isn’t a slogan. It’s a strategy built on discipline, not bravado. It means seeing opportunity where others see chaos and having the nerve to pull the trigger when headlines scream collapse.

Yes, it carries risk. Markets can stay irrational longer than expected. But the reward lies in positioning early—before the crowd returns. History backs it up: Rothschild, Templeton, the 2009 lows, March 2020. The edge isn’t just in being right. It’s in acting when others can’t.

Stay patient. Stay rational. Let panic do the pricing—and you do the buying.