What is Contrarian Thinking: Unveiling Its Remarkable Benefits

March 26, 2024

In a world that often rewards conformity and echoes the chorus of the status quo, contrarian thinking stands out as a beacon of innovation and creativity. But what is contrarian thinking? At its core, it’s the courage to challenge prevailing norms and the insight to see opportunities where others perceive obstacles. It’s the intellectual audacity to question established truths and the wisdom to recognize the transformative power of alternative perspectives.

The concept of contrarian thinking isn’t just a modern-day strategy for success; it’s a timeless approach that has catalyzed some of the most groundbreaking discoveries in human history. Take, for instance, the early 20th-century quandary in physics. The conventional wisdom of the time was entrenched in the belief that light was purely a wave and matter strictly particle-based. Yet, the contrarian views of Max Planck and Albert Einstein shattered these rigid paradigms and gave birth to quantum mechanics, reshaping our understanding of the universe.

Planck’s bold hypothesis that light could be emitted in discrete energy packets and Einstein’s subsequent revelation of light’s dual wave-particle nature were not mere acts of rebellion against scientific dogma. They were profound insights that expanded the horizons of human knowledge, leading to technologies that define our modern life, from lasers to quantum computing.

Similarly, the field of genetics was revolutionized by James Watson and Francis Crick, who dared to envision the structure of DNA differently from their contemporaries. Their contrarian hypothesis of the double helix went against the grain of established scientific beliefs and laid the foundation for modern biology, impacting everything from medicine to agriculture.

What is contrarian thinking if not the very engine of progress? It is the willingness to embrace the unknown, the resilience to withstand scepticism, and the vision to see beyond the horizon of current understanding. As we unveil the remarkable benefits of contrarian thinking, we celebrate the monumental leaps in science and technology and the subtle shifts in everyday life that challenge us to think differently and act boldly.

Contrarian Thinking: Unveiling the Quantum World

The early 20th century was a crucible of scientific innovation, particularly in physics. The era’s scientists grappled with the nature of light and matter, entrenched in the belief that light was a wave and matter a particle. This dichotomy was so deeply rooted in the scientific community that any alternative perspective was heretical. Yet, the contrarian thinking of Max Planck and Albert Einstein catalyzed a paradigm shift, leading to the development of quantum mechanics—a cornerstone of modern physics.

Max Planck: Challenging the Prevailing Wave Theory

Max Planck, often considered the father of quantum theory, introduced the concept that light could be emitted in discrete units of energy, or quanta. His resolution to the blackbody radiation problem directly challenged the wave theory of light. Planck’s quantum hypothesis was a rebuttal of the status quo and a fundamental rethinking of the interaction between energy and matter.

Albert Einstein: Expanding Quantum Mechanics

Building on Planck’s foundation, Albert Einstein proposed that light could behave as both a wave and a particle. His explanation of the photoelectric effect supported quanta’s existence and suggested that photons, the light particles, were a reality. Einstein’s work was a testament to the power of contrarian thought to unlock new realms of understanding.

Quantum Mechanics: A Paradigm Shift in Physics

Quantum mechanics revolutionized our understanding of the universe with principles like wave-particle duality, showing that electrons and photons behave as both waves and particles. It introduced the uncertainty principle, indicating that specific properties, such as position and momentum, cannot be simultaneously known with precision.

This groundbreaking theory necessitated a rethinking of physics’ core tenets, leading to advancements like quantum field theory and electrodynamics, which redefined our grasp of universal forces.

In context, the contrarian approaches of historical figures like Leonardo da Vinci, who merged art with science, and Marie Curie, who overcame scepticism to pioneer radioactivity research and win two Nobel Prizes, resonate with quantum mechanics’ transformative impact on scientific thought.

Contrarian Wisdom: From Quantum Breakthroughs to Market Triumphs

The legacy of contrarian thinking in quantum mechanics underscores its game-changing influence. Beyond reshaping our grasp of the cosmos, it has catalyzed technological leaps, leading to quantum computing, laser technology, and sophisticated imaging methods. Its ripple effect is evident in chemistry, material science, and biology, showcasing how challenging conventions can yield significant breakthroughs.

This principle of contrarianism echoes in the financial world through investors like Warren Buffett and Peter Lynch, who have famously employed contrarian strategies to achieve market success. Buffett, for instance, advocates for being “fearful when others are greedy and greedy when others are fearful,” a stance that has seen him invest in undervalued companies during times of market pessimism, leading to substantial gains as these companies rebound. Lynch’s approach of “buying what you know” led him to invest in mundane, often overlooked stocks, which could outperform market expectations simply because they were not on the average investor’s radar.

Contrarian thinking is not about opposition for its own sake; it’s a blend of courage, curiosity, and intellectual humility. It’s about recognizing our knowledge’s limits and daring to venture beyond them. Such a mindset propels progress and inspires us to redefine what’s possible, from the quantum realm to the stock market.

Contrarian Thinking: The Bold Journey Through Challenge and Opportunity

Contrarian thinking is a thrilling intellectual adventure, rich with challenge and the potential for significant reward. It demands that individuals not only go against the grain but also back their dissent with robust evidence and persuasive arguments. In the face of scepticism, contrarians must craft a compelling narrative that can overturn conventional wisdom and inspire a new way of seeing the world.

The challenges of contrarianism are multifaceted. One must be vigilant against the allure of contrarianism as an identity rather than a methodological approach. As Charles T. Munger, vice chairman of Berkshire Hathaway and longtime collaborator with Warren Buffett, often emphasizes, it’s not enough to be different—one must be correct. Munger’s “latticework of mental models” suggests that a successful contrarian doesn’t just reject the crowd but integrates knowledge from various disciplines to understand when the crowd is wrong.

Furthermore, the contrarian path is laden with the risk of cynicism. Legendary investor Jesse Livermore’s tale is a cautionary one, illustrating that while contrarian positions can lead to great success, they can also result in significant losses without the right discipline and emotional control. Constantly opposing the consensus can lead to a dismissive attitude toward valuable traditions and expertise, which is why balance is essential. The thoughtful questioning of paradigms, rather than reflexive doubt, leads to constructive insights.

Another considerable challenge for contrarians is timing. As Livermore’s experience sometimes showed, the market may remain irrational longer than the contrarian can remain solvent. The vindication of a contrarian idea often occurs only after a long period, during which the thinker must endure ridicule and dismissal. This aspect of contrarianism demands unwavering conviction and exceptional patience. It’s not just about being right but also about being right at the right time.

Navigating the exciting challenges of contrarian thinking isn’t for the faint of heart. It is a journey that requires resilience, open-mindedness, and the intellectual courage to face both the market’s mood swings and one’s own convictions. By embracing these challenges, contrarians like Buffett, Lynch, Munger, and Livermore have reaped the rewards of their investment strategies and cemented their legacies as master thinkers who dare to see—and shape—the world differently.

Considering Alternative Perspectives

Challenging assumptions through research is a cornerstone of sound decision-making. It involves a meticulous process of gathering data, analyzing trends, and consulting with experts to understand the subject at hand comprehensively. This systematic approach identifies patterns and correlations that might otherwise go unnoticed.

In the spirit of the ancient philosopher Socrates, who championed the importance of questioning as a form of intellectual inquiry, we must scrutinize our beliefs and the status quo. By doing so, we can uncover limitations in our reasoning and open ourselves to new possibilities. Socrates’ method of debate, or dialogue, reminds us of the value of engaging with diverse perspectives to refine our understanding.

Similarly, the Stoic philosopher Marcus Aurelius advised that we must be willing to abandon our preconceptions. When we challenge our biases and assumptions, we align closer with reality, enabling us to make decisions grounded in a more accurate view of the world.

Thus, Research and analysis become tools for decision-making and pathways to wisdom. By embracing the rigours of research and the knowledge of the ancients, we can enhance our decision-making processes, leading to innovative and deeply informed outcomes.

The Impact of Contrarian Thinking in Pioneering Success

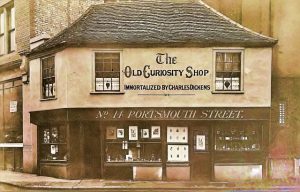

Contrarian thinking has been the driving force behind some of history’s most successful and transformative ideas. Steve Jobs and Apple’s “Think Different” campaign epitomizes this approach. By defying the norms of the technology industry and fostering a culture of creativity and innovation, Apple not only revolutionized its product line but also reshaped our interaction with technology.

Warren Buffett’s investment philosophy is a testament to the power of a contrarian mindset in finance. Buffett’s approach has yielded unparalleled success in the stock market by focusing on undervalued companies and resisting the allure of market trends, cementing his legacy as one of the most astute investors in history.

Elon Musk’s ventures into space exploration and electric vehicles with SpaceX and Tesla, respectively, showcase contrarian thinking in action. Musk’s willingness to challenge the established industry standards and take calculated risks has led to significant technological advancements and has disrupted traditional market dynamics.

These instances underscore the profound impact that contrarian thinking can have across various industries, by questioning the conventional, embracing risk, and thinking independently, contrarian thinkers have unlocked new possibilities and driven progress.

Conclusion

In conclusion, contrarian thinking is not merely a strategy but a philosophy that echoes the wisdom of ancient scholars who dared to challenge the status quo. As Socrates famously proclaimed, “I know that I am intelligent because I know that I know nothing,” the acknowledgement of our limitations often propels us to look beyond the obvious and question the collective narrative. The oracle at Delphi inscribed “Know thyself” as a testament to self-awareness, a core tenet of contrarianism, urging individuals to reflect internally before confronting external circumstances.

By embracing the contrarian approach, we unlock remarkable benefits; we become more resilient to market sentiments, more critical in our analyses, and more adept at identifying opportunities others overlook. The contrarians of today are the intellectual heirs to the likes of Diogenes, who eschewed societal norms in pursuit of authenticity. They are akin to Lucretius, who challenged the Epicurean gods in his poetic masterpiece “De rerum natura,” urging men to find truth through experience rather than dogma.

Investors like Peter Lynch and Jesse Livermore have exemplified this approach, leveraging contrarian principles to achieve remarkable success in the markets. Peter Lynch’s investment in Hanes is a classic example of contrarian thinking. Despite the market’s initial disregard for the company, Lynch recognized the potential in their new product line, L’eggs pantyhose. His foresight led to a significant payoff when the product became a staple in its category. Similarly, Jesse Livermore’s success came from his ability to go against market trends, famously profiting from the 1929 market crash by short-selling during a time of widespread optimism.

These investors demonstrate that contrarian thinking, while challenging, can lead to extraordinary outcomes. It requires a delicate balance between scepticism and open-mindedness and the fortitude to withstand market pressures and potential isolation. As we navigate the complexities of decision-making, whether in life or in the stock market, we would do well to remember the contrarian legacy — it is not just about going against the grain but about having the insight to see what others do not, the patience to wait for ideas to come to fruition, and the wisdom to act upon them decisively.

More Mental Treats

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

I’m Never Going to Be Financially Secure, So Why Try?

Saffron Supplement: Unveiling its Tantalizing Health Benefits