The AI Revolution in Finance: Unleashing Artificial Intelligence Investing

Updated Oct 27, 2023

Ascending Ascendants: How Artificial Minds Augment Investment Insights

The rapid advancement of artificial intelligence (AI) has significantly impacted the finance industry, ushering in a new era of AI-based investing. This transformation has enabled investment strategies that leverage machine learning algorithms, big data analysis, and predictive modelling to enhance investment insights and potentially improve portfolio outcomes.

Traditionally, finance heavily relied on human expertise and decision-making. However, with the advent of AI, machines have become powerful tools capable of processing vast amounts of data, identifying patterns, and generating investment recommendations. This has opened up new possibilities for wealth managers and investors to harness the potential of AI in their investment strategies.

One of the key advantages of AI investing is its ability to analyze massive datasets at high speeds, uncovering insights that may not be apparent to human analysts. AI systems can use machine learning algorithms to identify complex patterns and relationships within financial data, enabling more accurate predictions and informed investment decisions.

AI-based investment models can also adapt and learn from market dynamics in real time. These systems can continuously analyze market conditions, news sentiment, economic indicators, and other relevant factors, allowing for dynamic portfolio adjustments and proactive risk management.

Moreover, AI investing can help mitigate human biases often impacting investment decisions. Human investors are prone to cognitive biases such as confirmation bias or herd mentality, which can lead to suboptimal investment choices. AI systems, on the other hand, are designed to make decisions based on data analysis and predefined rules, reducing the influence of emotional or irrational factors.

There are several areas within finance where AI is making a significant impact. For example, AI-powered robo-advisors provide automated investment management services, offering personalized portfolio recommendations and rebalancing based on individual goals and risk tolerance. These platforms leverage AI algorithms to optimize asset allocation and deliver cost-effective and efficient investment solutions.

AI is also being utilized in quantitative trading strategies, where algorithms analyze vast amounts of historical market data to identify patterns and generate trading signals. High-frequency trading, powered by AI, enables rapid execution of trades based on real-time market conditions, exploiting short-term inefficiencies for potential profit.

Despite the numerous benefits of AI investing, challenges and considerations remain. Ethical concerns, data privacy, algorithmic transparency, and potential systemic risks are among the issues that need careful attention. It is crucial to strike a balance between the capabilities of AI and the need for human oversight, ensuring that AI systems are used responsibly and in alignment with regulatory frameworks.

Cryptic Clues in a Chaos of Codes: Unleashing Artificial Intelligence Investing

In finance, a profound transformation is underway as the AI revolution unleashes the power of artificial intelligence in investing. As vast troves of unstructured data stream daily, they present a seemingly chaotic landscape, hiding valuable signals from the human eye. However, through the magic of machine translation, these cascades of coded context can be unravelled, revealing hidden treasures that were once concealed. AI, driven by deep learning neural networks, can piece together patterns among prospects, decipher portents within the pulses of the populace, and uncover the true import of policies.

The rise of AI investing has shattered the limitations of traditional approaches. With the aid of machine learning algorithms and advanced data analysis techniques, AI-powered proxies can now perceive beyond surface nuances, weaving together holistic threads of information. This newfound capability allows AI systems to construct portfolios far surpass previous methodologies’ performance. By leveraging the power of deep learning, these artificial minds can discern connections and insights that were previously unattainable.

The potential impact of AI investing extends across various domains within the finance industry. Robo-advisors, driven by AI algorithms, have emerged as automated investment management platforms, providing personalized portfolio recommendations and dynamically adjusting asset allocations based on individual goals and risk tolerance. These robo-advisors leverage the analytical prowess of AI to deliver cost-effective and efficient investment solutions.

Quantitative trading strategies powered by AI have also witnessed a profound transformation. By analysing vast amounts of historical market data, AI algorithms can identify elusive patterns and generate precise trading signals. High-frequency trading, fueled by AI, enables rapid execution of trades based on real-time market conditions, seizing short-term inefficiencies for potential profit.

While the benefits of AI investing are undeniable, challenges and ethical considerations must be addressed. Data privacy, algorithmic transparency, and potential systemic risks require careful attention. It is imperative to strike a balance between the power of AI and the need for human oversight, ensuring that AI systems are deployed responsibly and in compliance with regulatory frameworks.

The fusion of AI and investing has unearthed cryptic clues hidden within a chaos of codes. By leveraging the capabilities of artificial intelligence, investors can now navigate through vast amounts of data, deciphering patterns, and uncovering insights that were once veiled. As AI-driven portfolios outperform previous limits, they provide a new dimension of perception, enabling investors to go beyond the surface and embrace a more nuanced understanding of the market. However, it is crucial to navigate the challenges and ethical considerations associated with AI, ensuring that technology is utilized responsibly and in the best interest of investors.

Risk Rebuked, Rewards Realized: Unleashing Artificial Intelligence Investing

In investing, the emergence of trillion-parameter paradigms and their predictive prowess has become a panacea for the perils that often plague managers relying solely on heuristics and hunches. These paradigms, driven by AI and machine learning, can guide decisions without the constraints of human biases, resulting in optimal outcomes even in the face of unpredictable market upheavals that can undermine fallible human faculties.

By harnessing the power of AI, these orchestrators of investment decisions can outmanoeuvre volatility through proactive precognition. With their forward-focused approach, they flourish as they shape the future through dispassionate analysis, tuned solely to identifying profitable possibilities. The results speak for themselves, as the performance of these AI-driven funds serves as a testament to the transformative impact of technology in elevating investment excellence.

The reliance on AI in investing not only mitigates risk but also unlocks the potential for greater rewards. With their immense computational capabilities, the trillion-parameter models can process vast amounts of data, uncovering hidden patterns and relationships that elude human perception. This ability to analyze and interpret data at an unprecedented scale provides a significant advantage in identifying investment opportunities and optimizing portfolio allocations.

Furthermore, AI-driven investment strategies are not swayed by emotions or cognitive biases that often cloud human judgment. They remain dispassionate and objective, focused solely on maximizing profitability. This unbiased approach allows AI systems to make decisions based on data-driven insights, free from the influence of subjective biases.

As technology advances and AI models evolve, the potential for even greater excellence in investment management becomes apparent. The trillion-parameter paradigms represent a significant leap forward in computational power and predictive capabilities, enabling investors to navigate complex market dynamics with unprecedented accuracy and efficiency.

However, it is essential to recognize that AI investing is not a substitute for careful analysis, human oversight, and sound risk management. While AI can greatly enhance investment decision-making, it is still necessary to have skilled professionals who can interpret and contextualize the insights generated by AI systems. Human judgment and expertise are crucial in aligning investment strategies with broader market conditions and investor goals.

Partners for Prosperity, Not Pretenders: Unleashing Artificial Intelligence Investing

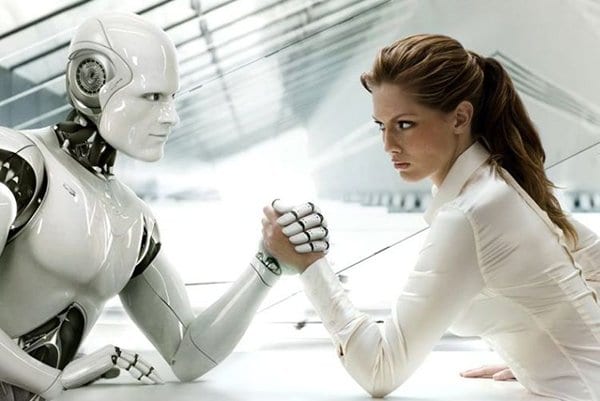

Amidst the rise of automation and the fears of professions being usurped, a new perspective emerges in hybrid approaches that enlighten sceptics. Rather than replacing humans, machines serve as partners, augmenting their capabilities. With the understanding of AI allies, investment professionals gain access to insights beyond what can be achieved unaided. Markets are propelled to higher ground in this partnership between man and mechanism, fostering cooperation where competition once reigned.

The relationship between humans and AI is evolving, leading to a reformation of roles and a shared benefit. Rather than being adversaries, they work in concert to guide investments ever upward. Unity triumphs over division as the synergy between human intuition and AI’s analytical power paves the way for enhanced outcomes. This transformative alliance marks a new dawn for the finance industry and its patrons.

Prescience, discipline, and diligence are the visionary virtues that drive this partnership forward. With the aid of AI, investment professionals can gain a deeper understanding of market dynamics, identify trends, and make informed decisions with greater precision. The combination of human expertise and AI’s analytical capabilities creates a powerful force that values the well-being of all stakeholders.

As this collaborative approach takes hold, the finance industry undergoes a profound shift. The traditional boundaries between man and machine blur, giving rise to a new paradigm where their respective strengths are harnessed for mutual benefit. The patrons of finance, whether individual investors or institutional clients, stand to benefit from the collective wisdom and insight that emerges from this partnership.

However, it is crucial to recognize that the human element remains essential in this evolving landscape. While AI can provide invaluable support and analysis, human judgment, intuition, and ethical considerations are indispensable in navigating the complexities of finance. The roles of investment professionals evolve, focusing on leveraging AI tools and insights to make informed decisions that align with broader goals and values.

The partnership between humans and AI in investing represents a paradigm shift that unleashes the potential for prosperity. Rather than pretenders, AI serves as a valuable ally, augmenting human capabilities and expanding possibilities. Investment professionals can navigate the financial landscape with heightened insight and effectiveness by combining prescience, discipline, and diligence. This transformative collaboration values unity over division, guiding investments towards a brighter future for all.

Conclusion

In conclusion, integrating artificial intelligence (AI) in investing has ushered in a new era of possibility and prosperity. The transformative power of AI, driven by trillion-parameter paradigms and deep learning neural networks, has unlocked vast troves of unstructured data, revealing hidden patterns and insights that were once concealed. By leveraging the predictive prowess of AI, investment professionals can navigate through a chaos of codes, deciphering cryptic clues and outmanoeuvring market volatility.

Rather than replacing human expertise, AI serves as a partner for investment professionals, augmenting their abilities and expanding their understanding. The collaborative approach between humans and machines cultivates a cooperative environment where unity triumphs over division. This partnership redefines the roles of investment professionals, allowing them to harness the analytical power of AI to make informed decisions and guide investments to higher ground.

The benefits of this partnership extend to investors and patrons of the finance industry. Investment strategies become more proactive, disciplined, and diligent through the fusion of human intuition and AI’s analytical capabilities. The shared benefit of this collaboration ensures that investments are guided by visionary virtues that value the well-being of all stakeholders.

However, it is crucial to balance the power of AI and the need for human oversight. While AI can provide invaluable insights and analysis, human judgment, expertise, and ethical considerations remain essential. The human element infuses investments with a deeper understanding of context, aligning strategies with broader goals and values.

As we embrace this new dawn of AI-driven investing, we recognize the immense potential for prosperity and its transformative impact on the finance industry. Integrating AI and human intelligence creates a harmonious synergy where the strengths of each complement and elevate the other through unity and cooperation, investment possibilities expand, paving the way for a future where technology and human expertise converge for the benefit of all.

In this partnership for prosperity, AI is not a pretender but a valuable ally, enabling investment professionals to navigate the complexities of the market with enhanced insight and effectiveness. The fusion of advanced technology, visionary virtues, and a commitment to shared benefit guides the journey towards excellence in investing.

Compelling Piece Worth Delving Into

1987 stock market crash anniversary discussions- nothing but rubbish ( Oct 24)

Dow 22K Predicted In July 2017; Next Target Dow 30k? (Oct 15)

Anxiety and Greed Index Don’t Support Stock Market Crash (Oct 14)

Fed States Inflation is not an issue? (Oct 13)

Is Bitcoin a Bubble or Good Investment? (Oct 9)