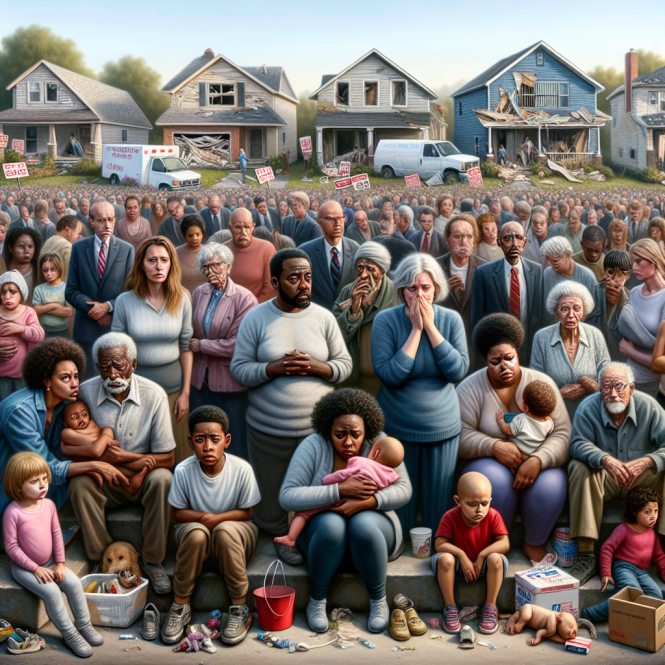

What is a Housing Crash? Pain and Loss

May 27, 2024

Introduction: Anatomy of a Housing Crash: History Tends To Repeat Itself

History repeats itself in the complex world of economics and finance, and the housing market is no exception. Housing crashes are cyclical historical events, leaving behind financial turmoil and economic distress. The question is not if they will happen but when and how severe the impact will be.

Today, we will dissect the anatomy of a housing crash, using the 2008 crisis as a pivotal example while exploring other instances to gain a comprehensive understanding. We will also discuss the role of common sense in avoiding such disasters and delve into the fascinating interplay of mass psychology and investment behaviour. We will incorporate renowned thinkers’ wise words, seamlessly blending their insights into our narrative.

Act 1: The Players – Freddie and Fannie

Two prominent players were at the heart of the 2008 housing crash: Freddie Mac and Fannie Mae. The Federal National Mortgage Association created these government-sponsored enterprises (GSEs) in the 1930s to facilitate homeownership by purchasing mortgages from banks. By buying these mortgages, banks could free up capital and issue more loans, thus accelerating the pace of homeownership. While initially seemed beneficial, this mechanism set the stage for a catastrophic unravelling.

Freddie and Fannie, though private companies, enjoyed a unique status as GSEs. They were backed by the federal government, which promised to rescue them if they faced failure. This arrangement led to a dangerous moral hazard: they could privatize profits while socializing losses. As the essay prompt states, this encouraged “immoral and unconscionable behaviour” because the downside risk was shifted to the government and, ultimately, the taxpayers.

Act 2: The Toxic Loans

As the housing market heated up, Freddie and Fannie deviated from their traditional acquisition of conventional fixed-interest rate mortgages with a 20% down payment. Instead, they began purchasing riskier loans, including negative amortization, interest-only, and subprime mortgages, many of which required minimal down payments. This shift in their business model exposed them to extreme toxicity, as these loans were highly vulnerable to default.

The data speaks for itself. In 2008, Fannie Mae’s loan portfolio included 62% negative amortization, 84% interest-only, 58% subprime, and 62% with less than a 10% down payment. Freddie Mac’s numbers were even more alarming, with 72% negative amortization, 97% interest-only, 67% subprime, and 68% requiring less than a 10% down payment. This reckless pursuit of exotic loans and subprime borrowers fueled the speculative real estate bubble, setting the stage for a painful collapse.

Act 3: The Cost to Taxpayers

The consequences of Freddie and Fannie’s actions became painfully apparent as the housing market started to crumble. In 2008, Freddie Mac reported a staggering loss of $50 billion and requested an additional $31.8 billion from the government on top of the $13.8 billion asked for the previous year. The government, committed to supporting these GSEs, pledged a massive $200 billion line of credit.

However, these companies’ supposed benefits to the public were vastly outweighed by their cost to taxpayers. As the essay prompt insightfully calculates, the potential savings of $100 million to borrowers were dwarfed by the $300 billion-plus financial support the government had to provide. Privatizing profits and the socialization of losses were starkly evident, and the failure to hold these companies accountable sent a troubling message.

Interlude: Mass Psychology and Investment Behavior

As we reflect on the events leading up to the housing crash, we must consider the role of mass psychology and investment behaviour. The prompt introduces a fundamental rule of investing: buy when the masses are scared and sell when they are euphoric. This contrarian approach recognizes that the crowd is often wrong at pivotal moments.

Chasing investments, especially in a housing bubble, is a recipe for disaster. Common sense and a prudent assessment of risk should always prevail. As Mark Twain wisely remarked, “History doesn’t repeat itself, but it often rhymes.” The echoes of past mistakes should serve as a warning to avoid the herd mentality that often precedes a crash.

Act 4: Wall Street and the Rating Agencies

While Freddie and Fannie played a significant role in the housing crisis, they were not alone. Wall Street firms, such as Goldman Sachs, JP Morgan, and Merrill Lynch, also had a hand in the disaster. They created complex financial instruments known as Collateralized Debt Obligations (CDOs) by bundling subprime mortgages with other higher-rated loans. These CDOs were then marketed as secure investments with AAA ratings, thanks to the stamp of approval from rating agencies like Moody’s, S&P, and Fitch.

Based on these ratings, investors poured their money into what they believed were safe, high-yield investments. However, the prompt astutely points out that they failed to dig deeper and understand the underlying risks. This negligence, driven by greed, set the stage for a painful awakening. Large institutions fueled the demand for CDOs, creating a vicious cycle that drove down borrowing costs, loosened lending standards, and inflated housing prices.

Act 5: The Crash and Its Aftermath

The warning signs were there. Towards the end of 2006, home prices peaked, and in 2007, they started to decline. Default rates began to rise, yet investors continued to buy these toxic securities, driven by the pursuit of higher returns. The blame rests not only on Wall Street and the rating agencies but also on the average investor who ignored the red flags in favour of quick profits.

The conmen had found willing participants in the form of suckers, as the prompt aptly describes. The game continued until the House of Cards crashed, leaving taxpayers to foot the bill. As the prompt emphasizes, this story’s moral is to avoid jumping into investments that have attracted mass attention. The masses are often late to the party and have a massive hangover when the bubble bursts.

Epilogue: Protecting Yourself and Learning from History

As we reflect on the anatomy of the housing crash, we must recognize the role we all play in such crises. Greed, negligence, and a disregard for history contributed to the disaster. We must learn from these mistakes and take proactive steps to protect ourselves.

As Plato wisely observed, “Those who do not learn from history are doomed to repeat it.” In the context of the housing crash, this means recognizing the importance of hard assets as a hedge against inflation. Precious metals, such as gold and silver, and other finite resources like oil, timber, and copper offer a tangible store of value during turbulent economic times.

The Italian proverb, “Once the game is over, the king and the pawn go back in the same box,” reminds us that, in the end, we are all impacted by economic crises, regardless of our social status. Therefore, we must learn from history, exercise prudent investment strategies, and avoid the pitfalls of herd mentality.

Conclusion: Learning from History to Build a Resilient Future

The 2008 housing crash is a stark reminder of the intricate interplay between the housing market, financial institutions, government policies, and individual behaviour. By examining the roles of Freddie Mac, Fannie Mae, Wall Street, and the masses, we gain invaluable insights into the anatomy of a housing crisis. History tends to repeat itself, and we must learn from these past mistakes to prevent future disasters. The cost of ignoring these lessons is too high.

As Confucius wisely advised, “Study the past if you would define the future.” In the context of the housing crash, this means recognizing the patterns that led to the crisis and taking proactive steps to mitigate similar risks in the future. It involves a commitment to transparency, accountability, and responsible lending practices. We must also foster financial literacy and empower individuals to make informed investment decisions, avoiding the pitfalls of herd mentality.

The impact of the 2008 housing crash was far-reaching and devastating. It resulted in widespread financial losses, disrupted lives, and eroded trust in the economic system. Homeowners faced foreclosure, retirement savings were decimated, and the economy spiralled into a deep recession. Our collective responsibility is to ensure that such a crisis never happens again.

Moving forward, we must prioritize sustainable and equitable growth in the housing market. This involves promoting responsible lending practices that consider borrowers’ long-term ability to repay loans. It also means providing education and resources to help individuals make informed decisions about homeownership and investments. By doing so, we can create a more resilient and inclusive economy.

Additionally, we must address the underlying issues that contributed to the crisis. This includes reevaluating the role and oversight of government-sponsored enterprises, strengthening regulations on financial institutions, and holding accountable those who engage in reckless or fraudulent behaviour. By learning from the past and implementing necessary reforms, we can build a more stable and just financial system.

In Confucius’s words, “Real knowledge is to know the extent of one’s ignorance.” As we reflect on the housing crash, let us embrace humility and acknowledge the limitations of our understanding. Let us strive to continually learn, adapt, and improve our policies and practices to create a more robust and equitable future for all.

The 2008 housing crash serves as a cautionary tale, reminding us of the importance of prudence, transparency, and accountability in the financial sector. By studying the anatomy of this crisis and incorporating the wisdom of the ages, we can build a more resilient and prosperous future for generations to come.

A fool despises good counsel, but a wise man takes it to heart. Confucius, BC 551-479, Chinese Ethical Teacher, Philosopher

Illuminating Insights: Articles that Enlighten and Inspire

Cognitive Bias in Investing: Master Them to Thrive