AEHR Stock Prediction: A Strategic Choice—To Commit or Walk Away

Updated Dec 31, 2024

Introduction: A Closer Look at AEHR Test Systems: An Overview and Outlook

AEHR Test Systems is a noteworthy participant, having carved its niche in the semiconductor industry. The company specializes in creating advanced test and burn-in systems for high-volume production and early failure rate tests. These systems are designed to reduce costly IC or chipset failures in semiconductors and photonics, thereby ensuring efficiency and reliability.

The business landscape for AEHR has been quite dynamic. Thanks to its unique product offerings and strategic business manoeuvres, the company navigates a competitive industry while maintaining a solid standing. Recent years have been quite promising, with significant improvements in the company’s overall performance.

Earnings-wise, AEHR has demonstrated an encouraging growth trajectory. The company reported robust earnings in 2022 and 2023, underscoring its financial stability amidst fluctuating market conditions. However, the specific figures are yet to be disclosed in this piece.

One of AEHR’s standout products is the FOX-P platform, a family of solutions that enables parallel test and burn-in for both packaged and wafer-level products, improving throughput and lowering the cost of tests. This product line has been instrumental in establishing AEHR’s reputation as a leader in the semiconductor testing industry.

Looking ahead, AEHR’s outlook is optimistic. As more industries rely on semiconductors and photonics, the demand for AEHR systems is expected to rise. The company’s commitment to innovation and quality and its strategic vision for growth position it well for future success in the semiconductor industry. Given the existing trends and market dynamics, AEHR is a stock worth watching.

AEHR Stock: Profiting from SiC Power Chip Surge in the EV Market

Aehr, a California-based semiconductor test equipment provider, has seen significant growth in the electric vehicle (EV) and other sectors thanks to its silicon carbide (SiC) power chips. Despite a recent dip in share price due to lower-than-expected EV sales growth, the company’s future remains promising. Aehr’s earnings have grown substantially, with a 64% jump in the latest quarter supported by a 45% revenue increase.

The company’s profit margin stands at 26% and enjoys a robust 29% return on equity. Industry predictions suggest SiC chip sales, a key driver for Aehr, could rise fivefold by 2027. Despite missing some traders’ expectations, Aehr’s sales and earnings growth remain strong. Recognizing the company’s positive outlook, insiders have made numerous open-market buys. Estimates suggest Aehr’s earnings could more than double in the coming year, and the company has consistently outperformed consensus estimates. This and strong insider buying suggest excellent potential for this fast-growing company.

Technical Analysis and Mass Psychology Perspective on Aehr

From a technical analysis perspective, Aehr’s stock is nearing the oversold range on the monthly charts. An oversold stock has fallen sharply and is expected to bounce higher. This is often seen as a potential buying opportunity as the stock is considered cheaper than it should be. However, it’s important to note that an oversold condition is not an automatic buy signal and should be combined with other tools designed to establish optimal buy and sell points.

Historically, Aehr has consistently outperformed consensus estimates, suggesting that the company’s stock price may follow past patterns. This aligns with the technical analysis principle that potential market outcomes may follow past patterns. However, it’s crucial to remember that past performance does not indicate future results.

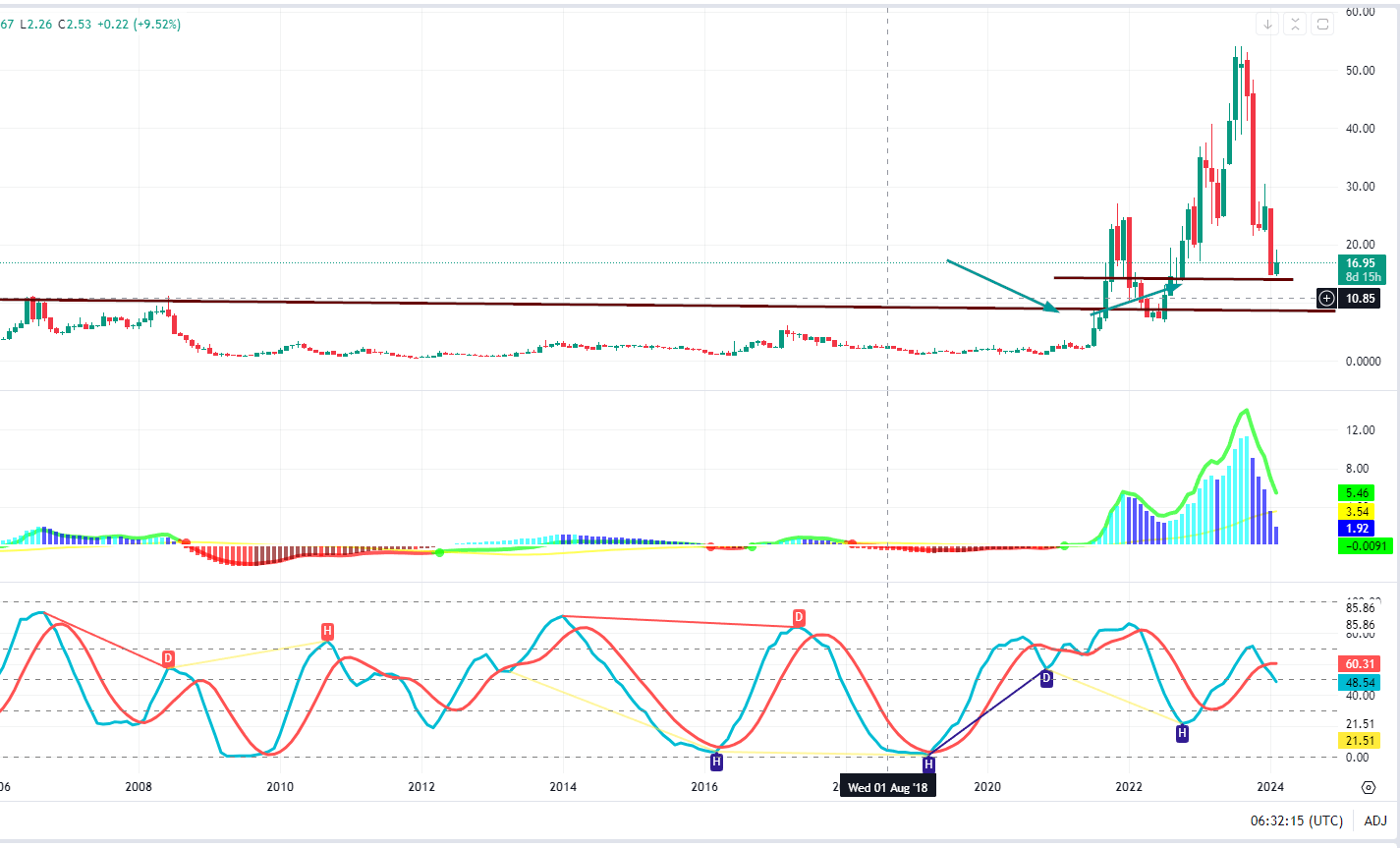

AEHR exhibits a notable retracement in the provided Monthly chart (displayed above), with several indicators entering the oversold zone. Despite this, our preferred indicators suggest there is potential for further decline. However, it’s essential to acknowledge the possibility of a sideways trend, gradually nudging the indicators toward extreme oversold conditions.

For an optimal entry point, patience is critical. Observing the stock within the channel formation and adding positions during dips aligns with the preferred strategy. However, it’s crucial to recognize that the perfect setup may not materialize.

A prudent approach involves dividing investments into 3-4 lots, initiating a portion within the 12.00 to 13.50 range, and incrementally deploying additional amounts during subsequent lows.

A monthly closure at or above 16.50 signals a bullish shift, paving the way for a potential ascent to the 23.50 to 25.50 range. It’s worth noting that this stock demands resilience and strategic decision-making, which is not recommended for those faint of heart.

Beyond Market Sentiment: Aehr’s Resilient Fundamentals and Growth Potential

From a mass psychology perspective, Aehr is not a popular trader choice. This could be due to the recent dip in share price caused by lower-than-expected EV sales growth. However, mass psychology can often lead to overreactions in the market, causing stocks to become oversold even when the company’s business fundamentals remain strong.

In Aehr’s case, the company’s core values and business model have not changed despite the recent downturn. The company’s profit margin stands at 26% and enjoys a robust 29% return on equity. Furthermore, industry predictions suggest SiC chip sales, a key driver for Aehr, could rise fivefold by 2027

Earnings Projections and Financial Outlook: A Contrarian View on Growth and Risk

Aehr Test Systems is projecting a bold 50% revenue growth for fiscal 2024, fueled by surging global demand in chips, particularly driven by the EV and AI sectors. Some analysts expect even higher revenues in the coming years, especially with repeat customers in the automotive and AI industries. However, contrarian investors should be wary of overly optimistic forecasts that often ignore underlying risks, as market sentiment can cloud judgment.

While insider confidence—evident through sustained leadership and insider buying—can appear reassuring, it also highlights a psychological tendency to follow bullish trends without considering potential pitfalls. If Aehr hits its aggressive targets, the stock could surge. But any setback, whether due to cyclical downturns, economic pressures, or emerging competitors, could trigger volatile market reactions as investor sentiment amplifies even minor deviations from expectations.

Aehr’s P/E ratio, generally seen as “healthy,” reflects market optimism about its growth potential. Tech stocks are often highly valued, but this is not necessarily a red flag as long as growth materializes. The critical question is whether Aehr can sustain its momentum, land new contracts, and expand its customer base—particularly in AI and EV. Contrarians, however, may caution against buying solely on growth projections, as the company must prove it can weather macroeconomic shifts and sustain performance amidst the inherent volatility of high-growth markets.

Conclusion: Contrarian Strategy for Long-Term Gains

Aehr Test Systems maintains its leadership in wafer-level burn-in testing, which is pivotal for the growth of AI, automotive, and green energy sectors. The company’s strong leadership, insider confidence, and solid financials indicate substantial long-term potential. However, in the high-growth tech world, the unpredictability of market sentiment cannot be ignored. Investor psychology often leads to dramatic price swings, and while Aehr’s fundamentals suggest robust future growth, volatility remains a reality.

For contrarians, this volatility offers potential opportunities. Aehr’s strategic position within AI, EV, and renewable energy markets—the expanding total addressable market (TAM)—is promising. But, as always, the broader economic cycles could influence stock prices. Aehr’s success will depend on its ability to adapt to market shifts, including regulatory changes in AI and evolving EV policies.

Investors must recognize the danger of overconfidence in high-growth stocks. Despite Aehr’s solid foundation and innovative position in wafer-level testing, market sentiment often drives short-term price fluctuations. A contrarian approach—focused on long-term potential while acknowledging short-term risks—can offer an edge. Investors who understand Aehr’s strategic relevance in high-power applications may find its growth trajectory appealing. However, staying vigilant and adaptable in the face of market shifts will be essential for success.

Revel in the Uncharted: Dive Deeper