Share Buyback Programs

“Corporate buybacks are the sole demand for corporate equities in this market,” David Kostin, the chief U.S. equity strategist at Goldman Sachs Group Inc., said in a Feb, 23 Bloomberg Television interview. “It’s been a very challenging market this year in terms of some of the macro rotations, concerns about China and oil, which have encouraged fund managers to reduce their exposure.”

However, the dumb money continues to sell, they withdrew $40 billion in Jan, a similar amount in Feb and in March outflows are set to hit $60 billion, illustrating that the masses are wrong once again. When we use the word masses we are not only referencing the small players, but big players like mutual funds and hedge funds; both these institutions are notorious for doing the right thing at the wrong time; in other words, selling when they should be buying.

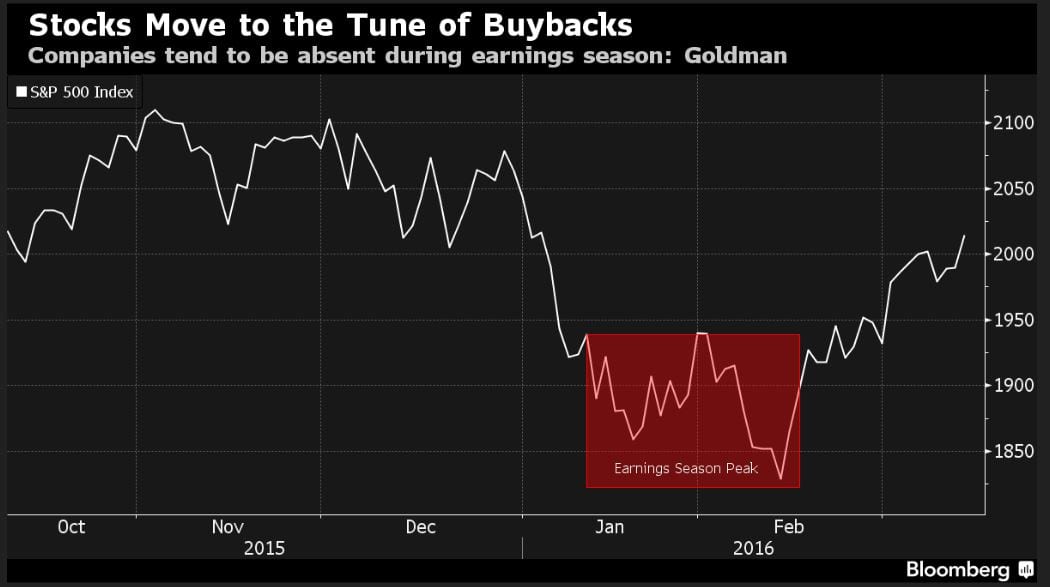

Corporations continue to plough money into Share Buyback Programs at the rate, they are buying up shares a new record will be set in this year. The chart below clearly illustrates that a number of share buybacks are directly correlated to higher stock prices and vice versa.

Corporations stepped in to buy during the selloff in January indicating that they are confident going forward. Why shouldn’t they be, they are buying back shares in record amounts and in doing so creating the look that earnings per share are improving.

Mr Kostin on Share Buyback Programs

“I’m willing to bet that after the rally we’ve had in the last few weeks, fund flows will follow suit,” he said. “You might see investors begin chasing that type of performance.”

We agree with his overall take because our trend indicator is bullish and as long as it remains bullish the market will trend higher.

Unknown analyst on Share Buyback Programs

“It’s definitely not sustainable that the only buyer is companies themselves,” said Vikas Gupta, Mumbai-based chief investment officer who helps oversee more than $8 billion at Arthveda Capital. “A lot of money needs to come back to the market. I’m just not sure if it’s going to happen next week, next quarter or in a year. That’s the part that’s unclear.”

Perhaps that is why he is unknown as he is basing his observations on logic and fails to understand that emotions drive the markets. In the very long run, he will be right, but by that time you and he could miss out on a massive upward move. Wall Street is full of Tombstone of people who were correct but could not say solvent long enough to reap the rewards.

Other related articles:

BIIB stock Price: Is it time to buy

Stock Market Forecast for Next 3 months

Boy are you gonna eat these words!

Well that is what they have been saying to us since the most hated bull market history began. It will end one day but not when the naysayers expect. And one day could be 1, 2, 5, or 10 years from now, so you would rather wait to be right then act make money and them move out when the masses turn euphoric. We will not maintain our bullish stance forever, when the trend changes we will walk away, just as we got into gold in 2003 and out of it in 2011. Embraced the dollar, from 2011, and went against the Euro and Yen, We have also been advocating buying every strong pull back for several years on end and on each occasion they have said wait you will be sorry. Turns out the naysayers are sorry so far. As stated we will bail out but we won’t fixate on what if events as that is for people who have too much time on their hands and who often don;t walk the walk, but are happy to talk the talk