Updated views are posted towards the end of the article

Share Buybacks: A Closer Look at Who Really Benefits

Updated March 2023

Robin Hood, the legendary hero who once took from the rich to give to the poor, has been reimagined in modern times as the victim of a new version of the story. Today, it is the wealthy corporations and their puppeteers who rob from both the poor and Robin Hood in their never-ending quest for even more riches. In this fast-paced world, where the only thing that seems to matter is money, the most profitable strategy is buying back vast shares, artificially inflating profits without lifting a finger. It’s the perfect con.

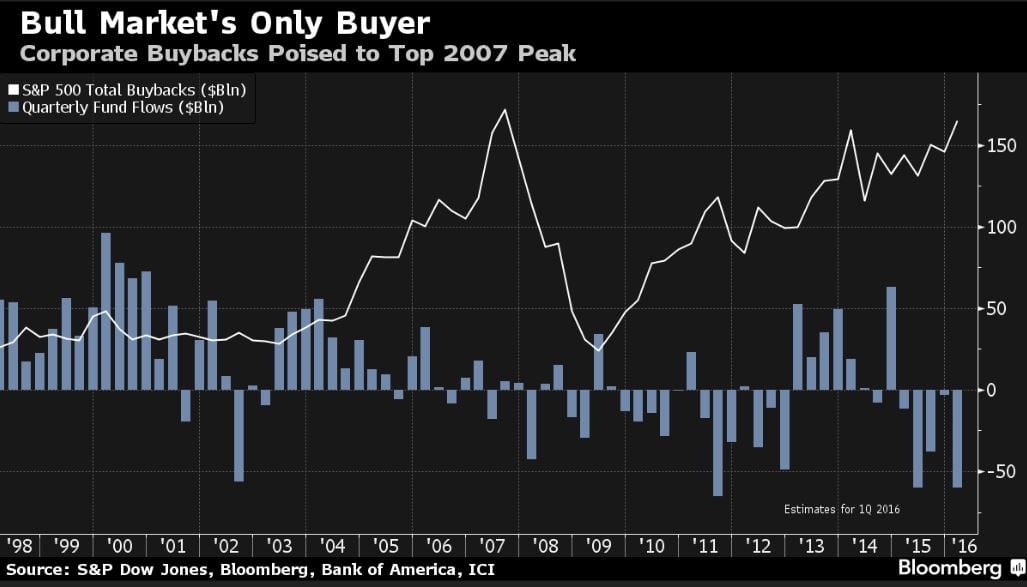

The S&P 500 Index is set to break the 2007 record with over $165 billion worth of stock purchases this quarter. While mutual funds and everyday investors are selling, the corporate world is buying, proving that the supposedly “dumb” money may not be so foolish after all.

In the markets, emotions, not logic, reign supreme. A staggering $40 billion has flowed out of the markets through mutual fund sales and individual redemptions, yet the corporate world has more than made up for this deficit. One might even say this is a positive divergence, as the business world boldly invested in stocks when the markets were plummeting, and the masses were frantically trying to exit.

The Share Buybacks Controversy: Is It Benefitting Investors?

Central bankers worldwide are embracing negative interest rates, and it’s no secret that low rates tend to encourage speculation. Just look at the current environment and consider the potential consequences if the US were to follow suit. It’s likely that an all-out feeding frenzy would ensue, with corporations eagerly borrowing even more money and the masses jumping into stocks, enticed by the appearance of rising earnings. However, as always, the bottom will eventually drop out, leaving average individuals holding the bag. The truth is that nothing has changed, and there is little hope that anything will change in the future.

As Andrew Hopkins, Director of Equity Research at Wilmington Trust Co., which oversees approximately $70 billion, wisely noted, “Relying solely on one thing to keep the market going is a dangerous situation. Over time, you realize these companies cannot continue growing indefinitely. Borrowing money to buy back stocks is a strategy that will inevitably come to an end.”

The Distorting Force of Corporate Share Buybacks

It’s worth noting that companies in the S&P 500 are currently flush with cash, meaning they can borrow money from open markets or use some of the cash reserves they have been hoarding to fund share buyback programs. According to Bloomberg, non-financial companies in the S&P 500 had over $900 billion in cash reserves at the end of 2015, and we can safely assume that this figure is now close to $1 trillion.

Meanwhile, hedge funds and mutual funds have struggled to make money over the past few years, making them net sellers in this market. However, this is nothing new; mass psychology dictates that the masses always get burned while corporations emerge unscathed. As David Kostin, the Chief US Equity Strategist at Goldman Sachs Group Inc., pointed out in a February 23rd Bloomberg Television interview, “Corporate buybacks are the sole demand for corporate equities in this market.”

Despite this reality, there seems to be little hope for change. This behaviour is likely to continue as interest rates remain low, and there is virtually no chance of rates rising anytime soon. Another option would be for Congress to pass new laws making share buybacks illegal, but this is highly unlikely given that Congress is essentially a part of “Crime Inc.” – they are profiting handsomely from the current state of affairs.

Uncovering the Hidden Costs of Share Buybacks: 2023

Share buybacks, as the mysterious force that seemingly propels stock prices ever upward, have long held an allure for investors and market participants alike. However, beneath the surface, these repurchases may conceal a more sinister tale of self-interest and missed opportunities. Let’s delve further into the reasons why share buybacks can be detrimental to both investors and the market as a whole.

The first and foremost concern regarding share buybacks is the potential for corporate managers to use them to conceal stock issuance to themselves. This hidden agenda allows managers to benefit financially while the shareholders bear the brunt of the costs. Such a scenario evokes images of shadowy boardrooms where executives plot to enrich themselves at the expense of the unsuspecting shareholders who trust them to act in their best interest.

In addition to this potential for deception, share buybacks can also starve companies of the vital resources they need to grow and innovate. By funnelling cash into share buybacks, businesses may inadvertently leave themselves with insufficient funds for research and development or investment into new products and facilities. This diversion of resources conjures visions of once-great corporations crumbling as they fail to keep pace with their competitors, their once-mighty foundations weakened by the insidious drain of share buybacks.

The Ripple Effect: Share Buybacks and the Broader Market

Moreover, the prioritization of share buybacks can lead to a short-sighted focus on immediate gains in stock price at the expense of long-term growth and profitability. As companies become increasingly fixated on using buybacks to bolster their share price, they may neglect more lucrative uses of their cash reserves. This focus on short-term gains casts a pall over the market, as the potential for sustainable growth is sacrificed in the pursuit of fleeting financial success.

Beyond their impact on individual companies and shareholders, share buybacks can disrupt the delicate balance between productivity and worker compensation. As businesses pour their resources into stock repurchases, they may inadvertently stifle the growth dynamic that links the labour force’s productivity with their pay. This disruption can manifest in the form of soaring corporate debt and increased financial risk-taking as companies struggle to maintain the illusion of prosperity in the face of dwindling resources and stagnating growth.

Conclusion

While share buybacks may appear to be an attractive strategy for companies and their shareholders, their hidden costs and potential for misuse make them a double-edged sword. By enriching corporate managers at the expense of shareholders, starving businesses of the resources they need to innovate and grow, privileging short-term gains in share price over long-term profitability, and disrupting the growth dynamics that link the productivity and pay of the labour force, share buybacks pose a significant threat to the stability and integrity of the market. In a world where appearances can be deceiving, investors and market participants need to be ever vigilant, lest they fall prey to the hidden dangers lurking beneath the surface of the seemingly innocuous practice of share buybacks.

Other related articles

Mob Mentality Psychology: Understanding and Profiting

IBM Stock Price Prediction: Time to Buy or Fly?

Examples of Herd Mentality: Lessons for Learning and Earning

When is the Next Stock Market Crash Prediction: Does it Matter?

Inductive vs Deductive Analysis: The Clash of Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

What Will Happen When the Stock Market Crashes: Time to Buy

Dogs of the Dow 2024: Barking or Ready to Bite?

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses