A complex system that works is invariably found to have evolved from a simple system that works. John Gall

Silver and Gold Bull Unleashed: Ready to Roar or Snore

Updated April 29, 2024

We’ll jump straight into the anticipated price action for Silver, providing insights up to March 3. Subsequently, we’ll share the earlier update from November 2023. Following that, we’ll embark on a historical journey to illustrate how astute timing can lead to a fortune in the market.

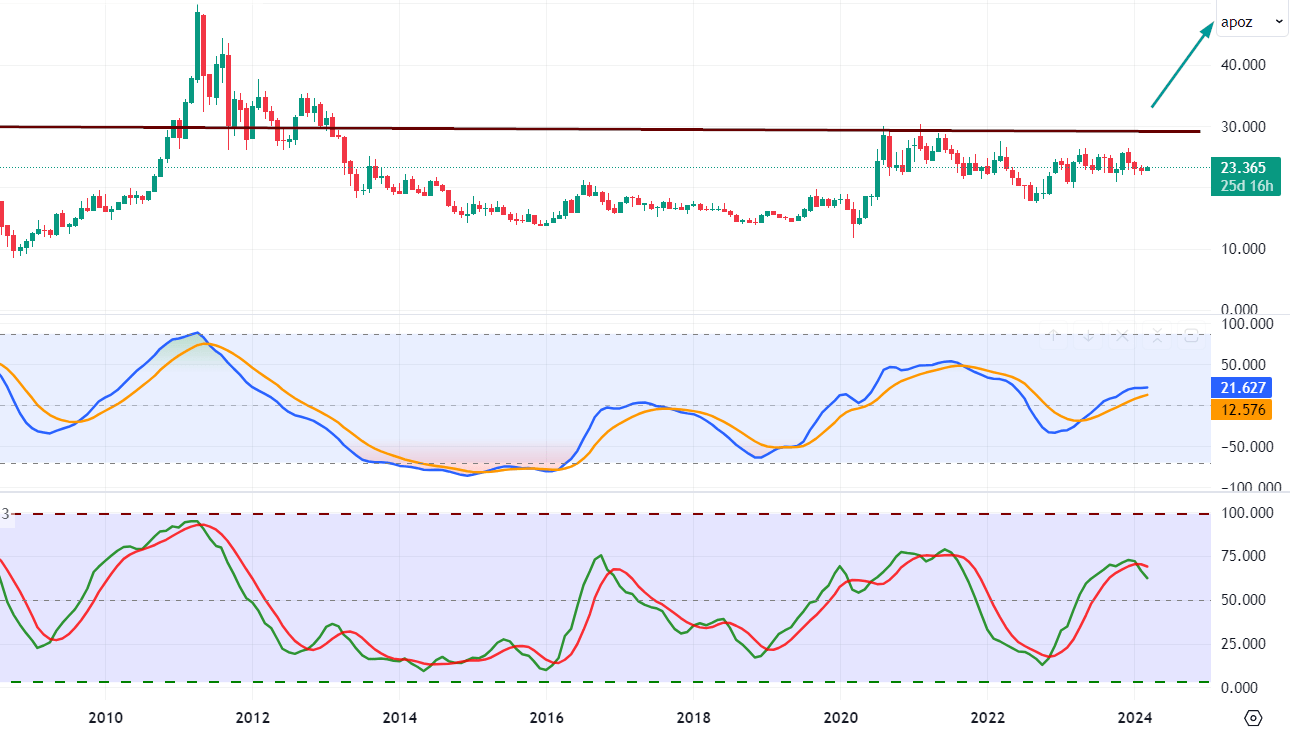

In market strategy, where foresight holds sway, a promising threshold for silver emerges—a monthly close around $29.50, ideally hitting $30.00. This signals the journey towards the formidable peaks of $42 to $45, and if fortune favours, there’s potential for an ascent to the 60 to 65.00 range.

Yet, adhering to the wisdom of Solon’s prudent statesmanship, we must progress cautiously, securing the strongholds at $42-45 before eyeing the more distant summits. As Machiavelli teaches, a measured approach in battle ensures victory in the war, not just the skirmish.

Standing at the brink of action, let’s heed Buffett’s wise counsel, recognizing the market’s pendulum swings from irrational exuberance to unwarranted despair. While monthly charts hint at imminent volatility, steadfastness prevails.

For those with a Solonian perspective, understanding the economic universe’s long arc bending towards prosperity, pullbacks are golden opportunities—a chance to accumulate silver bullion and equities. The crucible of short-term uncertainty is where the metal for long-term victory is forged.

Gold and Silver Bull Market Trend Outlook 2023-2024

One day, perhaps within just 9 months, people will wonder why they didn’t enthusiastically invest in palladium. There’s a straightforward lesson in investing: when an investment is unpopular, it may not be the best short-term choice, but it often represents a fantastic long-term opportunity. The entire precious metals sector holds appeal, but palladium is a resounding long-term buy. Market Update October 12, 2023

Palladium is taking a hit, reminiscent of the patterns we saw in bonds, echoing what we’ve emphasised during the COVID crisis. As the money supply increases, these market manoeuvres tend to escalate. The manipulation we’re witnessing today was unheard of a decade ago, and ironically, it’s expected to intensify in the years ahead. We’ve discussed the reasons behind this multiple times, but for a quick reminder: firstly, these big players have so much money that they need to shake up the markets to enter and propel the markets to the skies to exit. Secondly, they seem to derive pleasure from seeing the masses react. Their perspective is on a different level; dropping a million bucks is like spending ten bucks. To them, it’s all just a game.

Concerning Gold and Silver, Gold appears to be stronger, laying the foundation for the next upward leg. Meanwhile, Silver is still working on establishing a solid base, trading deeper in the oversold zone on the weekly charts. This suggests that it’s likely to be rapid when Silver does make its move. Be prepared for the possibility that this upward surge could take it to the range of 27.60 to 30.00 range.

The Historical perspective.

History is an invaluable teacher, offering lessons on recognizing opportunities that may initially appear as setbacks. Studying historical events gives us real-time insights into our actions and decisions.

Gold bugs and experts face frustration as the Gold Bull Market defies predictions. The dollar’s ascent surprises, and inflation eludes expectations. Public perception, often shaped by distorted government figures, guides reality. Truth and lies hinge on emotion-driven perceptions, opening all to debate. Today’s truths may fade tomorrow, and validity can shift swiftly.

This principle extends to the Gold Bull Market; its resurgence depends on mass acceptance, likely confining it to an 1100-1280 range until it is embraced widely. Contrarian thinking suggests questioning assumptions, anticipating unexpected shifts, and recognizing market movements precede consensus understanding, often confounding conventional wisdom. Understanding mass psychology reveals the potential for sudden market shifts, breaking patterns when consensus expectations fail.

Is the gold market ready to break out? A small excerpt is listed below:

Throughout 2016, we steadfastly maintained our cautious stance on Gold, resisting the tempting narratives of astronomical price predictions that circulated. Despite the allure of predictions soaring to the Moon or even the next Galaxy, we believed that exploring other lucrative markets like general equities or the US dollar would be more prudent until the trend turns positive. Some experts issued targets as ambitious as $20,000-$50,000, seemingly detached from the reality of Gold’s actual performance, which hasn’t surpassed $2,000.

In mass psychology, it’s fascinating to observe how experts sometimes venture into wishful thinking, releasing targets that lack grounding in current market dynamics. Such projections, often disconnected from common sense, raise questions about the broader understanding of market conditions. Even a target of $5,000 seems ambitious, warranting consideration only under extreme conditions.

Surprisingly, the overall outlook for this Gold Bull Market seems as uncertain now as it did in 2014, 2015, and 2016. In January, we highlighted several bullish signals that should have propelled Gold to the 1360 range. In a different market scenario, such a convergence of positive signals would typically trigger a more robust response. However, Gold’s move has been notably muted, owing to the prevailing neutral trend. Consequently, we approach the Gold markets cautiously, awaiting a more precise direction in the overall trend.

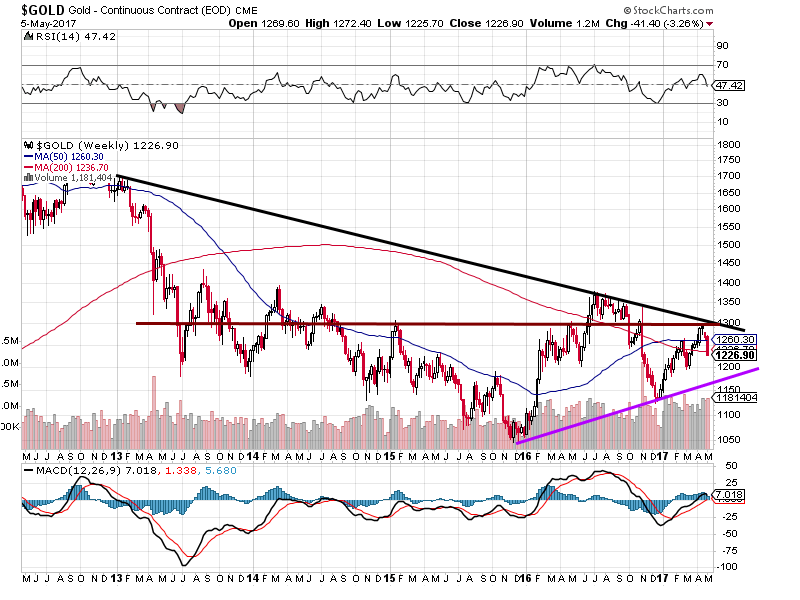

Gold has now given the first signal that it is getting ready to test the $1360 ranges with a possible overshoot to the $1380 range. A weekly close above $1380 will set up the path for a test of and potential challenge of the 2011 highs. Tactical Investor

Gold Bull Still Trying To Breakout

Short Term Outlook is Bearish

It could not even trade past $1300 every week; the word pathetic comes to mind when one examines the Gold market actions over the past few months. It appears that Gold markets are destined to experience more pain before attempting to challenge the $1300 range. Adding to the misery; the dollars consolidation is ending, and Gold is now trading in the overbought ranges.

The trend is what determines whether we embrace an investment or not. The trend was neutral in back in Jan, and it remains neutral on the long-term charts and negative on the short-term charts. In other words, the gold market appears ready to pull back instead of break out. We will not embrace Gold until the trend changes, as many other markets out there make for a better investment. One such example is the biotech sector; however, one needs to tread cautiously as this sector is full of speculative plays.

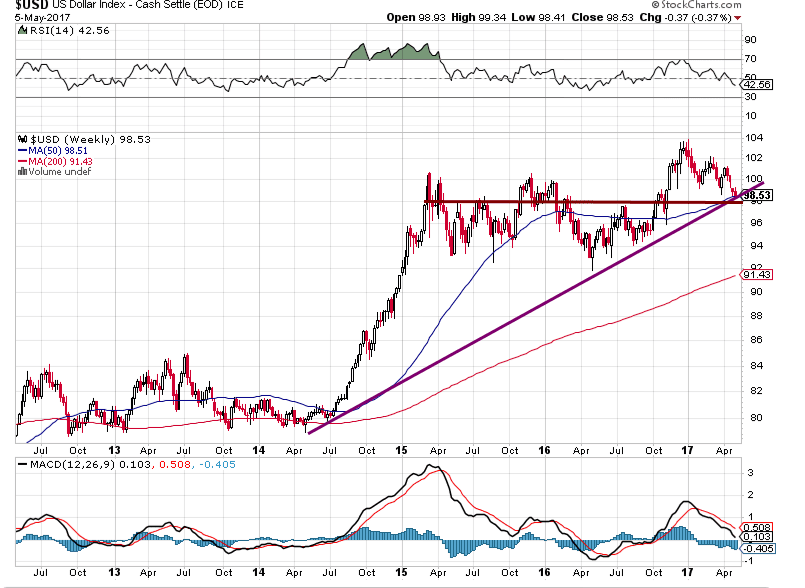

The dollar chart indicates that the Gold Bull is not ready to rumble yet.

A crucial milestone for Gold to trade above the main downtrend line is for the Gold Bull trend to resume. Regrettably, Gold has struggled to achieve this, and a formidable layer of resistance has developed in the $1300-$1350 range. The prolonged time it takes for a market to breach a specific zone intensifies the resistance; however, once breached, former resistance can transform into support.

Gold appears to be on a downward trajectory, and a weekly close below $1200 might propel it as low as $1100. Since December 2016, Gold has been forming higher lows, maintaining a trend that keeps the overall long-term outlook neutral. Gold needs to secure a monthly close above $1350 to shift this outlook to bullish.

Concurrently, the dollar has been consolidating since December 2016, with signs pointing towards the consolidation reaching its conclusion. A robust support zone exists in the 97.80-98.40 ranges, and as long as the Dollar doesn’t close below 97.80 weekly, the outlook remains bullish. Despite the dollar’s robust performance in recent years, the overall pattern favours the dollar over Gold, contributing to a more bullish sentiment for the former.

Gold Standard Dreams

The revival of the Gold standard appears unlikely in the coming decades, given the current generation’s disinterest in viewing Gold as a form of money. There seems to be a lack of awareness regarding the historical role Gold played in providing financial stability over several centuries. In the modern era, Gold is increasingly perceived as just another investment, subject to the ebb and flow of market dynamics. Knowing when to hold or fold, similar to any investment, becomes crucial.

Considering the possibility of Gold pulling back, a measured allocation to this metal from a long-term perspective could be a prudent move. It’s essential, however, to emphasize a conservative approach—allocating some, not a significant portion of one’s portfolio. As highlighted earlier, there are more attractive sectors, with the biotech sector being a notable example. Investing through an ETF like IBB can provide exposure to this promising field.

Examining the Gold bull market from a very long-term perspective, it seems to be in a deep coma rather than dead. Unlike many Bull Markets, the Gold bull hasn’t experienced the feeding frenzy stage, where masses enthusiastically embrace the investment, typically marking a long-term top in the markets. A parallel can be drawn with the oil market, which witnessed a feeding frenzy when it surpassed $120 and surged past $140 before experiencing a significant collapse.

Gold Bull Update Aug 2019

Exciting developments are underway in the Gold market as a bullish MACD crossover is observed on the monthly charts. For the first time in years, the trend is displaying mild positivity. The key now is whether Gold can successfully close above the $1500 mark. If achieved, a potential test of the $1800 range is in the cards, with the possibility of an overshoot to $1920. Meanwhile, Silver, currently lagging, is anticipated to gain momentum once the action in the Gold markets intensifies, and in terms of percentage performance, Silver is poised to outshine Gold Bullion.

Interestingly, the pattern for Bitcoin currently appears stronger than that for Gold. However, caution is advised for Bitcoin investors in the short term, as waiting for a cooldown before deploying new capital might be prudent.

Turning attention to Gold stocks, two noteworthy plays emerge. GFI stands out with a robust pattern, ranking as the fourth-strongest stock in the sector based on relative strength. Entry points in the $4.50-$4.70 range are considered favourable for establishing a position. Another intriguing play is DRD, although it comes with a higher level of risk due to its volatile nature. An entry in the $2.90-$3.00 range is suggested for those willing to take on a bit more risk in pursuit of potential gains.

Genius may have its limitations, but stupidity is not thus handicapped.

Elbert Hubbard

Initially released on May 8, 2017, this content has undergone continuous updates throughout the years, with the most recent update completed in November 2023.

Deeper Dive into Compelling Narratives

What is the Bandwagon Effect? Exploring Its Impact

Current Market Sentiment Indicators: Spotting Market Moves

Stock Market Correction History: Decoding Illusions Behind Crashes

October 1987 Stock Market Crash: Victory for the Wise, Pain for the Fools

Contrarian Investing: Thrive by Defying the Herd

Collective Panic Breeds Collective Losses: Break Free from the Herd

Blooms and Busts: Navigating the Tulip Bubble Chart Phenomenon

Mastering Technical Analysis Of The Financial Markets

Logical vs. Emotional Thinking: Deciphering the Dominant Force

Unleashing Market Fear: The Price of Folly in Investing

Contrarian Definition: Buy When Others Flee in Fear

Inside the Mind of a Permabear: Where Doubt Dances with Reality

What Happens If the Market Crashes? Smart Moves vs. Panic Runs

Learn About Stock Market Investing: Win by Going Against the Grain

Stock Market Anxiety: Overcome Fear and Focus on Opportunity

Stock Market Forecast for Next 3 months

Next Stock Market Crash Prediction

Dow theory no longer relevant-Better Alternative exists