When is the Next Stock Market Crash Prediction: Irrelevant Concerns?

Updated April 21, 2024

The Futility of Stock Market Crash Predictions: Focus on Opportunities

Predicting the timing of the next stock market crash is a futile endeavour. Instead of dwelling on fear and uncertainty, investors should focus on recognizing and seizing the opportunities that arise during market downturns.

Key Focus Points:

1. Mass psychology and sentiment analysis are crucial in understanding market dynamics. When bullish sentiment reaches extreme levels, it often precedes a significant decline in overheated sectors and indices.

2. Warren Buffett emphasizes treating stocks as company ownership interests rather than mere trading instruments. Short-term trading based on market swings is often a waste of time or worse.

3. Market downturns offer extraordinary opportunities to those not burdened by debt. Buffett advises against borrowing money to buy stocks, as there is no telling how far stocks can fall in a short period.

4. Jesse Livermore, a renowned trader, believed in staying with a stock as long as it was acting right and the market was right and not rushing to take profits.

5. Templeton, another successful investor, viewed crises as opportunities and suggested making a list of stocks to buy when their prices fall significantly below their current levels.

6. Machiavelli’s principle of being “fearful when others are greedy and greedy when others are fearful” aligns with the concept of capitalizing on market downturns.

7. Buffett compares the stock market to a casino, with many investors driven by speculation and trendy stocks rather than fundamental analysis.

Successful investors focus on the long-term, treat stocks as ownership in businesses, and view market crashes as opportunities to acquire quality assets at discounted prices. By controlling fear and maintaining a disciplined, rational approach, investors can navigate the complexities of the market and potentially reap significant rewards.

The Demise of Free Market Forces: A Paradigm Shift

Free market forces, where supply and demand dictate market dynamics without external interference, have long been idealized as a cornerstone of economic theory. However, the reality of modern markets is often characterized by manipulation and control by dominant players.

Key Facts:

1. Government intervention through regulations, taxes, and tariffs has always shaped market outcomes, distorting the natural flow of market forces.

2. Influential market players use fear as a strategic tool to manipulate market sentiments, a recurring strategy observed in various market crashes.

3. Major players capitalize on panic and uncertainty to influence market behaviours to their advantage, while the masses tend to make poor financial decisions driven by instinctual reactions.

4. The study of mass psychology and technical analysis provides a framework for navigating emotional biases and identifying underlying trends.

5. A disciplined approach to decision-making, valuing steady analysis over erratic reaction and strategic patience over hurried judgments, is crucial for recognizing and seizing opportunities amidst market chaos.

The shift from a perceived free market to one acknowledging the significant influence of manipulation and mass psychology necessitates strategically re-evaluating investment approaches. Aligning with market trends rather than the reactionary impulses of the crowd can lead to more successful investment outcomes. By focusing on analytical tools and making decisions based on logic and evidence, investors can navigate the complexities of the modern market and set a foundation for seizing opportunities amidst the chaos.

Market Crashes: Seizing Long-Term Buying Opportunities

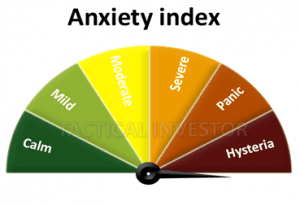

Market crashes often present long-term buying opportunities, but timing is crucial. Mass psychology suggests that the best time to enter the market is when the masses panic, and bearish sentiment reaches extreme levels (50-55 range). Examples like the 2020 COVID crash and the 2022 correction demonstrate that buying during mass fear can yield substantial returns.

Relying on unreliable predictions about when the market will crash is not advisable. Instead, investors should focus on separating fact from fiction and embracing a well-informed, rational approach to investing during market downturns.

The Wisdom of Warren Buffett: Be Bold When Others Are Fearful

Warren Buffett emphasizes the importance of being bold when others are fearful. Market corrections offer opportunities to acquire high-quality stocks at discounted prices, potentially yielding significant long-term gains.

Investing during market apprehension requires a long-term perspective and the ability to hold investments during periods of volatility. Historical data shows that the stock market delivers impressive returns over the long haul, even accounting for periodic corrections.

Smart Investing: Quality and Diversification

Investing during market corrections involves focusing on quality stocks with a proven track record of delivering strong returns. These stocks are often less susceptible to market volatility compared to lower-quality counterparts.

Maintaining a diversified portfolio is crucial for managing risk and capitalizing on market opportunities. A well-diversified portfolio includes a blend of stocks, bonds, and other investments, spreading risk across different asset classes.

Unveiling Stock Market Mastery: The Winning Strategy Revealed

Understanding mass psychology can provide a competitive edge in the stock market. Another winning strategy involves embracing contrarian investing by identifying undervalued assets with growth potential.

Anticipating emerging trends and pinpointing promising stocks within these sectors is crucial for staying ahead in the stock market. Mastering the fundamentals of technical analysis can enhance decision-making and fine-tune entry and exit points.

However, investing in the stock market carries inherent risks, and consulting with a financial advisor or conducting further research to tailor strategies to individual circumstances and goals is advisable.

Market Crashes: Seizing Long-Term Buying Opportunities

Market crashes often present long-term buying opportunities, but timing is crucial. Mass psychology suggests that the best time to enter the market is when the masses panic, and bearish sentiment reaches extreme levels (50-55 range). Examples like the 2020 COVID crash and the 2022 correction demonstrate that buying during mass fear can yield substantial returns.

Relying on unreliable predictions about when the market will crash is not advisable. Instead, investors should focus on separating fact from fiction and embracing a well-informed, rational approach to investing during market downturns.

Unveiling Stock Market Mastery: The Winning Strategy Revealed

Understanding mass psychology can provide a competitive edge in the stock market. Another winning strategy involves embracing contrarian investing by identifying undervalued assets with growth potential.

Anticipating emerging trends and pinpointing promising stocks within these sectors is crucial for staying ahead in the stock market. Mastering the fundamentals of technical analysis can enhance decision-making and fine-tune entry and exit points.

However, investing in the stock market carries inherent risks, and consulting with a financial advisor or conducting further research to tailor strategies to individual circumstances and goals is advisable.

Monkey Business: Primate Prowess Outshines Experts

In 2010, a Russian circus monkey named Lusha picked an investment portfolio that “outperformed 94% of the country’s investment funds” to great acclaim. Given 30 blocks, each representing a different company, and asked, “Where would you like to invest your money this year?” the chimp picked out eight blocks. An editor from a Russian finance magazine commented that Lusha “bought successfully, and her portfolio grew almost three times.” He suggested that “financial whizz-kids” be “sent to the circus” instead of rewarded with large bonuses.

We are examining the situation historically. Here, we demonstrate what we at Tactical Investor recommended in real-time.

New Stock Market Crash Update: Key Insights Unveiled

Now is an excellent time to sit back and dwell on how you felt back in March when the markets were crashing. At the Tactical Investor, we repeatedly warned our subscribers that this was a manufactured crisis and that the markets would recover. Fast forward, that appears to have come to pass. We are roughly 3K from Dow 30K, while the Nasdaq has already soared to new highs. In the end, the crowd always loses; remember that the next time the experts state that markets could crash and burn, the only that goes up in smoke is the egos of these shady experts.

This was the smallest bear market in history. It was killed before it could even gather traction. As the trend is bullish, the plan is simple. Embrace all pullbacks ranging from mild to wild, like a lost love.

The masses are far from bullish; in fact, they are downright panicking, and therefore, this blood-curling pullback has to be embraced with enthusiasm. The stronger the deviation, the better the opportunity. Six months from the crowd will regret having through the baby out with the bathwater. March 12, 2020

When will the Market Crash: Feb 2019 Update

The above two gauges show that the masses are far from happy. They should embrace every sharp pullback until they embrace this bull market; the more substantial the deviation, the better the opportunity.

Dr Doom: The Relentless Pessimist

Here’s Marc Faber’s next stock market crash prediction. Remember, if you follow this dude’s advice, you better take it with a bottle of whisky and a jar of salt. He feels that the markets are destined to crash. If you had listened to chap, you would have been blown out of the markets long ago. Jim Rogers has made some pretty good calls in the past; Mark Faber, on the other hand, very few treat him as a source of entertainment. He went on CNBC recently and made the following claims.

“I believe the time will come when the weakness of the euro becomes uncomfortable for the Europeans, specifically the Germans, and then there will be a reverse,” Faber said. “And the dollar will go down, and the money that flowed into U.S. assets will flow out of U.S. assets, and so the market is more likely to go down.” CNBC

Untimely Views on the Next Stock Market Crash Prediction

March 2017

Jim Rogers, one of the co-founders of the Quantum Fund with George Soros, is becoming increasingly bearish as he feels that the financial system is due for a shock. In Fact, he went on record to state that the Fed does not know what it is doing on Bloomberg TV. “A $68 trillion ‘Biblical’ collapse is poised to wipe out millions of Americans”, said Jim Rogers. Should the masses panic and listen to these statements, we will answer that shortly. For now, let’s look at what other experts are stating.

Next Stock Market Crash Prediction: Final Thoughts

In conclusion, successfully navigating market corrections requires discipline, patience, and a long-term investment mindset. By investing in high-quality stocks during times of fear, investors can leverage discounted prices and benefit from the stock market’s long-term growth potential.

Market corrections are a natural part of the market cycle, providing opportunities to acquire quality stocks at lower prices. It is important to note that investing in the stock market carries inherent risks, and seeking professional financial advice before making investment decisions is always recommended. While investing during market corrections can lead to significant long-term gains, it is crucial to understand the risks involved and maintain a long-term focus on investment strategies.

Captivating Articles That Leave a Lasting Impression

Unleashing the Power of Small Dogs Of the Dow

Stock Market Forecast for Next 3 & 6 Months

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

Unmasking Deceit: Examples of Yellow Journalism

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Investment Journal: Charting the Course Toward Financial Triumph

Trading Success: From Riches to Rags and the Rise to Wealth Mogul

Dow theory Forecasts: Alternative could be better

Contrarian Definition: Tactical Investor Trading Methodology

Herd Mentality: Understanding the Pros and Cons of Conformity

Projected Silver Prices: Setting Sail for Precious Metal Ascension

Which Of The Following Is A Cause Of The Stock Market Crash Of 1929

Stock Bubble: Act Quickly or Lag Behind

The Dow Theory: Does It Still Work?

Tactical Tools: Unleash the Power of Trend Prediction

Define Fiat Money: The USD Is A Great Example