Updated July 2019

Stock Market Bull: Is It Ever Going To End?

This Stock Market Bull Has Staying Power

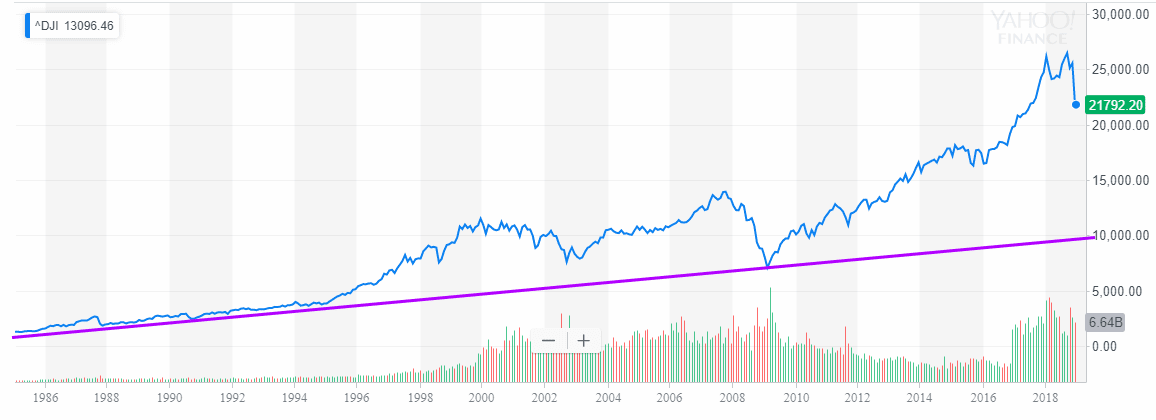

Each point on this chart represents a month’s worth of data; the worst one day crash (black Monday) is just an insignificant blip on this long-term chart, clearly proving that until Fiat money is eliminated that stock market crashes from a long-term perspective represent buying opportunities.

There are two main underlying themes behind every single market crash; a euphoric crowd and an extremely overbought market. Both elements were missing this time around, clearly highlighting that something else is at play here, and it smells dangerously akin to market manipulation. Market manipulation via weaponized news?

From a long-term perspective, this sharp pullback is creating another once in a lifetime buying opportunity event. The crash of 2008 was one of the most painful in recent history and yet despite this vicious pullback; the Dow is still trading several percentage points above its 2009 lows.

The Trend is Your Friend

It’s official now, according to Investopedia, this is the longest bull market of all time.

It’s official. This Saturday, March 9, 2019, marks the 10-year anniversary of what many call the longest bull market in history. It all started from the post-crisis low of March 9, 2009. The S&P 500’s (SPX) closing price on that fateful day in early 2009 was precisely 676.53. As of the market close on Friday (3/8/2019), the S&P 500 settled at 2743.07. That represents around a 305% rise in a 10-year period. Not bad for a large-cap stock index. Full Story

Easy Money Is Driving this Stock Market Bull To Insane Levels

In June 2019, we published the following article Fiat Currency: Instruments of Mass Destruction an excerpt of which is published below. This provides a clue as to how long this stock market bull will last.

This manipulation of the money supply is going to affect the stock markets dramatically; every single expert that refuses to adapt will be flung under the bus; there will be no exceptions.

The markets will experience many corrections ranging from wild to mild, but almost all of them will prove to be buying opportunities unless the trend changes. If one takes a look at the megatrend (megatrends are ultra-long term trends) then every back-breaking correction has to be embraced; however, by employing human emotion as a timing indicator, we can determine the optimum time to jump in and out of the markets.

The markets will experience many corrections ranging from wild to mild, but almost all of them will prove to be buying opportunities unless the trend changes. If one takes a look at the megatrend (megatrends are ultra-long term trends) then every back-breaking correction has to be embraced. The stock market is unlikely to crash until the Masses embrace this bull market.

Until we have a feeding frenzy stage this Stock Market Bull will not end

While you might feel sorry for them, just watch Pluto’s allegory of the cave to see how well the masses will reward you for trying to wake them up. In a nutshell, this development is a very bullish factor for it means that eventually, this market is going to experience what could turn out to be an extreme “feeding frenzy stage”. The crowd will ultimately be so mad they sat and did nothing for so long, that they will double up on this market and their sweet reward as always will be a very sharp guillotine.

Masses Will Eventually Embrace This Bull Market

However, contrarian players will mistake the initial surge in bullishness as a sign that the markets are ready to top out and will end up shedding a lot of tears in the process. At the Tactical Investor, our strategy is different; we will not adopt a position that opposes the masses until the crowd is in a state of ecstasy, in other words, the bandwagon of joy should be ready to collapse before we consider betting against the masses. So until the Crowd embraces this stock market bull, view all corrections ranging from mild to wild through a bullish lens.

Other Stories of Interest

Is this the end for Bitcoin or is this a buying opportunity? (Jan 24)

Stock Market Insanity Trend is Gathering Momentum (Jan 10)

Is value investing Dead (Jan 9)

Irrational markets and Foolish Investor: perfect recipe for disaster (Jan 5)

Stock market Crash Myths and Realities (Jan 3)

Bull-Bear Markets & Arrogance (Jan 1)

Will The Stock Market Crash In 2018 (Dec 11)

Has US Dollar Finally Hit Bottom (Dec 6)

BitCoin Has Done What Precious Metals Never Could (Dec 4)

Experts Making Stock Market Crash Forecasts usually know nothing (Nov 17)

1987 stock market crash anniversary discussions- nothing but rubbish ( Oct 24)