Is Current Stock Market Bull Ready To Trend Higher?

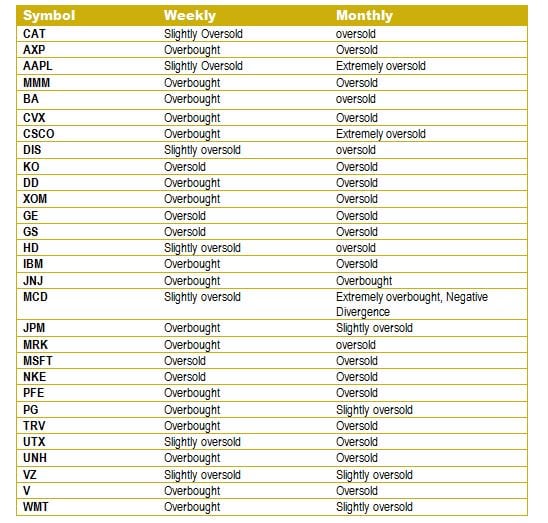

The market has resisted all attempts to correct. We know why it’s not crashing; this has to do with mass psychology, but what’s preventing it from letting out a meaningful dose of steam. The table below might hold the answer. We looked at all 30 components of the Dow on the weekly and monthly timelines utilising our indicators, and the results were quite surprising, to say the least. This Bull Market still has a lot of steam and the data below confirms this hypothesis.

Focus on the monthly section and you will notice that 28 components of the Dow are in various oversold conditions ranging from mild to extremely oversold. Conventional logic would have you believe that all the components would be trading in the overbought ranges.

The strength the Dow 30 stocks are showing on the monthly charts, clearly indicates that the most hated stock market bull still has plenty of room to run before it drops dead from exhaustion. However, at the moment the stock market is rather overbought and so it would not surprise us if it let us some steam. In fact, it would be very healthy for this market to let out a nice dose of steam before it surges higher. Oil and the Dow tend to trend together; oil pulled back, put in a bottom as expected in the $40.00 ranges and is now trending higher. Thus the Dow should follow in its footsteps; a minor correction before powering off to new highs. We discussed this in a recent article titled ” oil bottom likely to propel Dow Jones Higher”

Current Stock Market Bull Outlook April 2020

Now given the intensity of the current sell-off, the markets are likely to mount a rally, the first attempt usually fails, and if history is to be trusted then when this rally fizzles out, it should lead to another downward wave, that could take the market to new lows on an intraday basis. If the pattern is strong enough, we could issue either a short term put play or open up strangle position. This is where one opens up both a call and put but with different strike prices.

Don’t forget to keep a trading journal; the best time to take notes is when blood is flowing freely on the streets. Interim Update March 9th , 2020

Nobody knows the inner workings of a company better than the insiders and these chaps are doing something that can only be described as unprecedented, further confirming that this sell-off represents opportunity instead of a disaster.

So what are the readings today? Based on very heavy transaction volume, Vickers’ benchmark NYSE/ASE One-Week Sell/Buy Ratio is 0.33, and the Total one-week reading is 0.35. Insiders are not just buying shares, they are devouring shares. Insiders behaved in a similar fashion in late-December 2018, after stocks crashed on Christmas Eve; in early 2016, when stocks also corrected; and in late 2008/early 2009, at the depths of the Great Recession correction. Those were spectacular times to buy stocks. Insiders seem to be telling us that today offers a similar opportunity. https://yhoo.it/2TV0cE2

The 1987 crash and 2008 crash fell into the category of the “mother of all buying opportunities“, but we could get a setup that could blow these setups and create the “father of all opportunities“. Such an event is so rare that it might occur only once during an individuals lifetime. In the short term, there is no denying the landscape looks like a massacre, but if one is going to focus solely on the short timelines, then the odds of banking huge profits are quite slim

Other Stories of Interest

Violence Stupidity & religious intolerance will continue to soar (Aug 22)

Mass Media Turns Bullish: Stock Market Correction likely (Aug 19)

Crowd Control market Manipulation & Pensioners forced to Speculate (Aug 18)

China Following America’s lead: Exports Bad Debt Globally (Aug 13)

Wall Street Journal States that Russia Bombed US-Syrian Base (Aug 9)

Why won’t this cursed Stock market bull market crash (Aug 8)

Investor Anxiety; Rocket Fuel for Unloved Stock Market Bull (Aug 6)

Most Unloved Stock Market Bull Destined To Roar Higher (Aug 5)

Interesting analysis. As long as people in mainstream media keep warning about an imminent crash or overvalued markets, I think this bull market will continue to climb a wall of worry.