What Is Velocity of Money: Manipulating Inflation Through Spending Speed

Jan 17, 2025

The question isn’t if the system will crack under this manipulation—it’s when. Be prepared. Stay calm. And above all, recognize that the velocity of money is not just a number; it’s a weapon wielded by those who benefit most from keeping the rest of us in the dark.

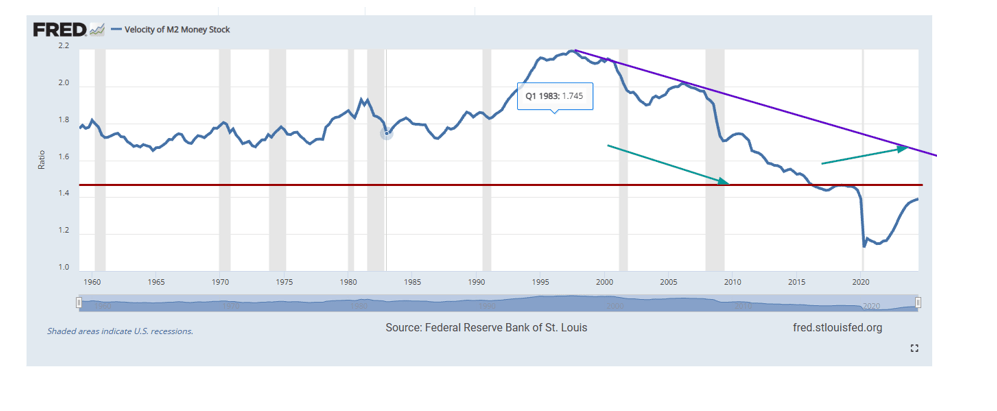

The Velocity of Money (VM) is a measure of how quickly money circulates in an economy. Technically, it’s calculated as the ratio of nominal GDP to the money supply. But behind this sterile formula lies a powerful lever that governments and central banks have used, time and again, to manipulate inflation, manage public sentiment, and exert control over economic dynamics.

VM isn’t just an economic statistic—it’s a weapon. By accelerating or decelerating the speed of money’s movement, authorities create inflationary or deflationary forces that shape the market, often in ways that serve political goals rather than economic stability. Let’s break this down and expose how VM has been a tool of manipulation.

Inflation: A Symptom, Not the Disease

Inflation is commonly misunderstood as rising prices but merely a symptom. The real disease is excessive money creation, often cloaked as “stimulus” or “relief.” For decades, this money never reached the hands of the average person. Instead, it sat in bank reserves, suppressing VM and keeping inflationary pressures at bay. This was the game post-2008: money printed for banks, not people.

COVID changed everything. Under the guise of necessity, the government put money directly into people’s hands—stimulus checks, unemployment benefits, and small-business loans. This wasn’t generosity; it was calculated. By injecting cash into the broader economy, VM accelerated, unleashing inflationary forces that policymakers could conveniently blame on “supply chain disruptions” or “global tensions.”

Post-COVID Tactics: Immigration and Government Expansion

With COVID programs winding down, new excuses were needed to keep money flowing. Enter illegal immigration and government hiring sprees. These weren’t accidents or lapses in border policy—they were deliberate moves to pump cash into the system.

Illegal immigrants were provided housing, food, and even cash stipends—direct injections that boost VM. Similarly, Biden-era policies to expand government hiring disguised as “infrastructure investments” or “inflation reduction” acts were just avenues to keep VM high. Every newly hired government worker becomes a cog in the inflationary machine, spending money that fuels rising prices.

What Happens if Velocity Falls?

Now, imagine a scenario where VM slows. If policies like mass deportations or government workforce reductions were enacted, the system would face a deflationary threat. Deflationary forces, distinct from outright deflation, emerge when spending slows, reducing demand. Bond markets tend to thrive in such an environment, as lower VM historically aligns with falling bond yields and rising prices.

Yet, today’s bond markets defy this pattern. Despite soaring VM since COVID, bond yields remain volatile—a sign of deeper structural instability. Should VM revert to its historical mean, the system’s fragility could finally come to light.

Lessons from China: A New Playbook for VM

China has watched this manipulation with keen interest. Facing deflation, they’ve adopted the U.S. playbook, increasing salaries for government workers for the first time in years and funneling money to small businesses. The logic is simple: if you want VM to rise, give money to those who spend it, not hoard it.

This strategy reveals the core truth: VM is controlled by who receives the money. Billionaires and corporations don’t spend; they save or invest in ways that don’t circulate money through the economy. It’s the “average Joes” and small businesses that drive VM—and the government knows it.

Inflation: A Manufactured Crisis

The narrative surrounding inflation has been distorted into a convenient scapegoat, serving the interests of those who control the money supply. The official story often blames external forces—supply chain disruptions, geopolitical tensions, and rising energy costs—for the inflationary pressures we’ve experienced in the wake of COVID. But this overlooks a more insidious driver: the velocity of money (VM) and how its deliberate manipulation by the government and central banks has been the true architect of this crisis.

The path to the current inflationary environment began long before the pandemic. For years, central banks and governments had used tools like quantitative easing (QE) to inject liquidity into the financial system. However, this liquidity largely sat in bank reserves, resulting in a decline in the velocity of money. This is where the story becomes key—money was being printed, but it wasn’t circulating effectively through the broader economy. The public didn’t see the full effects because the money wasn’t reaching them. Instead, it bolstered asset prices and inflated the wealth of those already holding financial assets.

COVID served as a convenient pretext to alter this dynamic radically. The government responded by sending out direct stimulus payments, unemployment benefits, and business relief packages to millions of individuals. This marked a dramatic shift in the velocity of money, as large sums of cash were now directly injected into the hands of consumers. This wasn’t a benevolent move; it was strategic. As money flowed through the system more rapidly, demand spiked, and prices followed suit. This was the first key point: the government needed inflation to hide the effects of the underlying economic issues, and they needed VM to rise to push inflation into overdrive. The government’s desire for inflation became evident when Jerome Powell, Chairman of the Federal Reserve, said that a little inflation wouldn’t be such a bad thing.

But this tactic has severe consequences. As the velocity of money accelerates, so too do the risks of hyperinflation, as it leads to rising prices and diminished purchasing power. The rising cost of living is the symptom, but the true culprit is the acceleration of money circulation or VM. Yet the inflationary forces we’re facing today have been artificially propped up by this acceleration—leading to an environment where inflationary pressures are widespread. Still, they aren’t necessarily driven by demand alone. They are, in fact, induced by a system that is carefully manipulating the flow of money to serve broader economic and political goals.

Conclusion: Velocity of Money as a Control Mechanism

The velocity of money is far more than an abstract economic metric—it is a powerful instrument used to control and manipulate the broader economy. By regulating the speed at which money circulates, policymakers can steer inflationary and deflationary pressures while maintaining an illusion of economic stability. Every action—from direct stimulus payments to manipulating immigration policy—has one common goal: influencing VM and inflation.

For example, the government hiring was expanded under the Biden administration. The government didn’t just print money and hope for the best; it directly employed millions of people—pushing up both the velocity of money and public sector wages. This not only kept VM elevated but also provided a convenient way to push the narrative that the economy was recovering when, in reality, it was a carefully engineered scheme to keep inflation moving upward. Similarly, the influx of illegal immigrants—who were given housing, food, and cash benefits—further accelerated the velocity of money in specific sectors of the economy. The spending power of these new entrants pushed demand higher, and in turn, prices followed.

The government and central banks knew what they were doing. By accelerating VM and creating inflationary conditions, they artificially inflated the economy. This was a controlled explosion. Inflationary pressures weren’t just the natural result of increased demand; they were manipulated, accelerated, and directed into the economy to cover up deeper economic malfeasance. With the right narrative and tools at their disposal, they have deflected attention from the real causes of the crisis, ensuring that inflation remains the primary scapegoat.

But history teaches us that this manipulation has limits. The more the velocity of money rises, the closer we come to a tipping point. If VM accelerates too rapidly, it triggers hyperinflation, destabilising the economy and destroying purchasing power. On the other hand, if VM slows down too much—whether through policy changes, reduced government spending, or a natural decline in economic activity—we could see deflationary pressures, leading to a downward spiral. Both extremes are dangerous, but the balance between them is maintained not by economic fundamentals but by psychological manipulation and political calculation.

The question is not if the system will break—it’s when. The evidence is everywhere. Watch how quickly inflation can rise when money is circulating fast, and how quickly it can reverse when spending slows. Understanding this dynamic gives investors and ordinary citizens a powerful tool: the ability to read between the lines of the government’s economic narrative. The real skill lies in discerning when the manipulation has gone too far and recognizing when to prepare for the inevitable backlash.

The velocity of money is not just an economic metric; it’s a weapon wielded by those who understand its power to control markets and populations. Those in control of the system know that as long as VM can be kept high enough, they can keep the economy on life support. But when it falls—when the velocity slows—so too does the illusion of stability. Be aware. Recognize the signs and prepare for the inevitable reckoning when the system cracks.