Boom and Bust Cycle Where Big Gains and Big Mistakes Share a Border

June 9, 2025

Booms seduce. Busts punish. And between them? A razor’s edge most investors mistake for a runway.

The boom-bust cycle isn’t just some Econ 101 footnote — it’s the market’s heartbeat. Expansion, euphoria, contraction, collapse. Rinse, repeat. What most forget is this: the damage isn’t done at the bottom — it’s baked in at the top, when dopamine drowns discipline and credit flows like cheap wine.

At face value, yes — booms mean growth, low unemployment, surging asset prices. Busts reverse the flow — layoffs, plunging valuations, credit crunches. But that’s the surface. The real mechanics happen in the shadows, between liquidity injections and psychological delusions.

Follow the money? No — follow the mispricing of time and risk. Central banks pull the strings, cutting rates and greasing the system with synthetic confidence. Cheap money births malinvestment — capital thrown at shiny nonsense with zero regard for terminal value. Think WeWork, 2021 SPACs, crypto mania. It’s not capital allocation; it’s capital hallucination.

And psychology? It’s not a side effect — it’s the accelerant.

“Markets are moved not by facts, but by what people do with those facts under pressure.”

During booms, investors don’t just get greedy — they get amnesiac. Risk? Forgotten. History? Irrelevant. Every time is different until it ends exactly the same.

Even Marx, buried under ideological baggage, saw it clearly — the cycle is as psychological as it is structural. Rational actors? Please. We’re watching a drama of belief, fear, and crowd mimicry, dressed up in data.

The cycle doesn’t just describe markets. It reveals them.

Ignore it, and you become the liquidity — the exit. Understand it, and you play above it.

Historical Examples & Tactical Lessons: Ghosts of Booms Past

History doesn’t repeat — it reloads.

The Great Depression wasn’t just a crash — it was an exorcism of the excesses of the Roaring Twenties. Markets had gorged on euphoria. Credit was loose, speculation rampant, and when the punch bowl was yanked in 1929, reality hit like a wrecking ball. The contraction lasted 43 brutal months. Jobs vanished. Banks imploded. And trust — the real currency — evaporated.

Fast forward: the dot-com hysteria of the late ’90s. A digital gold rush. Hype paraded as valuation. Everyone became a tech prophet. And when the dream ran into the wall of profitability, it collapsed. NASDAQ lost over 75%. But the real cost? Belief — in the system, in the narrative, in the future.

Then came 2008 — the financial equivalent of Chernobyl. Wall Street, drunk on derivatives and cheap money, cracked its own foundation. Subprime loans, CDOs, synthetic euphoria. The bust wiped out trillions, vaporized pensions, and torched institutions “too big to fail.” And just like that, the world remembered: leverage cuts both ways.

Each of these events wasn’t a surprise. They were foretold in balance sheets, behavior, and blind spots.

The Sorcerers Behind the Curtain: Central Banks & Monetary Mayhem

You want to find the villain? Follow the rate cuts.

Central banks aren’t observers of the cycle — they are the cycle. By manipulating interest rates and money supply, they amplify both the high and the hangover. During boom phases, they flood the system with liquidity. They say it’s for “growth.” What they really create is leverage on steroids.

The Fed in particular has morphed from lender of last resort to market mood manager. Whether cutting rates to prop up asset prices or unleashing quantitative easing to fight the monster they created — every move deepens dependence.

Critics call it currency debasement. Others see it as mass sedation. Either way, the Fed’s invisible hand doesn’t just move markets — it molds public perception. The press parrots policy. Analysts kneel to the dot plot. Most investors? Programmed.

“The Fed, via fiat money, indirectly controls the media; the press controls the masses through the garbage they print and pass off as news.”

Is it extreme? Maybe. But ignore it at your own expense.

Booms inflate not just markets, but illusions. Busts clear the fog — briefly. The trick isn’t avoiding the cycle. It’s weaponizing awareness before the next round begins.

Impact on Investors: Strategies for Survival, Not Serenity

Every major correction is a test — not just of capital, but of conviction. The amateur sees chaos. The seasoned investor sees clearance prices on future wealth.

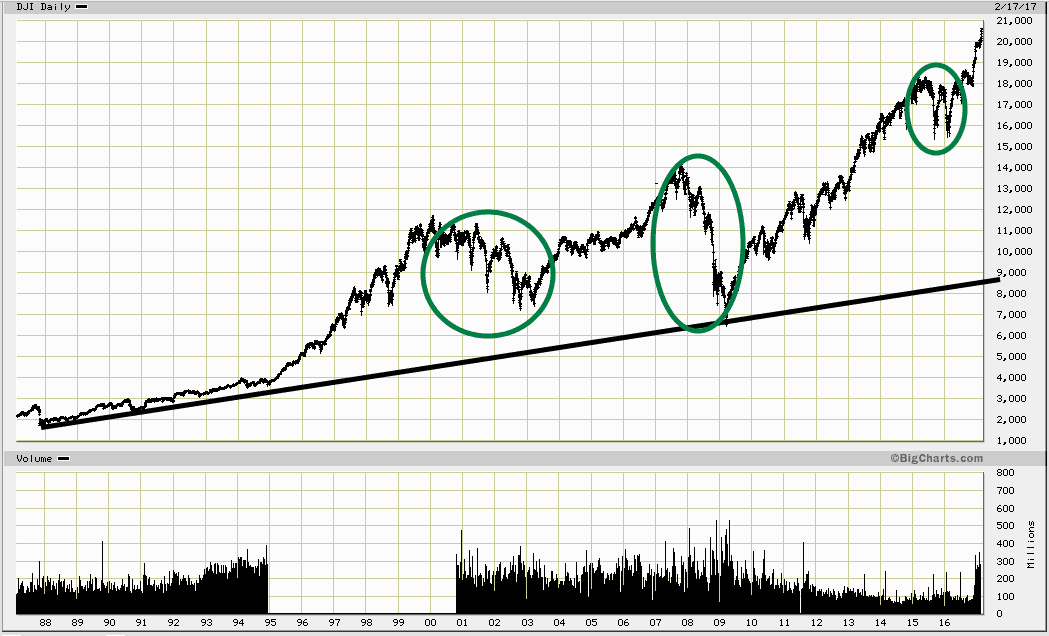

When the underlying trend is bullish, panic is the discount. The more violent the deviation from the mean, the more asymmetric the reward. History doesn’t lie: every so-called crash has eventually been a launchpad — for those who didn’t flinch.

The Fed’s real power isn’t just in rates — it’s in narrative architecture. Through fiat money and media echo chambers, it manufactures consent. Most believe they’re thinking freely. In reality, their fears and hopes are pre-loaded. Watch closely. The illusion of choice often masks the machinery of control.

So what to do?

Diversify, but not blindly.

Not all asset mixes are created equal. Spread exposure — yes — but aim for convexity, not comfort. Equity, bonds, hard assets, cash reserves — each serves a role, but only when tuned to the cycle’s tempo.

Think in decades, act in weeks.

Panic sellers fund long-term fortunes — just not their own. A portfolio built on historical awareness, not headlines, wins by attrition. Remember: volatility is only risk if you’re forced to sell.

“From a long-term lens, every crash was a disguised accumulation zone.”

That’s not optimism. That’s math + memory + mental resilience.

Broader Fallout: Economic Whiplash, Social Contagion

These cycles don’t just shift tickers — they fracture lives.

Booms inflate everything: confidence, credit, corporate expansion. Businesses fatten, balance sheets look divine, consumption surges. But underneath, excess piles up like dry brush waiting for a spark.

Then comes the bust — and the cleanup crew never arrives on time. Layoffs hit. Spending evaporates. Debt crushes those who once leveraged up to “participate.” The psychological recoil is worse than the financial one.

Governments lurch into action — stimulus, rate cuts, bailouts. But those fixes are often sugar bombs: short-term comfort, long-term cost.

“The system is hardwired to bust — not because of misfortune, but by design.”

Every intervention creates the seeds of the next imbalance. Policymakers don’t break cycles. They rebrand them.

Meanwhile, the social fallout deepens. The rich regroup, the poor absorb the blast. Inequality spikes. Trust in institutions erodes. What was once economic becomes political. Then cultural. Then explosive.

Conclusion: Thrive in the Chaos or Be Crushed by It

Boom and bust isn’t a glitch — it’s the system’s operating rhythm. You either learn the tempo, or you dance until the floor disappears.

For investors, this means discipline, diversification, and timeline alignment. Build not just for returns, but for resilience. Tailor your strategy to your own psychological capacity — not the market’s current story.

Policymakers must stop playing god with tools designed for weather, not wildfires. The goal isn’t to stop the cycle. It’s to stop pretending it can be stopped.

Because in the end, markets will correct. Economies will wobble. But if you’re positioned with clarity, capital, and courage — the next bust won’t destroy you. It’ll define you.