What is Mass Psychology: Winning the Investment Game

Jan 20, 2025

Mass psychology is an intriguing field of study that delves into how the collective behaviour and emotional states of groups influence individuals within those groups. This concept is particularly relevant in investing, where understanding the collective behaviours of market participants can be the key to making successful investment decisions. This article explores the essence of mass psychology, its implications in the investment world, and how investors can leverage this knowledge to gain an edge in the market.

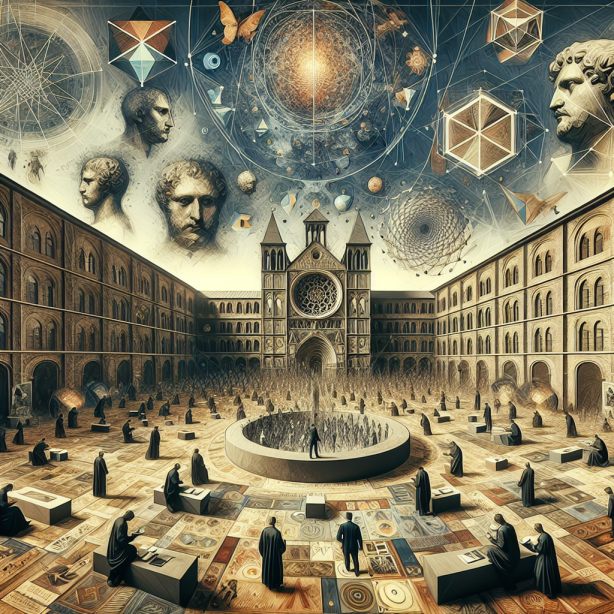

The Roots of Mass Psychology

The foundation of mob psychology is built upon the observations and theories of early philosophers and psychologists who studied human behaviour in groups. A 16th-century philosopher, Michael Montaigne, offered profound insights into human nature and group behaviour. His reflections suggest that humans often find comfort in ignorance, which can lead to a herd mentality—a phenomenon where individuals follow the crowd without independent thought. Montaigne emphasized the importance of self-awareness and personal integrity, suggesting that true wisdom comes from within and not from the fleeting approval of the masses.

Carl Jung, a 20th-century psychiatrist, further expanded on these ideas by exploring the psychological dynamics of crowds. He observed that individuals in a crowd often regress to a lower moral and intellectual state, driven by unconscious primal forces. This regression can lead to what Jung described as a collective psyche that operates on a more primitive level than an individual acting alone.

Historical Examples of Mass Psychology in the Markets

Throughout history, crowd psychology has been critical in shaping financial markets, often leading to dramatic economic events. One of the most famous examples is the Tulip Mania in the 17th century Netherlands, where the price of tulip bulbs reached extraordinarily high levels and then dramatically collapsed. This was one of the first recorded instances of an economic bubble, where collective public sentiment drove prices up only to crash when reality set in.

Another significant example occurred during the late 1990s and early 2000s dot-com bubble. Fueled by the excitement and speculative investments in Internet-related companies, stock valuations soared unsustainable. The NASDAQ Composite, heavily laden with tech stocks, grew from under 1,000 to over 5,000 within a few years. However, this surge was not supported by the underlying economic fundamentals. When investor sentiment shifted, the bubble burst, leading to substantial financial losses for those caught in the frenzy. These examples underscore the powerful influence of mass psychology in driving market excesses and the subsequent corrections that often follow.

Navigating Market Sentiments

Mass psychology plays a critical role in investing in shaping market trends and movements. Market sentiment, driven by investors’ collective emotions, can lead to significant fluctuations in stock prices and market indices. Understanding these sentiments and their origins can help investors predict potential market shifts.

For instance, during periods of economic optimism, the collective sentiment can drive stock prices to artificially high levels, creating what is known as a market bubble. Conversely, fear can lead to rapid sell-offs during economic uncertainty or crisis, resulting in a market crash. These patterns are often cyclical, and recognizing them can allow investors to buy low during panic sell-offs and sell high during euphoric peaks.

The Contrarian Approach

One effective strategy for leveraging mass psychology in investing is contrarian investing. This approach involves going against the prevailing market sentiment, buying stocks when others are selling (out of fear) and selling when others are buying (out of greed). Legendary investors like Warren Buffett and George Soros have successfully employed this strategy, often reaping substantial rewards by capitalizing on the market’s overreactions.

Contrarian thinking requires a deep understanding of market fundamentals and the psychological factors driving market participants. It also demands patience, discipline, and the courage to make decisions that may initially seem counterintuitive. Contrarian investors can avoid common pitfalls and achieve success by focusing on long-term investment goals and not swaying under the influence of short-term market sentiments.

Technical Analysis: Precision in a Sea of Emotion

While mass psychology sets the stage, technical analysis refines the approach. This method dissects price patterns, trends, and indicators to anticipate market movements precisely. During the pandemic’s market turmoil, investors who utilized technical analysis found clarity in the chaos.

Patterns like the “double bottom” signalled potential reversals, while indicators like the Relative Strength Index (RSI) highlighted oversold conditions primed for recovery. The moment the 50-day moving average crossed above the 200-day moving average in June 2020—a classic bullish signal—savvy investors re-entered the market and capitalized on the following explosive recovery.

Technical analysis provides structure amidst uncertainty, allowing traders to make calculated moves rather than emotional ones. Key tools such as Moving Average Convergence Divergence (MACD), the Average Directional Index (ADX), and support/resistance levels help investors navigate trends and pinpoint entry and exit points.

Mass Psychology and Technical Analysis

Combining mass psychology with technical analysis can further enhance an investor’s ability to make informed decisions. Technical analysis involves the study of past market data, primarily price and volume, to forecast future market behaviour. When used alongside an understanding of mass psychology, technical analysis can help investors identify when extreme emotions are driving the market and pinpoint potential entry and exit points based on historical patterns and trends.

For example, technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands can signal overbought or oversold market conditions. When these signals align with extreme sentiment readings—such as high levels of fear or greed—they can indicate a potential reversal in the market, providing a strategic opportunity for contrarian moves.

Mastering Market Psychology: The Edge of the Elite Investor

Market psychology is no longer just an academic concept—it’s a weapon in the hands of those who understand it. In today’s hyper-connected world, sentiment shifts faster than ever, creating both massive risks and unparalleled opportunities. The 2021 GameStop frenzy, fueled by retail traders on Reddit’s WallStreetBets, saw GME skyrocket over 1,500% in weeks, defying traditional valuation models. The lesson? Crowd psychology can overpower fundamentals in the short term, and those who recognize these movements early can either ride the wave or get crushed by it.

Understanding mass psychology means knowing when fear has peaked and when euphoria is about to collapse. Legendary investors like Warren Buffett have capitalized on this for decades—buying when others panic and selling when greed blinds rationality. Data-backed sentiment analysis and technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) allow traders to spot these emotional extremes before the broader market reacts.

Turning Psychology into Profit

Mass psychology isn’t about following the crowd but predicting their next move. Contrarian strategies, where investors take positions against extreme sentiment, have historically delivered substantial returns. The 2008 financial crisis wiped out portfolios driven by panic selling, yet those who saw past the hysteria and bought quality assets at bargain prices reaped enormous rewards in the recovery.

In today’s markets, AI-driven sentiment tracking, options flow analysis, and even social media trend monitoring provide insights into investors’ emotional pulses. Ignoring this aspect of the market is no longer an option—it’s a critical edge. Whether navigating volatile tech stocks, cryptocurrency surges, or broader economic cycles, those who master market psychology don’t just survive—they dominate.