Apr 4, 2024

Introduction

There are countless strategies and approaches to investing. One method that has gained significant popularity in recent years is index investing. This article will delve into the fundamentals of index investing, its benefits, and how it can be a powerful tool for building long-term wealth.

What is index investing? Index investing is a passive investment strategy that involves buying and holding a diversified portfolio of securities that mirror a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Instead of attempting to outperform the market by actively selecting individual stocks, index investors aim to match the performance of the chosen index.

In the 1970s, John C. Bogle, founder of The Vanguard Group, pioneered the concept of index investing. Bogle argued that most actively managed funds consistently fail to beat the market over the long term and that investors would be better served by tracking the market through low-cost index funds.

Benefits of Index Investing

Low Costs: One of the primary advantages of index investing is its low-cost structure. Because index funds passively track a market index, they have lower management fees and operating expenses than actively managed funds. According to a 2020 study by Morningstar, the average expense ratio for passive funds was 0.13%, while active funds charged an average of 0.66%.

Diversification: Index funds provide instant diversification by holding a broad range of securities representing a specific market segment. This diversification helps to mitigate the impact of individual stock or sector-specific risks on your portfolio. A 2019 study by Vanguard found that diversification through index investing can reduce portfolio volatility by up to 70%.

Simplicity: Index investing simplifies the investment process by eliminating the need for extensive research and analysis of individual stocks. This makes it an attractive option for investors who lack the time, expertise, or inclination to manage their portfolios actively.

Long-term Performance: While index funds may not outperform actively managed funds in any given year, they have a strong track record of delivering competitive returns over the long term. A 2020 S&P Dow Jones Indices report revealed that over a 15-year period, 92.1% of large-cap actively managed funds underperformed the S&P 500 index.

Contrarian Perspective

While index investing has gained widespread acceptance, some contrarian investors argue it can lead to market inefficiencies and potential bubbles. They contend that as more money flows into index funds, the prices of the underlying securities may become artificially inflated, regardless of their fundamentals. This phenomenon is often called the “index premium” or “index bubble.”

One real-life example of this concern is the Japanese stock market bubble of the late 1980s. During this period, the Nikkei 225 index, which tracks the performance of 225 large Japanese companies, experienced a significant surge in value. Many institutional and individual investors poured money into index funds tracking the Nikkei 225, contributing to the bubble’s growth. When the bubble burst in 1990, the Nikkei 225 lost nearly 50% of its value, and many investors suffered substantial losses.

More recently, some contrarian investors have raised concerns about the potential for index investing to create bubbles in specific sectors or industries. For instance, the technology sector has seen a significant influx of money through index funds, particularly those tracking the Nasdaq Composite or the S&P 500 Information Technology Index. As of 2021, the five largest U.S. technology companies (Apple, Microsoft, Amazon, Google, and Facebook) accounted for over 20% of the S&P 500’s total market capitalization. Contrarian investors argue that this concentration of funds in a single sector could lead to overvaluation and potential corrections in the future.

Additionally, critics argue that index investing can lead to a concentration of power among a few large asset managers, such as Vanguard, BlackRock, and State Street, collectively managing trillions of dollars in index funds. As of 2020, these three firms collectively managed over $15 trillion in assets, with a significant portion invested in index funds. This concentration of ownership could potentially lead to reduced competition and less pressure on companies to improve their performance.

For example, suppose a large index fund provider holds a significant stake in multiple companies within the same industry. In that case, it may be less likely to push for competitive practices or improvements in corporate governance. This concern has led some to question whether the rise of index investing could lead to a more passive approach to corporate oversight and a potential decline in market efficiency.

However, proponents of index investing counter that the strategy’s inherent diversification and low costs outweigh these potential drawbacks and that active managers have consistently failed to exploit any supposed market inefficiencies. They argue that the benefits of index investing, such as broad market exposure, lower fees, and long-term performance, make it an attractive option for many investors.

Moreover, supporters of index investing point out that the strategy’s passive nature does not necessarily lead to a lack of market efficiency. They argue that the market’s collective wisdom, driven by the actions of both active and passive investors, ultimately determines the prices of securities. The market should remain efficient as long as sufficient active investors seek to capitalize on any perceived mispricing.

Implementing an Index Investing Strategy

To start index investing, you can choose from various index mutual funds or exchange-traded funds (ETFs) that track different market indices. Some popular options include:

S&P 500 Index Funds: These funds track the performance of the 500 largest U.S. companies, providing broad exposure to the U.S. stock market.

Total Stock Market Index Funds: These funds offer broader diversification by tracking the entire U.S. stock market, including small, mid-, and large-cap stocks.

International Index Funds: These funds invest in non-U.S. companies, allowing investors to diversify their portfolios globally.

Bond Index Funds: These funds track various bond market indices, providing exposure to fixed-income securities.

When selecting index funds, consider factors such as expense ratios, tracking errors, and the reputation of the fund provider. It’s also essential to align your index fund choices with your investment goals, risk tolerance, and time horizon.

Conclusion

Index investing offers a simple, low-cost, and effective way to build long-term wealth. Index funds track market indices and provide broad diversification, competitive returns, and a streamlined investment process. While some contrarian investors may question the strategy’s potential drawbacks, the benefits of index investing have made it an increasingly popular choice among investors of all ages and experience levels. As with any investment approach, conducting thorough research, considering your circumstances, and maintaining a long-term perspective are crucial when implementing an index investing strategy.

Satisfy Your Intellect with These Delectable Reads

What Is the Key to Successful Investing? Patience and Discipline

How Can Economic Crises Lead to the Acceptance of Totalitarian Governments?

Future Market Insights: Move Beyond, Embrace the Trend

Collective Behavior Is Easy to Study: Let’s Dive In

long term vs short term investing in stocks: Understanding Key Differences

SPX 200-Day Moving Average: Unlocking Profitable Trading Strategies

What Percent of 18-29 Year Olds Are Investing in the Stock Market?

What Top Stocks to Buy Now: Mastering Your Entry Timing

History of Stock Market Crashes: Embrace Fear, Ignore the Noise

Rise in Sexual Immorality: Alarming Trends

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

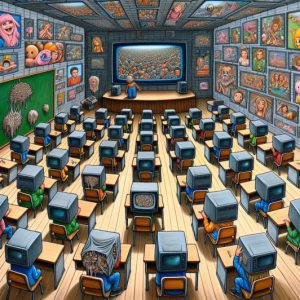

Giving Content to Investor Sentiment: The Role of Media in The Stock Market

Considering the impact of inflation, Why Is Investing Important?

Technical Analysis of Stocks and Commodities: Unveiling Insights