What is deflation: A deadly Disease?

What is deflation? Well, in essence, it’s where prices continue to drop, and one of the primary reasons for this is the rise of the machines or the emerging super AI trend.

As the US economy continues to reel from shutdowns related to the coronavirus pandemic, the oldest worry in the economics world has begun to rear its head — should we be worried about inflation?

The data suggests no. On Tuesday, we learned the largest-ever monthly drop in consumer prices was recorded in April. And as Gregory Daco, chief U.S. economist at Oxford Economics, said Tuesday, “A surge in inflation is the least of our worries.”

Instead, disinflation has now taken hold in the US economy.

Disinflation is most simply defined as a lack of either inflation or deflation. This might sound like a dream consumer scenario to some: nothing changes.

For the Federal Reserve, disinflation is too close to deflation for their liking. And this scenario bolsters the case for the central bank keeping its unprecedented monetary policy expansion in place for some time.

“If required, the Federal Reserve can go bigger, or longer, in the execution of its programs, and we think the central bank will fight hard against any persistence in this disinflationary impulse,” said Rick Rieder, BlackRock’s chief investment officer of global fixed income, in an email on Tuesday. https://yhoo.it/2WQK8DB

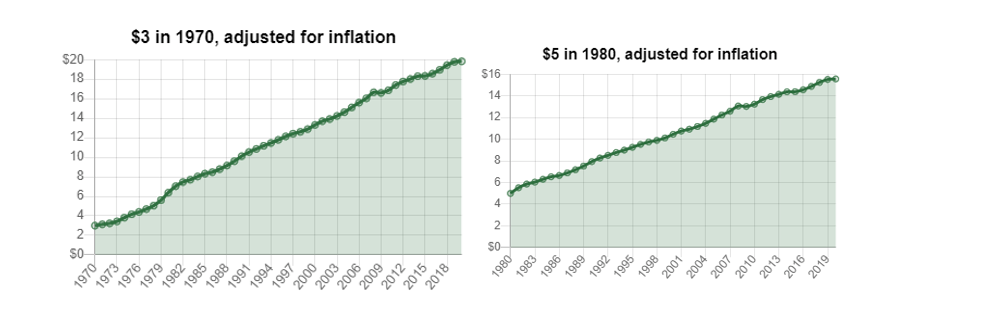

What is deflation? The charts below explain it well.

If you understand what inflation is, then understanding deflation is even easier. We warned about this long ago; the only way to keep inflation in check is to enslave large portions of the populace. You destroy industries, and you wreak just enough havoc to create the impression that everything is about to fall apart, but the only thing that falls apart is another chunk of the middle to upper-middle class; these guys now join the ranks of the poor. They are now forced to work in sectors that pay less. When you factor in inflation, a $15 per hour job still pays a lot less than $3 an hour in the 1970s or $5 per hour in the 1980s.

So you can see how cunning the guys at the top are. They create the impression that they are paying you more, but when inflation is factored in, you get nothing. This is how the Fed will keep inflation in check, and this is the game the Gold bugs have not figured out yet.

They are focussing on the absolute definition of inflation, which is an increase in the money supply, but the Fed is 10X smarter than its given credit for. They were smart enough to provide the patient with sufficient medicine to prevent the symptoms of the disease from manifesting. The sign of inflation is an increase in prices, and they controlled this by only including a particular basket of goods in their equation. Why would they do this?

What’s the Answer

The answer is obvious because they can manipulate those sectors freely. This is why farmers are dumping millions of gallons of milk as they no longer want to lower the price. However, milk in the store still costs quite a bit. Why is this? Because of the middlemen that make more money than the farmers.

AI will change this. Suddenly, these middlemen will be killed, and farmers can sell their products directly to supermarkets or individuals. While everyone will celebrate and call this a fantastic win, guess what? It will be another deflation force, allowing the Feds to increase the money supply even more. The Fed is not master chess players; they are master Go players. https://bit.ly/2Z2Ueni

While we will have bouts of inflation (rising prices), the overall long-term trend for inflation is down, and that’s because machines will keep replacing humans, forcing prices to drop and allowing governments to control a larger swath of the population.

Deflation: A overview

Deflation is often seen as a negative economic phenomenon, but some argue it can have positive effects. Deflation is a decrease in the general price level of goods and services, leading to increased purchasing power for consumers and increased competitiveness for businesses.

One potential positive effect of deflation is that it can lead to increased savings and investment. As prices fall, consumers may be more likely to save their money, leading to increased investment and economic growth in the long run. Additionally, deflation can increase competition among businesses as companies strive to lower prices to remain competitive. This can lead to increased innovation and efficiency in the marketplace.

However, there are also potential adverse effects of deflation. It can lead to decreased economic activity, as consumers may delay purchases in anticipation of lower prices. Additionally, it can increase debt burdens, as the value of debts does not decrease with deflation.

Despite these potential adverse effects, some economists argue that deflation should not be feared. They say that it is a natural part of the economic cycle and that attempts to stimulate inflation artificially can lead to financial instability in the long run.

Overall, the effects of deflation on the economy are complex and depend on various factors. While it can have some positive impact, it is essential to consider the potential adverse effects as well.

Here are some articles and links to further explore the topic of deflation:

- “Why Some Economists Love Deflation” by Matthew Boesler, Business Insider: https://www.businessinsider.com/why-some-economists-love-deflation-2013-12

- “Deflation: When Prices Fall, but Money Doesn’t Go Farther” by Neil Irwin, The New York Times: https://www.nytimes.com/2014/04/29/upshot/deflation-when-prices-fall-but-money-doesnt-go-farther.html

- “The Upside of Deflation” by Scott Sumner, The Wall Street Journal: https://www.wsj.com/articles/SB10001424052970204409004577157152591925374

Other Articles of Interest

Missed opportunity and the Mother of All Buy signals (Sep23)

Market Opportunity: Embrace crashes like a lost love (Sep23)

Market insights: Fight the Fed & End Up Dead (Sept 22)

Investment Pyramid: Valuable Concept Or ? (Sept 2)

Successful Investing; Never Follow the Crowd (Sep2)

Define Fiat Money: The USD Is A Great Example (Aug 13)

Deflation Economics: The Art of Twisting Data (Aug 12)

BTC vs Gold: The Clear Winner Is … (Aug 11)

Cash is king during Coronavirus Pandemic Based Sell off (Aug 10)

Russell 2000: Great Buy Signal In the making (Aug 9)

Strong buy stocks: Use the sell-off to load up on Top Companies (Aug 8)

Best Chinese Stocks: Focus on America Instead of China (Aug 7)

Strange Weather Pattern’s Set to Plague the Planet (Aug 7)

American power: The War Against China (Aug 5)

Strong Buy Stocks: Focus on The Trend & Not the Fear Factor (July 20)

Smart Money Acting Like Dumb Money (July 27)