What Does a Death Cross Mean in the Stock Market? Exploring Its Significance

Nov 30 2024

The Illusion of Simplicity

In the volatile world of financial markets, investors are constantly seeking tools and indicators to provide an edge in navigating the complexities of stock trading. Among the myriad of technical analysis techniques, one term that has recently gained notoriety is the “Death Cross.” This ominous-sounding phrase refers to a specific chart pattern historically associated with impending market downturns. However, as with many indicators in the financial realm, the true significance of the Death Cross is a subject of ongoing debate and analysis.

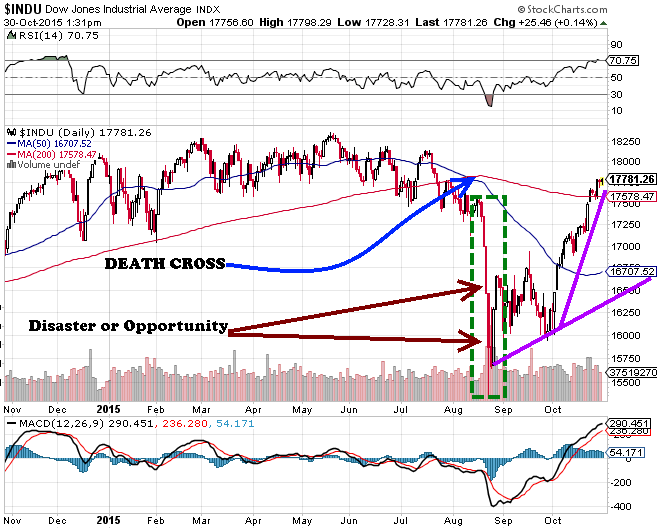

The Death Cross is a technical indicator that occurs when a security’s short-term moving average exceeds its long-term moving average. Typically, this involves the 50-day moving average dipping below the 200-day moving average. Many traders see this crossover as a bearish signal, indicating that the short-term trend has shifted downward, potentially foreshadowing a broader market downturn.

The Allure and Pitfalls of Simplicity

The allure of the Death Cross lies in its simplicity. Unlike complex mathematical models or intricate technical analysis techniques, the Death Cross is a straightforward concept that traders of all experience levels can easily understand and apply. This accessibility has contributed to its widespread adoption and the hype surrounding its potential predictive power.

However, as with any tool in the financial markets, the Death Cross’s actual value lies not in its simplicity but in its ability to forecast market movements accurately. And here, opinions diverge.

Don’t Fear the Death Cross: A Caution for Investors

When we examine this situation, there’s no imminent danger or cause for fear. Succumbing to fear leads to paralysis, often resulting in failure and loss rather than rewards. If you’re exceptionally agile, you might profit from shorting the markets, but that’s easier said than done, especially given how rapidly markets can reverse course.

Let’s take the Dow as an example. If one were to short the Dow based on the so-called “death cross pattern,” the results, in most cases, would be less than ideal. You might have entered the market based on the signal, but when would you receive the signal to exit? If you weren’t swift or waited for a trigger to negate the “death cross,” you would have missed out on potential gains. This is assuming you managed to enter precisely when the signal was triggered.

We believe your time would be better spent compiling a list of stocks to buy, as the potential gains from buying typically outweigh those from shorting. History supports this notion, as markets tend to trend upward over time, not downward.

At Tactical Investor, we view the Death Cross as a buying opportunity. It’s a moment to uncork a bottle of champagne and celebrate, even when the majority is chanting doom for the markets. It’s essential to grasp that disaster often conceals an opportunity, and the majority rarely finds themselves on the right side of the markets for any extended period. So, rejoice when panic abounds, and be cautious when the masses are exuberant.

The Psychology of Market Signals: Reliable Indicator or Mass Delusion?

The debate surrounding the Death Cross as a market indicator is deeply intertwined with behavioural psychology. Proponents argue that it has historically signalled impending bear markets, citing crashes like those of 1929 and 2008. However, confirmation bias may influence this perspective, where investors selectively remember instances that support their beliefs while overlooking contradictory evidence.

On the other hand, sceptical observers contend that the Death Cross is a lagging indicator, merely confirming what has already transpired in the market. This view aligns with the concept of hindsight bias, where past events seem more predictable than they were at the time.

The Bandwagon Effect and Market Momentum

The Death Cross’s influence on market behaviour can be partly attributed to the bandwagon effect. In this psychological phenomenon, people adopt certain behaviours or attitudes simply because others are doing so. This effect can be potent in financial markets, as investors may jump on the bearish bandwagon when they see the Death Cross forming, potentially exacerbating market downturns.

This self-fulfilling prophecy aspect of the Death Cross highlights the complex interplay between technical indicators and mass psychology in shaping market dynamics.

Cognitive Biases and the Illusion of Predictability

The allure of the Death Cross as a predictive tool taps into several cognitive biases:

1. Sample Selection Bias: Focusing on instances where the Death Cross preceded market crashes while ignoring false alarms or mild corrections.

2. Availability Heuristic: Overestimating the probability of a market crash based on easily recalled, dramatic examples.

3. Illusion of Control: Believing that recognizing the Death Cross pattern gives investors more control over unpredictable market outcomes.

These biases can lead to overconfidence in the Death Cross’s predictive power, potentially resulting in suboptimal investment decisions.

The Multifaceted Nature of Market Dynamics: Beyond Simple Patterns

While the Death Cross captures attention, it’s crucial to recognize that a complex web of factors influences financial markets. Economic indicators, geopolitical events, and regulatory changes all shape market movements. The cognitive load of processing all these variables may lead some investors to over-rely on simple heuristics like the Death Cross.

A more nuanced approach to the Death Cross involves viewing it not as a catastrophic event but as a potential opportunity. This perspective shift aligns with the concept of cognitive reappraisal, a strategy used in cognitive-behavioural therapy to change emotional responses by reinterpreting situations.

By reframing the Death Cross as a signal to reassess strategies rather than a definitive predictor of doom, investors can capitalize on market inefficiencies while avoiding the pitfalls of panic-driven decision-making.

The Role of Critical Thinking in Market Analysis

Investors can benefit from cultivating critical thinking skills to navigate the complexities of market signals like the Death Cross. This includes:

1. Slowing down decision-making to allow for more thorough analysis.

2. Seeking diverse perspectives to counteract confirmation bias.

3. Regularly challenging one’s assumptions about market indicators.

By adopting these practices, investors can work to mitigate the influence of cognitive biases and make more informed decisions in the face of market signals like the Death Cross.

A Case Study: The COVID-19 Pandemic

The COVID-19 pandemic is a recent example of how the Death Cross can be interpreted as an opportunity rather than a harbinger of doom. In early 2020, as the pandemic sent shockwaves through global financial markets, the S&P 500 plummeted by 34% in just 33 days, marking the fastest decline of this magnitude in history. Amidst the chaos, the dreaded Death Cross pattern emerged, fueling fears of a prolonged bear market.

However, those who maintained a level-headed approach and recognized the potential for a swift recovery were rewarded. By August 2020, just six months after the crash, the S&P 500 had already rebounded to new highs, catching many investors off guard. Those who succumbed to panic and sold their holdings at the bottom of the market missed the subsequent recovery, underscoring the importance of maintaining a long-term perspective and avoiding emotional decision-making based on short-term volatility.

Conclusion: A Balanced and Informed Approach

In conclusion, the Death Cross’s predictive power remains contentious. A study by Giot et al. (2007) found that the 50-day and 200-day moving average crossover strategy, which includes the Death Cross, did not consistently outperform a buy-and-hold approach across various markets and timeframes. However, Zakamulin and Giner (2020) demonstrated that moving average crossover strategies can provide superior risk-adjusted returns in certain market conditions, particularly during bear markets.

Quantitative analysis by Faber (2007) showed that a simple moving average timing strategy applied to the S&P 500 from 1900 to 2005 would have outperformed a buy-and-hold strategy, with an annual return of 10.47% compared to 9.21% while significantly reducing volatility (15.31% vs. 17.87%). However, these results are sensitive to the specific parameters and periods used.

Given the mixed evidence, investors should view the Death Cross as one of many potential signals rather than a definitive predictor. Its primary value may lie in prompting a reassessment of risk exposure and market positioning rather than as a standalone trading signal. Integrating the Death Cross with other technical and market psychology can provide a more comprehensive approach to market timing and risk management.