War of Attrition

Feb 6, 2023

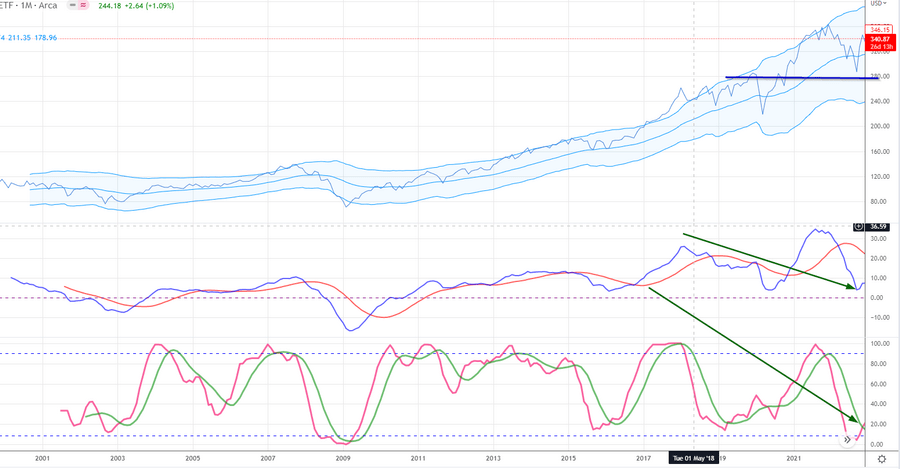

This chart contains data going back to 2000. The main point here is to illustrate that when markets trade at the level they are at currently, a long-term opportunity is brewing. This is a war of attrition.

Every time the Dow traded deeply into the oversold ranges, the markets experienced a solid bullish phase. At this point, the Dow is trading in the highly oversold Zone. However, given the current atmosphere, we suspect a long-term bottom won’t take shape until all the indicators are trading in the insanely oversold ranges; the teal lines in the above picture show these zones. When the markets are trading at extreme levels (oversold or overbought), sentiment readings play a pivotal role.

source: tradingview.com

There are some interesting long-term developments in this war of attrition:

This Market never experienced the tail-end move. You can see this by looking at the MACDs in the above chart. Usually, there is a rolling top formation; in this case, the MACDs just topped sharply and dropped. When this occurs, it indicates that the markets will trade in the overbought ranges on the next bull run for an extended period.

The MACDs are on the verge of putting in a new 14-year low. One of the requirements for a FOAB is the MACDs have to (at the very minimum) put in a new 12-year low. Ultimately, battle-tested investors that combine Mass Psychology with Technical analysis are likely to survive this war of attrition. The early bird gets the worm, the late one the bullet.

Surviving the War of Attrition: Tactics & Thoughts

The war of attrition in the stock market refers to a prolonged period of uncertainty, volatility and stress in which traders try to endure the ups and downs of the market. This war can affect a trader’s emotional and financial well-being. To win the war of attrition, it’s essential to have a solid understanding of mass psychology and how it affects the stock market.

Mass psychology refers to the study of how people react to market conditions. Understanding how masses of traders act during different market conditions can provide valuable insights into how to position oneself in the market. For example, during a market crash, many traders may panic and sell their stocks, causing prices to drop further. Understanding the psychology behind this behaviour enables a trader to make informed decisions and avoid knee-jerk reactions.

By incorporating the principles of mass psychology into their trading strategy, traders can win the war of attrition in the stock market. This requires discipline, patience and a long-term perspective. Having a well-defined risk management plan is also important to protect against potential losses. With a solid understanding of mass psychology and a well-thought-out strategy, traders can successfully navigate the challenges of the stock market and come out on top in the war of attrition.

Financial War of Attrition: Insights from Empirical Studies

Financial War of Attrition” by George M. Constantinides and Milton Harris (1996).

The present study proposes a theory of economic war of attrition, demonstrating the impact of the number of competitors on a company’s value and cost of capital. The competition for company control is conceptualised as a dynamic game of incomplete information in which participants must determine if they will make a takeover offer or withdraw from the contest. The tournament concludes when a single competitor makes a successful bid or all competitors opt to drop out.

Dynamic Price Competition in the Market for Corporate Control” by Paul A. Gompers and Josh Lerner (1997)

The authors research delves into the examination of price competition in the Market for corporate control. They discover that price reductions are common and persistent in takeover battles, signifying a competitive struggle among bidders. The study shows that the pricing competition is influenced by various contest features, such as the number of bidders and the level of competition, as well as target firm characteristics and stock market condition

Price Competition in OTC Derivatives Markets: An Empirical Analysis” by Massimo Massa and Johan Sulaeman (2007)

This paper studies the relationship between price competition in over-the-counter (OTC) derivatives markets and credit default swap (CDS) spreads. The study found that increased competition among dealers leads to lower CDS spreads and that the effect is stronger for less liquid CDSs. The results support the idea that competition benefits markets that are less efficient.

War of Attrition in the Market for Investment Banking Services” by Fabrizio Ferri, René M. Stulz, and Rohan Williamson (2007)

The authors analyse the Market for investment banking services through the examination of fees charged for M&A advisory services sheds light on the competitive dynamics of the industry. Our findings suggest that competition between investment banks is intense, characterised by lowering fees to secure business. The level of competition is determined by various factors, including the number of banks bidding for a deal and the magnitude of the deal. Moreover, the study indicates that the effect of competition on fees is more pronounced for smaller deals, aligning with the notion that less efficient markets benefit more from increased competition.

Overview of the War Of Attrition Article

The war of attrition in the stock market is a prolonged period of uncertainty, volatility and stress in which traders try to endure the ups and downs of the market. As the chart shows, every time the Dow has traded intensely into the oversold ranges, the markets have experienced a solid bullish phase. Currently, the Dow is trading in the highly oversold zone. Still, a long-term bottom is unlikely to take shape until all the indicators are trading in the insanely oversold ranges.

During extreme market levels, sentiment readings play a pivotal role, and mass psychology is crucial in understanding how masses of traders react to market conditions. By incorporating the principles of mass psychology into their trading strategy, traders can win the war of attrition in the stock market. Understanding how traders act during different market conditions can provide valuable insights into how to position oneself in the market.

The MACDs in the chart are on the verge of putting in a new 14-year low, indicating that the markets will trade in the overbought ranges on the next bull run for an extended period. This situation indicates that battle-tested investors combining mass psychology with technical analysis will likely survive this war of attrition. To win this war of attrition, it’s essential to have a solid understanding of mass psychology and how it affects the stock market.

Patience, discipline, and a long-term perspective are essential to winning the war of attrition in the stock market. It’s important to have a well-defined risk management plan to protect against potential losses. In conclusion, with a solid understanding of mass psychology and a well-thought-out strategy, traders can successfully navigate the challenges of the stock market and come out on top in the war of attrition.