Volatility of the stock market: Using it to your Advantage

Mar 18,2023

The ability to find opportunity in chaos is a valuable skill that can help us thrive in difficult times, especially in the volatile stock market. Although it may seem counterintuitive, history has shown that it is during times of upheaval that great strides forward are made. In fact, some of the most successful people in history have been those who were able to see opportunities where others only saw chaos and despair.

Staying Level-Headed and Adaptable in the Stock Market

One of the keys to finding opportunity in the volatile stock market is to stay calm and level-headed. When those around us are panicking, we should remain cool, calm, and collected, and assess the situation rationally. This allows us to make clear-headed decisions that can help us to move forward in a positive direction, even during market turbulence. We should also be willing to take calculated risks and step outside our comfort zones to take advantage of the opportunities that present themselves.

Another important factor is the ability to adapt to change in the stock market. When things are uncertain and constantly changing, those who can adapt quickly will have a distinct advantage. Rather than resisting change, we should embrace it and be willing to try new things. This may require a shift in mindset and a willingness to let go of old habits and ways of thinking, but it is essential if we want to find success in the midst of volatility.

Turning Adversity into Advantage in the Stock Market

The most successful investors in history have been those who have been able to turn adversity into advantage and use the challenges they faced as a springboard to success. We too can follow in their footsteps by remaining calm, staying adaptable, and seizing the opportunities that present themselves in the volatile stock market.

The Validity of the Contrarian Strategy in the Stock Market

The Contrarian Strategy, also known as the Overreaction Hypothesis, proposes that investors can profit by going against the crowd and taking positions in stocks that have underperformed in the recent past, while avoiding stocks that have performed well. Despite a lack of consensus regarding the persistence of overreaction, the factors that drive it, and the conditions under which it is most pronounced, many researchers have found evidence of overreaction in various markets, including the stock market.

Incorporating the Contrarian Strategy into Your Investment Approach

Investors, both institutional and individual, should be aware of the potential for overreaction in the volatile stock market and consider incorporating the Contrarian Strategy into their investment approach. This may help them to better navigate market turbulence and generate higher returns in the long term. By staying level-headed, adaptable, and willing to take calculated risks, investors can find opportunities in the chaos of the stock market and use it to their advantage.

Conclusion

In conclusion, the ability to find opportunity in chaos and market volatility is a valuable skill that can help investors to thrive in difficult times. By staying level-headed, adaptable, and incorporating the Contrarian Strategy into their investment approach, investors can take advantage of market volatility and generate higher returns in the long term.

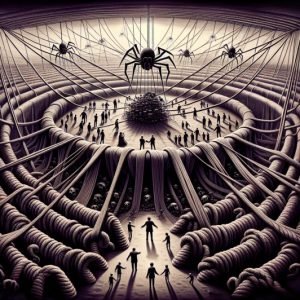

It’s important to note that Mass Psychology plays a crucial role in market volatility. When the masses are panicking and fear levels have spiked, the markets can become extremely volatile. By combining an understanding of Mass Psychology with market volatility, investors can get in at better prices and take advantage of opportunities that others may overlook.

In fact, many successful investors have used this approach to their advantage, buying when others are selling and selling when others are buying. By going against the crowd, these investors have been able to generate significant returns over the long term.

More Must-Reads: Compelling Articles You Don’t Want to Miss

How much money do i need to invest to make $4,000 a month?

Warren Buffett Stock Picks: Unveiling a Simple Strategy for Better Returns

How Do You Win the Stock Market Game? Effective Strategies

Amazon Stock Direct Purchase Plan: A Comprehensive Guide

Bullish RSI Divergence: A Key To Unlocking Market Opportunities

Types of Trend Lines: Their Power and Limitations

Best Silver ETFs: Shining Bright in Your Investment Portfolio

Black Monday 1987: Turning Crashes into Opportunities

Technical Analysis of Trends: Cracking the code

Golden Gains: The Key Advantages of Investing in Gold

A Sophisticated Approach: Do Bonds Increase Returns When the Stock Market Crashes?

Emotional Manipulation Tactics: The Dominant Force on Wall Street

Mastering Your Finances: Why You Need to Learn How to Manage Your Money with Grace

Stock Market Forecast Next 10 Years: Feasible or Not?