Why is the US Dollar Unbacked by Gold? Exploring the Consequences

April 29, 2024

Introduction

The true reason for abandoning the gold standard was far more sinister and dark. The actions of certain powerful elites, particularly central bankers, were nothing short of pure evil—menacing and filled with malice. These individuals viewed the gold standard as an obstacle to their pursuit of unrestricted control over the global financial system.

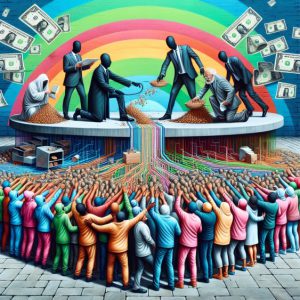

By freeing themselves from the constraints imposed by the gold standard, they could now manipulate the money supply, inflate prices, and amass vast fortunes, leaving ordinary citizens struggling to make ends meet. In other words, these bankers saw the abandonment of the gold standard as a golden opportunity to exploit the masses and further their selfish agendas.

Their intentions were nothing less than nefarious and wicked, leading to the grave and dire consequences that continue to plague society today. Therefore, when discussing the reasons behind the US dollar’s lack of gold backing, it is essential to consider the possibility that malevolent actors played a significant role in this decision. We must shed light on this issue and hold these perpetrators accountable for their actions, lest we succumb to the same corrupt practices again.

The Nefarious Motives Behind Abandoning the Gold Standard

Central bankers, the architects of the modern financial system, have long sought to consolidate power and control over the monetary supply. According to G. Edward Griffin, author of “The Creature from Jekyll Island,” abandoning the gold standard was a deliberate move to grant central banks the ability to create money out of thin air. The limited supply of gold had previously constrained this power.

Murray Rothbard, a renowned economist and historian, echoed this sentiment, stating that “the abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit.” This expansion of credit, fueled by the creation of fiat money, allowed governments to fund wars and enrich a select group of individuals and corporations with close ties to the central banking system.

Former U.S. Congressman Ron Paul, a staunch advocate for the gold standard, warned that “the Federal Reserve’s policy of money creation has allowed the federal government to accumulate historic levels of debt, which has facilitated the growth of the welfare-warfare state.” This pattern of currency debasement is not new; in fact, it dates back to ancient times. Diocletian, the Roman Emperor from 284-305 AD, debased the Roman currency to fund his military campaigns, ultimately contributing to the empire’s downfall.

Centuries of Financial Greed: A Historical Perspective on Bankers’ Influence

Moreover, this sordid tale of greed and corruption is not recent but dates back several centuries. For instance, during the American Revolution, George Washington and his fellow revolutionaries fought tooth and nail against the tyrannical British banking system, which imposed exorbitant interest rates and debts on the colonies. After gaining independence, the Founding Fathers established a constitutional framework that included provisions such as the prohibition of paper money, a measure designed to prevent the very kind of financial machinations that the bankers pursued.

Fast forward to the 20th century, and we witness another clash between the bankers and the common folk. During the Great Depression, President Franklin D. Roosevelt implemented policies like the New Deal and the creation of the Federal Reserve to combat the economic crisis. However, many historians argue that these initiatives also served as a cover-up for the bankers’ schemes, as they provided them with access to enormous sums of money and resources.

Furthermore, the infamous Bretton Woods agreement, signed in 1944, enshrined the gold standard as a cornerstone of international finance. Yet, within two decades, many countries began to abandon the gold standard, citing various economic and political reasons. The United States, under President Richard Nixon, was among them, and it ultimately pulled the plug on the gold standard in 1971.

Critics point out that Nixon’s decision coincided with a series of events that benefited the bankers, such as the deregulation of the financial sector, the privatization of public assets, and the expansion of debt-based instruments like bonds and derivatives. Thus, the bankers’ influence goes beyond mere speculation and extends to major policy decisions at the highest levels of government. Their insatiable thirst for profit and control has resulted in widespread social and economic disparities, increasing poverty, and destabilizing markets worldwide.

The Devastating Effects of Abandoning the Gold Standard

The consequences of abandoning the gold standard have been far-reaching and devastating for the American people. Since 1971, poverty rates and income inequality have skyrocketed, eroding the freedom and economic mobility that once defined the American dream. According to economist Peter Schiff, “The Federal Reserve’s money creation policy has led to a massive redistribution of wealth from the middle class to the wealthy elite.”

Moreover, the surge in wars and military conflicts since 1971 is no coincidence. David Stockman, former Director of the Office of Management and Budget under President Reagan, has argued that “the ability to create money out of thin air has enabled the United States to wage endless wars and engage in military interventions around the globe, at a tremendous cost to both human lives and economic stability.”

Economic instability and boom-bust cycles have become the norm in the post-gold standard era. The Federal Reserve’s manipulation of interest rates and the money supply has fueled speculative bubbles, such as the dot-com bubble and the 2008 financial crisis. As investor Jim Rogers has warned, “The Federal Reserve’s policies have created an artificial economy built on debt and speculation, which is unsustainable and will inevitably lead to a catastrophic collapse.”

The Consequences of a Fiat Currency System

The abandonment of the gold standard has paved the way for creating a fiat currency system, where the value of money is determined by government decree rather than by a tangible asset. This system has led to the erosion of purchasing power and the hidden inflation tax, as governments have been tempted to print more money to finance their spending habits.

Historical examples of hyperinflation, such as the Weimar Republic in Germany and, more recently, Zimbabwe, are stark reminders of the dangers of unchecked money creation. As Noam Chomsky, a renowned linguist, philosopher, and political activist, has warned, “The concentration of wealth and power in the hands of a few, facilitated by the fiat currency system, is a threat to democracy and the well-being of the majority.”

Conclusion

The reasons behind abandoning the gold standard cannot be fully understood without considering the actions of powerful elites, particularly the central bankers. Throughout history, there have been numerous instances where their interests have collided with those of the general population, causing tremendous harm to society. We must recognize these patterns, expose the wrongdoings, and work towards building a more just and equitable financial system that serves the needs of all rather than a select few.

In short, the abandonment of the gold standard was not merely a technical adjustment, but a deliberate act carried out by those who sought to consolidate their grip on the financial system. And the consequences of this action have been felt by generations of Americans, whose savings have lost value, whose jobs have disappeared, and whose communities have been ravaged by economic hardship.

It is high time that we awaken from our slumber and realize the gravity of the situation. We cannot afford to remain complacent in such blatant corruption and deceit. We must demand answers, seek redress, and hold the perpetrators accountable for their crimes.

Only then can we build a better future, one that is grounded in honesty, fairness, and equality. A future where everyone has equal opportunities to succeed, regardless of their background or circumstances. A future where money is seen as a tool for progress, not as a means of exploitation and oppression.

Unearth Fascinating Articles on Various Topics

What Is Mob Mentality? A Symbol of Irrationality

The Suave Strategy: How to Buy Gold and Silver for Investment

Which of the Following Investing Statements Is False? Let’s Uncover the Truth!

An Exquisite Approach: How to Buy Gold Without Paying Sales Tax

How to Buy Gold in Australia: A Captivating Roadmap to Glittering Riches

The Art of Portfolio Agility: Mastering the Tactical Asset Allocation Strategy

Stock Market Forecast for Tomorrow: Ignore Noise, Focus on the Trend

Defying the Crowd: Exploring the Stock Market Fear Index

Crowd Behavior Psychology: Deciphering, Mastery, and Success

Inflation vs Deflation vs Stagflation: Strategies for Triumph

What Is The Best Way For One To Recover After a Financial Disaster?

What Development In The Late 1890s May Well Have Prevented Another Financial Disaster?

Mass Psychology of Stocks: Ride the Wave to Win

How Inflation Erodes Debt and Strategies for Smart Investing

Demystifying StochRSI Strategy: Easy Strategies for Winning