US jobless claims

US jobless claims while higher are pulling back, regardless of whether they pull back or not, they are no longer as important as they once used to be. The reason for this is AI and machines; we have reached the point where it is becoming easier and easier to replace machines with AI. New technologies are making humans more efficient, which means what used to take several individuals to complete.

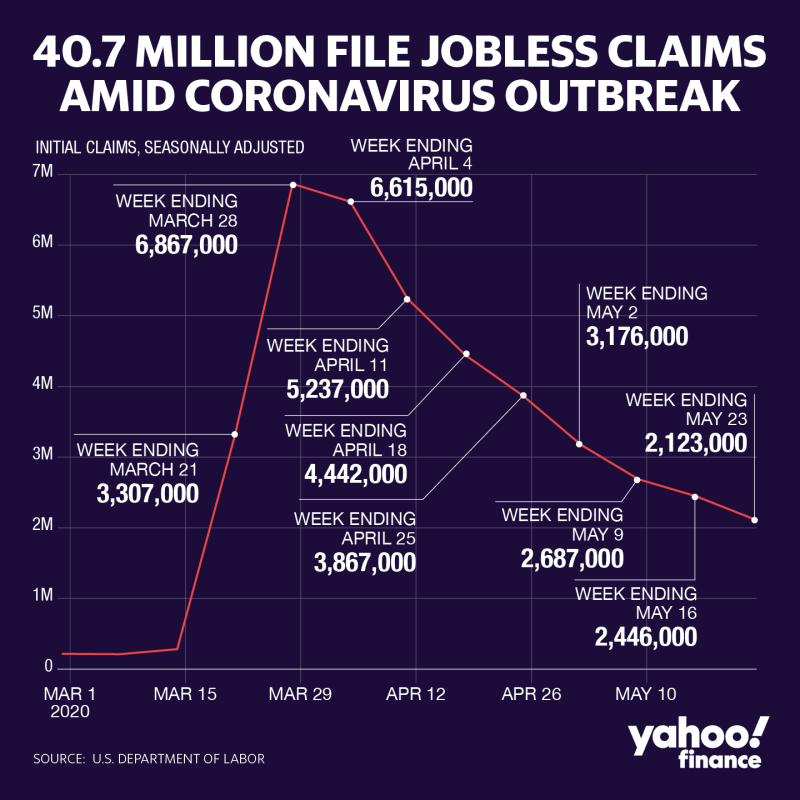

Jobless claims continue to decline, and that’s a positive as far as the markets are concerned. Another indirect confirmation that there is an agenda behind this pandemic and as we have been stating all along, the idea is and was to flood the system with as much money as possible. Notice how the focus has shifted from coronavirus to the riots taking place over the US and social distancing is in the toilet. Let’s see how long the media pushes this theme, for if they create another mountain out of a molehill, it could be used as an excuse to add more liquidity to the system and push through a new set of laws bringing the US one step closer to the Orwellian state.

US jobless claims don’t matter as Governments manipulate all the data

In the face of all this manipulation, the Mother of all buys signal has been triggered; “my my” what a world we live in! In the face of such rampant manipulation, a MOB signal is like pouring jet fuel or a blazing inferno. Astute players can use sharp pullbacks to keep adding to or opening new long positions until at least Dow 33K is hit. However, just because we have a MOB does not mean the markets will only trend upward. A MOB is a long-term buy signal.

Looking at the sentiment data, we have never had a period when the markets are rallying, and sentiment has remained negative for weeks on end.

To put it mildly, the Fed’s current actions are unprecedented, and the Fed will ensure that the masses embrace this bull market willingly or unwillingly. Unwillingly by making it so expensive to hold onto cash every Tom, Dick and Harry is going to jump into this market. Now is the perfect time to come out with some insane projections and the reaction will probably be the same as when we announced Dow 30K well before the Dow even tested 24K. Market Update May 24, 2020

US jobless claims and the Trend

We defined each bull market phase since the markets bottomed out in 2009. As this is a new bull of sorts and utterly different from all the bull markets to date, the only appropriate name that comes to mind for this market is disorder. We could call it chaos, but there is an order in chaos, disorder, on the other hand, is the opposite of order.

While one can find an order, it’s not easy as in many cases the situation has to be viewed from opposite angles and pieces from each perspective have to be combined to come up with a new order. This is why we stated that his new hybrid bull had been designed to kill both the bears and the bulls. Bears and bulls have a mono-dimensional view of the markets, and going forward, this will not work.

Hence, expect very sharp pullbacks that will appear as crashes as the Dow grinds its way to 36K; this will kill the bulls as they falsely assume that the bull is over. The bears will bask in the glory for a short time, and then 96% more will be destroyed when the markets reverse course, as was the case with the short-lived coronavirus bear market.

Masive manipulation on the Short term timelines

One can see that short-term options are being manipulated at an extreme level. The DIA puts hardly gain or loses value when the markets pull back but drop like rocks when the markets surge. We have very little time left on the June puts; the markets would have to pull back quickly. However, we will recoup these losses via other plays if they don’t.

Furthermore, do not get into options unless you understand the concept of all or nothing. One can lock in massive gains, but significant gains come with higher risks. There is no such thing as a free meal; if you take something for free, the final cost will be 10X more. Only take (free) gifts from close friends that are giving it to you with the right intention otherwise, offer to pay something, even a token payment and get rid of the energy/debt obligation.

No amount of chaos seems to deter this market.

And while some might say that is a good contrarian signal, it’s not. A market cannot climb a wall of worry vertically without pause, and if it does, the following correction is usually more potent. We monitored the situation as soon as the futures markets opened up (Sunday evening). We saw enough action to reconfirm that this market is being artificially pushed higher. There is no point in discussing why or how, as it won’t change the outcome. Now the apparent conclusion to such blatant manipulation is to state that this will not end well. That is also wrong. This blatant manipulation indicates that the Fed is ready and willing to push this market to whatever heights it deems necessary.

This market will likely experience a stronger-than-expected correction If the correction is delayed. On the surface, this analysis, while valid, is not entirely accurate. If one looks deeper, it will only appear strong because of the number of points shed. Here is an example we were expecting the Dow to test the 20,000 range, so that would have been a drop of 4500 to 5000 points.

Things to keep in mind

However, the Dow could trade to the 28,000 range and then drop to the 21.5K to 22K ranges, representing a 6000 to 6500 point drop, but it would put in a higher lower, which would be a very bullish development. So, in theory, it would look worse, but the pattern would be just as good, if not even better, than the first setup.

Because the manipulation is so blatant, developing a very short-term strategy is pointless, and the focus should be on the long-term trend. This level of manipulation is something we have never seen before, but remember that no market can trend in one direction only. The Fed is already giving a secret signal that it’s going to force everyone to embrace this bull. Right now, both the bulls and the bears are confused, which further reinforces our views that this new hybrid bull was designed to kill both the bears and the bulls, and the Fed is pulling out all the stops very early into the game.

Hence, we are going to change our general game plan. The focus will be to embrace all pullbacks ranging from mild to wild, for as this market trend rises, it will make less and less sense. And the only way to make any sense will be to focus on the underlying trend.

Other Articles of Interest

How to Become A Better Trader? (Sep23)

What is deflation? A bigger Problem Than Inflation (Sep23)

Missed opportunity and the Mother of All Buy signals (Sep23)

Market Opportunity: Embrace crashes like a lost love (Sep23)

Market insights: Fight the Fed & End Up Dead (Sept 22)

Investment Pyramid: Valuable Concept Or ? (Sept 2)

Successful Investing; Never Follow the Crowd (Sep2)

Define Fiat Money: The USD Is A Great Example (Aug 13)

Deflation Economics: The Art of Twisting Data (Aug 12)

BTC vs Gold: The Clear Winner Is … (Aug 11)

Cash is king during Coronavirus Pandemic Based Sell off (Aug 10)

Russell 2000: Great Buy Signal In the making (Aug 9)

Strong buy stocks: Use the sell-off to load up on Top Companies (Aug 8)

Best Chinese Stocks: Focus on America Instead of China (Aug 7)

Strange Weather Pattern’s Set to Plague the Planet (Aug 7)

American power: The War Against China (Aug 5)

Strong Buy Stocks: Focus on The Trend & Not the Fear Factor (July 20)

Smart Money Acting Like Dumb Money (July 27)