US Debt To GDP: Is Anyone Paying Attention To It

Updated Nov 1, 2023

It’s strange, and possibly sad, that despite the ever-increasing debt that has just passed the $22 trillion mark, bonds and equities markets don’t seem to be paying attention. Bonds are looking for any reason to mount a long-term rally after being held hostage to the false threat of inflation. The Federal Reserve is trying desperately to maintain the illusion that the USD is the strongest currency in the world. However, this illusion was achieved by shoring up interest rates, even though the data – though manipulated – has always indicated that inflation is a non-event.

Most central bankers are not following the same erratic path as the Fed, which appears to be acting like a delusional person convinced that their left toe is communicating with them. In contrast, some emerging nations are increasing interest rates only because they are being compelled to defend their currency against a stronger dollar.

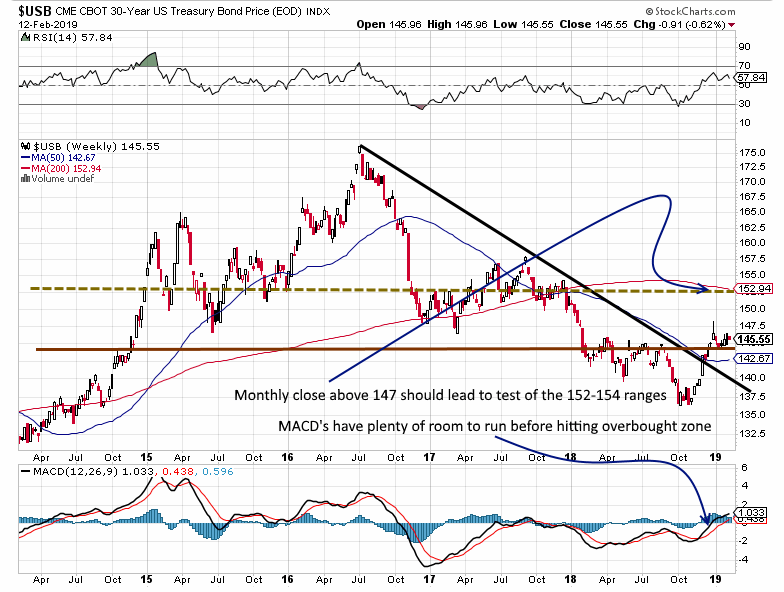

Weekly Chart of the Bond Market

A monthly close above 147 will likely push bonds to the 152-154 range with an overshoot as high as 159.00. The long-term outlook for interest rates is negative; in other words, rates are heading lower, and savers will be punished again.

Navigating the Global Currency Chessboard: Decoding the Fed’s Moves in a Decade-Long Economic Battle

In the intricate landscape of the Global Currency War, the Fed’s initiation of a rate-hiking program is perceived as a strategic move. Positioned to make the US dollar the world’s most attractive currency, this tactic plays a vital role in the ongoing global economic skirmish. As nations race to the bottom, the objective is not to finish first but last, and the US, despite accumulating substantial debts, strives to maintain the allure of its currency.

Anticipating an inevitable reversal in interest rates, the US, starting from a high point, is poised to influence other developed nations to follow suit. Why? Because in the competitive arena of exports, nations seek a favourable advantage. Attuning to this economic chess game, China and Germany understand the nuances better than most.

Germany abuses the EU.

Germany has been taking advantage of the EU by using the Euro to increase its exports to levels that would not have been possible if it were still using the German Mark. If Germany were still using the Mark, its currency would be 20% higher, and its exports would be nowhere near their current levels. It seems that no one is paying attention to the US Debt-to-GDP ratio, at least not the top players. However, astute investors who are aware of this ratio can protect their assets by viewing stock market crashes as buying opportunities. As long as fiat currency exists, the Fed will always intervene and prop up the market again, making market crashes a chance for savvy investors to purchase top-rated companies at a considerable discount.

Why the US can afford a stronger currency

The United States is not heavily reliant on exports, which means that it can afford to have a currency that is valued slightly higher than most. Even when the US lowers its interest rates, its currency will still be attractive relative to other major currencies because it will be starting from a favourable position. As most nations’ economies are export-dependent, they will also be forced to lower their rates, which effectively means that the USD will maintain its position as one of the most attractive currencies. However, the Federal Reserve must be careful not to overplay its hand.

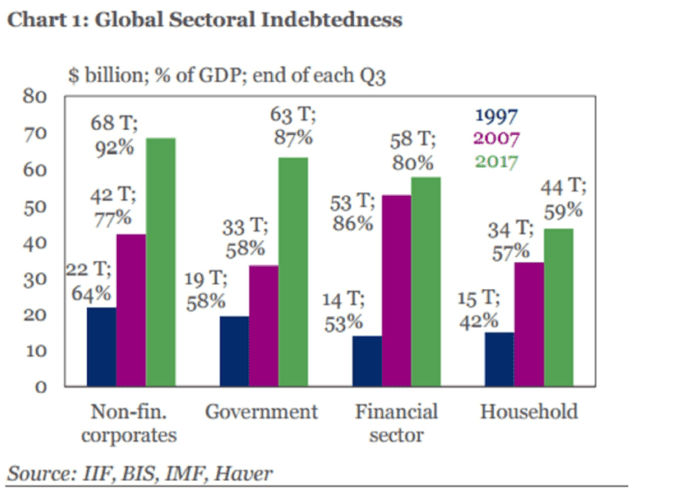

As we recently mentioned, global debt is skyrocketing, standing at $233 trillion in 2017. Therefore, despite the already high amount, another trillion here or there may not seem like a significant added burden. Nonetheless, collectively, the world’s nations will never be able to pay it back.

BOE all Bark and no Bite

THE BOE seems to be making statements that are not in line with reality, as they keep hinting at a future rate hike despite the current economic turmoil. With the Brexit crisis already taking its toll on the UK economy, the housing sector is feeling the strain too, with house sales dropping to their lowest level in five years. Under these circumstances, it would be unwise for the BOE to raise rates, and they may even be forced to reverse their decision on the August rate hike.

EU: playing a game of Cat and Mouse

They have done nothing. One minute, they state they are ready to raise rates, the next minute they cite new issues that call for more caution. Here is the latest from Draghi:

“We need to carefully monitor these trade risks over the coming months,” Draghi said. “However, we still see the overall risks to the growth outlook as broadly balanced, largely because the underlying drivers of domestic demand remain in place.” Full story

In other words, Draghi is saying; that we will state that there is a need for a rate hike, but we will not do anything about it because the outlook is quite terrible.

Japan, on the other hand, cannot afford a Robust Currency

The Boj has continued to huff and puff, but other than that, they have done nothing, and it will be hard-pressed to do anything. Interest rates were left untouched at -0.1% citing

The central bank also revised down inflation forecasts again, saying that the momentum toward achieving the price stability target of 2 percent is not sufficiently firm despite years of massive monetary easing. Interest Rate in Japan averaged 2.81 percent from 1972 until 2018, reaching an all time high of 9 percent in December of 1973 and a record low of -0.10 percent in January of 2016.

The inflation forecast for the fiscal year ending March 2019 was lowered to 0.9 percent from 1.1 percent previously estimated. Also, the central bank now expects inflation to average 1.4 percent for fiscal 2019 (vs 1.5 percent) and 1.5 percent for fiscal 2020 (vs 1.6 percent). Full Story

Interesting development on the weekly and Monthly charts

We have some exciting news to share. Typically, when weekly and monthly charts indicate that a market is oversold, the following upward move is usually significant. Despite the fact that utilities tend to perform poorly in a rising rate environment, the monthly charts of the Dow utilities are close to experiencing a bullish crossover, as indicated by the MACDs. We have several significant factors indicating that interest rates should decrease. However, the only thing that could delay this trend is a stubborn Federal Reserve. According to mass psychology, one should focus on investments that the masses are either ignoring or unaware of. Currently, hardly anyone is aware of the stealth bull market that is taking place in the bond arena.

Extracted in large part from the Nov 18, 2018 Market Update

Beyond Basics: Engaging Stories Await

Contrarian Thinking: The Power of Challenging the Status Quo

When Is the Stock Market Going to Crash: Anticipating the Unknown

Millennials are killing everything. Are you next?

American retirement just another Pipedream

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Uptrend Stocks: Navigating the Renaissance of Market Prosperity”

Immoral Behavior and the Religious Provocation Index

How To Get Financial Freedom: Escape the Herd for Lasting Success

Unleashing Passion: The Intriguing Realm of AI Sex Bots

Legalized Food Poisoning: America’s Toxic Diet by Design

“””Investing for dummies”””: Follow The Trend

Executive Compensation Driving Share Buybacks

Illusions of Economic Recovery: Negative Interest Rate Controversy

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

South China Sea Showdown: Intensifying Heat on the Horizon

Business Investment & Stock Market Uncertainty

Dow 30 Stocks; what are they saying about the markets