Market Timing Indicator: Valuable Tool or Merely Hot Air?

Jan 30, 2025

Let’s make one thing clear right out of the gate: We are not in the business of calling the perfect top or bottom, and anyone who claims they can is either delusional or selling snake oil. That’s not our game. We identify the signs—the subtle shifts and the movements that signal the market is nearing a turning point. Once we have those signs, we leverage our proprietary tools to pinpoint the best entry points that offer the maximum risk-to-reward ratio.

Until 2012, we relied on the Ultimate Market Timing Indicator and the Smart Money Indicator as our go-to tools for these shifts. But as the market evolved, so did we. In December 2012, we threw those old instruments aside and replaced them with our Trend Indicator, a dynamic tool that continues to serve as our primary weapon for determining market direction. Once we’ve identified the trend, we use secondary tools to confirm the signal.

Ultimate Market Timing Indicator

Our Ultimate Market Timing Indicator is a monster—combining 39 different indicators into one powerhouse. It helps us pinpoint when a market is on the verge of topping or bottoming. We don’t just look at one-time frames either; we scour the daily, weekly, and monthly charts to validate the signals. Flexibility is key in this game. Markets change, and we always adapt, fine-tune, and improve our tools to stay ahead. The result? Precision market insights delivered ahead of the curve.

Wisdom from John Swift & George Orwell

John Swift, a market titan, knows that adaptability is a non-negotiable in market timing. He sums it up perfectly: “The market is a living, breathing entity that constantly evolves. To succeed in market timing, one must be willing to adapt and evolve with it.”

And then there’s George Orwell, whose insight into human nature applies perfectly here: “To see what is in front of one’s nose needs a constant struggle.” It’s about focus—keeping your eyes on the market trends and resisting the urge to be distracted by noise.

This commitment to constant evolution led us to develop our finest indicator to date: the Trend Indicator, a game-changer in the quest for market precision.

Some random factors to consider

This market has yet to experience the “feeding frenzy stage,” as the masses have taken so long to embrace it, this stage will be spectacular. Expect the markets to take off vertically once the groups jump in. It seems complicated to believe that the Dow could take off like a rocket after such a massive correction, but that will happen if this hysteria subsides.

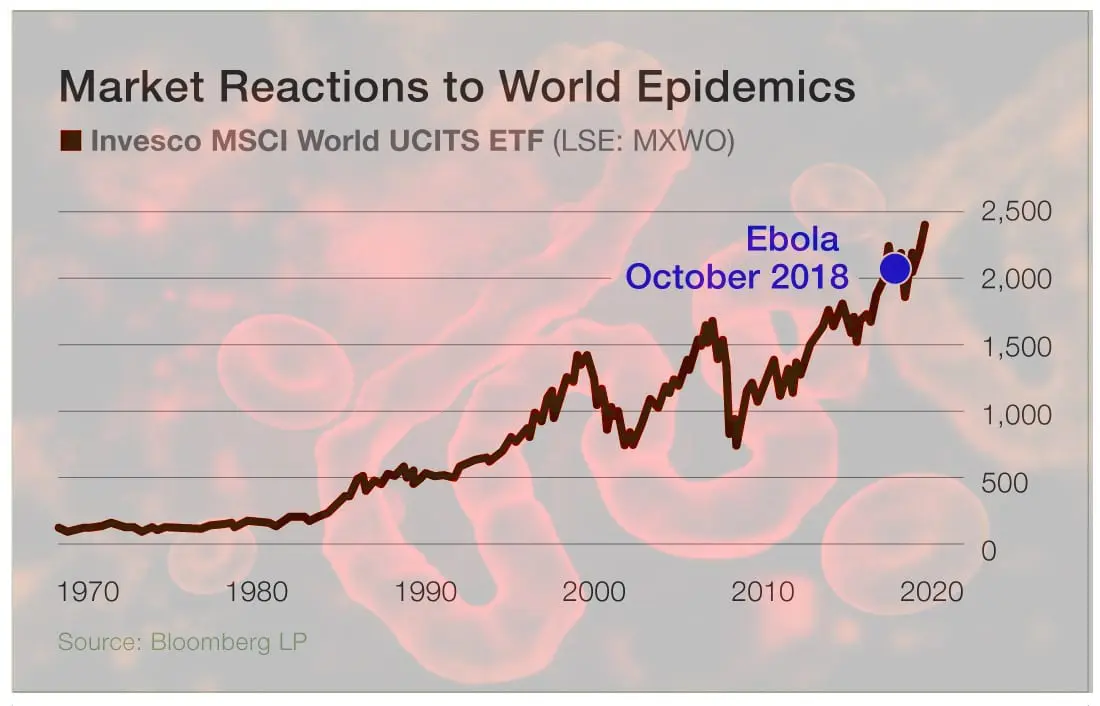

We have seen the same paranoia before; look at the above chart. We have had such deadly outbreaks before, but in the end, once the panic subsides, the markets resume their upward trend.

As the Tactical Investor says, “Every disaster leads to a hidden opportunity,” and the only way to spot that opportunity is not to give in to panic. We envision a similar outcome for the coronavirus; the markets could still sell off, but that sell-off should be viewed through a bullish lens.

From a psychological perspective, the longer the masses resist, the better, which means this bull will continue to trend higher. Use strong pullbacks to open positions in quality stocks. Forget the noise and focus on the trend.

The Tail-End Move: A Powerful Phenomenon

Market timing is a fool’s errand: The seductive idea of buying low and selling high is a trap that ensnares many into a cycle of poor decisions and subpar returns. The notion that one can predict market swings precisely is not just tricky; it’s near-impossible, even for the so-called experts.

Making just one wrong move can be costly. You must nail two critical choices: when to pull out and dive back in. Get it wrong, and you’re looking at substantial financial damage. Exit the market to dodge a slump, and you could miss a surge. Wait too long for a dip to buy, and you’ve lost the prime moment.

The reality is stark: consistent market prediction is a myth. Even the most experienced professionals, armed with advanced tools, fail to crack the market’s code. The market is a beast fed by a complex mix of economic data, political events, and investor sentiment whims—all notoriously fickle.

The hidden costs of market timing are a silent killer of returns. The more you trade, the more you pay in transaction fees and taxes, mainly if your gains are short-term. These aren’t just minor dents but significant enough to take a big bite out of your investment growth.

In short, market timing is not just aggressive; it’s aggressively misguided. It’s a strategy that promises much but delivers little, except for increased risk and decreased returns.

Patience and Discipline: Key Traits for Successful Investing

Patience and discipline are essential for successful investing, particularly for low- and medium-risk investors who may implement selling strategies during highly overbought market conditions.

When markets are trading in highly overbought ranges, investors may consider reducing their exposure to riskier assets and potentially moving into cash or more defensive investments. This strategy aims to protect portfolios from market downturns and limit losses.

However, exercising patience is crucial before the next buy signal is triggered. It is important to remember that markets can remain overbought or oversold for extended periods, and attempting to accurately time market tops and bottoms is challenging. Investors must resist the temptation to make impulsive decisions based on short-term market fluctuations and instead adhere to their long-term investment strategies.

Waiting for years before the next buy signal is triggered requires discipline and a commitment to the investment plan. During this waiting period, investors must remain focused on their investment goals and avoid making hasty decisions influenced by market noise or emotional reactions. This discipline ensures that investors stay on track and avoid rash decisions that could negatively impact their long-term investment performance.

Turbulent market conditions can test an investor’s patience and discipline. Market volatility and uncertainty can trigger emotional responses, leading to impulsive decision-making. Successful investors, however, remain calm and rational during such periods, sticking to their investment strategies and avoiding knee-jerk reactions.

By exercising patience and discipline, investors can benefit from the power of compounding and the market’s long-term growth potential. It allows them to stay invested during market upswings and capture the potential returns the market offers over time.

Market Timing: The Art of Getting In Early and Out Even Earlier

Nailing the absolute top is a fool’s errand. We’ve flirted with market peaks more than once—often by a mix of skill and raw luck. Anyone peddling a consistent method is peddling illusions. The track record of so-called experts is proof enough.

Learn from history’s brutal lessons: the true warriors of finance enter early and exit even sooner. The masses, as always, swarm in late and cling on when the tide turns. We left the housing market over a year before the crash—late 2006, when others still gambled. In the dot-com era, we warned private clients to bail by mid-1999. Sure, the rally soared afterwards, but gains are meaningless when captured too late.

Remember COVID. Over 90% attacked us with unbridled venom when we declared the 2020 crash as the buying opportunity of a lifetime—a true MOAB (Mother of All Buys). The backlash was savage: deafening outrage, relentless insults. Yet fickle minds forget, like fruit flies with short memories and even shorter convictions.

The constants remain: Patience. Discipline. And the unyielding truth that this time is never different when human folly is in play.