Types of Trend Lines and the Machiavellian Approach to Market Analysis

Updated March 12, 2024

Trend line investing can yield respectable outcomes, particularly when investors understand the rules and exhibit the patience and resilience necessary to navigate the numerous false signals that can arise. This approach is most effective for those who operate on short to medium timelines, ranging from 6 to 15 months. When combined with other technical indicators, trend line investing becomes a formidable tool in an investor’s arsenal.

Many traditional tools have lost their luster in an era when market manipulation is often perceived as rampant. Trend lines stand out as a notable exception. They are considered one of the most powerful tools in market analysis because they are based on price action and less susceptible to direct manipulation.

Machiavellian Insights for Trend Line Investing

Drawing from Machiavellian philosophy, one could argue that using trend lines aligns with the principles of adaptability and foresight. Niccolò Machiavelli, known for his cunning political strategies, would likely advocate for a flexible approach to investing, akin to his advice on warfare: “Change your proceeding when you become aware that the enemy has foreseen it.” In the context of the stock market, this translates to adjusting one’s investment strategy when market conditions change or when a trend line is broken, indicating a potential shift in market sentiment.

Machiavelli’s emphasis on ingenuity and efficacy could also be applied to trend-line investing. The investor’s supreme quality, much like the prince’s, should be the ability to anticipate market movements and act accordingly. This requires a keen understanding of market dynamics and the ability to interpret trend lines effectively.

Moreover, Machiavelli’s counsel to “act so your enemies do not know how you want to organize your army for battle” can be interpreted in the market sense as keeping one’s investment strategies and positions discreet to avoid tipping off other market participants, which could lead to adverse price movements.

Practical Application of Trend Line

In practice, trend lines are drawn by connecting the highs or lows in a price chart to represent support and resistance levels. These lines can help investors identify potential entry and exit points. For instance, a break above a downtrend line may signal a buying opportunity, while a break below an uptrend line might suggest it’s time to sell.

However, Machiavelli would likely warn against overreliance on any indicator, including trend lines. He would advise investors to be wary of the potential for deception—self-deception and market manipulation. Therefore, combining trend lines with indicators such as volume, moving averages, and relative strength index (RSI) can provide a more holistic view of the market and better inform investment decisions.

Incorporating Machiavellian principles into trend-line investing encourages a strategic, adaptable, and realistic approach to market analysis. It involves recognizing the limitations of any tool and the importance of resilience in the face of market volatility. By applying these timeless strategies, investors can navigate the stock market with a blend of historical wisdom and modern technical analysis.

Types of Trend Lines and How to use them

As we stated, while trend line investing can be helpful, it can frustrate a newbie due to the many false signals it generates. Most of these false signals are due to misinterpreting the trend. Unfortunately, the newcomer will have to deal with this as it takes time to master the concept of drawing trend lines accurately.

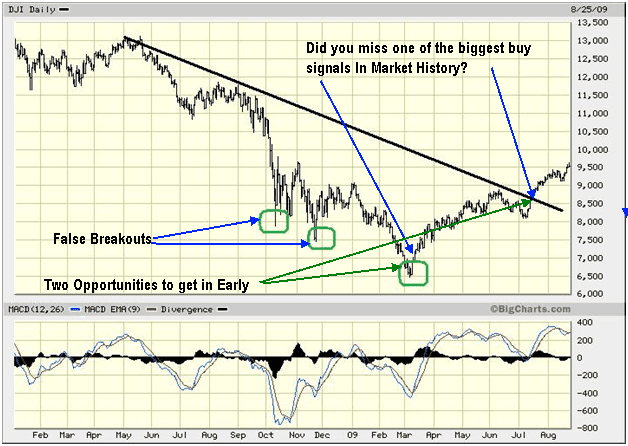

The most crucial aspect of Trend Line Analysis is identifying the points through which the line will be drawn. If you wrongly determine the facts, you could draw a trend line that gives you false entry and exit points. Even when you master this trait, waiting for the trend line to turn positive could cost you quite a lot in terms of profit. The limitations of trend lines can be seen below.

Seizing the first opportunity (March 2009) posed some risk, given that prices still trended below the primary downtrend line. However, factoring in mass psychology significantly mitigated this risk. During this period, bearish sentiment reached unprecedented heights, permeating widespread fear in the investment landscape. Almost everyone, from seasoned investors to the small guy on the street, felt apprehensive or uncertain—uncertainty essentially synonymous with a bearish stance.

The first breakthrough occurred in March 2009 amidst extreme negativity and the market trading in an exceptionally oversold range. Employing shorter-term trend lines during this phase allowed for early entry. For traders seeking additional confirmation, a more conservative approach would be to wait until July 2009, when prices breached the downward trend line. Even at this juncture, bearish sentiment persisted, and the contingent falling into the neutral camp, colloquially dubbed “nervous Nellies,” remained substantial. Combining both groups meant that over 80% of participants leaned towards a bearish outlook or were hesitant to enter the market. From a long-term perspective, the prevailing conditions unequivocally signalled a compelling buy.

Trendline Investing and Mass Psychology: A Powerful Combination

Investing is a complex field that requires a deep understanding of various strategies and tools. One such tool is **trendline investing**, which can yield significant results if used correctly. However, it’s not without its challenges. For instance, it can sometimes generate false signals, underscoring the importance of accurately understanding how to draw trend lines.

Trendline investing is most effective in short to medium timelines (6 to 15 months) and with other critical technical indicators. It’s considered a powerful tool in market analysis because it doesn’t rely on data that can be manipulated or twisted. However, misinterpreting the trend can lead to false entry and exit points, and waiting for the trend line to turn positive could cost potential profit.

But there’s more to investing than just trend lines. Mass psychology plays a crucial role in the market. The emotions and behaviour of investors influence the market, so understanding the state of the masses can help identify potential market trends and make informed investment decisions.

When the masses are euphoric, it might be time to be cautious; when they are fearful, it might be an opportunity to invest. This is the principle of contrarian investing, which is closely tied to mass psychology. By examining the state of the masses, you can gain insights into potential market trends and make more informed investment decisions.

When trendline investing and mass psychology are combined, they can provide a more comprehensive view of the market. Trendline investing provides a technical analysis of market trends, while mass psychology helps you understand the emotional state of the market.

This combination can help filter out false signals and make working signals more profitable, leading to a more efficient trading system. It balances the accuracy of the emerging signals, the system’s profitability, the risk level, and the signals’ frequency.

While trendline investing and mass psychology have their strengths, combining them can provide a more holistic approach to investing. It’s a strategy that considers the market’s technical aspects and the investors’ emotional state, leading to more informed and potentially profitable investment decisions.

For an in-depth exploration of spotting trends and gaining early entry, delve into the detailed discussions provided in these two links:

These articles offer valuable insights and can enhance your understanding of trend analysis and strategic market entry.

Unlocking the Door to Freedom: The Power of Knowledge

If you seek freedom, the 1st task is to attain financial freedom to break free from the clutches of the top players who seek to enslave you. They want you to run in a circle like a hamster that runs on a spinning wheel. The hamster thinks the faster it runs, the further it will go, but sadly, it is going nowhere.

Investing can be challenging, but you can gain a significant advantage by understanding the role of mass psychology. We teach you how to use mass psychology to your advantage and view disasters as opportunities. By subscribing to our free newsletter, you’ll stay up-to-date on the latest developments and be ready to take advantage of new opportunities.

Our “Investing for Dummies” section provides a wealth of free resources on the most important aspects of mass psychology. Whether you’re an expert or just starting, you’ll find the tools to succeed.

To succeed in investing, you must resist the mass mentality and alter your perspective. Subscribe to our free newsletter and start your journey to becoming a confident, booming, and independent investor. The choice is yours – will you resist, break free, or do nothing?

Mass psychology is a potent tool, and if employed correctly, it can help you spot the abnormal levels of manipulation the masses are subjected to. We strongly suggest that you view or read or view Plato’s allegory of the cave.

Alternative Articles Worth Exploring

Investor Sentiment and the Cross Section of Stock Returns: Exploring the Hot Connections

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

Nature created the masses to serve as cannon fodder