Primary Stock Investing Mistake: Avoiding Panic at All Costs

Dec12, 2024

Most investors lose money in the Stock Market, because they invest with their emotions. Sol Palha

From the Tulip bubble of the 17th century to the Financial Meltdown of 2008, one theme remains constant: the masses never seem to learn from history. They are quick to embrace risk when profits are abundant yet just as fast to panic and lament their losses when the market inevitably turns. This cycle of greed and fear is why many investors consistently lose money in the stock market.

It seems that nature has designed the masses to serve as cannon fodder for the market’s ups and downs. Despite the efforts of well-meaning individuals throughout history, the masses remain resistant to change. Those who have attempted to educate or assist the masses have often met with violence and persecution.

Ultimately, the challenge lies in perception. It is impossible to force one’s worldview onto others and vice versa. This is why the Federal Reserve has spent decades attempting to gradually shift the masses’ perception of the market and the economy. However, their efforts have been met with mixed results.

In short, history teaches a clear lesson: Those who fail to learn from it are doomed to repeat their mistakes. As long as human nature remains unchanged, market booms and busts will continue unabated.

Stock Investing Mistakes: Common Sense is Uncommon

It can be challenging to discuss the topic of fiat currency and the role of the Federal Reserve with the average person, as these concepts can be complex and often go against mainstream thinking. However, it is crucial to understand the potential dangers of fiat currency and how the Fed’s policies can impact our economy and financial well-being.

Many people may roll their eyes or dismiss these ideas as conspiracy theorist’s ramblings. Still, it is crucial to consider the potential consequences of an overreliance on fiat currency. As you have rightly pointed out, truth and falsehood are subjective concepts that can depend on one’s perspective and angle of observation.

The reality is that the top players in our society have a great deal of influence and power, and they may not always act in the best interests of the masses. Convincing people to challenge their beliefs and consider alternative viewpoints can be challenging. Still, it is essential to do so if we hope to enact meaningful change in our society.

The mountain of debt we currently face is indeed a significant concern that could have dire consequences if left unchecked. However, this debt may one day seem relatively minor compared to future challenges.

The National Debt: Unstainable in the long run

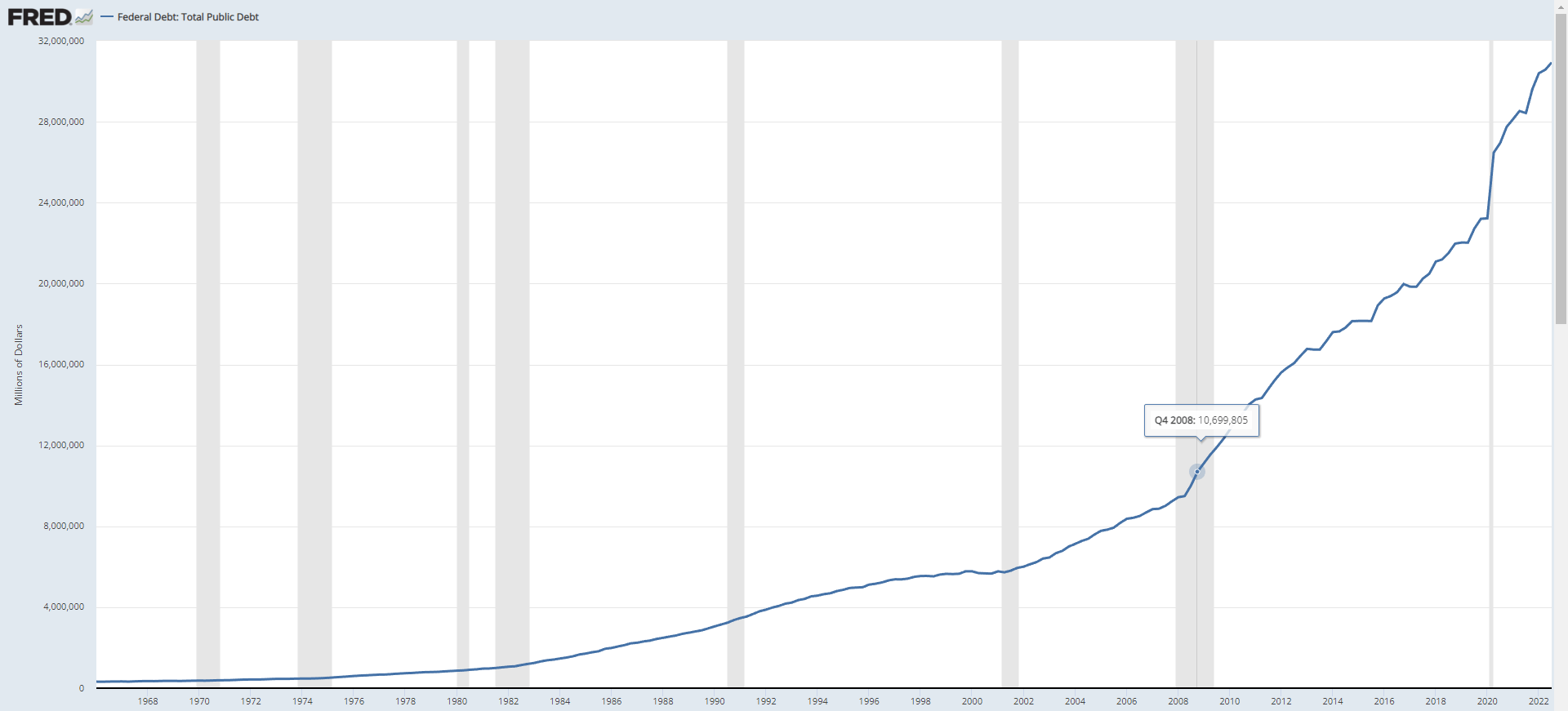

Indeed, the rapid growth of our national debt is a cause for concern. It is alarming that we are adding trillions of dollars to the deficit every year when it took over 100 years to reach the $1 trillion mark.

One would expect the masses to be outraged and demand action to address this issue, but many people are either unaware of the problem or have become desensitized. This worrying trend could have severe consequences for our economy and financial stability.

One of the biggest problems with our current monetary system is that money can be created out of thin air. This allows massive amounts of debt to be accumulated without any natural consequence, at least in the short term. However, this debt will eventually need to be paid off, and the longer we wait, the more difficult it will be.

It is not inconceivable that the debt could continue to grow to astronomical levels. As a society, we must demand that our leaders address this issue before it is too late. The consequences of inaction could be dire, and we must act now to ensure a stable and prosperous future for ourselves and future generations.

The Shades of Gray in Financial Systems: Beyond the Binary of Investing

Investing and economic systems are mired in shades of grey, far from the binary simplicity many ascribe. The pitfalls of a binary mindset can be seen in the FIAT currency debate. FIAT money, often accused by critics, isn’t intrinsically flawed. The crux of the issue is in its governance—specifically, the centralization of control in the hands of private bankers who can, and historically have, manipulated the supply for personal gain.

Consider the Federal Reserve’s role in the Great Depression. Scholars like Milton Friedman argued that the Fed’s failure to counteract banking panics exacerbated the crisis, proving that mismanagement of the money supply can have dire consequences.

As some suggest, transitioning to a gold standard is not a panacea. Historical examples, such as the U.K.’s struggle with the gold standard in the post-World War I era, which limited economic growth and exacerbated deflation, illustrate that the underlying governance structure is paramount. Even with a commodity-based currency, systemic corruption can distort the intended stability; the critical factor remains who controls the reserves and how they wield that power.

The fundamental challenge is to democratize financial control and ensure that the management of the money supply reflects a transparent and equitable approach. This is not merely an aspirational goal—examples like Sweden’s Riksbank, the world’s oldest central bank, show that public trust in monetary institutions is achievable through a combination of transparency, independence, and accountability.

It is a daunting task but necessary for sculpting a financial system that serves the collective interest. The issue’s complexity demands a nuanced understanding and a concerted effort to look beyond a binary viewpoint. We can only aspire to forge a financial landscape that equitably benefits all constituents.

Wrong Perceptions Lead To Faulty Outcomes

Indeed, taking a dogmatic approach to any issue can blind one to the underlying complexities and nuances. It is essential to step back and examine the situation from multiple perspectives before jumping to any conclusions.

The elite players often use this tactic to manipulate the masses and maintain control. We must resist this manipulation by seeking out the truth and not simply accepting what is presented to us on the surface. Only by identifying the root cause of the problem can we hope to find a solution that will truly benefit all parties involved.

Stock Investing Mistakes: Solution and Strategies

However, the stock market is not a true reflection of the economy. It is primarily fueled by cheap money from central banks and corporate stock buybacks rather than economic growth. This creates a dangerous bubble that is bound to burst at some point, causing massive losses for investors who are caught unaware.

Investors must know the risks and not blindly follow the herd mentality. Instead, investors should focus on building a diversified portfolio that can weather the storms of the market. This means investing in various asset classes, such as stocks, bonds, real estate, and commodities. It also means discipline and sticking to a long-term investment plan rather than chasing short-term gains.

The current economic situation is complex and requires a nuanced understanding. Blindly following one perspective or the other will not lead to success. Instead, investors should focus on building a well-diversified portfolio and staying disciplined in the face of market volatility.

A Contrarian View of the Stock Market & Fiat Currency

FIAT currency is not wrong but terrible because private bankers control the money. The outlook would not be so bad if they were not in charge. If we have a gold standard and crooks (Aka Banksters) can control the reserves, what’s to prevent them from lying to the masses? Identifying the real problem and not adopting a contrarian mindset is essential for success. Don’t grab any of the solutions pushed on you by the elite players, as they are designed to have the opposite effect.

The Fed is hell-bent on flooding the system with money. There is no option but to devalue the currency or die. Anyone who tries to resist runs the risk of destroying their economy. The real solution is to let the economy undergo a cleansing phase, but today’s society is not ready to deal with such pain. Central bankers are happy to accommodate this stance, for they can pretend to help the masses while fleecing them of their last penny.

The stock market will continue to roar until the masses embrace this market. As the groups hate this market, it has a long way to go before it blows up. We must understand that latching onto any perspective prevents us from seeing the other half of the equation, the elite players’ master game plan. They make us take a side and stick to it. The solution is to identify the real problem and not grab one of the solutions pushed on us by the elite players.

The Elitist Game Plan: Why History Keeps Repeating Itself

From the Tulip Bubble to the Financial Meltdown of 2008, history has shown that the masses never learn and continue to make the same mistakes. They are willing to take risks when making money but scream bloody murder when they start to lose. Most investors lose money in the stock market mainly because they do not learn from history.

The top players have done a fantastic job of conning the masses, and it will take a monumental amount of pain and misery to change their outlook.

Fiat currency isn’t just flawed—it’s a tool of deception controlled by banksters who manipulate the financial system for their gain. The real problem isn’t the fiat currency but the crooks who wield power over it. With their unchecked ability to print money, inflate currency, and destabilize economies, these banksters are the true culprits behind our economic crises.

Switching to a gold standard won’t solve the issue if the same crooks control the reserves. The idea that a gold-backed currency is inherently safer is a myth if these banksters continue to dominate the system. They can just as easily manipulate the gold supply, lie about reserves, and deceive the public, perpetuating the same cycle of control and exploitation.

The real challenge is identifying the true villains—these elite bankers—who craft solutions that only serve their interests while pretending to offer stability. Rejecting fiat currency alone is not enough; we must reject these crooks’ control over any form of money. Don’t fall for the solutions pushed by these elites—they’re designed to mislead and keep the masses under their thumb.

It’s time to face the reality: the problem isn’t the currency but the crooks in charge. To protect your financial future, you must recognize the banksters for what they are and resist their attempts to maintain control, regardless of the currency system in place.

Other Articles of Interest