Richard Russell’s Dow Theory Signals

Updated Feb 2024

Our perspective still favours the idea that a better alternative exists to the Dow Theory, and we even deem the Dow Theory as somewhat irrelevant in current times. As for the second question discussed earlier, we find that while the Crowd’s nervousness has decreased compared to October and early November 2022, the masses are not experiencing euphoria; however, they are dangerously close to reaching that point. Presently, Bullish sentiment data readings stand at 50. Any reading at or above 55 would be considered borderline Euphoric.

To enhance the clarity of this discussion, we will utilize historical data to provide real examples of why the current form of the Dow theory is not as effective as it used to be. To facilitate easy comprehension, we will include specific dates under the subtitles, allowing readers to discern the periods we refer to.

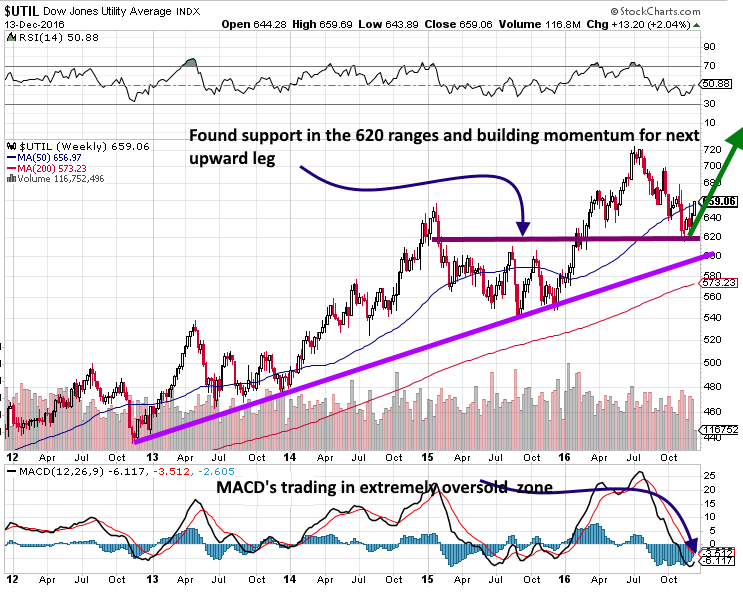

Dow Utilities vs. Dow Theory: Unveiling Insights

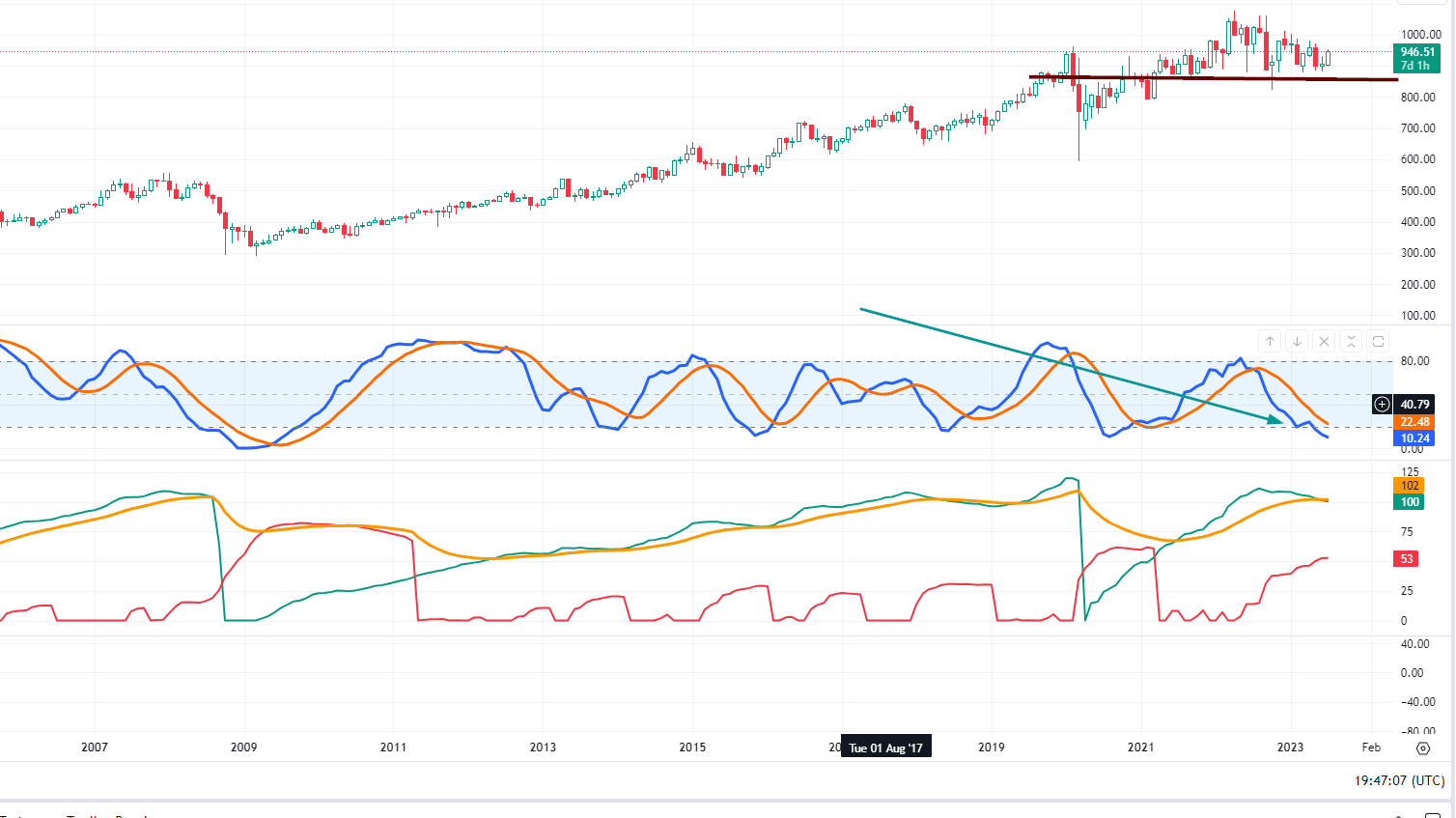

According to the Tactical Investor Alternative Dow theory, the utility sector leads in both upward and downward movements. As observed in the monthly chart above (each bar represents one month of data), the utility sector is currently in a consolidation phase, indicating that the ongoing market rally may lose momentum. Investors should closely monitor the utility sector for a clear buy signal, as it would signal a potential turning point, and corrections, ranging from mild to significant, should then be embraced. Until such a signal emerges, the market is likely to experience volatility.

A bullish crossover in the MACD indicator (the first indicator) would be a potential indication of a bottom.

Richard Russell Dow Theory: Sell Signal Not Valid?

March 2020

The masses are still very nervous, and no bull market has ever ended on a negative note. Therefore, the most likely path for the market is to trend higher instead of dropping.

The last time we put this data out publicly, the anxiety index was trading close to the Hysteria zone. It has advanced quite a bit since then, but the gauge is still far from the calm or euphoric zone. The masses have still not embraced this market, and until they do, sharp pullbacks need to be treated as bullish developments.

The number of individuals in the bullish camp has risen compared to the early November and October data, but the combined score of people in the neutral and bearish camps is still higher than those that are bullish. We would only start to get nervous when the number of bulls surges past the 60% mark; until then, the path of least resistance is up. Individuals in the neutral camp are bulls with no cajones or bears with no teeth, and they are just waiting for the perfect moment to take another beating.

Alternative Dow Theory vs Richard Russell’s Dow Theory

Oct 2016

As we alluded to in the alternative Dow Theory article, the Dow utilities lead the way up or down.

It looks like the Utilities are coiling up to break out again. This suggests that the Dow industrials will follow in their footsteps. If you look at the utilities, you will see that, in general, they tend to lead the way up and down and are a better barometer of what to expect from the markets than the Dow transports. The utilities are coming out of a correction, so the Dow will likely experience a sentence sometime in the 1st part of next year before rallying higher. The correction should fall in the 5-10% range. We use the utilities as a secondary indicator. Our primary indicator is the trend; as the trend is up, we would view substantial pullbacks as a buying opportunity.

Exciting read: Copper Market News Analysis: Unveiling Today’s Signals and Trends

Markets rally when Market Sentiment is negative and vice versa.

Yes, this bull market will experience a back-breaking correction one day, but that day is still not upon us. No bull market has ever ended without the masses jumping in; in other words, the masses need to turn euphoric. Some of the most famous and foolish naysayers love to use the term “the truth hurts” when discussing the markets. Does the truth hurt; is the truth not supposed to liberate you or set you free?

The most egregious of these naysayers will hide behind such names and come out with great proclamations that make no sense and sound more like the ravings of a lunatic. Consider them the best contrarian indicator instead of reacting to such individuals negatively. This is valuable data for one day, these fools will embrace this market, and when they do, you will know the end is near. Disqus is a good source if you are looking for individuals of such a calibre. When experts start to panic, one should do the opposite and buy.

The Dow utilities are getting ready to break out, and as they lead the way up, the Dow will likely continue to follow in its footsteps. Like the Utilities, the Dow is expected to experience a correction before trending significantly higher, and this is most likely to occur in the 1st quarter of next year.

The Trend is Bullish: Embrace Strong Pullbacks

Nov 2015

The trend (as per our trend indicator) is still bullish and shows no signs of weakening. Until it changes direction, the market is not likely to crash. We can already tell you what will happen when the markets start to pull back. They will sing the same song, something we had already described in past articles when we discussed Brexit, the possibility of a Trump win, etc. The naysayers will rush out again, proclaiming that all hell will break loose.

They are not students of history and refuse to learn from it; instead, they seem almost to take masochistic pride in repeating the same mistakes repeatedly in the hopes that they will be correct. One day, they will be right, but anyone who had listened to them would have been bankrupt several times by then.

As the markets drop, the Dr’s of Doom will scream louder and louder; momentarily, these guys will appear to have finally struck Gold. Then, the brief period of joy will vanish, and their songs will turn into pain as the market suddenly puts at a bottom and rallies upwards. Like cockroaches, they will disappear in the woodwork, waiting for the next moment to sing the same miserable tune of gloom. Please don’t fall for this rubbish; even rubbish has some value; it can be used as compost. Don’t fall into the stock market crash hysteria; expect an extreme Trump Rally.

Other articles of interest

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unveiling Secrets: Technical Analysis for Dummies

The Primary Purpose of Portfolio Diversification is to Finesse Your Investments for Optimal Returns

The Enduring Reign: Why is the US Dollar the World’s Most Pre-eminent Currency?

Fiat Money Example: The Dollar Shines as a Prime Illustration

Dogs of the Dow ETF: BiggerBite, Less Work

Understanding the Kansas City Financial Stress Index

How much money do i need to invest to make $4,000 a month?

Warren Buffett Stock Picks: Unveiling a Simple Strategy for Better Returns

Which of the Following Is the Biggest Pitfall of Economic Indicators: Analysis

How Do You Win the Stock Market Game? Effective Strategies

Amazon Stock Direct Purchase Plan: A Comprehensive Guide

Bullish RSI Divergence: A Key To Unlocking Market Opportunities

Types of Trend Lines: Their Power and Limitations