Sentiment Trader: Dancing to Your Own Market Tune

Updated Oct 14, 2023

We will approach this topic from a historical perspective because the best way to learn is through the lens of history. Those who learn from history not only avoid repeating the same mistakes but also discover how to profit from them.

Step into the world of trading, where fortunes are made and lost in the blink of an eye. The markets, with their unpredictable twists and turns, have always been a captivating arena for investors seeking excitement and profit. But amidst the chaos and volatility, there is a secret weapon that savvy traders wield to gain an edge—the power of sentiment analysis.

In the fast-paced realm of finance, understanding investor sentiment is like having a crystal ball that reveals the collective emotions and beliefs of market participants. It allows traders to tap into the pulse of the market, deciphering the ebbs and flows of bullish and bearish sentiment. By harnessing this valuable insight, traders can make informed decisions, avoiding the pitfalls of the herd and paving their own path to success.

But sentiment analysis goes beyond mere guesswork or intuition. It is a discipline rooted in history and data, honed by rigorous analysis and technological advancements. By delving into the annals of market history, we uncover the patterns and trends that have shaped investor sentiment over time. By learning from the mistakes and triumphs of the past, we equip ourselves with the knowledge to navigate the present and future.

In our quest to decode market sentiment, we explore the realm of behavioral finance—a field that peels back the layers of human psychology and cognition that drive financial decision-making. From the irrational exuberance of bull markets to the paralyzing fear of bear markets, sentiment analysis reveals the emotional undercurrents that can either drive markets to dizzying heights or send them spiraling into chaos.

As we delve deeper into the topic, we encounter a diverse array of asset classes where sentiment analysis can be applied. From stocks and bonds to foreign exchange and commodities, each market has its own unique dynamics that can be unraveled through sentiment analysis. By adapting and fine-tuning our approach to different asset classes, we unlock new opportunities and gain a comprehensive understanding of market sentiment across the financial landscape.

But sentiment analysis is not without its limitations and challenges. We explore the criticisms and pitfalls of relying solely on sentiment indicators, highlighting the importance of complementing such analysis with other forms of evaluation, such as technical and fundamental analysis. By integrating multiple perspectives, we construct a holistic framework that strengthens our decision-making process and enhances our chances of success.

In this journey through the world of sentiment trading, we uncover the tools and platforms that enable traders to harness the power of sentiment analysis. From sophisticated algorithms that process vast amounts of textual data to social media platforms that capture the zeitgeist of market chatter, these tools empower traders to stay ahead of the curve and make timely, well-informed trading decisions.

So, join us as we embark on this exhilarating exploration of sentiment trading. Let’s dance to our own market tune, guided by the pulse of investor sentiment and armed with the knowledge to thrive in the ever-evolving world of finance. Together, we will uncover the secrets of the markets and unlock the potential for profit that lies within.

Sentiment Trader: Navigating Market Trends with Sentiment Insights

The Tactical Investor is the only financial site to maintain such an Index. It took years to develop and is based on data that we personally collect. We don’t have to rely on second-hand data that might be tainted as we control the data. We are continually fine-tuning our data collection protocols. The latest development includes an AI (artificial intelligence component) which scours the net for keywords and phrases. The phrases are then ranked and given values ranging from 0-100.

If you ever wanted to see what is going on in the mind of the average investor, then this index provides a very clear picture. The pictorial format makes the data easy to understand and implement. We are confident that it can significantly improve your trading results. Imagine knowing in advance what the crowd is thinking and or doing. This index has helped keep us on the right side of the market for years.

When all the experts were busy proclaiming that this stock market would crash and burn, we begged to differ. With this Index and the trend indicator, we viewed every strong pullback as a buying opportunity and to date that strategy has paid off handsomely. Our subscribers have locked in massive gains over the years and will continue to do so for the foreseeable future.

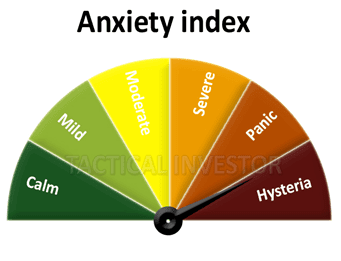

The Anxiety Index: A Valuable Tool for Providing Insights to the Sentiment Trade

This index gives you an insight into the mass mindset. It allows you to see whether the masses are agitated or in a calm mode. The best time to buy is when the Masses are in the Panic or hysteria zone, and the best times to take profits or sit on the sidelines are when the crowd is in the mild to Calm Zone. Throughout this bull run, the Crowd has hardly ever moved past the moderate zone, and we find that fascinating, particularly since the market has gone to put in a series of new highs.

The Anxiety index and the market sentiment chart (below) provide a very accurate picture of the market when combined with the Trend Indicator. This index gives us a peek into the mass mindset; it allows us to see whether the crowd is anxious or calm when it comes to investing in the markets. The crowd has been anxious for months on end and to their dismay, the stock market has continued to trend higher. The latest Anxiety index numbers confirm that nothing has changed. The crowd is apprehensive and the Stock market bull seems to delight in this. It continues to trend higher and higher, as the crowd continues to worry.

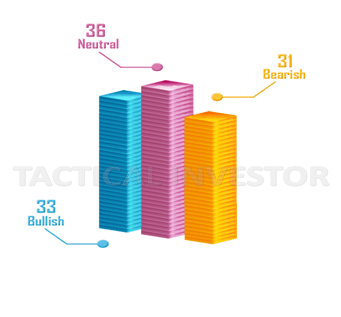

Unveiling Mass Sentiment with Percentages

This chart provides further insights into the crowd’s stance regarding this bull market. At the Tactical Investor, we focus extensively on the state of the mass mindset. The study of the masses is also known as Mass Psychology; this is the single most effective tool when it comes to gauging market direction.

Buy When The Masses Panic and sell when they are Joyous

This stock market will continue to trend higher until the Crowd throws in the bucket and joins the party. Stock bull markets never end on a note of anxiousness. History indicates that bull markets always end on a note of Euphoria.

Sentiment Trader: How To Revolutionize Cross-Asset Trading?

1. Stock Market: Sentiment analysis has proven to be a valuable tool for the sentiment trader in the stock market. By analyzing social media feeds, news articles, and company announcements, sentiment analysis can gauge the overall sentiment towards a particular stock or company, providing sentiment traders with critical insights. Positive sentiment can indicate potential upward movement in stock prices, while negative sentiment may suggest a decline. Sentiment traders can use this information to make informed decisions on buying or selling stocks. For example, if sentiment analysis reveals positive sentiment towards a specific company, sentiment traders may consider buying its stock in anticipation of a price increase.

2. Foreign Exchange (Forex) Market: Sentiment analysis has also found success among sentiment traders in the forex market. By monitoring news sentiment, economic indicators, and market chatter, sentiment traders can gain insights into the sentiment surrounding different currencies. For instance, if sentiment analysis shows negative sentiment towards a particular currency due to geopolitical tensions or economic instability, sentiment traders might consider selling that currency against a stronger currency. By leveraging sentiment analysis, forex sentiment traders can align their positions with market sentiment and potentially profit from currency movements.

3. Cryptocurrency Market: Sentiment analysis has become increasingly popular among individuals that fall under the category of “the sentiment trader” in the cryptocurrency market. The highly volatile nature of cryptocurrencies makes sentiment analysis a valuable tool for sentiment traders seeking to understand market sentiment and predict price movements. By analyzing social media sentiment, online forums, and news sentiment related to cryptocurrencies, sentiment traders can gain insights into market trends and investor sentiment. Positive sentiment towards a specific cryptocurrency may indicate a potential price surge, while negative sentiment could signal a possible downturn. Sentiment traders can utilize sentiment analysis to inform their cryptocurrency trading strategies and improve their chances of success.

4. Commodity Market: Sentiment analysis has been utilized in the commodity market as well, benefiting sentiment traders. Sentiment traders can monitor sentiment indicators related to specific commodities, such as oil, gold, or agricultural products, to gauge market sentiment. For example, sentiment analysis can provide insights into factors like supply and demand dynamics, geopolitical tensions, and economic indicators that impact commodity prices, offering sentiment traders a comprehensive view. By incorporating sentiment analysis into their trading strategies, sentiment traders in the commodity market can identify potential opportunities and manage their risk more effectively.

It’s important to note that while sentiment analysis can provide valuable insights, sentiment traders should use it in conjunction with other forms of market analysis, such as technical and fundamental analysis, to make well-rounded trading decisions.

Mastering Sentiment Trader Strategies

Integrating sentiment analysis with technical and fundamental analysis can provide a sentiment trader with a comprehensive understanding of the market and enhance their decision-making process. Here’s how a sentiment trader can seamlessly integrate sentiment analysis with these two approaches:

1. Technical Analysis: Technical analysis serves as a foundation for a sentiment trader’s trading strategies. By combining sentiment analysis with technical indicators, a sentiment trader can validate or challenge their analysis findings based on the prevailing sentiment in the market. For example, if a sentiment trader identifies a bullish trend in a stock through technical analysis, positive sentiment analysis can provide additional confirmation, increasing the sentiment trader’s confidence in taking a long position. Conversely, if technical analysis suggests a bearish trend, sentiment analysis can reinforce the sentiment trader’s decision to take a short position. This integration allows a sentiment trader to make more informed and confident trading decisions.

2. Fundamental Analysis: Fundamental analysis is a key component of a sentiment trader’s toolkit. By evaluating the intrinsic value of an asset through factors such as financial statements and industry trends, a sentiment trader gains a deeper understanding of the asset’s potential. Sentiment analysis can complement fundamental analysis by providing insights into the sentiment of the market towards these fundamental factors. For instance, if a sentiment trader conducts thorough fundamental analysis on a company and finds positive prospects, but sentiment analysis reveals negative sentiment towards the company due to concerns about future growth, the sentiment trader may reconsider their investment decisions. This integration allows a sentiment trader to align their strategies with both fundamental factors and prevailing market sentiment.

3. Risk Management: Effective risk management is crucial for a sentiment trader. By monitoring sentiment indicators, a sentiment trader can gauge the sentiment of the market towards specific assets or sectors. If sentiment analysis identifies a significant shift in sentiment that could impact the market, a sentiment trader can adjust their risk management strategies accordingly. For instance, if sentiment analysis reveals a sudden surge in negative sentiment towards a particular industry, a sentiment trader may consider reducing exposure to related assets or implementing tighter stop-loss orders to mitigate potential losses. This integration allows a sentiment trader to proactively manage their risks based on the sentiment of the market.

By seamlessly integrating sentiment analysis with technical and fundamental analysis, a sentiment trader can gain a comprehensive view of the market, validate their analysis findings, and make informed trading decisions. The combination of these approaches empowers a sentiment trader to navigate the dynamic landscape of the financial markets and capitalize on opportunities driven by sentiment analysis.

What Are Key Sentiment Indicators for Sentiment Traders?

1. Social Media Sentiment: Sentiment traders can monitor social media platforms like Twitter, Facebook, and Reddit to gauge public sentiment towards specific stocks, currencies, or commodities. By analyzing the overall sentiment expressed in posts, comments, and discussions related to a particular asset, sentiment traders can gain insights into market sentiment.

2. News Sentiment: Monitoring news sentiment involves analyzing news articles, press releases, and financial news to determine the prevailing sentiment towards specific assets. Sentiment traders can use natural language processing techniques to extract sentiment from news sources and identify whether the sentiment is positive, negative, or neutral.

3. Sentiment Indexes: Sentiment indexes are composite indicators that measure market sentiment based on various factors. These indexes are often created using surveys or sentiment analysis algorithms that aggregate data from investors, analysts, or traders. Examples of sentiment indexes include the CBOE Volatility Index (VIX), which measures market volatility sentiment, or the American Association of Individual Investors (AAII) sentiment surveys.

4. Options Market Sentiment: Sentiment traders can analyze options market data to gain insights into market sentiment. For example, the put-call ratio, which compares the volume of put options to call options, can provide an indication of market sentiment. A high put-call ratio may suggest bearish sentiment, while a low ratio may indicate bullish sentiment.

5. Insider Trading: Monitoring insider trading activities can provide sentiment traders with insights into the sentiment of company insiders, such as executives and major shareholders. Unusual buying or selling activities by insiders may indicate their sentiment towards the future prospects of the company.

6. Sentiment Analysis Tools: Sentiment traders can also leverage sentiment analysis tools and platforms that use natural language processing and machine learning algorithms to analyze sentiment from various sources. These tools can process large volumes of data, including news articles, social media feeds, and online forums, to extract sentiment and provide sentiment scores or indicators.

It’s important to note that sentiment indicators should be used in conjunction with other forms of analysis and should not be the sole basis for trading decisions. Combining sentiment analysis with technical and fundamental analysis can provide a more comprehensive view of the market and help sentiment traders make well-informed trading decisions.

How Can A Sentiment Trader Effectively Use Sentiment Indicators?“

To effectively interpret and use sentiment indicators in their trading decisions, sentiment traders can follow these guidelines:

1. Understand the Context: It’s important for sentiment traders to understand the context in which sentiment indicators are derived. Consider the source of the sentiment data, the methodology used to calculate the sentiment scores, and any limitations or biases associated with the indicators. This understanding helps sentiment traders interpret the indicators more accurately and make informed decisions.

2. Combine with Other Analysis: Sentiment indicators should be used as a complementary tool alongside other forms of analysis, such as technical and fundamental analysis. By integrating sentiment analysis with these approaches, sentiment traders can gain a more comprehensive view of the market and validate or challenge their trading ideas.

3. Monitor Multiple Indicators: Instead of relying on a single sentiment indicator, sentiment traders should monitor multiple indicators to cross-validate the sentiment signals. Different indicators may provide varying perspectives on market sentiment, and by considering a range of indicators, sentiment traders can reduce the impact of individual biases or noise in the data.

4. Track Changes and Trends: Sentiment indicators are dynamic and can change over time. Sentiment traders should track changes and trends in sentiment indicators to identify shifts in market sentiment. Sudden spikes or drops in sentiment, as well as sustained trends, may provide valuable insights for trading decisions.

5. Establish Baselines and Thresholds: Sentiment traders can establish baselines and thresholds based on historical data or market norms to determine when sentiment signals are significant. By comparing current sentiment readings to these baselines or thresholds, sentiment traders can identify deviations that may indicate potential trading opportunities or risks.

6. Consider Contrarian Signals: Sentiment indicators can sometimes provide contrarian signals, where extreme sentiment readings suggest a potential reversal in market direction. Sentiment traders should be aware of these contrarian signals and consider them in their decision-making process. However, it’s essential to exercise caution and not solely rely on contrarian signals without additional analysis.

7. Combine Short-term and Long-term Perspectives: Sentiment indicators can be used for both short-term and long-term trading strategies. Short-term sentiment indicators may be more useful for capturing immediate market reactions, while long-term sentiment trends can provide insights into broader market sentiment shifts. Combining both perspectives can help sentiment traders make well-rounded trading decisions.

8. Adapt to Market Conditions: Market conditions can influence the effectiveness of sentiment indicators. Sentiment traders should adapt their interpretation and usage of sentiment indicators based on the prevailing market conditions, such as high volatility, news-driven events, or changing market dynamics.

By following these guidelines, sentiment traders can effectively interpret and use sentiment indicators as part of their trading decisions. It’s crucial to remember that sentiment indicators should be used in conjunction with other analysis techniques and should not be the sole basis for trading decisions.

What Biases and Limitations Does A Sentiment Trader Face with Sentiment Indicators?

Sentiment indicators, like any other tool or approach, have certain biases and limitations that sentiment traders should be aware of. Here are some common biases and limitations associated with sentiment indicators:

1. Noise and False Signals: Sentiment indicators can be influenced by noise, which refers to irrelevant or random fluctuations in sentiment data. Noise can lead to false signals, where sentiment indicators may suggest a particular sentiment when it may not accurately reflect the true market sentiment. Sentiment traders should be cautious and carefully analyze the underlying data to filter out noise and identify reliable signals.

2. Herding Behavior: Sentiment indicators can be influenced by herding behavior, where market participants tend to follow the crowd rather than making independent decisions. This can lead to sentiment indicators being skewed or exaggerated, particularly during periods of extreme market sentiment. Sentiment traders should be mindful of the potential impact of herding behavior on sentiment indicators and consider it in their decision-making process.

3. Sample Bias: Sentiment indicators often rely on data samples, such as social media posts or news articles, which may not represent the entire market or investor population. Sample bias can occur if the sentiment data is skewed towards a particular demographic, platform, or geographic region. Sentiment traders should consider the representativeness of the data sample and assess its potential bias when interpreting sentiment indicators.

4. Time Lag: Sentiment indicators may have a time lag, meaning they might reflect past sentiment rather than the current sentiment in the market. This time lag can limit the effectiveness of sentiment indicators for short-term trading strategies or capturing immediate market reactions. Sentiment traders should factor in the time lag and consider it in their trading decisions, particularly for time-sensitive trades.

5. Lack of Contextual Information: Sentiment indicators often provide a simplified measure of sentiment without capturing the full context behind the sentiment. They may not account for specific events, news, or market conditions that could significantly impact sentiment. Sentiment traders should seek additional contextual information and consider it alongside sentiment indicators to gain a more nuanced understanding of market sentiment.

6. Self-fulfilling Prophecy: Sentiment indicators can influence market participants’ behavior and potentially create self-fulfilling prophecies. If sentiment indicators suggest a strong bullish sentiment, it may attract more buyers and drive prices higher, irrespective of other fundamental or technical factors. Sentiment traders should be aware of this potential feedback loop and consider the broader market dynamics when using sentiment indicators.

7. Overreliance on Sentiment Indicators: Overreliance on sentiment indicators without considering other forms of analysis, such as technical or fundamental analysis, can lead to incomplete or biased trading decisions. Sentiment indicators should be used as a part of a comprehensive trading approach, considering multiple factors and indicators to mitigate the limitations associated with sentiment analysis alone.

By being aware of these biases and limitations, sentiment traders can approach sentiment indicators with a critical mindset and use them as a complementary tool alongside other forms of analysis to make more informed trading decisions.

Now, let’s examine the topic from a historical perspective.

Sentiment Trader Update: August 2019

The Dow has tried to trade above 26,800-27,000 ranges almost 19 months. Furthermore, these attacks have been widely spaced out. Hence, the Dow is now at an inflexion point”; it either blasts above 27,000 and in doing so former resistance turns into strong support

Alternatively, if it fails to hold above 27K (after trading above it) the pullback could range from medium to strong. A medium pullback would end in the 25,500-25,800 ranges. A strong pullback could take the Dow all the way down to 24,5K (plus or minus 200 points).

This outlook is based on the short to intermediate timelines; the long term picture is still bullish. We are not worried about a sharp or medium pullback for the only thing that changes is the opportunity factor. When the trend is up, strong deviations are viewed through a very bullish lens; in other words, the strong the deviation, the better the opportunity factor. If the above comes to pass, it will be a good time to test your resolve for it is easy to buy when the situation appears to be calm, but when it’s not most panic and run instead of embracing the opportunity. It’s amazing how when a market is soaring everyone wants to get in and pay more and more, but the same individuals that were willing to pay more are now afraid to pay less for the same stock.

Market Insights and the COVID Sell-Off: May 2020 Update

To put things into perspective, consider this: If cancer were a virus, it would be one of the most lethal viruses of all time, yet no one blinks that we lose 9.6 million people a year to this insidious disease. Until mass-scale testing is underway and the data is broken down into categories such as age group and other pre-existing conditions, all the massive death projections experts are issuing amount to faulty science.

It appears that the only course of action on the table is to give in to panic and flee for the heels. Well, that’s true if you are part of the herd; such action brings short term relief at the expense of monumentally large gains for the long-term player. Nobody knows the inner workings of a company better than the insiders and these chaps are doing something that can only be described as unprecedented, further confirming that this sell-off represents opportunity instead of a disaster. We will finish tabulating the latest batch of sentiment data tomorrow and another update will be sent within 48 hours if not sooner.

It appears that markets are experiencing the “backbreaking correction” one which every bull market experiences at least once and is often mistaken for the end of the bull. In today’s manipulated markets, one cannot tell which correction will morph into the backbreaking correction, as free-market forces have almost been eliminated from today’s markets. While it feels like the end of the world, such corrections always end with a massive reversal. Given the current overreaction to the coronavirus, there is now a 70% probability that when the Dow bottoms and reverses course; it could tack on 2200 to 3600 points within ten days. Interim update March 9, 2020

Unprecedented Investment Opportunity in Stock Market Sentiment

The 1987 crash and 2008 crash fell into the category of the “mother of all buying opportunities“, but we could get a setup that could blow these setups and create the “father of all opportunities“. Such an event is so rare that it might occur only once during an individuals lifetime. In the short term, there is no denying the landscape looks like a massacre, but if one is going to focus solely on the short timelines, then the odds of banking huge profits are quite slim.

Just 15 days ago, everyone would have begged for such prices, but 15 days later everyone is ready to throw the towel in. The volatility is likely to continue until the end of the month, especially since V readings soared by a whopping 650 points to an all-time high. Again, think about it, when was the last time the Fed dropped rates by 150 basis points in two weeks. This is a massive development but its overshadowed by the current hysteria. As we stated before, companies are going to go ballistic with their share buyback programs.

When the panic subsides, it will create a feeding frenzy of the likes we have never seen before. When you combine zero rates, two trillion dollar injection by the Feds and several more billion-dollar packages designed to stimulate the economy, the result is going to be a market melting upwards. The markets will be driven to heights that are unimaginable by today’s standards. Zero rates are also going to force a large portion of individuals on a fixed income to speculate, and these guys have a lot of cash sitting on the sidelines.

The masses are in a state of disarray and until they embrace this market, the markets will continue to defy logic and trend higher. Hence the only play, even though it goes against all s0-called common-sense measures of long term investing, is to embrace all sharp corrections.