Volatile Markets: Embrace the Chaos and Learn How to Thrive in Turbulent Times

Updated March 2023

In these volatile markets, complacency is the enemy of success. V-readings are on the rise, indicating wider trading ranges and the potential for market turbulence. Traders who ignore these warning signs do so at their peril. Even the Dow, previously considered extremely overbought, is now in danger of falling into the same zone as the markets become increasingly unstable.

We cannot assume that this market will pull back on its own. Complacency levels are rising, and it’s only a matter of time before the masses throw caution to the wind. When that happens, the market will react with a sharp correction or healthy pullback, leaving those who were too complacent in the dust.

Remember: this is a market of disorder. Anything can happen. But by keeping a watchful eye on V-readings and market volatility, traders can stay one step ahead of the competition and achieve success in even the most unpredictable of market

Market Mastery: Strategies for Navigating a Volatile Market

Nothing changes, fear, euphoria, and doubt are all perceptions, and the foundations for these perceptions are illusory at best. Sol Palha

In these volatile markets, the only constant changes. But that doesn’t mean you should change your trading strategy on a whim. Prudent traders know that success comes from careful portfolio management and a keen eye for risk-to-reward ratios.

When bullish sentiment surges and the markets move towards overbought ranges, it’s always wise to take some money off the table. But what happens if the stock market doesn’t correct? Who cares? We remain focused on the long-term success of our portfolios, always looking for the best opportunities and not giving in to fear, euphoria, or doubt.

Perceptions can be illusory, and foundations can shift in an instant. That’s why we don’t let our emotions dictate our trading strategies. Instead, we stay true to our core principles, recognizing that anything can happen in a market of disorder. By doing so, we can stay ahead of the competition, weathering any storm and emerging stronger than ever before

Volatile Markets: Turn Adversity into Opportunity and Come Out on Top

Updated Dec 2022

If you want to ensure it’s different this time, then do something different.If the trend is positive and the market pullback then embraces the correction with a bear hug, now that is doing something different, everything else falls under the category of hogwash, rubbish or hot air. Tactical Investor

In these volatile times, it’s crucial not to get caught up in the frenzy of bullish sentiment. While V readings continue to soar and trading ranges widen, many market participants are becoming increasingly complacent. During times like these, it’s prudent to take some profits off the table and remain level-headed.

But don’t be discouraged if the markets don’t pull back as expected. Instead, stay the course and continue to look for opportunities with the best risk-to-reward ratios. While fear, euphoria, and doubt may cloud our perceptions, sticking to sound portfolio management principles for long-term success is essential.

There are always opportunities in the making, and stocks across various sectors are trading in oversold ranges or approaching these zones. Keep a close eye on the trend and be prepared to act when the time is right. If the markets do experience a sharp correction, don’t hesitate to deploy your dry gunpowder.

Remember, those who declare “it’s different this time” are often proven wrong, and the same mistakes are repeated. To ensure a different outcome, we must do something different. Embrace corrections with a bear hug, and be willing to take calculated risks. Don’t fall for the hot air and hogwash – make your own path to success.

Trend Mastery: How to Ride the Wave and Make It Work for You

Naysayers do have a purpose; their job is to drive the masses insane. These wenches work for the smart money group and will sing both ways as long as their pockets are well-lined. Tactical Investor

In a market where fear and uncertainty reign, it’s important to keep a clear head and not fall for the naysayers’ tricks. When the underlying trend is positive, no matter how many reasons one and their buddies come up with for a market crash, it simply won’t happen. Sure, there might be correction-like crashes, but these are opportunities to jump in and back the truck up.

During the so-called COVID-19 crash, we didn’t panic like the masses; we saw it as a buying spree and made a killing. The naysayers’ job is to drive the masses insane, and they do it well. They work for the smart money group, and their loyalty lies with those that line their pockets, not the average Joe. Following them is a recipe for disaster.

The masses have an uncanny skill of doing the worst thing at precisely the right time. It’s crucial to never follow the herd blindly, for generations later, nothing has changed. It takes a keen eye to see through the noise and the skill to take advantage of opportunities when they arise. The smart money doesn’t wait for the market to give them permission to make a move, and neither should you

Those that listen to these fools masquerading as wise men were, are and will always be in for a rude awakening.

The Winning Combination: Harnessing Sentiment and Volatility to Gain the Edge in the Market

Remember, Tactical investors never panic, and they never flee; they calmly finish the glass of wine, or a cup of java, etc. they are drinking and then stroll out of the room. Tactical Investors also never chase a stock; we wait for the stock to come to us.

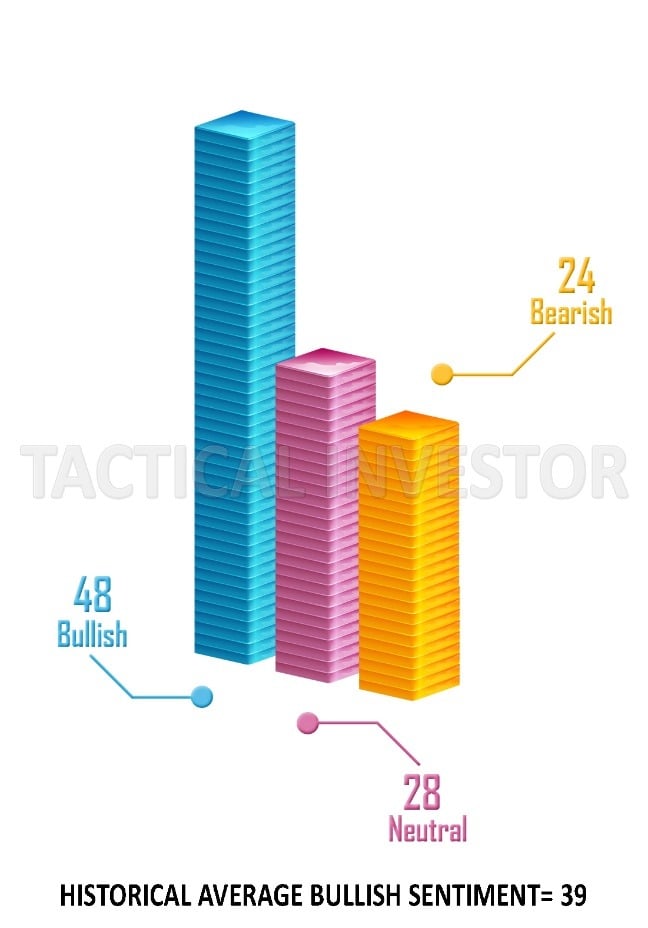

Despite the recent pullback in bullish sentiment, it still stands at a level that is well above its historical average. Additionally, the anxiety gauge has moved up, marking the fastest upward movement in almost 18 months. As a result, it’s important to exercise caution and opt for more conservative entry points when deploying new capital.

That being said, there’s no need to panic or worry. Tactical investors don’t flee or chase after stocks. Instead, they wait for the stock to come to them and calmly make their moves.

On a more positive note, the surge in neutral sentiment suggests that the crowd is becoming uncertain once again. And when there’s uncertainty, it usually indicates that the stock market is about to make significant gains. In fact, neutral readings of 50 or more have almost always been associated with explosive market moves.

Uncertainty is the optimum emotion. When a group is sceptical/unsure, it is a clear indication that the stock market is going to surge significantly higher.

Conversely, spikes in bullish sentiment have often been linked to short-term tops. If you take a look at the long-term sentiment chart below, you’ll notice an interesting correlation between bullish sentiment and market tops. One can even argue that when Neutral Sentiment spikes above 45, an opportunity is typically right around the corner

Conclusion: How Tactical Investors Navigate Volatile Markets

The stock market has been experiencing bullish sentiment, with investors feeling optimistic about the market’s future. However, taking some money off the table is always prudent when sentiment surges and the market becomes overbought. While oversold stocks may have opportunities, cautious entry points are recommended.

Tactical investors stay calm and do not panic or chase stocks. Instead, they wait for the market to come to them. Additionally, spikes in neutral sentiment can indicate the potential for significant market moves, while spikes in bullish sentiment can indicate short-term tops.

Ultimately, while remaining cautiously optimistic, it is essential to maintain portfolio management and avoid following the masses. Whether the market experiences a sharp correction or continues to surge, tactical investors will continue to seek out the best risk-to-reward ratio.

originally published Mar 9, 2021, updated March 2023

Other Articles of Interest

Clear Proof Millennials Are Dumbest Generation

Inductive vs Deductive Approach: The Path to Massive Gains

Resource Wars in Africa: Russia Takes the Throne

How Can You Tell Fake News Stories from Real Ones? Using Common Sense

How To Deal with Social Anxiety: Unveiling Crowd Phobia

Succinic Acid: Boosting Energy, Controlling Sugar & Inflammation

Does Passive Investing Outperform the Market? Discover the Surprising Trutht

Happy Retirement: An Unattainable Dream for Many

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Millennials Retirement Reality: Less Than $100K in Savings

Margin of Safety Investing: The Focus Should Be the Trend

What is the Stock Market Forecast for 2024? Ignore the Rubbish, Focus on the Trend

Stress Kills: Evolve or Perish

How Did Panic Selling Affect the Stock Market? A Tale of Financial Ruin for the Masses

Which Is the Greatest Risk When Investing in Stocks? Bankruptcy

Stock Market Fear Index: The Crowd is still nervous

Can the US Stock Market & US dollar Trade-in Tandem?

Stock sentiment and Market sentiment Charts

Investors’ Primal Fear is their inability to deal with Market crashes

The Fear Factor is what Propels Investors to Panic at the Wrong time