Mindset: The New Psychology Of Success- Do or Die

Updated July 2022

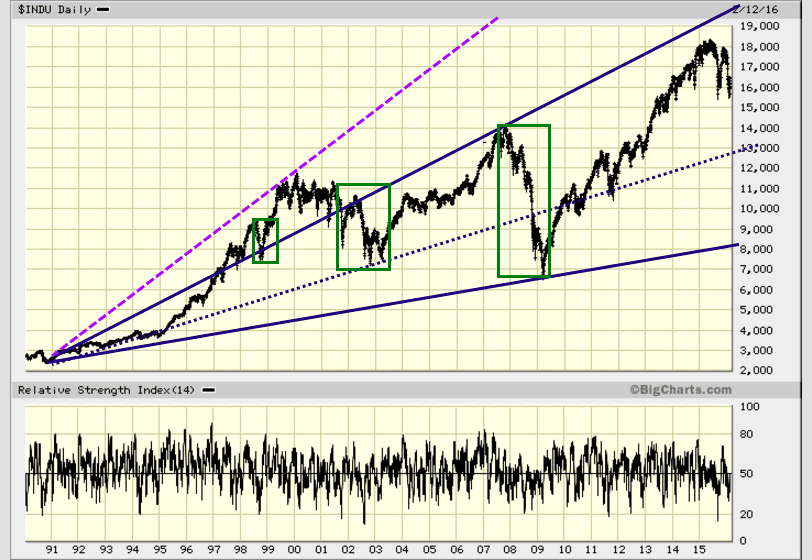

The current correction is the only one since 2011 that is real, and it could prove to be a precursor to a more significant upward move. If you recall, in the dot.com era, the markets corrected firmly in 1998, it looked like the end was near, but then the NASDAQ had its best year ever in 1999. It had tacked on gains of roughly 100%. The chart below highlights this dramatic reversal.

Mindset: The New Psychology Of Success: Focus On The Trend

Throughout this bull run, many reasons have been laid out to indicate why this bull should have ended years ago. Many of the reasons are valid, but being right does not equate to successful investing. The markets are not driven by logic; they are driven by emotion. One needs to understand the emotional state of the masses, and then one can plan a course of action. The masses are notorious for jumping in late and out too early. In both instances, their only gain is pain; in terms of money, they lose on both sides of the equation. Be wary when the masses are joyous and happy when they are worried. The trend is your friend, and everything else is your foe.

Game Plan

The Fed is on a “mission to speculate” the end game here is to force as many people as possible to speculate in the markets. How will they achieve this? The mechanism being used is “negative interest rates”. We have moved into the next stage of the currency war games, the era of negative interest rates. Negative rates will eventually force the most conservative of players to take their money out of the banks and speculate. This process will resemble another massive stimulus and provide the bedrock for another monstrous rally.

Make a list of stocks you would like to own and use strong pullbacks to add to or open new positions in blue-chip companies or companies with strong growth rates. Some examples are OA, AMZN, BABA, GOOG, RTN, CHL, etc.

Mindset: The New Psychology Of Success Video

Stock Market Update Oct 2019

APPL is also putting in a fascinating and bullish pattern, which also bodes well for this market, as this stock was a laggard. The canary in the mine could be signalling that the markets might be overreacting to all the negative news.

The Dow utilities surged to new highs in September. According to the Tactical Investor alternative Dow Theory, it is an early indicator that the Dow industrials and Dow Transports will follow suit.

Everyone is jumping onto the negativity bandwagon, as seen by the enormous amounts of money leaving the markets. Therefore the only plausible outcome is that the crowd (as always) will get hammered.

Lastly, the market is putting in a pattern that is dangerously akin to 2009, especially in the sentiment arena. We all know what happened after that.

Stock Market Outlook March 2020

It appears that markets are experiencing the “backbreaking correction” one which every bull market experiences at least once and is often mistaken for the end of the bull. In today’s manipulated markets, one cannot tell which correction will morph into a backbreaking correction, as free-market forces have almost been eliminated from today’s markets. While it feels like the end of the world, such corrections always end with a massive reversal. Given the current overreaction to the coronavirus, there is now a 70% probability that when the Dow bottoms and reverses course; it could tack on 2200 to 3600 points within ten days. Interim update March 9, 2020

To put things into perspective, consider this: If cancer were a virus, it would be one of the most lethal viruses of all time, yet no one blinks that we lose 9.6 million people a year to this insidious disease. Until mass-scale testing is underway and the data is broken down into categories such as age group and other pre-existing conditions, all the massive death projections experts are issuing amount to faulty science.

It appears that the only course of action on the table is to give in to panic and flee for the heels. Well, that’s true if you are part of the herd; such action brings short-term relief at the expense of significant gains for the long-term player. Nobody knows the inner workings of a company better than the insiders, and these chaps are doing something that can only be described as unprecedented, further confirming that this sell-off represents opportunity instead of a disaster. We will finish tabulating the latest batch of sentiment data tomorrow, and another update will be sent within 48 hours, if not sooner.

References

These articles demonstrate the value of having the right mindset when it comes to investing:

- “The Importance of a Winning Mindset in the Stock Market”: https://www.thebalance.com/the-importance-of-a-winning-mindset-in-the-stock-market-4169941

- “How Your Mindset Can Sabotage Your Stock Market Success”: https://www.investopedia.com/articles/investing/120115/how-your-mindset-can-sabotage-your-stock-market-success.asp

- “The Psychology of Successful Trading”: https://www.forbes.com/sites/moneybuilder/2013/06/19/the-psychology-of-successful-trading/?sh=43a6cd3e6e97

- “Mindset Matters: Mastering the Mental Game of Trading”: https://www.nasdaq.com/articles/mindset-matters%3A-mastering-the-mental-game-of-trading-2017-05-12

- “The Psychology of Trading: How to Conquer Your Emotions”: https://www.thestreet.com/personal-finance/the-psychology-of-trading-how-to-conquer-your-emotions-12944274

Other articles of Interest:

Becoming a Better Investor: Key Strategic Moves

Investing in a Bear Market: Ignore the Naysayers

Buy the Dip: Dive into Wealth with this Thrilling Strategy

Resource Wars: Navigating a Shifting Global Landscape

The Prudent Investor: Prioritizing Trends Over Speculation

Optimal Strategies for The Best Stocks To Invest Long Term

Seizing Dominance: The Relentless Rise of Mental Warfare

What is Inflation? Unveiling Effects and Strategies for Mastery

The Cycle of Manipulation in Investments

Investor Sentiment Data Manipulation: Unveiling Intriguing Insights

Stock Buybacks: Exploring Their Detrimental Effects

US Dollar Rally: Is it Ready to Rumble?

Stock Books For Beginners: Investing Beyond the Pages

Psychological Manipulation Techniques: Directed Perception