SNH (Senior Property Housing Trust)

It pays a high dividend of over 8%. It primarily invests in senior housing properties, so its business is relatively stable, unlike commodities-based companies, where the commodity price could soar to the moon or drop down into the pits of hell.

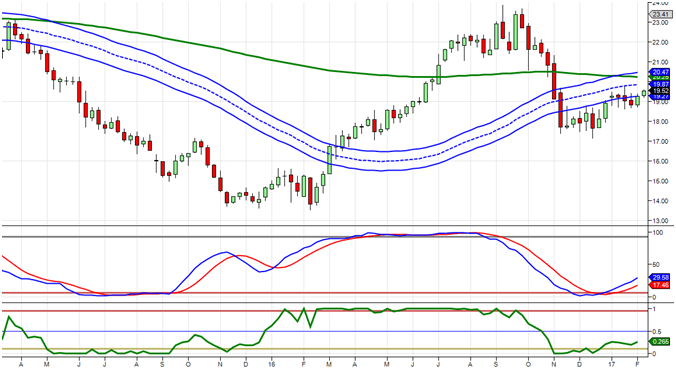

The weekly chart indicates the stock is oversold, and there is a good chance that the stock could trade to and past 24.00 before the MACD traded in the overbought ranges.

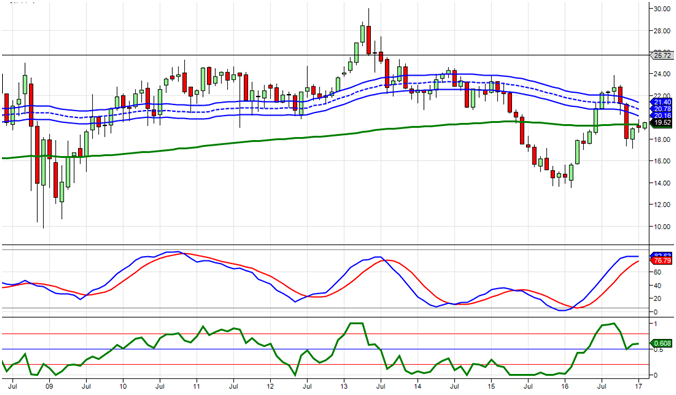

The monthly charts paint a different story, meaning Senior Property Housing Trust is not a long-term hold. It could be worth getting in now if you are willing to hold it for a few months and then bank profits.

If you are not in a hurry, the safer route would be to wait for the stock to pull back. We can see that once the MACDs cross on the monthly charts, the store does shed quite a bit of weight. We expect the markets to pull back this year, and the withdrawal could be substantial. It is possible that this stock could drop down to the 14 range again, at which point, not only would it make for a great buy, but the dividend would soar too. Patience has rewards; dividend players might be interested in putting this play on their list of stocks to monitor.

Other stories

Rolling Over Options: The Ultimate Guide to Mastery

VIX Market Volatility: The Power of Understanding Market Risks

Flocking Behaviour: Insights into Group Dynamics

The Uselessness of Experts: Trading Mistakes to Avoid

The Intricacies of Stock Market Behavior: Patterns and Predictions

Stock Market Timing: Unlocking Hidden Strategies for Lasting Success

SPY 200-Day Moving Average Strategy: Learn, Earn, and Prosper

Understanding Herd Mentality: Lessons from the 2017 ICO Boom

Dow Jones Utility Average: A Riveting Alternative Dow Theory

Trading Journal: The invaluable tool for traders

Stock Market Bubble: Embrace Sharp Corrections

Navigating Stock Market Uncertainty: Pythagorean Insights for Stock Investors

Michael Burry Stock Market Crash: All Bark, Zero Bite

Unveiling The October 24 1929 Stock Market Crash

Why Contrarian Investing Triumphs: Bullish Divergence MACD Analysis

The Dutch Tulip Bubble of 1637: A Tale of Madness and Ruin