Palladium Price History: Navigating Profitable Trends

April 5, 2024

Introduction:

Palladium, a precious metal with unique properties and critical industrial applications, has captured the attention of investors and market analysts alike. The palladium market has been characterized by supply challenges, price volatility, and growing demand from various sectors, particularly the automotive industry. As we delve into the fascinating history of palladium prices, we uncover a narrative of resilience, opportunity, and the pursuit of profitable trends in the face of market fluctuations.

Palladium Price History: Supply Challenges and Price Volatility

Palladium’s constrained availability stems from its byproduct nature in platinum and nickel mining. The complex and costly extraction process, coupled with the concentration of production in Russia and South Africa, exacerbates supply issues. In 2021, the palladium market briefly moved into excess, but it is expected to shift back to a significant deficit due to weaker supply rather than robust demand.

The scarcity of palladium and increasing demand from the automotive industry for catalytic converters have driven price volatility. Palladium prices have surpassed gold in recent years, with the metal reaching an all-time high of $3,440.76 per troy ounce in March 2022. The unpredictability of prices and the metal’s rarity make it an attractive investment for those willing to take on the associated risks.

Demand Drivers and Market Dynamics

Approximately 80% of palladium demand comes from the automotive industry, with other uses including electronics, dentistry, and jewellery. Persistently high prices have led to substitution in the auto sector, transitioning towards higher platinum loadings in autocatalysts at the expense of palladium.

Palladium’s status as a byproduct of platinum or nickel mining means output lags price gains. The amount produced is projected to fall short of demand for an eighth year in 2019. This supply-demand imbalance has led to palladium for immediate delivery trading at a premium to material for later delivery, suggesting manufacturers are scrambling for supply.

Investment Opportunities and Risks

The investment landscape for palladium remains intriguing, contrasting with the current fascination with AI stocks. The general principle of contrarian investing suggests that opportunities may arise in neglected sectors when most of the market is focused on one area.

Investors can gain exposure to palladium through various avenues, such as investing in palladium bullion or the stocks of companies involved in the palladium business. However, it is essential to recognize that commodity prices are subject to market fluctuations, and investing in palladium carries inherent risks.

Future Outlook and Considerations

Mining and exploration companies continue to search for new palladium reserves, and technological advancements may influence future demand. Research into alternative materials and technologies for catalytic converters could reduce the reliance on palladium.

Despite potential changes, given the current limitations on palladium supply and its critical role in various industries, palladium will likely continue facing price pressures soon. Monitoring market conditions and supply dynamics is essential for assessing the long-term prospects of palladium.

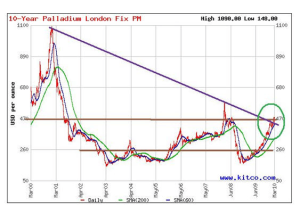

Now, let’s examine the historical context of the palladium market. The current trend resembles the situation in 2008, and there’s a potential for a repeat scenario, albeit on a larger scale, compared to what occurred previously. This is particularly concerning given Russia’s status as one of the leading producers of this metal and its strained relations with the United States.

Palladium Forecast: Examining the Technical Landscape.

Palladium took a severe hit in 2008, swiftly erasing all its previous gains within months. However, this adversity ultimately transformed into an exceptional buying opportunity we wholeheartedly endorsed from late 2008 through early 2009. We were so convinced of its value that we categorized it as a “screaming buy,” a term we reserve for exceptionally undervalued investments with remarkable potential. Over roughly 15 months, Palladium made a fantastic recovery, surging by well over 120%, an astonishing rate of return.

It easily breached the initial resistance point at 375 and is now striving to overcome an even more formidable resistance zone. The $465-$475 range constitutes a region of substantial opposition. Several attempts will likely be necessary for Palladium to break through this zone. However, the path should become considerably smoother once achieved, leading to the 550-600 range.

Palladium’s Pivotal Point: Breaking Barriers and Charting a Bullish Future

Palladium finds itself at a crucial crossroads, having recently broken free from a long-term downtrend line and endeavouring to escape the constraints of a 10-year channel formation. The next significant milestone for Palladium involves sustaining trade within the 465-475 range for a continuous 12-day period. Achieving this would lay the foundation for a potential rally to propel it toward the 800-890 range. Regarding timing, these targets could materialize within 12 to 18 months once Palladium maintains this range for the suggested period.

However, the actual bull market for Palladium will only commence when it surges past the 1100 mark. From a longer-term perspective, securing a monthly close above 1100 and trading above this level for a continuous 15-day stretch could pave the way for a test of the 1500-1700 ranges.

Palladium Forecast: Resilient Outlook and Investment Wisdom

Our proprietary timing indicators send positive signals for Palladium across daily, weekly, and monthly timelines, painting a promising long-term outlook for this precious metal. Palladium’s unique performance sets it apart – it’s the sole precious metal to achieve a new 52-week high, even in the face of a strengthening dollar. In 2022, palladium prices spiked to an all-time intraday high of $3,339 per ounce before falling to a year-to-date low of $1,657 in December.

As the legendary investor Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.” The current volatility in the palladium market presents an opportunity for prudent investors to leverage strong pullbacks by increasing existing positions or initiating new ones. Another investing icon, John Templeton, famously stated, “The best time to invest is when you have money. This is because history suggests it is not timing that matters but time.”

While palladium may experience some profit-taking in the short to intermediate term, given its remarkable rally over the past 15 months, the long-term and very long-term prospects appear exceptionally bright. Peter Lynch, the renowned mutual fund manager, emphasized the importance of a long-term perspective, saying, “The real key to making money in stocks is not to get scared out of them.”

Investors can gain exposure to palladium through various avenues, such as investing in palladium bullion, ETFs like the Aberdeen Physical Palladium ETF (PALL), or the stocks of companies involved in the palladium business. However, it is essential to recognize that commodity prices are subject to market fluctuations, and investing in palladium carries inherent risks.

For example, the demise of diesel engines may support some shift into gasoline cars or hydrogen fuel cells, which could impact palladium demand. Nevertheless, with its critical industrial uses and supply challenges, palladium could represent an opportunity for investors looking to diversify away from the mainstream focus on AI stocks.

Conclusion:

The palladium market presents a compelling case for investors seeking to diversify their portfolios and capitalize on the metal’s unique supply and demand dynamics. Despite the potential for short-term volatility, the long-term outlook for palladium remains exceptionally promising. As global demand for catalytic converters continues to rise, driven by stringent emissions regulations, and supply constraints persist due to the concentration of production in specific regions, palladium prices are poised for growth.

Investors can gain exposure to palladium through various avenues, such as investing in palladium bullion or Exchange-Traded Funds (ETFs). However, this market should be approached with a long-term vision, as it is volatile, and focusing on short-term fluctuations can lead to sleepless nights. When investing in this market, the best strategy is to allocate funds that you don’t need in the near future, allowing you to ride out the short-term gyrations without undue stress.

Historically, when palladium trades in the oversold zone, it presents an excellent opportunity for investors. Currently, palladium is trading in an exceptionally oversold zone, making it an outstanding long-term investment prospect. As the legendary investor Sir John Templeton once said, “The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” This wisdom aptly applies to the current palladium market sentiment.

Astute investors will recognize that now is the time to buy rather than worrying about trying to time the market for the best price. Attempting to predict the perfect entry point can lead to missed opportunities, as tomorrow’s prices are never guaranteed. Instead, investors should focus on the long-term potential of palladium and take advantage of the current oversold conditions to establish or expand their positions.

By adopting a patient, long-term approach and investing funds that are not immediately needed, investors can navigate the volatility of the palladium market with greater confidence. This strategy allows them to capitalize on the compelling investment opportunity presented by palladium’s current oversold status, positioning themselves for potential gains as the market recovers over time.

Exploring the Extraordinary: Must-Reads

From Zero to Stock Market Hero: Stock Investing for Dummies PDF