Middle East Oil Wars: China, Russia, and Iran Reshaping Eurasia

Updated May 2023

Buckle up; 2015 promised a geopolitical whirlwind, with China, Russia, and Iran challenging what I’ve termed the “Empire of Chaos.” This year would see significant moves toward Eurasian integration, gradually diminishing the hegemony of the US dollar, especially the petrodollar.

Despite formidable challenges, China exuded confidence as an emerging commercial superpower. President Xi Jinping and his administration invested heavily in urbanization and anti-corruption efforts. On the international stage, China accelerated its ambitious “Silk Roads” project, both overland and maritime, aiming to unify Eurasia through trade and commerce.

Amidst this, global oil prices remained low, and the fate of a nuclear deal between Iran and the P5+1 was uncertain. If sanctions persisted, Iran was poised to further integrate with Asia rather than the West. The geopolitical landscape was evolving, with these key players asserting their influence and reshaping the Eurasian terrain.

Western Sanctions and the Oil Price Collapse: Targeting Iran and Russia

Western sanctions have been a significant factor in the geopolitical landscape, particularly concerning Iran and Russia. The United States has recognized that achieving a comprehensive deal with Iran relies on Russia’s cooperation. Such an agreement would represent a notable foreign policy success for the respective administrations involved. However, it is worth noting that Iran and Russia have faced Western sanctions, which have had significant implications for their economies and global relationships.

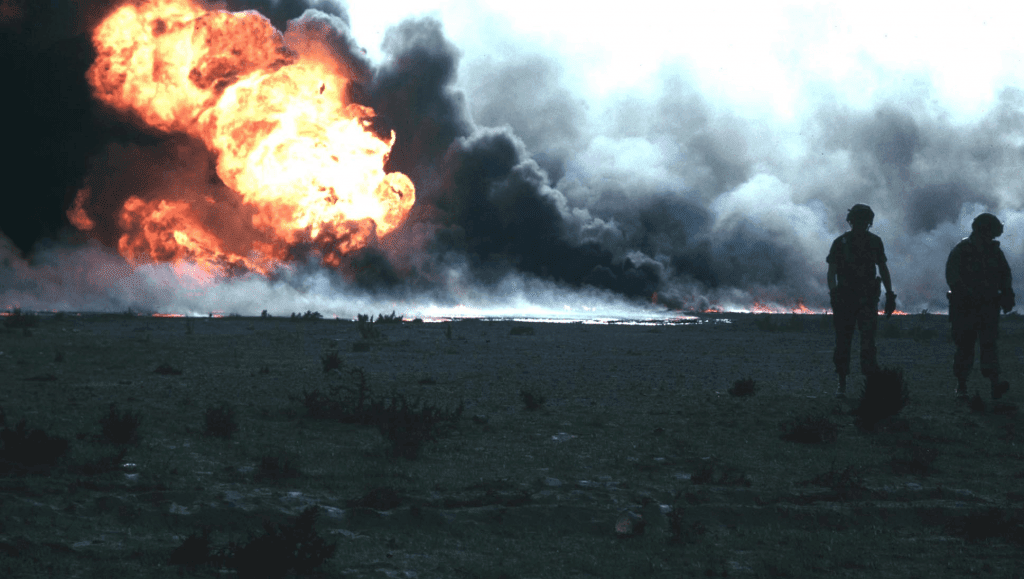

The ongoing financial and strategic collapse of oil prices has also played a role in targeting Iran and Russia. The decline in oil prices has had a direct impact on the economies of these countries, as both heavily rely on oil exports for revenue. The collapse in oil prices has put pressure on their economies, affecting their fiscal stability and overall geopolitical influence.

It is essential to consider that the dynamics of Western sanctions and the oil price collapse are complex and multifaceted. They involve various geopolitical considerations, economic factors, and strategic interests. The interplay between these elements shapes the relationships between Western nations, Iran, and Russia and has broader implications for global politics and energy markets.

Middle East Oil Wars: Shifting Power Dynamics

Now, let’s take a look at Russian fundamentals. Russia’s government debt totals only 13.4% of its GDP. Its budget deficit in GDP is only 0.5%. Assuming a US GDP of $16.8 trillion (the figure for 2013), the US budget deficit totals 4% of GDP versus 0.5% for Russia. The Fed is essentially a private corporation owned by regional US private banks, although it passes itself off as a state institution. The US publicly held debt equals a whopping 74% of GDP in the fiscal year 2014. Russia’s is only 13.4%.

The declaration of economic war by the US and EU on Russia – via the run on the ruble and the derivative oil attack – was essentially a derivatives racket. Derivatives – in theory – may be multiplied to infinity. Derivative operators attacked the ruble and oil prices to destroy the Russian economy. The problem is that the Russian economy is more soundly financed than America’s.

This swift move was conceived as a checkmate, so Moscow’s defensive strategy was not bad. On the key energy front, the problem remains the West’s – not Russia’s. If the EU does not buy what Gazprom offers, it will collapse. Moscow’s fundamental mistake was to allow Russia’s domestic industry to be financed by external, dollar-denominated debt. Talk about a monster debt trap which the West can easily manipulate. The first step for Moscow should be to supervise its banks closely. Russian companies should borrow domestically and move to sell their assets abroad. Moscow should also consider implementing a system of currency controls so the basic interest rate can be brought down quickly. Full Story

Another exciting take on the situation is that it’s certainly not an open and closed case like the USA and EU are making it look like.

Impact of Middle East Oil Wars on the U.S.: A Closer Look

The current situation involving the U.S., Saudi Arabia, and Russia raises significant concerns. It’s a complex dynamic where a country known for human rights violations, Saudi Arabia, and the U.S. seem to be targeting Russia, a more liberal and modern nation.

The strategy appears to be flooding global oil markets to undermine Russia’s economy and weaken Putin’s popularity. However, the plan may backfire. Putin remains popular in Russia, and the Russian people are unlikely to blame him for economic troubles caused by external factors. The provocative actions of NATO and military tensions further solidified Russian unity.

Moreover, the recent near-collapse of the banking system in the U.S. and EU, masked by central bank interventions, highlights the fragility of the global financial system. The stability of this system depends on world trade, and China’s role in maintaining the strength of the euro and dollar cannot be ignored. As China continues to bolster its domestic economy, the global economic landscape is shifting, with the U.S. no longer holding the title of the world’s largest economy. The outcome of these complex geopolitical and economic manoeuvres remains uncertain. Full Story

Saudi Arabia’s Risky Gamble in Middle East Oil Wars

Saudi Arabia finds itself in a precarious situation as it embarks on a new conflict, this time not against weaker nations like Iraq, Libya, or Iran, but against Russia. Unlike previous opponents, Russia can respond with overwhelming force or support groups like the Houthis to create chaos within the kingdom.

The ongoing challenge of dealing with the Houthis in Yemen adds to Saudi Arabia’s vulnerabilities. If the Houthis were to receive substantial external support, it could pose a significant threat to the House of Saud.

China and Iran aligning with Russia further complicates the situation. Saudi Arabia’s reliance on indefinite U.S. support may prove unreliable in the face of these shifting alliances. In the end, this alliance with the U.S. might become a decision that the House of Saud regrets.

Originally Published on: Sep 23, 2016; Updated Over the Years with the Latest Update Done in May 2023