Unravelling the Oil Crash of 2016: Causes, Impacts, and Lessons Learned

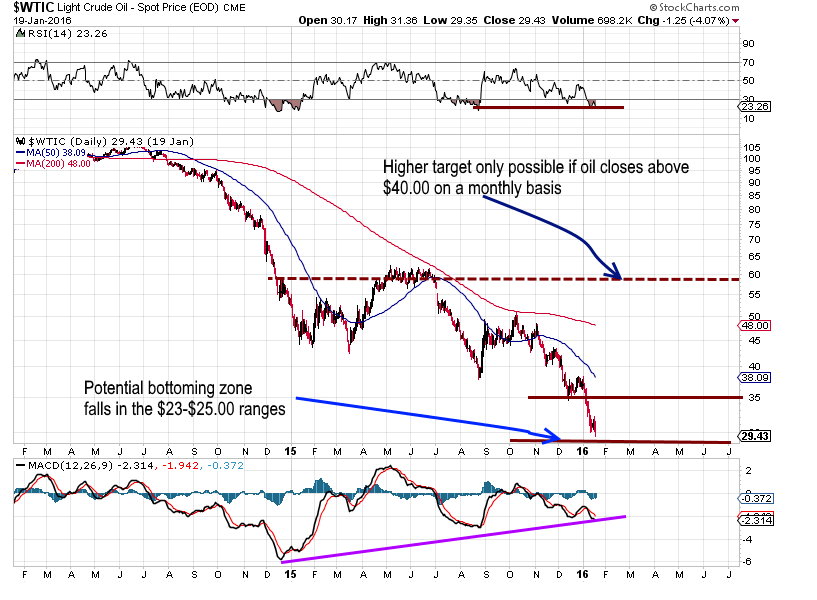

The year 2015 proved challenging for speculators attempting to time the oil markets. Oil consistently pierced through each support level, reminiscent of a hot knife slicing through butter. Despite occasional glimpses of a potential rally, it would inevitably fade, causing oil prices to drift lower. In a previous article from November of the last year, we emphasised that oil would need to achieve a weekly close above $50 to signal the possibility of higher prices. Unfortunately, it failed to meet this requirement and continued its descent. When oil closed below $32 on a weekly basis, it nullified any minor bullish indications it had exhibited in 2015.

The question arises: Is oil on the verge of establishing a bottom, or will it disappoint once again and descend to new lows? There is a common belief that low prices can only be cured by even lower prices and vice versa. With that in mind, we anticipate one final wave of selling before oil reaches its bottom and commences a gradual upward trend. However, we do not expect any abrupt upward reversals unless the tensions between Iran and Saudi Arabia escalate to the point of triggering a new war.

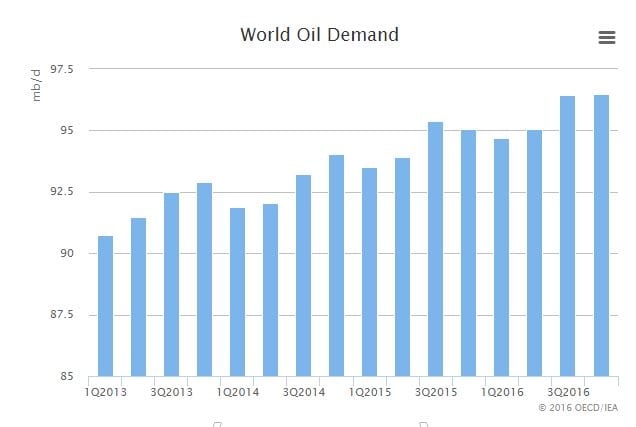

According to the IEA, oil demand 2016 is expected to remain almost unchanged from 2015. In 2015, it stood at 96.43 million barrels per day (Mb/d); in 2016, it is expected to be 96.49 Mb/d.

From Boom to Bust: Exploring the Factors Behind the 2016 Oil Crash

Interestingly, the International Energy Agency (IEA) anticipates a slight decline in oil supplies, but their projections have a history of inaccuracy. It remains uncertain if these projections account for the forthcoming influx of Iranian oil. Furthermore, Russia and Saudi Arabia show no signs of reducing their oil supplies.

In 2016, Russia achieved record-breaking crude oil production of 534 million tonnes, with a 1.4% year-on-year increase in oil and gas condensate production. Bloomberg noted that Russia’s oil production was poised to reach a post-Soviet record, exceeding 10.86 million barrels per day. Similarly, Saudi Arabia has been pumping oil at near-maximum capacity instead of cutting production. From a supply perspective, no encouraging factors exist for a sustained upward trend in oil prices.

It is worth noting that the oil market unexpectedly plummeted, contradicting predictions from top analysts and peak oil theory experts. What happened to the notion of peak oil? Rather than production peaking, we find ourselves flooded with oil while the peak oil experts have faded into obscurity. Just as the market collapsed amidst predictions of higher prices, oil will likely stabilize in 2016, contrary to expectations of continued decline. As it has broken through multiple levels of support, the oil will need to trade sideways for an extended period before any hopes of a breakthrough can arise.

A Prudent Approach for Speculators and Conservative Investors Alike

As oil has now closed below the psychological threshold of $30 on a weekly basis, it will probably undergo another downward wave before reaching a tradable bottom. The possibility of a move towards the $23-$25 range has become considerably strong. However, if oil does not register a weekly close below $23.00, it will form a slow bottoming pattern.

It is important to note that expectations for a significant surge in oil prices should be tempered once a bottom is established. Trading will likely be confined within a relatively narrow range of $24.00-$36.00 for a considerable period. A monthly close above $40 will signal a potential shift in the trading range to a slightly higher zone of $36.00-$58.00, possibly reaching $65.00 in an overshoot scenario.

Caution and Opportunities in the Volatile Oil Market

Although two minor bullish factors have emerged, namely the MACD showing higher lows and the RSI holding steady without reaching new lows, the ongoing turmoil in the oil market suggests caution. Investing in oil stocks is not recommended at this stage, as many companies face insurmountable debt issues and may go bankrupt. However, this presents future opportunities within the sector. For speculators, a wiser approach would be to consider playing the sector through ETFs such as UCO, OIL, and USO. It is advisable to wait until oil reaches at least $25 or lower before allocating funds to this sector.

Conservative investors, on the other hand, may find it more prudent to wait for the market to stabilize before making any significant moves. Later in the year, when the dust settles, there will likely be ample opportunities to purchase promising stocks from companies in the oil sector that have weathered the storm and are poised to benefit from higher oil prices.

An ounce of patience is worth a pound of brains.

Dutch Proverb

Other Stories of Interest

6 Rules to making money in the Markets Using Mass Psychology