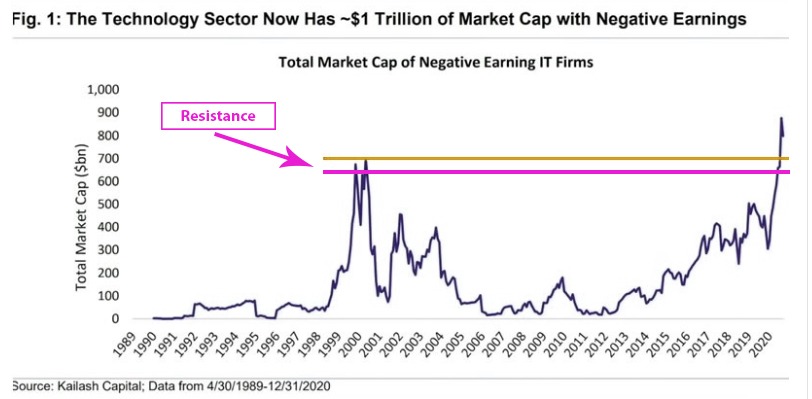

What does the term Negative retained earnings imply? According to askalot:

Negative retained earnings. When a company records a loss, this too is recorded in retained earnings. If the amount of the loss exceeds the amount of profit previously recorded in the retained earnings account as beginning retained earnings, then a company is said to have negative retained earnings

A subscriber sent this chart to us and asked us for our opinion on this negative retained earnings trend. Well, one glaring error we can spot is that this chart has not been adjusted for inflation. Taking the bastardised figures from the Fed, 1000 dollars in 2000 is now worth roughly 1600. The red line should either be brown or purple as it does not represent danger but support.

Former resistance turns into support. 700 billion in 2000 would be the equivalent of 1.12 trillion. In reality, 1K in 2000 is probably worth at least 2K in today’s dollars, if not more. So 1.4 trillion would be a more accurate representation. Then add in the stupidity factor, as there are 10X more morons trading today than in 2000. A more apt figure would fall in the 1.9 to 2.4 trillion ranges. So, we do not view the above as a dangerous development but simply a sign that we should expect more volatility as we head higher.

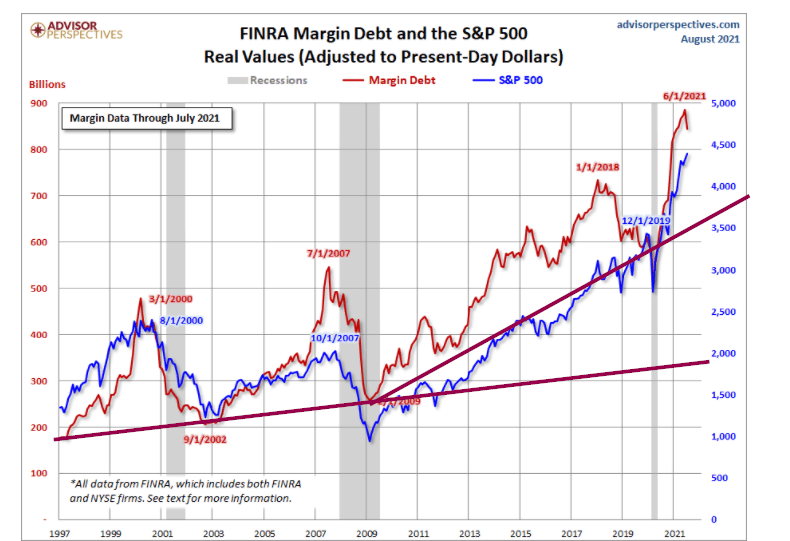

A similar assessment could be made on the chart below. Much noise is made about margin debt without focussing on interest rates and the Fed’s monetary policies. If you factor these developments into the equation, it’s a waste of time to focus too heavily on margin debt.

What do you notice when you look at the above chart? Margin debt has been trending upwards. Secondly, we have a new branch (trend line) of the main uptrend line, indicating that margin debt and total U.S. debt will soar to unimaginable levels. What you see today will one day be viewed as sane. The experts today consider margin debt levels of 2000 and 2007 as rational compared to current levels.

If we use the same inflation adjustment factor used above (1K is worth 2K today), then at the minimum, margin debt levels would need to surge past 1 trillion. When stupidity is factored into the equation, margin, debt would need to surge to the 1.45 to 1.74 Trillion ranges before alarm bells are raised.

One should understand something the Fed will not allow the markets to crash for a prolonged period. This is especially true when the trend is positive. This is why we did not panic during the COVID crash of 2020. The trend was positive, so we knew that the crash was engineered, which meant the markets would recoup their losses just as quickly.

Lastly, don’t fall for the rubbish stories out there stating that the Fed is running scared. They are not frightened. They can lay waste to any corporation, or any entity they deem is stepping out of line. They have the power to create new money, and until the masses refuse to embrace Fiat (don’t hold your breath for this day), the Fed is all-powerful.

Other Articles of Interest

Candlesticks: Unconventional Techniques for Reliable Interpretation

Bitcoin Price Analysis: Unveiling the Potential Boom or Bust

The Role of the Federal Reserve in US Economy

Embracing Challenges, Seizing Opportunities: Investing in China

Euro ETFs: Navigating the Investment Landscape

Short Dollar ETF: Navigating the Financial Markets

Why Is Freedom of Speech Important? Embracing It as Our Birthright

BBC Global 30 Index: Forecasting Profit or Peril

Enhancing AI Dangers Awareness: Understanding the Risks

Buying Stocks When There’s Blood in the Streets

Digital Currency Group: Leading the Way in Cryptocurrency Innovation

Denmark Anti-immigrant Ads: U.S. helpless against Russian hardware

Artificial Intelligence Investing is transforming investment strategies

Stock Market Outlook Unveiled: The Magic of Mass Psychology