Do not anticipate trouble, or worry about what may never happen. Keep in the sunlight.

Benjamin Franklin

Perma Bull vs. Perma Hate: Balancing Optimism and Skepticism in Markets

Updated July 2023

Approaching subjects with a historical backdrop is optimal, as the adage goes: those who disregard history’s lessons risk reliving it. Keeping this wisdom in mind, we’ll delve into the Perma Bull concept, employing historical examples to reinforce our perspective. It’s worth noting that extreme emotions in the market can be perilous.

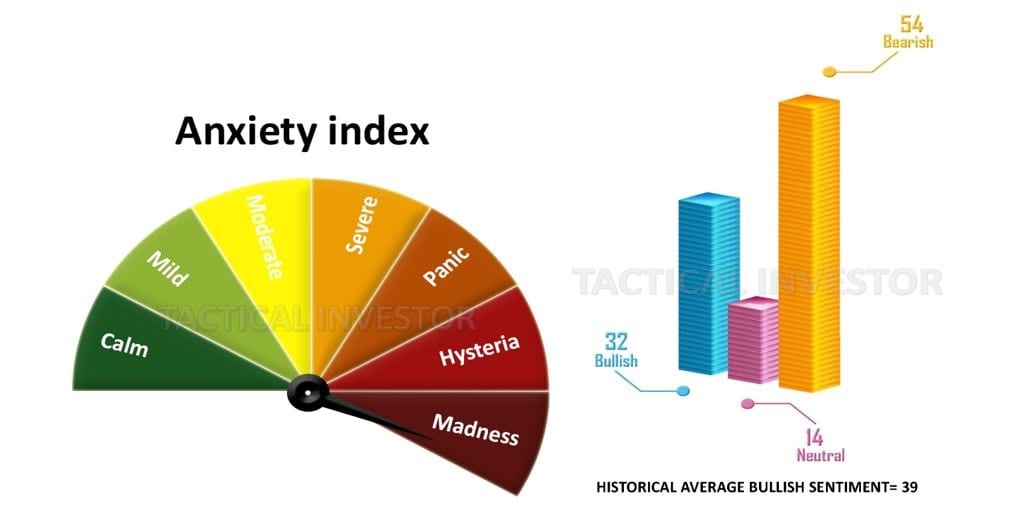

The general public lacks faith in the potential for this market to trend higher. Sentiment remains largely pessimistic, and this sentiment has been consistently validated over time. For many consecutive months, investors with a neutral or bearish stance have outnumbered those with a bullish outlook. What’s intriguing is that as this market continues to rise, the masses grow increasingly uneasy. In essence, this is precisely why the market is poised to climb higher persistently.

We concur that the driving forces behind this economy possess an illusory quality, and this economic marvel is being sustained by inflows of speculative funds. No other factors are propelling this economic rebound. Any piece of data susceptible to manipulation has indeed been altered to fit the narrative the Federal Reserve wishes to present. All of this holds true, yet opposing the Federal Reserve is a path leading nowhere but to early setbacks. Until the trend takes a negative turn, it’s advisable to welcome any substantial pullbacks.

Central bankers have adopted the era of negative interest rates.

And this experiment shall persist until another currency crisis unfolds. The exact timing of this event remains uncertain. What we are certain of is that many of those who were absolutely convinced that this scenario would unfold within their lifetimes are no longer with us. An indicator that something is awry will emerge when the masses transition into a state of euphoria, yet that point is still a considerable distance away.

One might assume that the number of individuals adopting a bullish stance would skyrocket following the market’s surge to new record highs. However, such luck has not been forthcoming. In reality, our exclusive “anxiety index” indicates that the public sentiment has consistently resided within the bounds of the “fear zone,” with no movement into the “calm zone” over the past half-year. Data underscores that the collective outlook has maintained an unusually pessimistic disposition for an extended duration.

Perma Bull persists: Hot money fuels the drive.

Both the Federal Reserve and the corporate sphere grasp the truth that no authentic economic recovery is underway. It’s understood that the very moment the influx of hot money halts, the perma bull market will come to an abrupt halt. Furthermore, this very awareness is the driving force behind the Fed’s unwavering commitment to propping up this market. Both the Fed and corporate entities are resolute in their determination to uphold the facade of prosperity. This mission entails generating and injecting a substantial amount of funds into the markets, enough to propel them to even greater heights. Those who attempt to oppose the Fed’s efforts will find themselves ruthlessly overrun.

The collective mindset has now arrived at a point where the prevailing belief is that this state of affairs is the new normal. The populace has embraced the illusion, preferring to shun reality, largely due to their upbringing in a world steeped in illusion. For them, grappling with the illusory is far simpler than confronting reality itself. This is where the adage “tell me sweet lies” finds its resonance. As a result, individuals should brace themselves for market manipulations that will astonish anyone aged 40 or older.

Anticipate interruptions in this Perma Bull with sharp corrections ahead.

Foresee intermissions in this enduring Perma Bull trend, accompanied by notable corrections on the horizon.

The era of hot money is not drawing to a close; rather, it is only just commencing, as central bankers have fully embraced the concept we’ve dubbed “inflate to infinity.” Furthermore, when the Federal Reserve adopts negative interest rates, it will be akin to pouring jet fuel onto a roaring inferno. In simpler terms, the stock market is poised to ascend to such extraordinary heights that even the staunchest of bulls will find themselves astonished. While a day will come when this bull market is abruptly halted, that moment has not yet arrived. Until then, it’s advisable to perceive sharp pullbacks as favourable buying opportunities. In fact, the more substantial the pullback, the more promising the opportunity becomes.

This is the reason why a crash (or, more accurately, a significant correction) will ultimately transpire, but that juncture is still in the future. It’s highly probable that the markets will achieve levels far beyond what these pessimists could ever fathom. The Federal Reserve wields a far greater influence than the limited number of outspoken individuals who profess expertise yet, in reality, possess scant understanding. Lastly, within such a climate, allocating a portion of one’s funds to precious metals appears to be a prudent choice.

Perma Bull Update After Coronavirus Pandemic April 2020

Conversely, the media is employing statistics to construct a misleading narrative by omitting crucial data. Another realm where the press is actively fueling heightened anxiety is in its coverage of the situation in New York. Characterizing the current surge in new cases as a cause for alarm is utterly nonsensical. Furthermore, distorting the data to insinuate that the risk level is equivalent for both the young and the elderly is highly unethical.

Anyone possessing common sense understands that an increase in testing will naturally lead to a rise in reported cases. What should be emphasized is that despite the expanded testing efforts, the mortality rate remains steady at 1.28% across all age groups. This same strategy is repeatedly employed to induce a sense of urgency among the masses. It’s essential to never accept information at face value and always delve deeper for a more accurate understanding.

Given the prevailing unease among the masses, utilize any pullbacks as opportunities to augment your positions. Disregard the distractions and concentrate on the overarching trend.

Anger, if not restrained, is frequently more hurtful to us than the injury that provokes it.

Seneca

Originally published on August 5, 2016, this article has been periodically updated, with the latest revision conducted in July 2023.