Mean Reversion Trading: A Simple Path to Reliable Market Gains

Sep 26, 2024

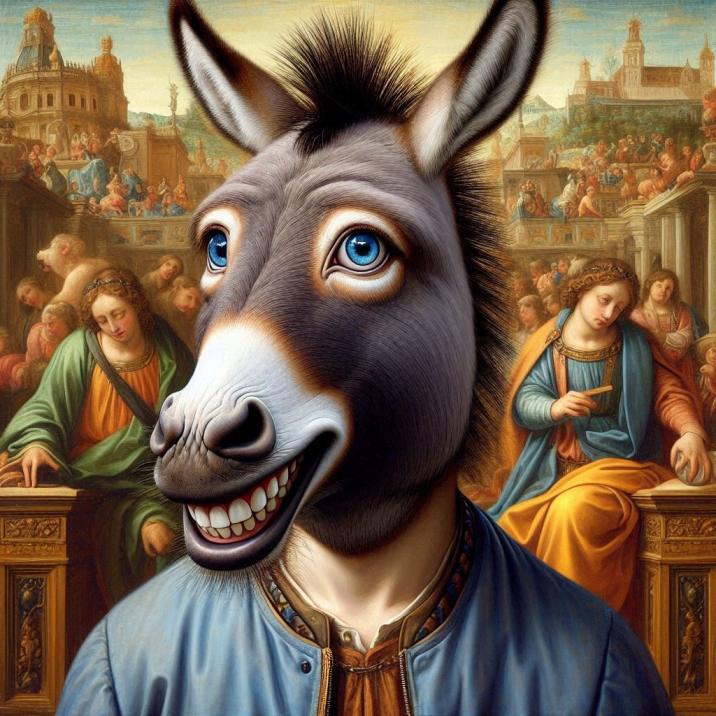

In financial markets, there is often a tendency to follow the herd, which can be dangerous for the astute investor. This phenomenon, referred to as “being a burro,” describes those who, out of fear or excitement, mimic the majority’s decisions, often at the wrong time. In contrast, those who practice mean reversion trading adopt a contrarian approach, seeking opportunities where the masses see turmoil. Mean reversion trading hinges on the idea that extreme price movements will eventually reverse toward their long-term averages, offering opportunities for those who dare to act against popular sentiment.

To truly master this strategy, it’s essential to understand the deeper forces at play—mass psychology, contrarian thinking, and market turbulence. Far from being chaotic, turbulence can reveal hidden patterns, and for the astute trader, these patterns become fertile ground for profit. Drawing on insights from philosophers and market experts alike, we can explore how market volatility and human behaviour dynamics intersect to create substantial opportunities.

Understanding Mean Reversion: The Basis of Contrarian Thinking

At its core, mean reversion trading is grounded in a simple yet profound concept: markets move in cycles. Prices fluctuate, often deviating far from their intrinsic value, but over time, they tend to revert toward their historical average. This cyclical nature presents opportunities to profit by buying low when markets oversell and selling high when they overshoot. It’s a strategy that thrives on volatility and, more importantly, requires a sharp understanding of mass psychology.

Mass psychology plays a significant role in price movements, particularly during heightened volatility. The herd mentality drives the majority of traders to overreact, pushing prices to unsustainable levels. This is where the contrarian thinker, who refuses to be a donkey, steps in. Rather than following the crowd, the contrarian trader seeks out points of maximum pessimism (or euphoria) and positions themselves accordingly, betting on reversing the mean.

This is not a new concept. Anaxagoras, the ancient Greek philosopher, once remarked, “The wise recognize patterns in chaos.” Turbulence often presents chaos in financial markets, but those who recognize the underlying patterns, such as mean reversion, can exploit these moments for profit.

Market Turbulence: The Breeding Ground for Opportunity

Periods of market turbulence—whether driven by geopolitical events, economic shifts, or unexpected crises—are often viewed as times of uncertainty and risk. However, these are also the moments when the most substantial opportunities arise. As the market overreacts, prices move to unsustainable extremes in the long run. This is where the concept of mean reversion proves invaluable.

The greater the turbulence, the better the opportunity. When markets experience extreme volatility, prices tend to deviate further from their long-term averages, creating wider gaps for eventual reversion. Richard Chilton, a renowned hedge fund manager, has long advocated that volatility should be embraced, not feared. According to Chilton, “Volatility is not a risk; it’s an opportunity.” His philosophy is aligned with the principles of mean reversion, where extreme price movements are seen as temporary dislocations ripe for exploitation.

A classic example of this occurred during the 2008 financial crisis. Amid market turmoil, stocks plunged far below their intrinsic values as fear gripped investors. Yet, those who understood mean reversion—like Steven A. Cohen—saw this as an opportunity. Cohen, the founder of Point72 Asset Management, took calculated positions, betting on a recovery. When markets eventually rebounded, his contrarian strategy yielded substantial profits. His approach exemplifies how market turbulence, paired with a deep understanding of mean reversion, can be a goldmine for the savvy investor.

Contrarian Thinking: The Key to Unlocking Profits

To succeed in mean reversion trading, one must embrace a contrarian mindset. This involves going against the grain, often making decisions that appear counterintuitive in the short term but are rooted in long-term logic. Daniel Loeb, another prominent hedge fund manager, has built his career on contrarian thinking. He famously stated, “You make the most money when you buy when nobody else is.” Loeb’s ability to go against popular sentiment, especially during turbulent times, has allowed him to capitalize on mean reversion opportunities that others overlooked.

Contrarian thinking is not just about doing the opposite of what others are doing; it’s about understanding why the majority is wrong. During periods of volatility, emotional decision-making often clouds judgment. Fear drives investors to sell at the bottom, while greed pushes them to buy at unsustainable highs. By understanding the psychology behind these moves, contrarian traders can benefit when the inevitable reversion to the mean occurs.

This idea finds roots even in ancient philosophy. Empedocles, the pre-Socratic philosopher, believed in the cyclical nature of existence, where forces of strife and love (akin to fear and greed in markets) constantly alternate. Much like Empedocles’ view of the universe, financial markets are also cyclical, oscillating between extremes. Much like Empedocles’ philosopher, the contrarian trader must recognize these cycles and act when others are blinded by emotion.

Real-World Examples: Seizing Opportunities in Turbulent Times

There is no shortage of real-world examples where mean reversion trading has proven effective. Take the case of the dot-com bubble in the early 2000s. As technology stocks soared to unsustainable heights, driven by euphoria and speculative excess, the eventual collapse was inevitable. The prices of many tech stocks deviated far from their intrinsic values. Investors like Richard Chilton recognized this dislocation and positioned themselves to profit from the eventual mean reversion.

Similarly, during the COVID-19 pandemic, markets reacted with panic, leading to sharp declines across virtually all asset classes. However, as prices plunged far below their historical averages, astute contrarian traders like Steven A. Cohen saw an opportunity to bet on a recovery. Once the initial wave of fear subsided, markets quickly reverted to their mean, rewarding those with the foresight to act against the prevailing sentiment.

One of the most dramatic examples of mean reversion occurred with oil prices in 2020. At the height of the pandemic, oil prices briefly turned negative—a historical anomaly fueled by panic and logistical concerns. Yet, within months, oil prices reverted to more normal levels, providing enormous profits for those with the foresight to bet on mean reversion during this period of extreme volatility.

Logic and Strategy: The Science Behind the Art

While mean reversion trading is often viewed as an art, it is also deeply rooted in logic. The science behind the strategy lies in the statistical tendency of prices to revert to their long-term average. Numerous studies support this concept, showing that over time, assets that deviate significantly from their historical averages tend to revert back. Identifying when these deviations are large enough to present profitable opportunities is key.

Democritus, the ancient Greek philosopher, believed everything in the universe followed a pattern governed by natural laws. Similarly, though seemingly chaotic, financial markets follow patterns that can be predicted using logical reasoning. Mean reversion is one such pattern, and by applying logic to the analysis of price movements, traders can make informed decisions that transcend emotional reactions.

This rational approach is exemplified by hedge fund managers like Daniel Loeb, who combines rigorous analysis with a contrarian mindset. Loeb’s strategy involves identifying points of extreme price deviation, backed by data and logic, and positioning himself for the inevitable mean reversion. His success is a testament to the power of combining logic with contrarian thinking in mean reversion trading.

Expert Insights: Lessons from Past and Present

Throughout history, philosophers and market experts have recognized the cyclical nature of events and the power of going against the crowd. Anaxagoras’ belief in identifying patterns in chaos is echoed in the strategies of modern traders like Richard Chilton and Daniel Loeb, who see market turbulence as an opportunity rather than a risk. Empedocles’ view of cyclical forces is reflected in the behaviour of markets, where fear and greed alternate, creating opportunities for those who understand mean reversion.

Even in today’s complex financial landscape, mean reversion principles remain relevant. Steven A. Cohen, known for his ability to navigate market turbulence, has consistently profited from recognizing the cyclical nature of price movements. His approach, grounded in logic and contrarian thinking, is a blueprint for those looking to unlock profits through mean reversion trading.

Conclusion: Don’t Be a Fool

Mean reversion trading offers a powerful strategy for those who can resist the temptation to follow the crowd. Traders can unlock significant profits during market turbulence by understanding mass psychology, embracing contrarian thinking, and applying logical reasoning. The greater the volatility, the greater the opportunity—provided one has the insight to see beyond the noise and recognize the underlying patterns at play.

As history has shown, from ancient philosophers to modern-day market experts, those who refuse to be mules, who think independently and act against the herd, consistently come out on top. In the end, mean reversion trading is not just about recognizing price trends but mastering the psychological and logical elements that drive markets and turning them to your advantage.