Best Tech Stocks to Buy Now: Navigating Opportunities in Market Crashes

May 6, 2024

Introduction: Embracing the Opportunity in Market Corrections

The key to successful stock investing lies in identifying the best stocks and timing your purchases effectively. Even mediocre stocks can perform well if bought at the right time while buying even the best blue-chip stocks at the wrong time can lead to losses.

Experts often focus on the impending doom of market crashes, neglecting to highlight the opportunities that arise in their wake. It is time to shift our perspective and understand that every crash produces a new bull market. This essay explores the notion that, contrary to popular belief, market crashes are not disasters but moments ripe with potential. By examining historical trends and human behaviour, we can uncover valuable insights to improve our investment strategies.

From the outset, individuals are conditioned to view market crashes with fear and trepidation. This essay will challenge that mindset and encourage readers to see crashes as opportunities. By analyzing the tactics employed to divert attention and manipulate public sentiment, we can develop a more astute approach to investing. The masses tend to buy when the market is euphoric and sell when fear takes hold, precisely the opposite of what smart money does.

The renowned stock market investor Jesse Livermore understood this dynamic well. His principles emphasized the importance of discipline, encouraging investors to go against the herd mentality and make informed decisions. Livermore’s insights serve as a valuable framework for navigating market crashes and capitalizing on the opportunity factor.

The Art of Contrarian Investing: A Machiavellian Perspective

Adopting a contrarian approach can be immensely powerful when it comes to investing. This strategy involves going against the prevailing market sentiment and buying when others are fearful. Niccolo Machiavelli, the renowned Italian political philosopher, offers insights that resonate with this approach. In his seminal work, “The Prince,” Machiavelli presents a pragmatic and often controversial guide to acquiring and maintaining power.

Machiavelli writes, “It is better to be feared than loved if you cannot be both.” This quote captures the essence of contrarian investing. As investors, we must make bold decisions that may be unpopular in the moment but will ultimately prove beneficial. Fear in the market presents an opportunity to acquire undervalued assets, much like a ruler seizing power in a time of chaos.

Machiavelli’s thoughts extend beyond mere power dynamics. He understood the importance of adaptability and pragmatism. In the context of investing, this translates to embracing change and adopting strategies that may deviate from conventional wisdom. Machiavelli writes, “The first method for estimating the intelligence of a ruler is to look at the men he has around him.” As investors, our ability to surround ourselves with diverse perspectives and challenge conventional wisdom is crucial for success.

The Medici family, a symbol of power and influence during the Renaissance, serves as a real-life embodiment of Machiavellian principles. They expanded their influence through strategic marriages into royal families and secured their position. Similarly, investors can seek out strategic alliances and partnerships to enhance their portfolio’s potential.

Market Crashes: Embracing the Bullish Perspective

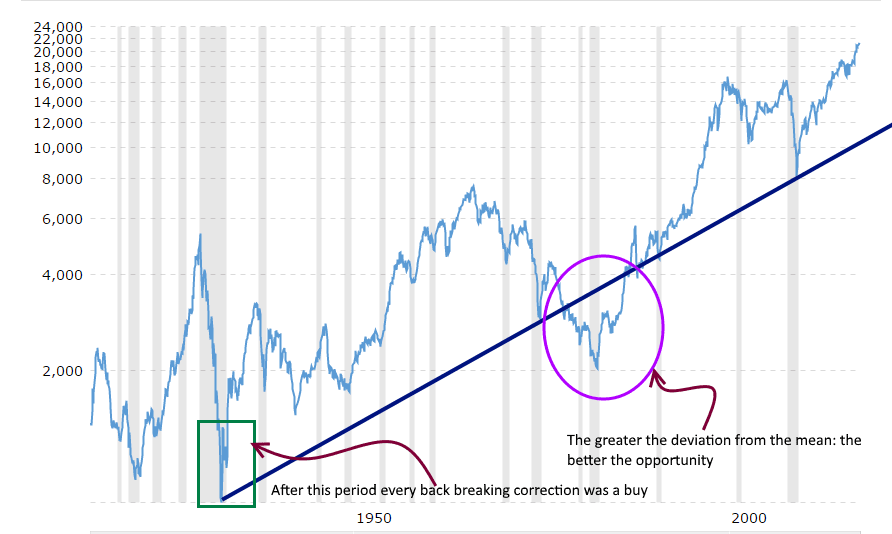

Market crashes are akin to back-breaking corrections, and history has shown that they present appetizing opportunities for long-term investors. It is essential to recognize that fear exacerbates the impact of these crashes, leading individuals to proclaim, “It’s different this time.” However, a deeper examination reveals that the fundamental nature of market dynamics remains unchanged.

The intelligent money waits patiently for these moments of panic, allowing the stampede to sell off assets at bargain prices. The masses, shell-shocked by the crash, often miss the subsequent uptrend. This is where the wisdom of Michel de Montaigne, a French philosopher and writer, comes into play. Montaigne encouraged individuals to question their assumptions and embrace a sceptical mindset.

In his essay “Of Experience,” Montaigne writes, “There is no man so good, who, were he to submit all his thoughts and actions to the laws, would not deserve hanging ten times in his life.” This quote invites investors to challenge their fears and assumptions during market crashes. By doing so, we can break free from the herd mentality and recognize the opportunity beneath the surface.

Mark Twain, the celebrated American author, also provides a witty and insightful perspective. He is credited with saying, “History doesn’t repeat itself, but it often rhymes.” This notion underscores the cyclical nature of markets and the recurring patterns that present opportunities for astute investors. We can identify similar patterns by studying historical market trends and position ourselves to capitalize on the next uptrend.

Sentiment Analysis: Navigating the Noise

Sentiment analysis is a crucial tool for long-term investment success. It involves assessing the prevailing market sentiment to identify entry and exit points. When bullish sentiment reaches extreme levels, it is often a sign that the market is due for a correction. Conversely, when bearish sentiment dominates, it presents an opportunity to buy at discounted prices.

The Anxiety Gauge, a sentiment indicator, is vital in this context. It measures the level of anxiety in the market, providing insights into potential turning points. Combining this tool with mass sentiment analysis allows us to time our entries and exits more effectively. Sentiment analysis will enable us to identify when the crowd is far from bullish, presenting ideal buying opportunities.

However, it is essential to recognize the influence of media narratives on public sentiment. For example, the media played up the hysteria during the coronavirus pandemic, causing unnecessary panic. It is crucial to maintain a critical mindset and not fall prey to sensationalized headlines. Machiavelli’s emphasis on pragmatism and questioning assumptions aligns with this approach.

Seizing Opportunities: A Disciplined Approach

When the crowd panics, it is time for disciplined investors to step in. Market crashes present the best opportunities to buy tech stocks at discounted prices. The current pandemic-induced market turmoil is an ideal example. While it has caused widespread fear, it also offers long-term investors a chance to acquire quality tech stocks at a bargain.

As Livermore emphasized, a powerful correction will inevitably occur, and our goal should be to use trend indicators to time our exits. We don’t need to pinpoint the exact top or bottom but rather focus on identifying warning signals and adjusting our positions accordingly. This disciplined approach aligns with Machiavelli’s emphasis on strategy and pragmatism.

Additionally, by teaching our children and grandchildren to view market crashes through a bullish lens, we impart a valuable lesson that extends beyond the confines of the public education system. This perspective equips them with the knowledge to recognize opportunities where others see only disaster. It is a gift that will serve them throughout their financial journeys.

The Power of Perspective: A Renaissance Reflection

The Renaissance period, a time of immense growth and innovation, offers a unique perspective on market crashes and investment opportunities. During this era, influential intellectuals like Machiavelli and Montaigne challenged conventional thought and sparked new ways of understanding the world. Their writings encouraged individuals to question assumptions and embrace a more nuanced perspective.

In investing, the Renaissance mindset encourages us to view market crashes as catalysts for growth and transformation. It invites us to see beyond the immediate chaos and recognize the potential for renewal and resurgence. This perspective aligns with the notion of tech stocks, often at the forefront of innovation and disruptive change.

The Medici family, patronising the arts and sciences during the Renaissance, reminds us of the power of knowledge and strategic alliances. By investing in innovative ventures and fostering connections, they secured their legacy. Similarly, investors today can seek out tech stocks with disruptive potential and forge strategic partnerships to enhance their portfolio’s growth.

Managing Risk: A Balanced Approach

While seizing opportunities during market crashes is crucial, it must be coupled with a balanced approach to risk management. Machiavelli emphasized the importance of both ability and fortune in his writings. As investors, we must recognize that skill and preparedness are essential, but we must also accept the role of luck in our endeavours.

By diversifying our portfolios and adopting a long-term perspective, we can mitigate the impact of short-term volatility. This balanced approach aligns with the wisdom of Montaigne, who encouraged individuals to embrace a measured and thoughtful life. In his essay “Of Experience,” he writes, “The most certain sign of wisdom is cheerfulness.” This quote invites investors to approach market crashes with a calm and collected mindset, recognizing the potential for growth amidst the chaos.

Additionally, Mark Twain’s wit offers a lighthearted yet insightful perspective on risk management. He is credited with saying, “Put all your eggs in one basket and—watch that basket.” While this may seem contrary to the typical advice of diversification, it underscores the importance of focus and due diligence. As investors, we must thoroughly research and understand the tech stocks we invest in, ensuring we closely monitor our “basket.”

The Human Element: Understanding Crowd Behavior

Market crashes are inherently linked to human behaviour and crowd psychology. As social creatures, our decisions are often influenced by the actions and sentiments of those around us. This dynamic can lead to herd behaviour, where individuals follow the crowd without critical thought. Machiavelli understood this aspect of human nature, and his writings explored the interplay between power and the masses.

In “The Prince,” Machiavelli writes, “Men in general judge more by the sense of sight than by the sense of touch because everyone can see but few can feel.” This quote captures the tendency of individuals to be swayed by what they see others doing, often neglecting their judgment. As investors, recognizing this dynamic is crucial for making informed decisions.

The Medici family’s rise to power provides a real-world example of understanding and manipulating crowd behaviour. They cultivated a favourable public image through strategic alliances and patronage, which helped solidify their influence. Similarly, investors can benefit from understanding crowd sentiment and recognizing when the masses are happy, which may signal a time to exit the market.

Additionally, Mark Twain’s satirical wit offers a unique perspective on human behaviour. In his works, Twain often critiqued society and the follies of human nature. His writings encourage investors to approach market crashes with a sense of humour and a critical eye, recognizing the absurdity often accompanying crowd behaviour.

Long-Term Investing: A Patient Approach

Market crashes can be particularly challenging for investors with a short-term mindset. However, by adopting a long-term perspective, we can harness the true potential of tech stocks. This approach aligns with the wisdom of the Medici family, who understood the importance of patience and long-term vision. Their patronage of the arts and sciences laid the foundation for a cultural renaissance that endured for centuries.

In investing, a long-term horizon allows us to ride out short-term volatility and focus on the broader growth trajectory. Tech stocks, in particular, often exhibit high growth potential over the long term due to their innovative nature. By embracing a patient approach, we can benefit from the disruptive technologies and trends that shape our world.

Machiavelli emphasized the importance of foresight and planning in his writings. He writes, “The first method for estimating the intelligence of a ruler is to look at the men he has around him.” As investors, our ability to look ahead and surround ourselves with diverse perspectives is crucial for long-term success. By adopting a patient approach, we can make more informed decisions and avoid the impulsive reactions often accompanying market crashes.

Additionally, Montaigne’s essays provide a thoughtful perspective on the passage of time and the benefits of a long-term view. In his essay “Of Experience,” he writes, “There is no man so good, who, were he to submit all his thoughts and actions to the laws, would not deserve hanging ten times in his life.” This quote invites investors to embrace the long-term nature of investing, recognizing that short-term setbacks are part of the broader journey.

Conclusion: A Journey of Discovery and Adaptation

Investing in tech stocks during market crashes requires a nuanced understanding of human behaviour, a contrarian mindset, and a long-term perspective. We can navigate market crashes strategically and opportunistically by drawing insights from Machiavelli, Montaigne, Mark Twain, and the Medici family.

Machiavelli’s emphasis on pragmatism and power dynamics provides a foundation for bold investment decisions. Montaigne’s encouragement to question assumptions and embrace scepticism helps us recognize the opportunities within market crashes. Mark Twain’s wit and satire offer a lighthearted yet insightful perspective on human behaviour and risk management.

The Medici family’s rise to power is a real-world example of the power of alliances, patronage, and long-term vision. Their influence during the Renaissance reminds us of the potential for growth and transformation that market crashes can bring. By adopting a disciplined and patient approach, we can harness the true potential of tech stocks and create enduring wealth.

History is not on their side, and the average person who fails to examine history is none the wiser. When a lot of noise is made, one must understand that it is being done to redirect one’s attention; the masses always fall for this ploy. Stock market crashes are perfect examples of misdirection; the crowd is directed to fixate on the fear factor and not the opportunity factor. The dumb money always buys close to the top and sells close to the bottom, and the smart money always does the opposite.

The chart was provided courtesy of http://www.macrotrends.net

Exceptional Discoveries Await Your Curiosity