Market Sell Off: The Art of Buying Fear & Selling the Noise

Dec 15, 2023

Intro:

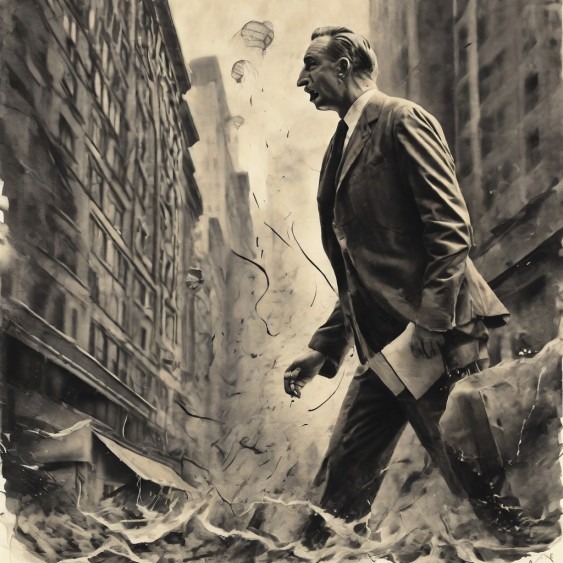

In the fickle world of finance, market volatility is as sure as the rising sun. Periods of growth are punctuated by market sell-offs, sending panic waves through investors worldwide. But these periods of turbulence can also be opportunities for strategic resilience and change.

During a market sell-off, rapid and widespread selling of securities leads to a sharp price decline. This phenomenon is often triggered by economic indicators, geopolitical events, or investor sentiment, creating a climate of fear and panic among investors. The mass psychology during a sell-off is driven by anxiety, causing investors to engage in panic selling, further driving down prices.

However, there are strategic approaches that can help investors navigate market sell-offs and even turn them into opportunities. Strategic resilience involves maintaining a long-term perspective and resisting the urge to panic sell. Instead, investors should focus on their investment goals and the fundamental value of their holdings. Undervalued securities during a sell-off can provide opportunities to buy at discounted prices.

Contrarian investors, particularly, see market sell-offs as opportunities rather than threats. They understand that the best time to buy is during severe market downturns when prices are low. Contrarians can capitalise on market sell-offs by resisting the fear-driven herd mentality and making investment decisions based on the fundamental value of securities.

Warren Buffett, one of the world’s most successful contrarian investors, demonstrated strategic resilience during the 2008 financial crisis. While many investors were selling, Buffett saw the sell-off as an opportunity and made substantial investments in companies like Goldman Sachs and General Electric, which have since yielded significant returns.

Today, we will explore the psychology behind market sell-offs, delve into case studies of past sell-off events, and discuss strategies for navigating sell-offs with resilience and a contrarian mindset. By understanding the dynamics of market sell-offs and adopting strategic approaches, investors can defy fear and turn these turbulent times into opportunities for growth.

Understanding Market Sell-Off

Unravelling the intricacies of a market sell-off involves understanding its core elements, drivers, and implications for the financial world. As mentioned earlier, a market sell-off is characterised by a rapid, widespread selling spree of securities, resulting in a significant drop in prices. This mass unloading of assets is typically led by harmful influences such as worrying economic indicators, turbulent geopolitical events, or a sudden shift in investor sentiment.

A key aspect of a market sell-off is the domino effect it can create. As investors begin selling their holdings, it can trigger a chain reaction, causing others to follow suit, further accelerating the price drop. The prevalent fear and panic among investors can exacerbate the situation, often leading to an overreaction that overshoots the actual economic implications.

The 2008 global financial crisis is a prime example of such a scenario. Sparked by the collapse of Lehman Brothers, the crisis brought about a massive market sell-off as investors worldwide rushed to offload their assets, fearing a total collapse of the financial system. This panic-induced selling frenzy further deepened the crisis, leading to sharp price declines across various asset classes.

Another illustrative case is the COVID-19-induced market sell-off in early 2020. The global spread of the virus, coupled with the impending economic uncertainty, resulted in one of the fastest sell-offs in history. Grappling with the unforeseen circumstances, investors rapidly sold off their holdings, causing the markets to plummet.

The Psychology Behind Market Sell-Off

To delve deeper into the psychological aspects driving a market sell-off, one must understand the fundamental human emotions, primarily fear and greed. During a market sell-off, fear becomes the dominant emotion. Investors hastily offload their assets as prices start to dip, driven by their fear of incurring substantial losses. This panic selling further drives down prices, perpetuating a vicious cycle. This propensity to follow the crowd, known as herd mentality, often leads to investors making hasty, suboptimal investment decisions, such as selling low and missing the chance to buy at discounted prices.

The 1987 Black Monday crash is a stark example of the role of psychology in market sell-offs. On October 19, 1987, stock markets worldwide crashed, shedding an immense amount of value quickly. The crash began in Hong Kong, spread west to Europe, and hit the United States after other markets had declined significantly. Fear had gripped investors so tightly that they were selling their stocks regardless of their value, resulting in one of the most drastic market sell-offs in history.

Similarly, during the Dotcom bubble burst in the early 2000s, investors, driven by fear, started to sell off their technology stocks. The panic selling resulted in a severe drop in tech stocks, leading to a market crash. In both instances, fear-based decision-making, fueled by herd mentality, led to suboptimal investment decisions and further exacerbated the market sell-off.

These cases highlight the significance of investor psychology in financial markets. Understanding this psychology can be crucial for investors, helping them to stay level-headed during turbulent times, make more rational decisions, and potentially take advantage of market corrections rather than becoming victims of them.

Case Study: The COVID-19 Market Sell-Off

Examining the COVID-19 market sell-off provides a deep insight into the dynamics of modern market volatility. In early 2020, as the severity of the pandemic became apparent, investors were gripped by the fear of a global economic downturn. The S&P 500, a benchmark indicative of the U.S. stock market’s health, plunged by approximately 34% from its February peak to its March trough, signifying an unprecedented market sell-off.

This sell-off was not limited to the U.S. but was a global phenomenon, affecting both developed and emerging markets. The FTSE 100, the UK’s leading stock index, also saw a significant drop of around 34% in the same period. Furthermore, the MSCI Emerging Markets Index, a measure of equity market performance in global emerging markets, dropped by about 23.6%.

The speed of the sell-off was another critical aspect of this event. The S&P 500 took 16 trading days to go from recent highs to bear market territory (a drop of 20% or more), making it the fastest decline in history. This rapid sell-off can be attributed to the widespread panic and uncertainty the pandemic instigated.

However, the market also demonstrated remarkable resilience following the initial sell-off. As governments worldwide implemented stimulus packages to support their economies, investor sentiment improved. By August 2020, the S&P 500 had fully recovered, reaching new highs, further underscoring the unpredictable nature of financial markets.

This case study underscores that while unexpected global events can trigger market sell-offs, they can also provide potential opportunities for investors who manage to keep their wits about them in periods of heightened uncertainty and volatility.

Strategic Resilience: The Key to Navigating Market Sell-Off

The concept of strategic resilience, though simple, is a challenging principle to uphold, especially during a market sell-off. It fundamentally involves maintaining a broader, long-term perspective and resisting the urge to engage in panic selling. This approach requires investors to remain focused on their long-term investment goals and the intrinsic value of their holdings, as opposed to reacting impulsively to short-term market trends.

Amid a market sell-off, it’s crucial to identify and seize investment opportunities. Often, sell-offs result in certain securities becoming undervalued, presenting a chance to buy quality stocks at discounted prices. The challenge, however, lies in differentiating between genuinely undervalued securities and cheap ones for a reason.

The late 1990s and early 2000s dot-com bubble provide a fitting case study of strategic resilience. Many investors who clearly understood the fundamental value of their holdings refrained from panic selling during the sell-off that followed the bubble burst. They recognized that while certain technology stocks were overvalued, others were unfairly punished by the broad market sell-off. These investors maintained their holdings and sometimes capitalised on the opportunity to purchase additional shares at significantly lower prices. As a result, they experienced substantial returns when the market eventually recovered.

Similarly, during the 2008 financial crisis, astute investors who could withstand the initial panic sold off their underperforming assets and reinvested in undervalued securities. This strategic move resulted in significant profits once the market rebounded.

The key to navigating a market sell-off lies in understanding its mechanics and psychological drivers and demonstrating strategic resilience. This involves maintaining a long-term investment perspective, resisting panic selling, and capitalizing on opportunities to buy undervalued securities.

Case Study: The Tech Bubble Burst

The tech bubble burst in the early 2000s offers valuable insights into the dynamics of market sell-offs and the importance of strategic resilience and diversification. During the late 1990s, investor enthusiasm for technology companies led to a speculative bubble. Many investors heavily invested in these stocks, hoping for high returns. However, when the bubble burst around 2000, these investors incurred significant losses during the ensuing market sell-off.

Nevertheless, some investors maintained a diversified portfolio, spreading their investments across different sectors and asset classes. This diversification strategy reduced their exposure to the volatility of the tech sector and helped mitigate the losses during the sell-off. Moreover, those who stuck to their investment strategy and didn’t succumb to panic selling saw their portfolios recover over time.

For instance, the Vanguard 500 Index Fund, a mutual fund that aims to track the performance of the S&P 500 index, experienced a decline of about 9% in 2000 when the tech bubble burst. However, investors who held onto their investments in this fund saw a recovery of about 28.7% in 2003. This rebound was mainly due to the fund’s diversified portfolio, which included stocks from various sectors and not just technology.

The tech bubble burst serves as a potent reminder of the importance of portfolio diversification and strategic resilience in investing. While trends and hot sectors can be tempting, a balanced and diversified portfolio can provide a safety net during market sell-offs. Furthermore, it reaffirms that staying committed to one’s investment strategy, even during market downturns, can lead to recovery and potential gains in the long term.

The Contrarian Approach to Market Sell-Off

Contrarian investing, as the name implies, involves going against the prevailing market trends. Contrarian investors see market sell-offs not as threats but as ripe opportunities. They inherently understand that the best time to buy is often during severe market downturns with low prices. They resist the fear-driven herd mentality that typically dominates these situations and instead base their investment decisions on the fundamental value of securities. This approach requires a deep understanding of market dynamics and a robust mindset capable of withstanding market pressures.

Warren Buffett, one of the most successful investors of all time, is a prominent advocate of the contrarian approach. His famous saying, “Be fearful when others are greedy and greedy when others are fearful,” encapsulates the essence of contrarian investing. During the 2008 financial crisis, while most investors were selling out of fear, Buffett, with his contrarian perspective, invested billions in companies like Goldman Sachs and General Electric. These investments, made when the market was at its nadir, yielded substantial returns when it recovered.

Another example of successful contrarian investing is the dot-com bubble burst of the early 2000s. At the same time, most investors were rushing to sell off their technology stocks. Contrarians identified and invested in fundamentally strong tech companies whose stocks were undervalued due to the widespread panic. When the market stabilised, these investments proved highly profitable.

These case studies underscore the potential rewards of the contrarian approach to market sell-offs. By resisting the fear-induced herd mentality and making decisions based on fundamental value, contrarian investors can capitalise on market downturns, turning apparent threats into lucrative opportunities.

Case Study: Warren Buffett’s Investment during the 2008 Financial Crisis

Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, is renowned for his contrarian investing approach and strategic resilience. His actions during the 2008 financial crisis exemplify this approach. While panic selling was rampant, Buffett saw the crisis as an opportunity to invest in fundamentally strong companies at discounted prices.

In October 2008, at the height of the crisis, Buffett invested $5 billion in Goldman Sachs, acquiring preferred stock with a hefty 10% dividend yield and warrants to buy additional shares. Similarly, under comparable terms, he invested $3 billion in General Electric in the same month. These bold moves were made when the future of these companies seemed uncertain, and their stock prices plummeted.

However, Buffett’s confidence in these companies and long-term outlook paid off. By 2011, Goldman Sachs and General Electric had recovered, and Buffett’s investments had yielded substantial returns. Goldman Sachs redeemed the preferred stock in 2011, which gave Berkshire Hathaway a profit of over $1.6 billion. In addition, the warrants to buy additional shares were exercised in 2013, generating more profit.

Meanwhile, General Electric redeemed its preferred stock in 2011, netting Berkshire a profit of $1.2 billion. Furthermore, the crisis-era investments in these companies significantly boosted Berkshire’s income for several years through dividend payments.

This case study highlights the value of strategic resilience and a contrarian approach during market sell-offs. Buffett’s ability to remain calm during the crisis, his conviction in the fundamental strength of the companies he invested in, and his long-term investment horizon enabled him to turn a crisis into an opportunity, generating substantial returns.

Conclusion: Thriving Amidst Market Sell-Off

In conclusion, fear and panic, the driving forces of mass psychology during market sell-offs, often lead to irrational decisions and missed opportunities. Investors who succumb to this fear-driven herd mentality may engage in panic selling, often at the worst possible time. Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.” In the face of a market sell-off, this timeless wisdom could be the guiding light for investors seeking to defy fear and build long-term wealth.

However, by incorporating an understanding of mass psychology and the principles of strategic resilience, investors can turn market sell-offs into opportunities. Recognising that fear and panic are contagious emotions during these turbulent times allows investors to take a step back, assess the situation rationally, and make informed decisions based on long-term goals and the fundamental value of their holdings.

The actual test of an investor’s mettle is not how they perform during market upswings but how they navigate the stormy seas of market sell-offs. It’s about turning the ship around, not by fighting against the waves of mass psychology, but by using them to propel forward. It is about harnessing the power of contrarian thinking and going against the current.

It’s about finding calm within the chaos and using strategic resilience to transform market sell-offs from a source of fear to a launchpad for growth. So, in the face of the following market sell-off, remember: fortune favours the brave, the resilient, and the contrarian.

Provoking Articles for Curious Minds

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric

Investor Sentiment in the Stock Market: Maximizing Its Use

Graceful Money Moves: 6 Powerful Tips on How to Manage Your Money

The Prestigious Path to Financial Wellness: How to Achieve Financial Wellness with Distinction

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What is Inductive and Deductive Reasoning: Unveiling the Mystery

Savings Bonds 101: How Do Savings Bonds Work for Dummies

Finessing Your Finances: How to Manage Your Money When You Don’t Have Any

Copper Stocks to Buy: Seizing Wealth Opportunities In The Metal’s Market

Unveiling the Mysteries: How ESOPs are Typically Invested in and Why It Matters

I’m Never Going to Be Financially Secure, So Why Try?

SuperTrend Insights: Unmasking Market Moves with Mass Psychology