Investor Sentiment in the Stock Market: Wise Use or Miserable Loss?

April 23, 2024

Investor sentiment in the stock market is a pivotal factor that can either pave the way for significant gains or substantial losses. For instance, the Dow Jones Industrial Average is at a critical juncture; it could either surpass the 27,000 mark, solidify it as a new support level or fail to maintain this threshold, potentially triggering a pullback to as low as 24,500. This scenario underscores the importance of investor sentiment as a market influencer, where the perception of value can drastically sway market directions.

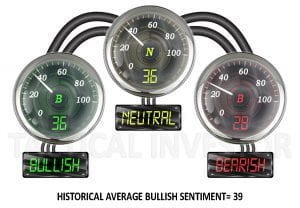

Throughout 2019, the general market sentiment has not fully embraced the bullish potential, with sentiment indices often falling below the historical average of 39%. This observation suggests a cautious market stance despite upward trends, providing a strategic advantage to those who recognize the underlying bullish momentum. The reluctance to engage fully with the bull market hints at a significant potential upside, as historical patterns suggest that subdued bullish sentiment often precedes strong market rallies.

Moreover, the current state of the market, with a high percentage of investors either indifferent or pessimistic, sets the stage for a prolonged bullish phase. This sentiment is particularly evident in the lacklustre corrections and the market’s resilience against bearish expectations. The potential for the Dow to reach 55,000 in the coming years further illustrates the optimistic long-term outlook despite short-term fluctuations and investor hesitancy.

Combining Investor Sentiment with Technical Analysis to Enhance Market Returns

It’s amazing how when a market is soaring, everyone wants to get in and pay more and more, but the same individuals willing to pay more are now afraid to pay less for the same stock. Sol Palha

Integrating investor sentiment with technical analysis can significantly enhance investment strategies and boost market returns. For example, consider the scenario where technical indicators suggest a bullish breakout, but investor sentiment is predominantly bearish or neutral. This divergence can often signal a contrarian opportunity, where the prevailing pessimism may lead to undervaluation, presenting a lucrative buying opportunity before the broader market recognizes the bullish signals.

A practical application of this strategy was evident in the early signals from our proprietary MOAB (Mother of All Buying) index, which approached a near-perfect buy score of 99. Despite this strong signal, the broader market sentiment did not immediately reflect this optimism, indicating a lag in investor response. This scenario provided an excellent opportunity for informed investors to capitalize on the impending upward movement before the sentiment caught up with the technical indicators.

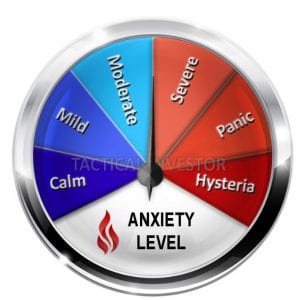

Furthermore, combining sentiment analysis and technical tools can guide investors during market corrections. For instance, a significant increase in bearish sentiment, as indicated by a rise in bearish investors to above 60%, coupled with technical signs of a market bottom, can signal a robust buying opportunity. Such strategic alignment between sentiment and technical analysis confirms the strength of potential market reversals and enhances the timing and effectiveness of investment decisions.

The Investor Sentiment Index: Your Ideal Buying Signal

The stock market experiences a gradual decline, and in today’s fast-paced world, even waiting a single day feels too long. Consequently, a sharp pullback would cause only minor long-term damage. To truly impact investor mindset, either a slow and grinding decline or unpredictable actions are required. Therefore, an optimal scenario would involve a wide-range bound action with no clear direction. Subsequently, observing a significant increase in individuals adopting a neutral stance is crucial. Any value above 50 would be considered favourable, but a move to 55 or higher would be excellent.

Navigating Market Dynamics with a Focus on Investor Sentiment

The current landscape of investor sentiment and market dynamics presents a complex but rewarding challenge. The predominance of neutral sentiment and sporadic bullish enthusiasm suggests that the market is teetering on the brink of a significant directional shift. This environment requires a vigilant and strategic approach, focusing on subtle investor sentiment shifts and broader technical patterns.

The mild nature of recent market corrections and the ongoing reluctance among the masses to fully commit to the bull market underscore a latent potential for substantial growth. This scenario is ripe for strategic investments, where understanding and anticipating shifts in investor sentiment can lead to outsized returns.

In conclusion, the wise use of investor sentiment in the stock market, particularly when combined with technical analysis, can significantly mitigate the risk of losses and enhance the potential for profitable investments. By maintaining a disciplined and patient approach and focusing on the nuanced interplay between market sentiment and technical indicators, investors can navigate the complexities of the stock market and achieve long-term success.

Historic examples of how we utilized sentiment data in real-time to stay on the right side of the markets

Masses are Still Not Embracing This Market.

Another exciting development is that for most of 2019, bullish sentiment has traded well below the historical average of 39. Market Update July 11, 2019

Bullish and Neutral readings came in at 36 this week, which is very telling as it indicates that the masses are still far from embracing this bull market. Secondly, it provides ammunition to the new hypothesis we are putting forward.

One thing sticks out sorely when we look at market sentiment: bullish readings have hardly traded past their historical averages. It, therefore, forces us to consider another possibility that would make no sense under different conditions. We hypothesise that when the bears are asleep and the bulls are barely awake (as is the case presently), the market will tend to drift towards the direction of least resistance, and the path of least resistance is up.

Stock market Update

This is probably one of the most unspectacular corrections the market has experienced; the bears and the naysayers were sure the end was nigh, and the only thing that got smashed was these individuals’ over-inflated egos. Market Update Sept 15, 2019

68% of investors are either clueless (bears and neutrals) or in a state of panic, which bodes well for this long-term bull market. This bull market is probably going to set records for years to come. In some aspects, one could argue that this bull market is in its infancy, as the masses have ignored it. It is possible that this bull could last another 6-9 years, but don’t fixate on these numbers. We were one of the first to state that the Dow could trade to 30K, and that was when the Dow was trading well below 20K.

When 30K is taken out, we will reevaluate the situation. If this bull lasts another six years, then a Dow 55K is possible. However, let’s focus on the now, for the past is gone, and the future is yet to come. By focusing on the present, you can shape both the past and the future.

Articles That Cover a Spectrum of Timeless Topics