Market Psychology is the Study of the Herd: its Impact on Investing

March 25, 2024

Introduction

Embark on a sophisticated exploration of market psychology, an enthralling domain where the collective consciousness of investors orchestrates the rhythm of the financial markets. Prepare to navigate through the intricate labyrinth of human emotions that, though often irrational, are the architects of the market’s unfathomable trends. This journey promises to reveal the veiled opportunities and snares that await the astute investor.

Market Psychology is the Study of the mass mindset; it represents a confluence of human sentiment and economic activity, serving as the compass by which we can decode the enigmatic signals of the market’s heartbeat. It is the nexus where the nuanced study of behavioural economics meets the rich tapestry of human psychology, offering a compelling analysis dimension that intrigues and enlightens.

As we embark on this intellectual odyssey, we shall dissect the very fibres of investor behaviour. Prepare to harness the power of market psychology, elevating your investment acumen to unparalleled heights. Welcome to a world where mastering the mass mindset is not just an advantage—it is an art.

Market Panic and the Creation of Opportunities

Market psychology studies how herd mentality can lead to market panics. During these panics, investors become gripped by fear and engage in widespread selling, often irrationally. This panic selling can create significant buying opportunities for astute investors who recognize that the market has overreacted.

Historical examples of panic selling abound, leading to excellent buying opportunities. In the crash of 1987, the Dow Jones lost over 20% of its value in a single day as investors succumbed to fear. But those who bought in the aftermath were rewarded as the market recovered. Conversely, market psychology can also lead to bubbles and crashes when investors become overly enthusiastic. The dot-com bubble of the late 1990s saw technology stocks soar to unsustainable heights before crashing back to earth. Understanding the psychological triggers behind these mass investment behaviours is critical to navigating market panics and bubbles.

The Lemming Effect and the Bandwagon Effect in Investing

The lemming and bandwagon effects are two related but distinct phenomena in market psychology. The lemming effect refers to how investors will follow the crowd, even if it leads to their detriment – much like lemmings blindly following each other off a cliff. The bandwagon effect is similar but is driven more by a desire to conform and not miss out on what others are doing.

In the stock market, these effects manifest as investors piling into hot stocks or sectors, driving prices up in a self-reinforcing cycle. Eventually, the music stops, and prices crash back down. Case studies like the Bitcoin mania of 2017 illustrate this perfectly – as more and more investors jumped on the bandwagon, prices soared to unsustainable levels before crashing. Understanding these effects is crucial for investors seeking to avoid the pitfalls of herd mentality.

Enhancing Market Psychology with Technical Analysis

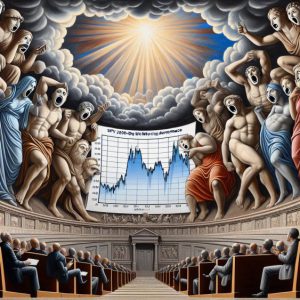

While market psychology focuses on investor behaviour’s emotional and irrational aspects, technical analysis provides a framework for measuring and predicting these psychological states using data. Indicators like Moving Averages, RSI, and the Fear & Greed Index have proven effective at gauging the psychological state of the market.

For example, when the RSI shows a reading of over 70, it suggests the market is overbought, and investor enthusiasm may have peaked. Conversely, a reading under 30 indicates oversold conditions and a market panic. The Fear & Greed Index aggregates several indicators to measure the overall level of fear or greed in the market. Extreme readings in either direction can foreshadow a market turn. Investors can gain an edge by combining an understanding of market psychology with technical analysis tools.

The Role of Market Seasonality in Timing Investments

Market seasonality refers to the tendency for markets to perform better or worse at different times of the year. While not a hard and fast rule, these seasonal patterns can often be traced to the collective psychology of investors. For example, the “Sell in May and Go Away” adage suggests that investors are more risk-averse during the summer months, leading to weaker market performance.

Other seasonal patterns, like the Santa Claus Rally and the January Effect, also have psychological underpinnings. By understanding these seasonal tendencies, investors can potentially time their market entries and exit more effectively. However, it’s important to note that seasonality is not a guarantee and should be combined with other forms of analysis.

Patience and Discipline: The Cornerstones of Successful Investing

Perhaps the most critical lesson of market psychology is the need for patience and discipline. The market plays on investors’ emotions, causing them to make impulsive decisions often detrimental to their long-term success. Fear and greed are powerful motivators that can lead investors astray.

The antidote to these emotional pitfalls is a commitment to patience and discipline. This means having a well-thought-out investment plan and sticking to it, even in market volatility. It means avoiding the temptation to chase hot stocks or try to time the market. History has shown that a disciplined, long-term approach is the surest path to investment success.

Putting Market Psychology into Practice: Real-World Examples

Market psychology studies how understanding investor behaviour can lead to better investment outcomes. Here are three real-world examples of market psychology in action:

Warren Buffett and the Dotcom Bubble: In the late 1990s, as internet stocks soared to unprecedented heights, Warren Buffett famously avoided the hype. He recognized the bandwagon effect in play and stuck to his disciplined value-investing approach. Buffett’s patience was rewarded when the bubble burst as his portfolio outperformed.

John Templeton and the Great Depression: In 1939, at the height of the Great Depression, John Templeton made a bold move. He bought $100 worth of every stock trading below $1 on the New York and American exchanges. This was a classic example of contrarian investing – going against the herd when panic was at its highest. His bet paid off handsomely as the market eventually recovered.

Paul Tudor Jones and Black Monday: In 1987, Paul Tudor Jones correctly predicted the Black Monday crash using technical analysis and market psychology. By noting the extreme levels of investor euphoria and complacency leading up to the collision and combining this with signals from his technical models, Jones made a hugely profitable bet against the market.

These examples illustrate how an understanding of market psychology, combined with disciplined analysis and a contrarian mindset, can lead to outsized investment returns. By studying the behaviour of legendary investors like Buffett, Templeton, and Jones, modern investors can learn to put the lessons of market psychology into practice in their portfolios. Market psychology studies how a keen understanding of investor behaviour is a key to investment success.

Words of Wisdom from Philosophers and Investors

The teachings of market psychology find support in the wisdom of ancient philosophers and historic investors alike:

“It is impossible to produce superior performance unless you do something different from the majority.” – Sir John Templeton, 18th-century investor

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham, 18th-century investor.

“If you have been playing poker for half an hour and still cannot tell who the patsy is, you’re the patsy.” – Warren Buffett, quoting an adage.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.” – Charles Mackay, 19th-century Scottish journalist.

Conclusion

In conclusion, market psychology studies how investors’ collective mindsets can shape market behaviour, often in irrational and emotional ways. By understanding concepts like market panics, the lemming effect, and the bandwagon effect, investors can navigate the pitfalls of herd mentality. Technical analysis provides valuable tools for measuring the psychological state of the market, while an awareness of market seasonality can inform timing decisions.

Ultimately, though, the most crucial lesson of market psychology is the need for patience and discipline in the face of emotional decision-making. By heeding the wisdom of those who have come before and committed to a rational, long-term approach, investors can master the psychology of the market. Understanding market psychology is a decisive edge for any investor.

Other reads

The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment Trusts

TGB Stock Forecast: Rising or Sinking

Stock Market Crash Date: If Only The Experts Knew When

Reasons Why AI Is Bad: The Dark Truth?

The Inflationary Beast: Understanding What Inflation is and What Causes It

Carnosine Benefits: An Antioxidant for Health, Longevity, and Disease Prevention

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Psychology of Cursing: Why Do People Curse So Much?

Spy 200-Day Moving Average: Covert Financial Indicator Unveiled

Black Monday Crash of 1987: Turning Crisis into Opportunity

TGB Stock Price: Riding the Copper Wave with Taseko Mines

Why is the US dollar the Strongest US currency: its deadly effects

Explain Why Diversification Is Such an Important Concept When It Comes to Investing for Your Future

Unearthing the Housing Market Collapse: Learning From The Past