The Unrivaled Strength of the US Dollar: Why It Reigns as the Strongest US Currency

Apr 29, 2024

Introduction

The US dollar has long been the dominant currency in the global financial system. Its strength and stability have made it the go-to currency for international trade, investments, and foreign exchange reserves. The rise of the US dollar to its current position of power is a fascinating story that spans decades of economic and political developments. In this article, we will explore the factors contributing to the US dollar’s strength and the potentially deadly effects it can have on the global economy.

The Sage of Omaha on Patience in Investing

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett (1930-present) Warren Buffett, the legendary investor known as the “Sage of Omaha,” emphasizes the importance of patience in investing. The US dollar’s strength is underpinned by the stability and growth of the US economy, which rewards patient investors willing to take a long-term view. Buffett’s approach to investing, which involves identifying undervalued companies with strong fundamentals and holding them for the long term, has proven to be a successful strategy in navigating the complexities of the financial markets.

Factors Contributing to the US Dollar’s Strength

The US dollar’s strength can be attributed to several key factors. Firstly, the US economy is the largest and most stable globally, with a long history of growth and innovation. This economic stability attracts investors from around the globe, who view the US dollar as a haven in times of uncertainty. Secondly, despite its challenges, the US political system is relatively stable compared to many other countries. This political stability provides a level of predictability essential for long-term investments.

Thales of Miletus on Contrarian Investing: “A wise man is he who knows the limits of his wisdom.” – Thales of Miletus (c. 624-546 BC) Thales of Miletus, the ancient Greek philosopher and mathematician, reminds us of the importance of recognizing the limits of our knowledge. In investing, this means being aware of the pitfalls of following the crowd and the benefits of contrarian thinking. The US dollar’s strength can sometimes lead to overconfidence among investors, who may be tempted to follow the bandwagon without considering the potential risks. Investors can reap significant rewards by taking a contrarian approach and identifying undervalued opportunities.

The Deadly Effects of a Strong US Dollar

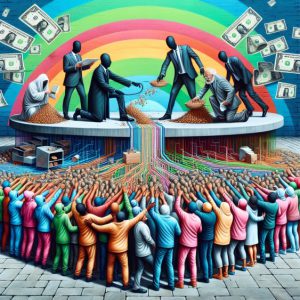

While a strong US dollar has its benefits, it can also have deadly effects on the global economy. One of the most significant impacts is on emerging markets, which often have high levels of dollar-denominated debt. As the US dollar strengthens, these countries’ debt burdens increase, making it more difficult for them to service their obligations. This can lead to financial crises and economic instability, as we have seen recently in countries like Argentina and Turkey.

Sir John Templeton on the Dangers of Overconfidence

“The four most dangerous words in investing are: ‘this time it’s different.'” – Sir John Templeton (1912-2008) Sir John Templeton, the renowned investor and founder of the Templeton Growth Fund, warns against overconfidence in investing. The belief that “this time it’s different” can lead investors to ignore historical patterns and take on excessive risk. In the context of the US dollar’s strength, it is essential to remember that no currency is immune to the boom and bust cycles. By maintaining a healthy dose of scepticism and a long-term perspective, investors can navigate the challenges a strong US dollar poses.

Mass Psychology and Market Psychology in Investing

Understanding mass psychology and market psychology is crucial for successful investing. Crowds can be prone to irrational behaviour driven by fear, greed, and herd mentality. By recognizing these psychological factors, investors can capitalize on market sentiment and make informed decisions. Contrarian investing, which involves going against the prevailing market trend, can be a powerful strategy in this context. By identifying undervalued assets and betting against the crowd, contrarian investors can potentially generate significant returns.

Technical Analysis and the Bandwagon Effect

Technical analysis, which involves studying chart patterns and trends, can be helpful for investors seeking to navigate the financial markets. By examining historical price movements, trading volumes, and other market data, technical analysts attempt to identify potential entry and exit points for their investments. This approach is based on the belief that market trends and patterns repeat themselves, providing opportunities for informed decision-making.

However, it is essential to be aware of the potential dangers of the bandwagon effect, where investors follow the crowd without conducting their analysis. The bandwagon effect occurs when investors base their decisions on the actions of others rather than on their research and understanding of the market. This can lead to irrational exuberance and the formation of market bubbles, as seen in the dot-com boom of the late 1990s or the housing market before the 2008 financial crisis.

The US dollar’s strength, a dominant theme in recent years, can sometimes lead to a bandwagon effect, where investors pile into dollar-denominated assets without considering the potential risks. The US dollar’s status as the world’s reserve currency and its reputation as a haven during economic uncertainty have contributed to its strength. In fact, according to the Bank for International Settlements, the US dollar accounted for 88.3% of all foreign exchange transactions in 2019, highlighting its global dominance.

However, blindly following the crowd and investing in dollar-denominated assets without proper analysis can be dangerous. For example, during the Asian financial crisis of 1997-1998, many investors had heavily invested in Asian currencies and assets, believing in the “Asian miracle.” When the crisis hit, these investors suffered significant losses as the value of their investments plummeted.

By utilizing technical analysis in conjunction with a contrarian approach, investors can potentially identify opportunities that are overlooked by the crowd. Contrarian investors seek to buy assets undervalued by the market and sell those overvalued. This approach requires a strong understanding of market fundamentals and thinking independently rather than following the herd.

One hypothetical scenario illustrating the benefits of a contrarian approach in the context of the US dollar’s strength could be as follows: An investor, well-versed in technical analysis, notices that the US dollar has been overbought and is due for a correction. While most investors continue to pile into dollar-denominated assets, this contrarian investor looks for undervalued opportunities in other currencies or markets. By doing so, they may be able to capitalize on the potential downturn in the dollar’s value and generate significant returns.

John Maynard Keynes on Market Irrationality

The influential British economist John Maynard Keynes reminds us that markets can be irrational for extended periods. This observation is particularly relevant when considering the US dollar’s strength and potential impact on investor behaviour. While the US dollar’s dominance is underpinned by fundamental factors such as the size and stability of the US economy, its status as the world’s reserve currency, and the country’s political influence, it can also be influenced by market sentiment and investor psychology.

Keynes’ quote highlights the danger of betting against the market, even when an investor believes the market is acting irrationally. For example, during the dot-com bubble of the late 1990s, many investors thought the market was overvalued and due for a correction. However, those who attempted to short the market too early fought against the irrational exuberance that drove stock prices to unprecedented levels. As Keynes suggests, the market’s irrationality outlasted the solvency of many contrarian investors.

In the context of the US dollar’s strength, investors may be tempted to bet against the currency, believing it is overvalued relative to other currencies. However, the dollar’s strength has persisted for years, supported by various factors such as the Federal Reserve’s monetary policy, the US economy’s resilience, and the dollar’s role as a haven during global uncertainty.

A hypothetical scenario illustrating Keynes’ point could involve an investor who believes that the US dollar is overvalued and decides to short the currency. Despite their analysis, the dollar continues to strengthen, driven by market sentiment and investor preference for dollar-denominated assets. As the investor’s losses mount, they may be forced to close their position, ultimately succumbing to the market’s irrationality.

By recognizing the potential for irrational behaviour and maintaining a long-term perspective, investors can weather the storms of market volatility. This approach involves focusing on fundamental analysis, diversifying investments, and avoiding the temptation to make short-term bets based on market sentiment alone. By doing so, investors can potentially navigate the challenges posed by the US dollar’s strength and other market anomalies, ensuring the preservation and growth of their wealth over time.

Conclusion

The US dollar’s dominance as the strongest US currency is a testament to the resilience and stability of the US economy and political system. However, its strength can also harm the global economy, particularly in emerging markets. By understanding the factors contributing to the US dollar’s strength and the potential risks it poses, investors can make informed decisions and navigate the complexities of the financial markets.

The wisdom of top investors and philosophers, spanning centuries, reminds us of the importance of patience, contrarian thinking, and recognizing the limits of our knowledge. By applying these insights to the context of the US dollar’s strength, investors can potentially generate significant returns while managing risk. Ultimately, the key to successful investing lies in maintaining a long-term perspective, conducting a thorough analysis, and being willing to go against the crowd when necessary.

Journey of Discovery: Fascinating Reads

Winning the loser’s game timeless strategies for successful investing pdf

Why ‘When Will Market Bottom Out?’ is Misguided.

What Is Mob Mentality? A Symbol of Irrationality

US Dollar Devaluation: How the Fed Legally Robs You

The Suave Strategy: How to Buy Gold and Silver for Investment

Which of the Following Investing Statements Is False? Let’s Uncover the Truth!

An Exquisite Approach: How to Buy Gold Without Paying Sales Tax

How to Buy Gold in Australia: A Captivating Roadmap to Glittering Riches

The Art of Portfolio Agility: Mastering the Tactical Asset Allocation Strategy

Stock Market Forecast for Tomorrow: Ignore Noise, Focus on the Trend

Defying the Crowd: Exploring the Stock Market Fear Index

Crowd Behavior Psychology: Deciphering, Mastery, and Success

Inflation vs Deflation vs Stagflation: Strategies for Triumph

What Is The Best Way For One To Recover After a Financial Disaster?