The Crowd begs for a Market Opportunity and when it comes……

They panic stating that it would make more sense to wait for a better price. When the better price arrives, they say well things don’t look so good, right now because so and so is saying this and the other brain surgeon is saying that. Let’s just wait for the dust to settle, and the only thing that settles in the dust is the poor chap who kept waiting for a better opportunity. Market opportunity knocks rarely, and it does not take kindly to being ignored.

This is the one reason the masses are destined to repeat history forever and ever Amen. Nothing will ever change; the equation must balance. For the few to win, many must lose; you are welcome to try to alter that equation. No one can change you; only you can change the way you think or act. Counsel with the wisest of men and women is not going to help shape a silly man or woman that has decided that he/she knows what’s best without even taking the time to study oneself and the mass mindset.

Now this poor SOB that missed the bottom is waiting for the markets to pull back again, but while he/she is waiting they keep complaining that they can’t get into the very stocks that were being given away not too long ago. See a pattern here. If you are not brutally honest with yourself, then you will repeat the same mistake over and over again. Nothing will change; for the masses, it’s ground hog’s day every day; they just can’t see it. Because one puts on a new suit, takes a shower, don’s a new pair of sunglasses and hops into a new car, does not change anything. All one has done is to change the scene, but the theme is the same. Hence, this person will inevitably revert to what brings on a sense of belonging and comfort; the average Joe needs to feel that he or she is part of something, even though that something will inevitably yield nothing.

Crashes equate to Market Opportunity

One feels warm and fuzzy when one is in the company of those that seem to share their fears, desires and tribulations and vice versa. Hence the saying misery loves company and never has this been more clearly demonstrated than during this fake coronavirus pandemic and the hysteria based selling it triggered.

Do yourself a favour and stop asking how low or how high the market will go? Focus on the trend? As we stated in the last update, the most tragic event in one’s life is one’s death. Yet how many fixate on this event? You can’t compare death to even the deadliest of stock market crashes; the markets will recover, but once you kick the bucket, that’s a permanent crash. Yet, people continue to operate, they save for their retirement, even though they know that the closer they get to this point, the less time they have on this planet and yet no one is operating in the gloom and doom mode. How is this possible? Yet, they all know the markets will recoup, but they fixate on the present state as if it represents the end of everything. If you want to change, then focus on these issues. Focus on the fact that the only way to change is to change the way you perceive a given situation. A crash can be viewed as a monumental tragedy or a tremendous opportunity; the crowd will focus on the tragedy aspect, and less than 10% of the populace will have the capacity to rise above the fog of fear and see the crash for what it truly is.

Coronavirus crash was a once in a life time Market Opportunity

The markets will let out some steam, but the crash phase is over. Over the years we have published so many articles on how crashes are viewed through a prism of negativity, when in fact, they should be embraced like a lost love. If you are interested, then head over to our website and just type the word crash or stock market crash in the search box to bring up a plethora of these articles.

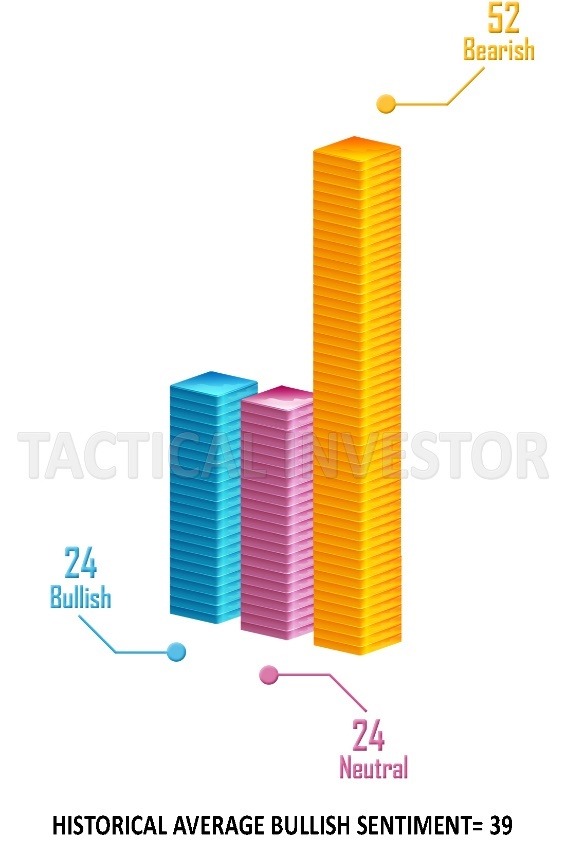

The only thing that one should focus on is the sentiment and the trend. If the crowd is bearish or uncertain and the trend is up, then the only option left is to view all pullbacks ranging from mild to wild as opportunities. Trying to time the exact bottom or top is a recipe for disaster. Hence, the focus should be on not on trying to get in at the bottom but aiming for a great price. What’s a great price? Well, if you were ready to pay 50 bucks for the stock five weeks ago and then the stock is trading at 30, today, would you not say that’s a great price.

Or are you going demand that it goes down to 25 and then two weeks later it’s trading at 45, and now you are cursing yourself that you let it go? By the time you decide its time to jump in, you could end up paying 70 for a stock you could have purchased at $30. Here’s the rub; the trend is up and if you paid 45 for a stock and you think it’s a reasonable price, and it drops to 38, stop frowning or screaming and deploy the 2nd lot because it’s being offered at an even better price. This is what a lot of traders did when PJT, AMOT, HTLF, FCX, INTC, GOOGL, MRTN, etc. all traded below their suggested entry points.

Tomorrow never comes; move today or lose tomorrow forever

Stop waiting for tomorrow as tomorrow never comes; today is the tomorrow you promised to change yesterday. Instead, it is a repeat of yesterday’s tomorrow that you vowed to change the day before yesterday. Remember for the masses it’s ground hog’s day every damn day of the year.

We received a lot of emails from new subscribers as to why all the entry points on all the pending plays are well below the current price of the stock. We have never opened a position at market price, and we don’t think we will ever opt for this route.

Every single play in our portfolios was bought at a significant discount to where that stock was trading on the day the play was issued. Why do we do this? We are investors, not dreamers. Investors want to get in at the best possible price, and in doing so, they maximise the profit and or minimise the loss potential of a given play.

Despite the strong rally, the gauge on the anxiety index has not moved at all, and that’s is both stunning and fantastic. Stunning because this is one of the sharpest rallies of all time and it should have pushed the needle out of the madness zone. Fantastic because it tells us that this Bull market has a long way to go before it dies. Dow 30K is going to be taken out with ease probably in less than 12 months. Market Update May 2, 2020

Masses are still nervous; markets will continue to trend higher

This week one would have expected much lower bearish sentiment readings, but instead, it stands at 53, and the anxiety gauge is still locked deep into the madness zone. This clearly tells us that the crowd is still sitting on the side-lines and that the Fed is playing an active role in pushing the markets higher. If you expect a long rant of how this is unfair and how this is going to lead to a spectacular fall because the crowd knows better. You are mistaken. We could care less whether it’s the Fed and or the big players jumping in and manipulating this market or if it’s the small player being tricked into jumping in at the wrong time. Who pushes the market higher is of no concern to us? We focus on the trend and not the mechanism that is used to achieve the objective. The Fed won’t lose; eventually, they will convince the masses as has been the case for decades that its time to jump in and they will jump in.

Other Articles of Interest

Market insights: Fight the Fed & End Up Dead (Sept 22)

Investment Pyramid: Valuable Concept Or ? (Sept 2)

Successful Investing; Never Follow the Crowd (Sep2)

Define Fiat Money: The USD Is A Great Example (Aug 13)

Deflation Economics: The Art of Twisting Data (Aug 12)

BTC vs Gold: The Clear Winner Is … (Aug 11)

Cash is king during Coronavirus Pandemic Based Sell off (Aug 10)

Russell 2000: Great Buy Signal In the making (Aug 9)

Strong buy stocks: Use the sell-off to load up on Top Companies (Aug 8)

Best Chinese Stocks: Focus on America Instead of China (Aug 7)

Strange Weather Pattern’s Set to Plague the Planet (Aug 7)

American power: The War Against China (Aug 5)

Strong Buy Stocks: Focus on The Trend & Not the Fear Factor (July 20)

Smart Money Acting Like Dumb Money (July 27)