Updated June, 2023

Crude oil: Ready to Breakout?

On the 19th of this month, two articles were published simultaneously, one stating that oil could go to $26 and the other saying that oil is ready to trade to $80. Which one will it be, $26 or $80, and how will the average Joe be able to discern which one is a depiction of what lies ahead? This is the problem with today’s mass media; bombastic and often conflicting articles are published simultaneously in their quest to attract eyeballs.

One almost feels that most major sites have only one agenda, quantity over quality. The idea is to use emotions, Greed or Fear to trigger a reaction. Whether the data supporting the hypothesis is valid or not appears to be irrelevant. Perhaps this is why more American drink coffee daily than invest in the markets.; over 50% of the public is still sitting on the sidelines.

Mass Psychology is probably the simplest, most misunderstood and most underutilized tool for trading. The first rule of mass psychology dictates that one put aside one’s emotions. You have to cut the power of these useless forces. It is not easy, and it never becomes automatic. You have to fight it, but you know you are close to doing something right when you are not overly confident about the decision you are going to make. The second factor is to eliminate the noise factor; use mass media as a source of entertainment or provide information on what you should not be doing.

Let’s attempt to shed some light on what is going on. Let’s start off with the fundamentals; for the record, we do not place too much emphasis on fundamentals. Fundamental data is presented in a standard format, so anyone accessing it can draw the same conclusion. Thus it negates the edge it is supposed to give an investor. However, if you combine that with Mass psychology and or technical analysis, the outcome improves considerably.

IEA price targets

The fundamental side, the IEA expects oil to trade at $80 by 2020. The IEA also made the following statement.

“The IEA expects all the production in the United States to go down half a million barrels in next year – 500,000 barrels a day. I expect to go down a million barrels a day in 2016 and another million barrels in 2017,” he said. “On top of that, demand will increase by another 2 million barrels over the next 2 years. So that’s already a 4 million barrel swing over the next 22 months. That’s going to make a difference with oil prices.”

The IEA is notorious for painting a picture that often bears no resemblance to reality. Fundamentals tend to give you a rear-view look at what is going on. By the time, the fundamentals improve, the market has moved and is trading well off its lows.

If we combine both articles, we draw closer to the truth. We have been stating for some time that we expect crude oil to trade within a wide range, barring some unforeseen events, such as a full-fledged war in the Middle East. This is what we said to our subscribers recently.

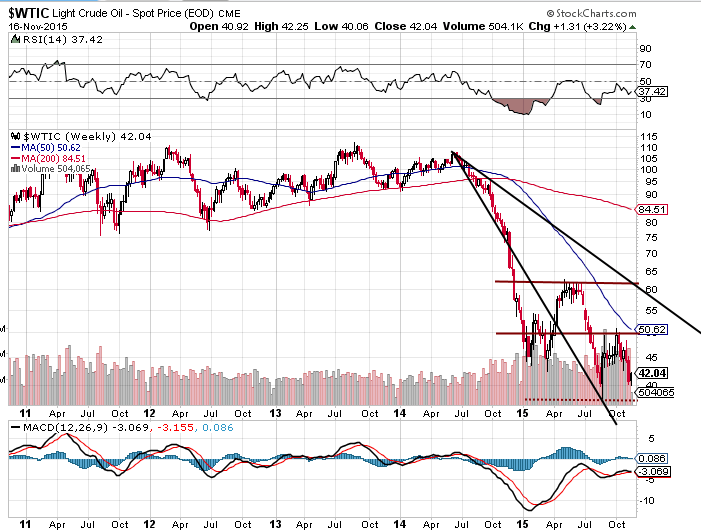

Oil is expected to continue trading in a wide range (33-60) but will face bouts of resistance at 50.00. Once oil manages a weekly close above 50, it will widen to 60-65 ranges: market Update, Nov 1st, 2015.

What’s next for Crude oil?

As the dynamics of global energy markets continue to unfold, the fate of crude oil stands at a crossroads, teetering between the peaks of potential recovery and the valleys of continued uncertainty. Recent market fluctuations have brought crude oil to the edge, hovering around the $50.00 mark, only to witness a retreat, hinting at a possible revisit to the $32.00 range. The anticipation lingers, with the market awaiting a defining moment—a higher low or a positive divergence signal that could shape the trajectory of oil prices.

In the intricate dance of market forces, the technical lens unveils a critical juncture for crude oil. A weekly close above $50.00 is deemed essential to paint a bullish picture, signaling the potential for higher prices on the horizon. Looking further ahead, a monthly close surpassing the $60.00 threshold would not just be a milestone; it could set the stage for a more ambitious ascent, possibly testing the $75.00 mark. However, the path forward is riddled with complexities, and the oil market appears poised to meander within this range unless geopolitical tensions, especially in the Middle East, inject an element of volatility.

Examining the prospective journey of crude oil requires not just a technical analysis but a comprehensive understanding of the multifaceted factors shaping its destiny. The intricate interplay of supply and demand, global economic trends, and geopolitical events weaves a narrative that is as volatile as the substance it seeks to decipher. In the backdrop of a recovering global economy, the demand for oil remains a pulsating variable, influenced by factors ranging from industrial activities to the resurgence of travel and transportation.

The prospect of crude oil finding its footing in the $32.00 range presents an intriguing scenario—a potential pivot point that could either propel it into a renewed bullish phase or signal a continuation of the prevailing bearish sentiment. Investors, analysts, and market observers watch keenly for the telltale signs that will unveil the direction oil is poised to take.

Geopolitical elements, notably tensions in the Middle East, cast a looming shadow over the oil market’s trajectory. Historically, any escalation in this volatile region has reverberated through energy markets, injecting sudden and unpredictable volatility. The market, therefore, remains on high alert, acknowledging that the delicate balance between supply and demand could be disrupted by geopolitical events, sending shockwaves through the pricing dynamics of crude oil.

Amidst this intricate tapestry of market forces, the anticipation of a monthly close above $60.00 emerges as a potential game-changer. It transcends technical analysis, representing a shift in sentiment and investor confidence. Such a milestone would not only mark a resurgence in the bullish narrative for crude oil but could also unlock a pathway towards the $75.00 threshold, a level that holds both symbolic and economic significance.

As we navigate the undulating terrain of crude oil’s future, the market’s response to changing global dynamics remains a constant source of fascination. The demand for oil, intricately tied to economic activities and geopolitical developments, adds layers of complexity to the narrative. Will crude oil forge a path towards recovery, supported by a rebounding global economy, or will lingering uncertainties cast a shadow over its journey?

The odyssey for crude oil unfolds against a backdrop of economic rejuvenation, geopolitical intricacies, and the perpetual dance of market forces. Whether it finds itself at the mercy of renewed optimism or continues to grapple with the challenges of oversupply and subdued demand, the future of crude oil remains a compelling saga, waiting to be inscribed by the unpredictable quill of global events.