Trading in the Zone: Mastering the Psychology of Trading

Updated May 15, 2024

Introduction: Navigating the Tempestuous Seas of Investment with Ancient Wisdom

With its volatile markets and unpredictable crashes, the tumultuous world of investing can often feel like a treacherous ocean voyage. However, just as the most skilled navigators of old relied on the wisdom of the stars to guide them through uncharted waters, modern investors can find solace and direction in the insights of ancient philosophers. By examining the teachings of four renowned thinkers – Seneca, Epictetus, Marcus Aurelius, and Lao Tzu – we can uncover timeless principles for mastering the art of trading in the zone and seizing investment opportunities amidst the chaos.

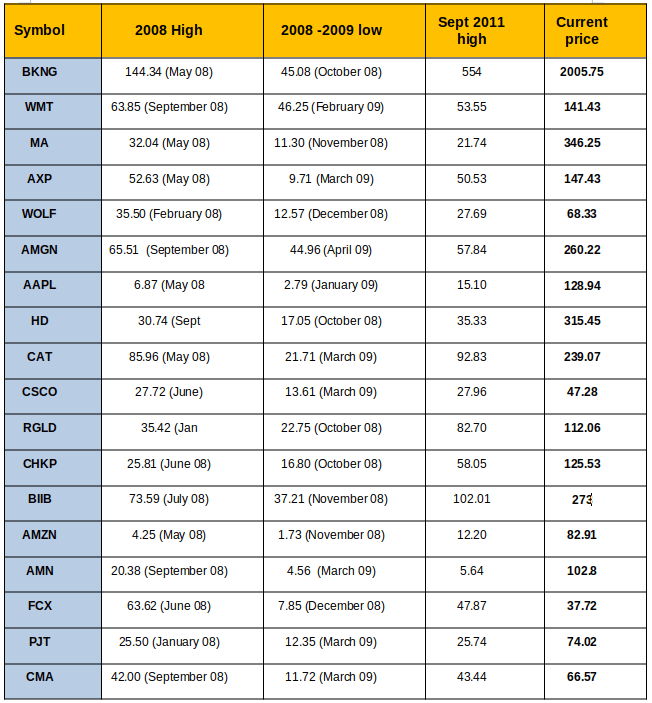

The Stoic philosopher Seneca reminds us that “difficulties strengthen the mind, as labour does the body.” In investing, this wisdom suggests that market crashes and corrections, while painful in the short term, can present valuable opportunities for growth and profit. Just as RGLD, a gold stock, has demonstrated irrefutable evidence that crashes equate to investment opportunities, Seneca’s words encourage us to view market turbulence as a chance to strengthen our financial understanding and resilience.

Epictetus, another Stoic sage, advises us to “focus on what you can control.” In trading, this translates to maintaining emotional discipline, adhering to a well-crafted trading plan, and utilizing technical analysis to identify patterns and trends. Investors can stay in the zone and make rational, profitable decisions by concentrating on these controllable elements rather than succumbing to fear or panic during market uncertainty.

Marcus Aurelius, the philosopher-emperor, offers a powerful perspective on embracing opportunities: “The impediment to action advances action. What stands in the way becomes the way.” This insight is particularly relevant when considering the potential for a Father of All Buys (FOAB) signal, which could herald the dawn of a new decade-long bull market. By recognizing that obstacles and challenges often hold the seeds of great opportunity, investors can cultivate the mindset necessary to capitalize on such rare and lucrative events.

Finally, Lao Tzu, the ancient Chinese philosopher and founder of Taoism, teaches us that “the journey of a thousand miles begins with a single step.” This wisdom reminds us that mastering the art of trading in the zone is a gradual process requiring patience, practice, and perseverance. By focusing on each trade, decision, and lesson learned, investors can steadily progress towards greater proficiency and success in navigating the ever-shifting tides of the financial markets.

Now, let’s step back in time so individuals can learn from history and simultaneously see what actions were taken in real-time.

Dec 30, 2022

Irrefutable Evidence that Crashes Equate to Investment Opportunity:

RGLD is a Gold stock. We purposely selected this stock to illustrate that even a sector-specific stock that one should generally only get into when the sector triggers a buy proves that crashes are buying opportunities.

Doing nothing but buy and hold these stocks would have yielded incredible gains. Notice how fast the profits started to surge after 2011. This is due to only one factor:

The Fed began to print more money. The recovery period between boom and bust is almost 5X faster than in 2009. If one had only used long-term charts (monthly charts) to buy and sell the above stocks, one would have fared even better. For example, one can utilise the monthly charts to jump in and out of the market while the trend remains positive.

One could have at least doubled the above returns using this simple strategy. Experienced traders could take things a step further. Use the weekly charts to jump in and out while the Monthly chart trades below the overbought zone. Essentially, one would sell when the stock was trading in the overbought ranges and re-purchase it when it moved into the oversold zone. Only traders with some knowledge of TA should attempt this.

Trading in the Zone: Cannonball Strategy

Applying the conservative cannonball strategy to several plays above would have yielded much higher returns than the buy-and-hold strategy. Cannonball strategy implies purchasing LEAPs when the stock is trading in the extremely oversold range and selling the position when the stock is sitting in the highly overbought zone.

The simple lesson we are trying to convey here is that if one does not panic and logic does not go out the window, one can bank outstanding gains over the long run. And history is on our side in this regard.

You won’t see the next opportunity if you give in to fear. This is particularly important now, for the top players are creating new narratives on the fly. What does this mean? They can prematurely create the illusion that the Bull market is dead forever. They have so much money that all of this is a game. Power is addictive, so they will keep doing this with more frequency. Hence, those who don’t prepare themselves psychologically for this ploy could lose everything.

Trading in the Zone: Embrace Opportunities & Overcome Fear

The big players create every disaster or crash for only one reason: they delight in fleecing the masses. They want fear to take over so that you will gladly sell your top holdings for nothing; many will beg to bail out at or very close to the bottom. These players will then sit out of the markets for years while a new set of players are lured in. Finally, the old players (the ones that sold at or close to the bottom) will jump in (usually years later) and then the big boys will kill the new and old fish in one shot. Market Update September 11, 2022

This game has been repeated for generations; it will continue for one simple reason: the masses do not pass this valuable data to their offspring. Sadly, a new set of suckers are born every year.

The bottom line is that things always look rough in the short term, but the rewards that await the Astute Players are massive. 2023 might start rough, but it will provide Tactical Investors with many fantastic opportunities. Using this conservative cannonball strategy should amplify the gains.

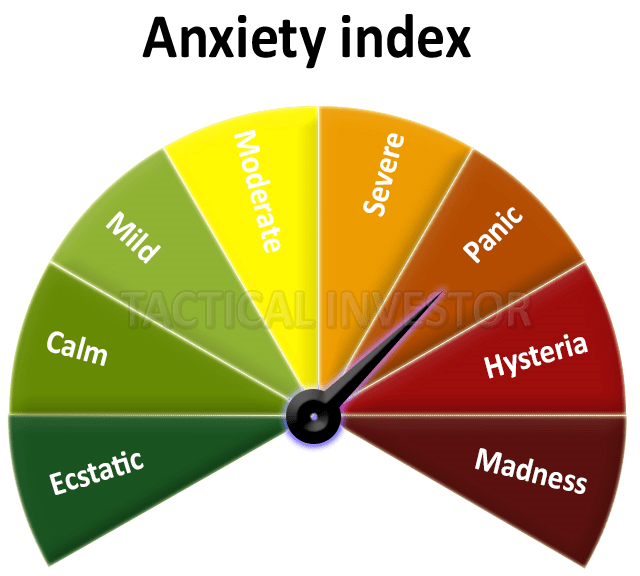

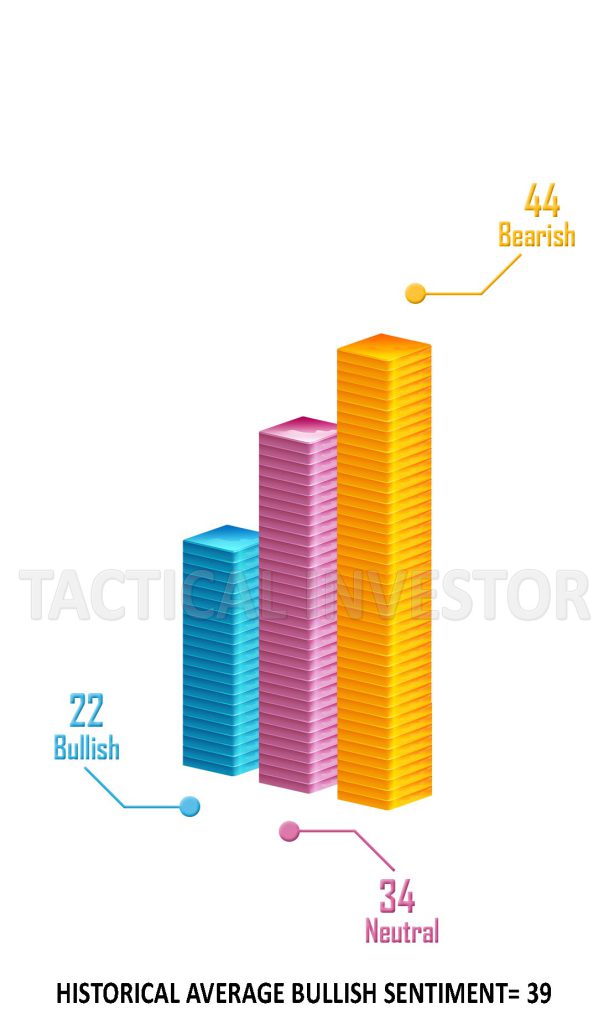

Stay in the zone by paying attention to the Sentiment.

Making money trading in the zone involves mastering the psychological aspects of trading, such as emotional control, discipline, and risk management. One effective way to stay in the zone and make profitable trades is to use technical analysis, which involves studying charts and market data to identify patterns and trends. It is also essential to have a solid trading plan that includes entry and exit points, stop-loss orders, and position sizing.

Staying focused and making rational decisions can be challenging during market uncertainty and panic. However, experienced traders understand that opportunities often arise during turmoil. As the needle in the Anxiety Index moves deeper into the panic zone, it is crucial to remain vigilant and patient, waiting for the right signals to appear.

The recent signal indicating a potential Father of all buys (FOAB) is a rare opportunity that could signal the start of a new decade-long bull market. By staying in the zone and keeping emotions in check, traders can take advantage of these opportunities and profit from market movements. Remember, mastering trading in the zone is a process that requires practice, discipline, and patience.

Conclusion

In conclusion, by drawing upon the timeless insights of these four ancient philosophers – Seneca, Epictetus, Marcus Aurelius, and Lao Tzu – modern investors can cultivate the psychological fortitude, emotional discipline, and opportunistic mindset necessary to thrive in the turbulent seas of investing. By embracing market volatility as a chance for growth, focusing on controllable elements, recognizing opportunities in challenges, and committing to a patient, persistent approach, traders can master the art of trading in the zone and unlock the vast potential of investment opportunities, even amidst the most turbulent of times.

Other Articles of Interest

The Relationship Between Risk and Reward in Investing: A Compelling Analysis