Apollo Commercial Real Estate Inc: A Good Play

This company operates as a real estate investment trust that primarily originates, acquires, invests in and manages commercial first mortgage loans, subordinate financings, commercial mortgage-backed securities, and other commercial real estate-related debt investments in the United States. The current yield stands at lofty 10.4%

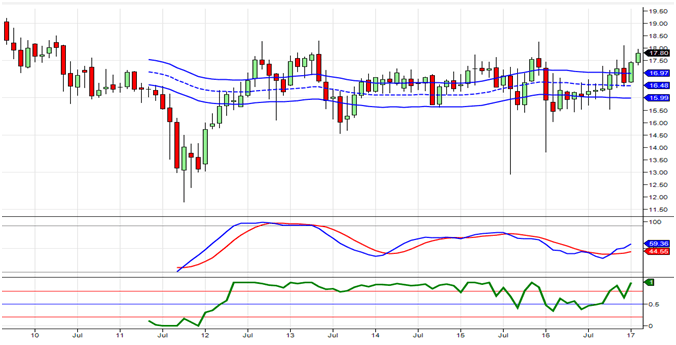

Like SNH, the stock looks attractive on the weekly charts, and a bullish crossover on the MACDs should push it to a series of new 52-week highs.

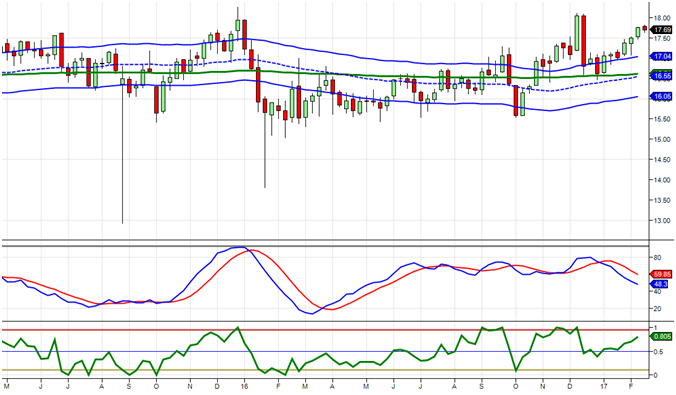

The monthly chart shows that the MACD, surprisingly, are trading in what we would label as the “minimum oversold ranges”.

Suggested strategy

Purchase one lot in the 16.50-16.80 ranges

Deploy one more lot in the 15.70-15.90 ranges

If it happens to drop to or below 15, use the last 1/3rd of your funds to purchase an additional position.